Buckle Down Through Fed Rate Hikes

“October: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August and February.” This notorious quote by Mark Twain is a cynical assertion that speculation in stocks always comes with risk, especially in the month of October.

In actuality, the month of September has historically been the stock market’s worst month of the year for the past two decades. This year is not out of character with the S&P 500 index down -5.2% by the third week of September, and down almost -13% since the mid-August peak and again hovering in bear market territory below -20%. Likewise, the AAII Investor Sentiment Survey indicates that 60% of members hold a bearish outlook which comes as no surprise but may be a contrarian indicator of better years ahead.

Positive Changes

The stock market is adjusting to a new chapter in the inflation story not seen in decades that could keep Fed policy rates higher for longer while tighter monetary policy also rekindles questions around whether the Fed can achieve a so-called “soft landing” through this turbulent year, as it walks the line between combating inflation and preventing a recession. Recent market swings may be challenging even for the most patient investors, but this adjustment period is both natural and expected through a bear market.

Despite all the ominous headlines, there is a bit of light at the end of the tunnel with energy, oil and food prices recently decelerating, the global supply chain index (GSCPI) decreasing, and used car prices cooling off. You may not see these and other slow-moving shifts helping to alleviate inflation, but they are taking place. Just in as much the container ship backlog outside Los Angeles ports cleared down to 8 ships a few weeks ago, down from a record 109 in January.

We recommend to buckle down and hang on through the Fed rate hikes with elevated volatility and not jump off a moving roller coaster as the consensus from the Federal Reserve Bank of Philadelphia’s Survey (SPF) was that the CPI inflation rate will decline from 8% in 2022 to 3.2% in 2023 and down to 2.5% in 2024, though its going to be a rough ride to get down to the bottom target.

60/40 is not Dead

Generally speaking, “60/40” is shorthand for the broader theme of investment diversification between cash, bonds and stocks for a moderate -risk investor. The traditional 60/40 portfolio diversification strategy may be a bit scathed through 2022, but not actually dead, with a simultaneous and unusual bond and stock bear market with both asset classes trending down near 20% this year.

Diversification is like an insurance policy that does not always pay off every year but helps provide more consistent returns and a smoother ride over time. The key phrase is “over time,” as there are more up years for long term investors to reap the rewards of diversification that stay on course, rather than panicking and capturing losses. Too boot, a diversified 60/40 portfolio has provided better results year to date as compared to the S&P 500 headline- index and with less volatility.

There are very few better liquid, low-cost alternatives to better help meet your financial goals and to keep up with taxes and inflation over time than stocks and bonds even through your golden years. If you are in cash, you are losing about 8% per year to inflation and not growing your wealth before and through retirement. If you need income in retirement, neither cash nor gold can help provide you with income.

Jon here. The silver lining to the Fed hiking the Fed Funds rate multiple times this year is that bonds of varying duration, sector and credit quality are paying more than decent dividends not seen in a decade anywhere from 2%-8%. For those investors that do not seek income, the reinvested dividends are helping to conserve principal while bonds are now working more as a non-correlated hedge against stocks.

Fed Fighting Core Inflation

In times like these, it’s helpful to have a broad perspective by remembering how we got here. Mark Twain also said that history does not repeat itself but often rhymes.

