Crude Realities: Oil Prices and War

Oil prices wield significant influence over the global economy, exerting a direct pull on what you pay at the gas station and a subtle push on the prices of everything else you buy. Beyond this immediate impact, they’ve emerged as a pivotal force shaping global markets and inflation patterns in recent years.

This dynamic relationship is akin to a bustling intersection: when oil prices are low or steady, they fuel economic growth, which in turn drives up the demand for oil. Conversely, a flourishing economy stimulates greater demand for oil, thereby influencing its price in a continuous cycle of economic give-and-take. Could a direct or indirect U.S. involvement with a potential Israel – Iran war greatly increase domestic and global crude prices no matter a Harris or Trump Presidency win with potentially opposing energy policies? The short answer is yes.

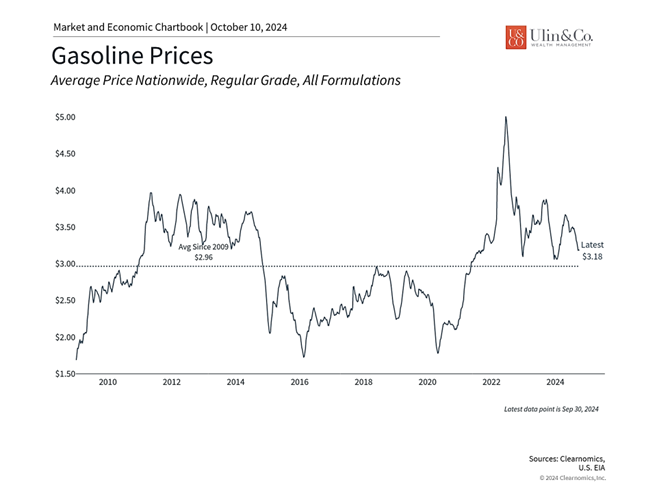

Higher gasoline prices are effectively a tax on households and consumers since driving to work, school, and buying groceries are necessities. Higher gas prices also reduce disposable income for other purchases, especially larger discretionary items from home hardware and appliances to cars, which can impact retail sales and corporate earnings. This could also put the Fed’s lower inflation hopes and new rate cut cycle on hold.

Harris vs. Trump

Israel recently pledged a forceful response to Iran’s recent massive ballistic missile attack, most likely targeting Iranian oil facilities. This escalation threatens to further drive-up oil prices, already soaring in the aftermath of the attack and fears of Israeli retaliation. The potential spike to crude and fuel costs could pose a challenge for Vice President Kamala Harris as she navigates the final stretch of her presidential campaign. History shows that those running while currently in the oval office often suffer in popularity when gas prices increase, regardless of the circumstances.

Iran is an OPEC member with production of around 3.2 million barrels per day or just 3% of global output worth tens of billions of dollars in profits annually. Last week President Biden said in an interview that the US is discussing with Israel the possibility of Israeli strikes on Iran’s oil infrastructure as payback for a volley of nearly 200 rockets fired at the Jewish state by Iran. When asked if he would support such strikes, Mr. Biden said “We’re discussing that.”

While America is one of the world’s largest oil producers, only about 40% of U.S. oil needs are met at home. The top five source countries of U.S. gross petroleum imports in 2023 were Canada, Mexico, Saudi Arabia, Iraq, and Brazil, with Canada as the majority contributor. (US EIA). While the U.S. being a major oil producer could help hedge oil price spikes, domestic producers don’t have the capacity to immediately counter a spike, no less it will be a global commodity pricing issue. Trump’s policies and focus on deregulation in the energy sector could help increase domestic oil and gas production which could help stabilize or reduce energy prices, a significant factor in overall inflation.

Bets on Higher Oil Prices and War

Options traders are making bullish bets that oil could hit $100 a barrel for both WTI and Brent crude on fears of an Israeli retaliation and the effects of both a strike on Iranian oil infrastructure as well as what could happen if Iran shuts down the Strait of Hormuz. This would be the most significant risk to Middle Eastern oil supplies in decades.

If you are old enough to remember, in the 1970s, the Organization of the Petroleum Exporting Countries (OPEC) imposed an oil embargo on the U.S. in response to U.S. support for Israel during the Yom Kippur War in 1973. As a result, OPEC drastically reduced oil exports to the U.S. and other countries supporting Israel, which led to a severe energy crisis. Oil prices quadrupled, causing widespread fuel shortages and skyrocketing gas prices. That would be like paying nearly $13 per gallon at the pump today or over a couple hundred dollars to get a full tank.

To manage the scarcity from the OPEC embargo, the U.S. implemented rationing measures, including limiting gasoline purchases based on the last digit of a car’s license plate – odd or even numbers determined which days you could buy gas, resulting in notable long lines at gas stations across the country. OPEC probably would not go to these extremes today if the U.S. supported a war with Israel against Iran, though Iran this week put out an ominous warning to all OPEC members including the U.S. of any support or involvement with Israel should an attack occur.

Investor Impact

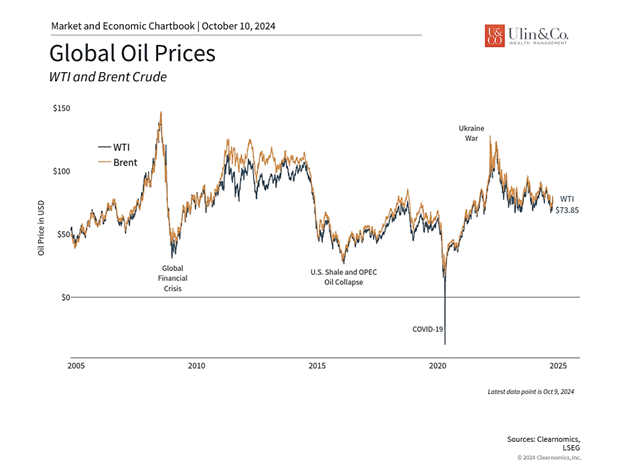

Although prices have fallen from their 2022 high, they have recently risen amid a spike in geopolitical tensions and the potential risk to oil supply. The escalating conflict in the Middle East, which began a year ago with Hamas’s October 7 attack on Israel, is concerning and has significant humanitarian consequences. While acknowledging the human side of the conflict, some investors may wonder what trends in oil prices may mean for their portfolios and the broader economy in the coming months.

