Is There an Oil Crisis Evolving?

The short answer is yes, but perhaps for the short term. With the recent surge in fossil fuel prices, inflation and supply-side issues, many headlines are ruminating on the potential path to a global energy and oil crisis.

In the early 1970s, a different type of energy debacle gripped the U.S., caused partly by an oil embargo led by major Middle East oil producers, as consumption surged, and America was greatly dependent on imported crude.

Are you old enough to remember the long lines at the gas stations? The oil crisis of the 70’s was brought about by the Yom-Kippur (Arab- Israel) War of 1973 and the Iranian Revolution of 1979. Both events resulted in disruptions of oil supplies which created difficulties for the nations that relied on energy exports from the region.

Oil Dependency

Energy is the lifeblood of the economy, with global oil demand reaching 100 million barrels per day prior to the COVID-19 crisis with an expectation by OPEC to surpass that level in 2022. Although there is increasing attention on renewable energy sources, fossil fuels still constitute the vast majority of global energy use.

The strong demand for crude appears here to stay in the coming decades. Any decline will only be very gradual, despite the wishes of environmental activists, to Biden’s trillion dollar green deal and infrastructure proposal that big oil firms stop drilling or fracking and leave the world to run on green energy.

Crude oil touches quite a bit of our lives and is utilized as a base for more than just jet fuel, gasoline, diesel fuel, heating and electricity generation. It is also part of petroleum byproducts for tar, asphalt, paraffin wax, and lubricating oils, to chemical use in fertilizers, perfumes, insecticides, soap, and vitamin capsules. Plastic involves use in heart valves to plastic bags, otherwise carbon fiber in aircrafts, PVC pipes, cosmetics and even for windmill parts and machinery.

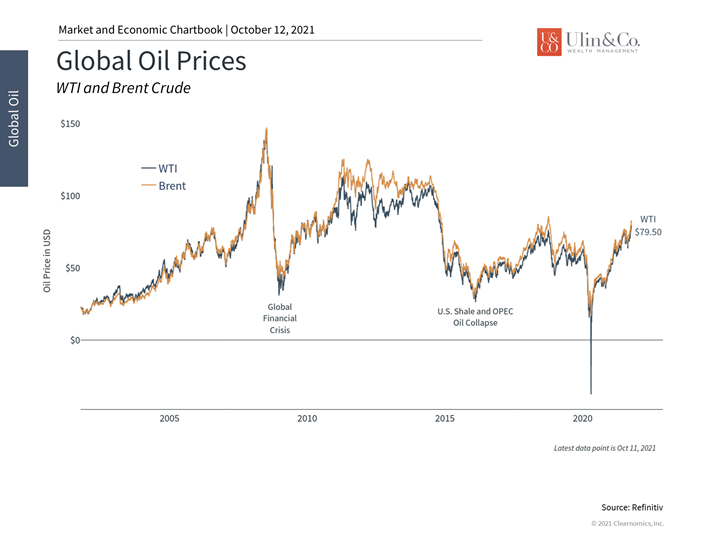

Oil Prices

Oil and natural gas prices tend to be highly correlated with economic booms and busts, as was seen during the mid-2000’s housing bubble when crude reached historic records and, more recently, during the global COVID19 lockdowns when oil prices plummeted below zero last year. (see below) This latter episode resulted in a negative price of oil when financial investors were forced to pay to get rid of contracts in order to avoid taking physical delivery.

Less than a year later, oil prices recovered as the economy quickly rebounded while inflation is rampant. These episodes are a reminder that disruptions to energy markets can occur at any time. Challenges facing U.S., Middle East, and other regional producers are always possible. While the US government does have a strategic petroleum reserve (SPR), it has not sought to utilize it just yet, as we are not experiencing the mass hysteria from the 70’s crisis. The fact that the U.S. has approached energy independence over the past decade has helped over this period.

How Rising Energy Prices Affect Investors and the Economy

It’s impossible to understand today’s economy and markets without a clear perspective on global supply chain disruptions. From computer chips to the availability of workers, supply bottlenecks are raising concerns around economic growth and inflation. One major contributor to these worries is the energy sector with oil prices rising above $80 per barrel, the highest since 2014. (see below) What implications will this have for the economy and long-term investors?

