Financial Shocks and Inflation Through Retirement

Prices have increased substantially and have remained elevated longer than many economists originally anticipated. Inflation affects our everyday lives in several ways and, naturally, this disproportionately hurts consumers who either live paycheck to paycheck or who are in or near retirement. However, it also impacts those who have not benefited from a proper set of diversified investments.

Financial Shocks

If you are blessed with longevity, you may need to buffer against cost-of-living adjustments in addition to taxes, market volatility, health issues, loss of a spouse or job, and other unexpected financial shocks that could occur at any point before or through retirement.

A study by the National Endowment for Financial Education indicated that it is typical for a person to experience significant setbacks with their retirement savings and income throughout their lifetime, so common, that 96% of Americans experience four or more financial shocks by the time they reach age 70. People that want to believe “it won’t happen to me” are often underprepared from their estate planning and insurance to overall financial management.

This is precisely why it can be beneficial to work with an experienced, accredited, fiduciary advisor such as a CFP® pro to help get you on track and keep you on track for financial independence.

What’s Your Retirement Number?

Determine how much cash you will need from your savings annually to pay for your household budget while adjusting for inflation – as part of determining your lump sum retirement savings number. To determine your “number,” first divide your income goal by 4%, or multiply by 25. For example, for $60K/year in gross portfolio income, you would need a cool $1.5M dollar nest-egg to retire today in addition to Social Security and other potential income sources as part of your retirement paycheck.

Next consider the deterioration effects of inflation on your retirement income goal over time. Just based on an annual average 3.4% inflation rate as things eventually cool off, if you desire $60K for your first year of portfolio income, in 10 years you may require closer to $90K/year and in 20 years $120K (rule of 72).

Being disciplined by saving from every paycheck while remaining invested in a low-cost, diversified portfolio of active and passive fund strategies can be a sound, disciplined prescription to help reach and maintain your retirement savings number and income goal over time. Reaching for yield or being too conservative in cash may not be a sustainable plan through your golden years.

Consider Both Sides of the Inflation Story When Investing

It’s no secret that the prices of everyday goods are rising quickly from their pandemic lows due to strong consumer demand and on-going struggles with global supply chains. Not only does this impact consumers’ wallets but it also has wide-ranging implications for investment portfolios. However, it’s important to keep inflation, consumer sentiment, and the overall growth of the market in perspective when making long-term financial decisions. After all, the same factors that have pushed up the prices of goods have also boosted stock prices, home values and more.

In January, the consumer price index rose by 7.5% over the prior year, the fastest pace since 1982. This was fueled by everyday necessities such as food and energy which rose 7% and 27%, respectively. Other major categories continue to be impacted by supply chain disruptions, most notably for vehicle prices which rose 12.2% for new cars and 40.5% for used ones. Basic needs such as housing and apparel are more expensive as well. Thus, it’s important for investors to separate three relevant impacts of rising prices on their financial needs.

First, inflation is already affecting consumer sentiment. Recent surveys suggest that consumers expect inflation to average 5% over the coming year before beginning to decline. (see below) This pattern is consistent with what many economists expect, i.e., that inflation will peak around mid-2022. To the extent that strong demand has been one driver of inflation, consumer expectations that dampen buying activity could deflate prices somewhat. This is also because other boosts to buying activity such as the stimulus checks of the past two years are now in the rear-view mirror.

The upshot is that consumer buying activity could slow from their recovery highs to more normal levels. This will likely affect the top-line sales figures of many companies, but it was never sustainable to expect retail sales to remain near multi-decade highs. As long as revenue and earnings growth remain steady, history shows that the stock market and investment portfolios can benefit over time.

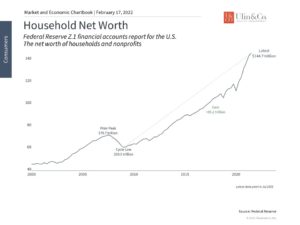

Second, while higher prices affect everyone’s pocketbooks, the average consumer is doing well financially. This is because inflation doesn’t just increase costs – it also boosts home prices, asset valuations, savings rates and more. Household net worth in the U.S. is at a record of nearly $145 trillion which can also create a “wealth effect” that supports long-term consumer spending beyond the initial recovery. (see below) Thus, it’s important to consider the full consumer income statement and balance sheet when evaluating the impact of inflation.

Third, all these factors underscore the need to hold an appropriate diversified portfolio to offset rising expenses, inflation and interest rates. Specifically, this means being aware of spending requirements relative to portfolio yield and other sources of income. With consumer price inflation rising quickly, the average savings account or certificate of deposit not only isn’t keeping up, but its value can be quietly eroded over time.

Whether inflation continues to rise at this pace depends on what is driving it in the first place. If inflation does prove to be more about supply chains than about monetary policy, for instance, then over-reacting in one’s portfolio by only focusing on inflation may not be the right move. Similarly, if inflation does remain hot but in a way that benefits corporate profits, many parts of the market can still do well even as the Fed hikes rates as we saw similarly in 2013.

As always, it’s best to hold a portfolio that can withstand different economic conditions across a full business cycle, ideally with the help of a trusted advisor, in order to stay on track to help achieve long-term financial goals. Below are three charts that provide perspective on how inflation is affecting consumers and investors today.

1 Consumers expect inflation to get worse before it gets better

Consumer sentiment has plummeted in no small part due to rising inflation concerns – in some cases higher than many have experienced in their lifetimes. Still, these surveys also show that expectations fall after a year which suggests that consumers do not expect inflation to remain high forever.

2 Household net worth is at record levels

Despite fears that inflation could boost costs, the average consumer is benefiting from the highest level of household net worth in history. In the long run, this wealth effect is what should drive consumer activity rather than the one-time shock of inflation.

3 Inflation quietly erodes the value of cash

For many, the primary challenge is that inflation erodes the value of hard-earned cash savings. This underscores the need to properly invest this cash to generate a return in order to preserve purchasing power over time.

The bottom line: Investors should focus on both sides of the equation and hold diversified portfolios amid higher inflation through retirement. This is essential not only for the short term but to stay liquid, nimble and diversified for any expected or unexpected financial shocks that may arise in the course of a multi-decade retirement.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.