The price of Brent crude, the global oil benchmark, recently jumped to $78 per barrel due to the conflict between Israel and Hezbollah/Iran. While this represents a 13% increase from the recent low of $69 a month ago, oil prices are still roughly flat on the year and far below the 2022 peak of nearly $128 when the Russia-Ukraine war commenced. Oil prices can be volatile and difficult to predict, but fears that the conflict in the Middle East would send prices skyrocketing well above $100 a barrel have so far not materialized.

Oil is sensitive to geopolitics and economic growth

Historically, oil prices are influenced by both geopolitics and economic growth. While conflicts can cause prices to spike, as they did when Russia invaded Ukraine, sustained increases in oil prices have more often been the result of rising demand due to strong economic growth. The historic level of oil prices during the mid-2000s, for instance, was the result of rapid global growth prior to the 2008 housing crash and global financial crisis. Thus, geopolitics and growth tend to impact supply and demand, respectively, which can affect how long prices stay high and the resulting effects.

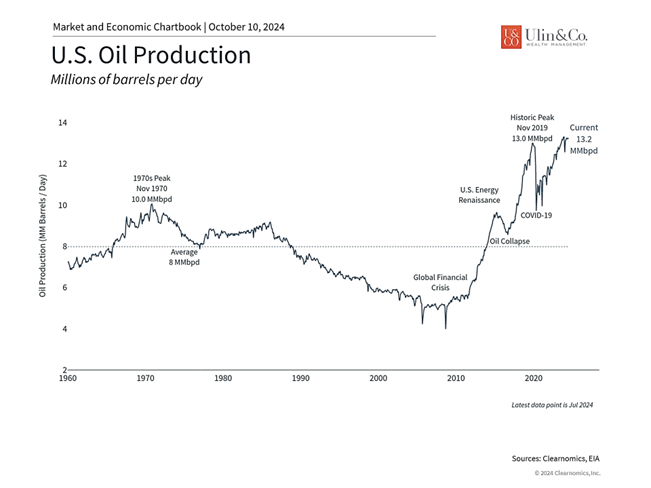

The U.S. is the world’s largest producer of oil and gas

One reason the distinction between supply- and demand-driven shocks matters is because oil producers can respond to changing prices. Unlike in the mid-2000s, the U.S. is now the world’s largest producer of crude oil. Advancements in exploration and drilling have increased output, allowing the industry to maintain high productivity levels. According to the Energy Information Administration, these improvements have been key to sustaining U.S. oil production growth which now exceeds 13.2 million barrels per day.

In theory, this means that the U.S. can play the role of “swing producer” to increase supply when oil prices are high. Of course, this is an oversimplification since the U.S. still relies on foreign imports for 60% of domestic needs (as we covered above) due to the different types of crude oil needed by refineries as well as the effects of various energy policies. Nonetheless we may have a small buffer on price impacts.

In the long run, world oil production is expected to outstrip demand over the next several years, according to the International Energy Agency. This is partly due to U.S. production, but it also reflects the changing dynamics of OPEC+. The group has extended production cuts into 2025 in order to maintain higher oil prices, although the incentives to renege on these commitments to gain market share are high among member countries. This has made the cartel less relevant over the past decade.

Despite these trends and the growing adoption of renewable energy sources which could take many decades to develop, the world remains heavily reliant on oil, which means that it still serves as a transmission mechanism for geopolitical tension to influence the global economy. A further spike in oil prices could act as a headwind to the economy and the “soft landing” the Fed is hoping to achieve.

Gasoline prices remain relatively low

Perhaps the biggest impact of higher oil prices on everyday consumers is via gasoline prices at the pump. Fortunately, gasoline prices remain far lower than their peak in 2022 when the average price per gallon of regular unleaded reached $5. This led the Department of Energy to begin releasing oil from the Strategic Petroleum Reserve (SPR), an emergency supply of crude maintained by the government. Since then, the government has been refilling the SPR at more attractive prices. Still, The United States consumes an average of 20 million barrels of oil a day. Oil can be pumped from the Reserve at a maximum rate of 4.4 million barrels per day for up to 90 days, then the drawdown rate begins to decline as storage caverns are emptied.

From an investment perspective, navigating oil price fluctuations can be challenging especially if they are the result of uncertain or troubling geopolitical developments. The performance of the energy sector during periods of market stress illustrates this point. In 2022, when the broader S&P 500 index was down 18% and most sectors posted negative returns, the energy sector delivered a remarkable 66% gain. This followed a 55% return in 2021 for the sector when the economy roared back after the pandemic.

While past performance does not guarantee future results, maintaining a diversified portfolio that includes many sectors, including energy, can help investors to offset the volatility that results from rising oil prices. In the long run, holding a portfolio that can weather market swings allows investors to stay focused on their long-term financial goals.

The bottom line? Oil prices have risen due to Middle East tensions but remain well below their recent peaks. While oil can impact economic growth, investors should focus on maintaining broad sector exposures in their portfolios and avoid overreacting to daily headlines.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.