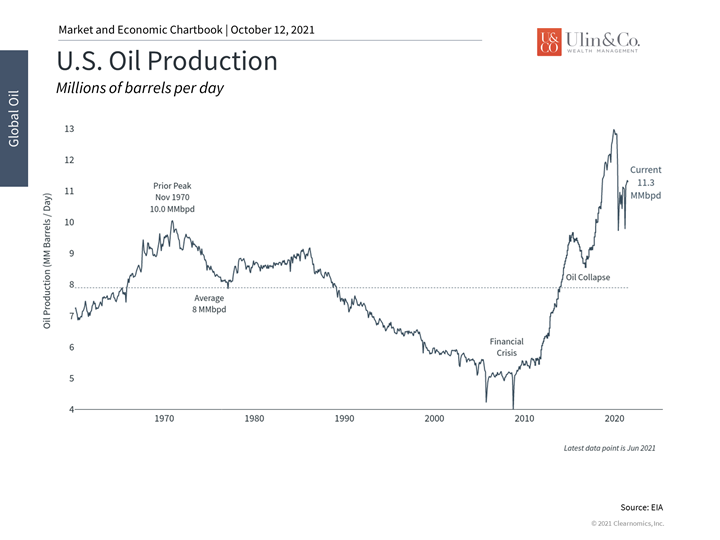

Supply has been slower to keep up with energy demand. OPEC and Russia (known collectively as OPEC+) have raised production only modestly and U.S. producers haven’t filled the gap. Dwindling natural gas supplies and inventories are expected to spill over into oil markets. Places like the U.K. are dealing with gasoline shortages while China is suffering rolling blackouts. Altogether, these forces are pushing energy prices higher. Energy prices affect investors in many ways.

First, today’s oil and natural gas prices are symptomatic of supply chain issues facing almost all industries. Not only are shortages of raw materials and labor impacting production and manufacturing, but logistics are hamstrung with container ships stuck waiting to unload. While it’s normal for energy costs to rise over the course of a business cycle, as they did before 2008 and during the last cycle, today’s situation is somewhat unique.

Thus, even with U.S. consumers in a strong financial position, supply constraints are impacting economic growth. While this should eventually be resolved, it’s hard to estimate how long it will take and will depend on each industry. Some economists, the Fed included, still believe that these factors are “transitory” and could be resolved in 2022.

Second, higher energy prices are negative for U.S. consumers and businesses since they boost the cost of products and services directly and indirectly. Oil prices affects 95% of transportation and create higher food prices. It also impacts 45% of industrial products and around 20% of residential use. As a result, higher oil prices increase the cost of everything you buy, creating inflation.

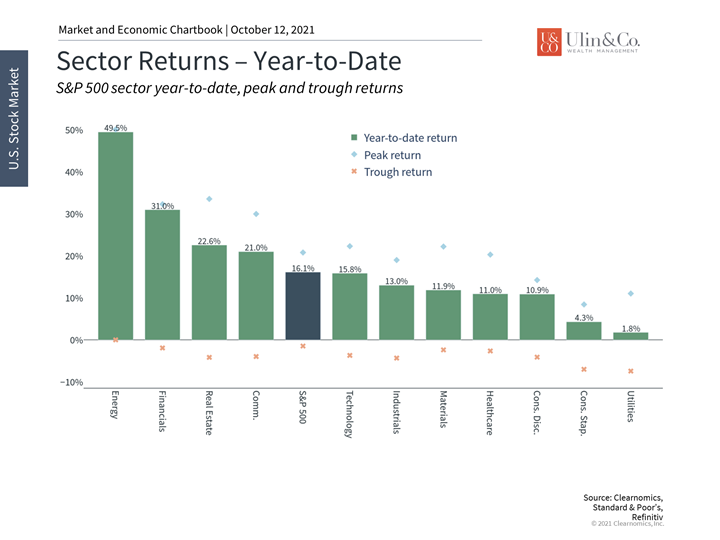

Third, from an investment perspective, the energy sector has been a volatile component of diversified portfolios. The shale revolution which began in the early 2010’s, has faced many ups-and-downs as over-supply became an issue before the pandemic. This led to the underperformance of the sector for years, which most likely caused some investors to avoid energy-related assets.

However, for those who are properly diversified, the energy sector accounts for just under 3% of the S&P 500’s market capitalization. The fact that the sector has gained 50% this year alone, and 81% over the past twelve months, emphasizes the importance of investing within and across markets. (see below) It’s difficult to know what may or may not outperform in any given year, especially once a sector falls out of favor, and thus it’s important to be broadly diversified.

Thus, rising oil prices are both a reflection of supply chain problems as well as a factor that will directly impact consumers and businesses. Although oil prices are above $80 (see below), there are reasons to believe that the economy can still grow steadily, especially if more supply can come online. Long-term investors ought to stay diversified and focused on the underlying issues rather than the day-to-day movements of energy prices. Below are three charts that help to provide perspective on these markets.

1 Oil prices are rising due to supply constraints

Oil prices have been rising over the past 18 months due to surging demand and limited supply. This is consistent with broader supply chain bottlenecks across the global economy.

2 U.S. oil production hasn’t kept up with demand

While U.S. energy companies were expected to serve as the marginal “swing” producers, their production levels have yet to fully recover. Coupled with limited supply increases from OPEC+, rising demand has boosted energy prices to multi-year highs.

3 The energy sector has benefited from higher prices

The energy sector has benefited from higher prices with the S&P 500 Energy index gaining 50% year-to-date. Many investors had avoided the sector over the past few years due to poor performance. This is further evidence that investors should stay diversified both within and across markets since predicting exact winners and losers is difficult, if not impossible.

The bottom line? While there may be an oil crisis in the short term, investors should maintain perspective on supply chain issues rather than day-to-day oil price movements. Staying diversified across sectors is still the best way to manage through the current environment and to achieve financial goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.