Perform a Market Correction “Muster-Drill”

Shoppers are clearing out cases of water, hand sanitizer, face masks, trail mix and other bulk items from Target and Costco shelves in the face of a potential pandemic. Saudi Arabia has stopped pilgrimages to holy sites. Japan closed its schools. Facebook, Microsoft, and Google have cancelled major conferences. Thousands of people are trapped on board cruise ships from San Francisco to Rome. This sounds more like the beginning of a terrifying Stephan King movie than the reality of today’s world.

On wall street we’ve seen the VIX “fear index’ shoot up a warning flair this month from 14 to 40 points, following one of the most volatile weeks in stock market history, with the S&P 500 experiencing four daily swings of 3% or more in both directions, enough to make one nauseous and sea sick.

If history has taught us anything, it’s that the most fundamental deterrent for many investors to “stay the course” with their investments and not to jump overboard to cash – is simply to help ensure they have properly diversified portfolios according to their age, goals and risk tolerance.

In many instances, an investor’s portfolio “ailment” leading to financial demise may be due more to being “over-weight” in stocks than the COVID-19 virus headlines causing the extreme selloff.

If you hear the headline news in the morning on your way to work and think “maybe I should sell everything and buy a bigger mattress,” just recognize it’s either too late or a bad decision. While headlines out of China may spark panic, and market swells may be substantial, they can be “counter-balanced” in a strategically diversified portfolio by the rest of the world and by different “non-correlated” asset classes.

Perform a “Muster Drill”

A market correction of 10% or more is the perfect time to open your 401(K) and brokerage statements and perform a “muster drill” (an emergency test) by checking and verifying your portfolio performance and strength in extreme market conditions before the next big bear market storm hits.

A muster drill is a tedious exercise conducted by the crew of a ship with all of the passengers on board putting on cumbersome life vests prior to embarking and running through emergency procedures. With this practice, you will know the alert signal and where to ‘muster’, allowing for less panic and worry in the event of a cruise or stock market emergency.

We empathize with our clients. Nobody likes losing money or seeing big drops in the US Markets at any age. As our client’s financial “captain” and psychologist, we need to be the voice of reason while providing direction and verification through the fog of complex data and hurricane-like news reports.

Benchmark your performance

The stock market has been greatly increasing in volatility over the past few weeks as new reports emerge of COVID-19 (coronavirus) spreading around the world. And while the underlying cause of this stock market pullback may be unique, the fact that the market has declined is not.

Many investors of all ages and investment acumen have very little idea of exactly what percent their portfolio returned as a whole in down markets, or if their losses on their statements are “reasonable” and acceptable based on their personal risk tolerance.

Benchmark your portfolio results year to date against a “blended” benchmark that matches your specific “target” risk tolerance. In most cases, your benchmark may not be the “headline news” benchmark of the Dow Jones (DJIA) index.

If your investment returns are well below your target blended benchmark results or the same (or greatly worse) than the Dow Jones (DJIA) index, it may be time to update and amend your investment strategy and process.

For example, if the Dow DJIA index, is down -10% year to date – and your “moderate” risk allocated portfolio is only down -3% (along with your selected target benchmark results), you may be in better shape than you thought. If you are down -15%, it may be time to make some changes.

Develop Your Diversification Strategy

If history has taught us anything, it’s that the most basic precaution for many investors is simply to make sure that they have properly diversified portfolios. An appropriate portfolio not only has the right mix of stocks, bonds and other asset classes to weather all market conditions but is also tailored to an investor’s financial goals. Of course, this is often easier said than done. Fortunately, those investors who receive appropriate financial guidance are most likely already prepared for market conditions such as the current one.

The S&P 500 has fallen –13% from its peak less than two weeks ago and -8.5% year-to-date. At the same time many “risk off” sectors and indices are forging forward more so than just Gold up 9% YTD. Many major investment grade bond indices are accelerating up as rates are plummeting. As of today the Barclays US Bond index benchmark is up almost +4% year to date and the 20 Year Treasury Bond index up +17% year to date.

Simply put, diversification strives to smooth out unsystematic risk events in a portfolio, so the positive performance of some investments neutralizes the negative performance of others.

The benefits of diversification hold only if the securities in the portfolio are not perfectly correlated – that is, they respond differently, often in opposing ways, to market influences.

Measure your Emotional Resolve

In our everyday lives, it makes sense to heed expert advice on travel restrictions and take basic, sensible precautions. Additionally, while it’s important to stay well-informed, it’s just as important to listen to true experts and not those spreading misinformation or even fear. For a few, building and hiding in a bunker may be a tempting knee-jerk reaction, but this is likely to be an unnecessary overreaction.

The same is true in our financial lives. When it comes to our investment portfolios, it often takes real discipline to avoid short-term panic. Investors today are bombarded by influential sources such as the financial media, pundits focused on short-term trading, and even friends and colleagues who may feel that the sky is falling. It can be difficult to distinguish between appropriate investment advice and knee-jerk reactions driven by market fear and panic. It’s understandable that in these situations, some investors may be tempted to sell well-planned investments and seek safety.

We find that time after time, many investors’ significant underperformance is correlated to their own emotional behavior, more so than the performance of the markets themselves.

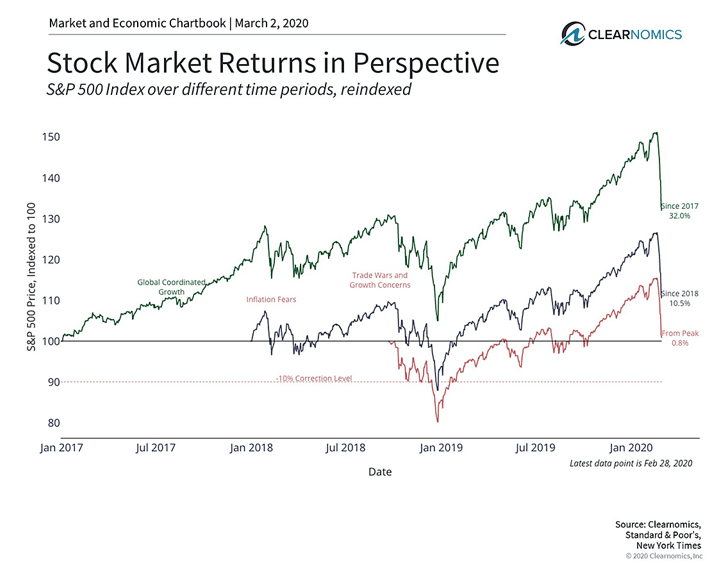

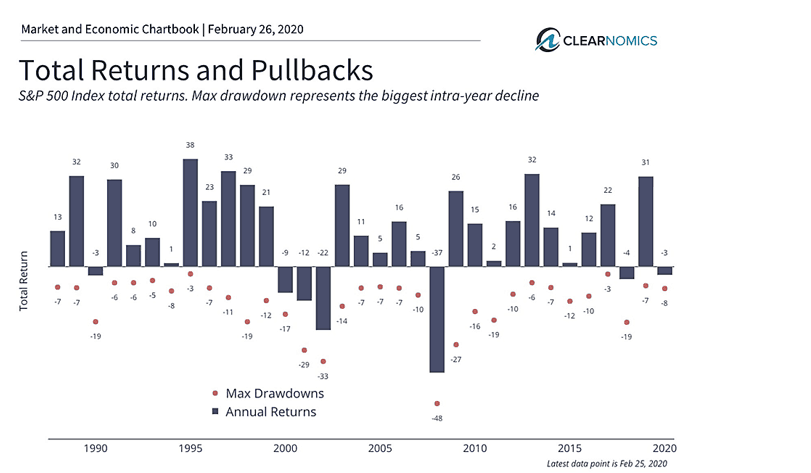

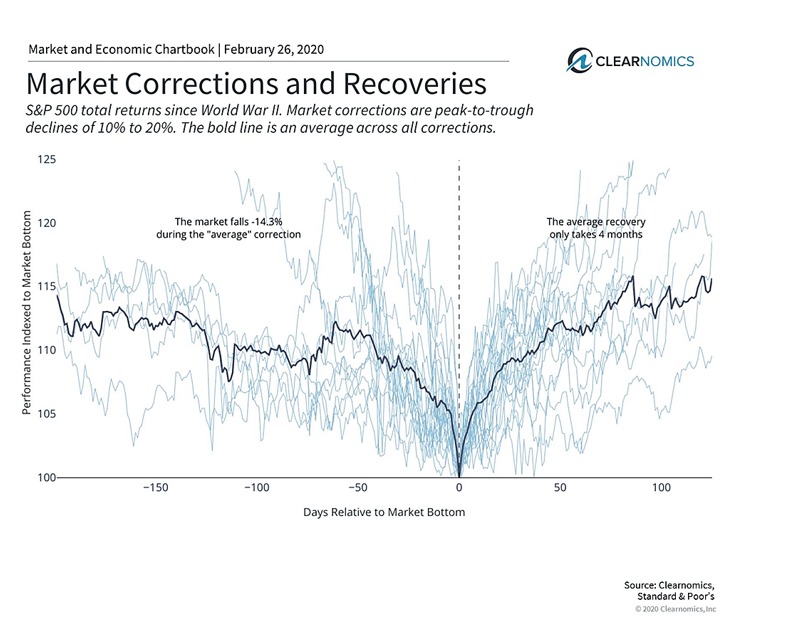

Below are three charts that help to put recent market movements in perspective.

1. The stock market decline has been swift but needs to be put in context

The stock market decline of the past two weeks has been swift. The market is now officially in correction territory, usually defined by a drop between 10 to 20% from all-time highs.

However, it’s important to put this move in perspective. First, the market nearly entered bear market territory at the end of 2018, only to recover swiftly. Investors had many deep concerns at that time about the economy and the Fed – none of which were trivial in the moment.

Second, while the market has dropped 13% from the peak, this is in the context of large gains over the past few years. Since 2017, the S&P 500 is still up 32% (or about 10% per year!). Since 2018, investors have gained 10.5%. Long-term investors should not expect markets to simply move up in a straight line.

2. Short-term stock market swings are normal and expected

Stock market pullbacks occur each year on a regular basis, although the past year has been relatively calm. Historically, the average intra-year decline is nearly 15%. This is true even though the market ends up in positive territory most years. Thus, it’s important to stay invested when markets are volatile and to keep the size of the market decline in perspective.

3. Trying to time the markets is often counterproductive

The term “market correction” is often used to characterize market declines that are between 10 and 20%. While every market correction has distinct underlying reasons, the average market correction recovers within months! This is especially the case if the underlying economy is still healthy and corporate profits are growing.

The bottom line? It’s unclear when the coronavirus will be contained. What is evident, however, is that market swings are normal and expected. Investors should test and test and review of how their portfolio has held up through the recent correction against a similar target benchmark and make any necessary adjustments.

When it comes to diversified portfolios, risk and reward are two sides of the same coin. If history and over half a century of financial market research have taught us anything, it’s that long-run investors are rewarded exactly because it’s difficult to stay invested. If it were easy to be disciplined and to hold onto stocks when the going got tough, everyone would do it. This would drive down expected returns, making stocks less appealing in the long run.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us .

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.