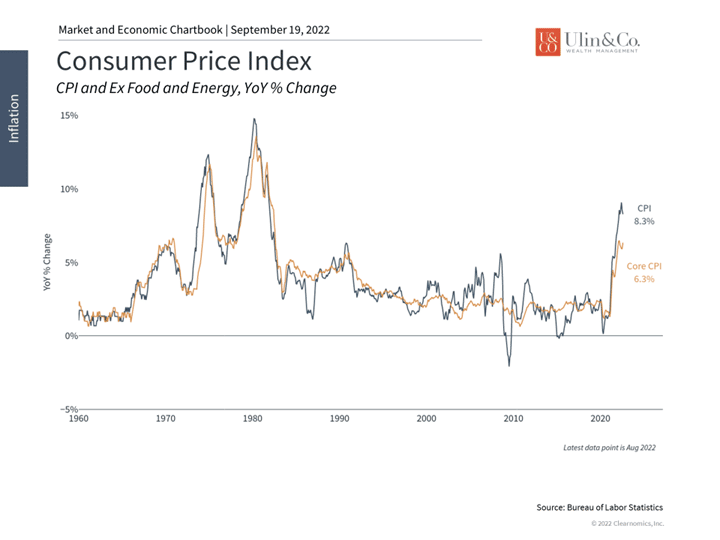

This inflationary period began with pandemic-era shortages and supply chain problems. This was made worse by surging consumer and business demand during the swift economic recovery, fueled in part by stimulus checks and loose central bank policies. These factors caused the Consumer Price Index (CPI) to accelerate past 2% on a year-over-year basis in the first half of 2021 as it climbed steadily to 7% at year end. Then, the war in Ukraine at the beginning of the year pushed energy and food prices higher, causing consumer prices to surpass 9% and producer prices to reach almost 12%. All of these numbers represent the largest price increases since the inflationary period of the 1970s and early 1980s.

Core inflation has re-accelerated even as headline inflation has eased

The good news recently is that energy prices have fallen dramatically since June. Oil is now trading under $90 per barrel of Brent crude, down from its peak of $128 in March. The average price of gasoline has fallen from $5 for regular unleaded to under $3.70 over the same period, driving down the gasoline component of CPI by 10.6% in August. While this is still one of the highest gasoline prices experienced over the past decade, its decline is positive for consumers, businesses and investors.

So, why do markets expect the Fed to tighten further if energy prices are falling? While this driver of inflation has reversed, the bad news is that the effects of inflation have broadened. Measures of “core inflation,” i.e. inflation excluding food and energy prices, re-accelerated in August to 0.6% month-over-month, or a rate of 6.3% year-over-year. This is worrisome because these increases are not in one or two categories, but across many consumer goods and services.

These numbers led market expectations of the Fed to shift upward. Rather than reaching a fed funds rate of 3.75% by year end, the market now expects it to be closer to 4.25%. The peak rate in 2023 has also moved higher to about 4.5% rather than 4%. Interest rates across the yield curve have shifted as a result too, with the 10-year Treasury yield now around 3.5%. Mortgage rates have surpassed 6%, their highest level since 2010 and above their 30-year average of about 5.9%. This could further dampen an already softening housing market.

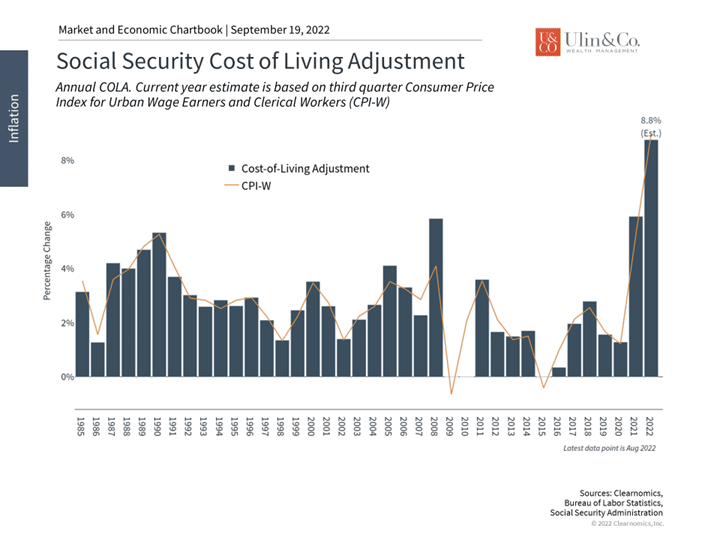

Social Security Cost-of-Living Adjustment is on track to be the best since 1981

However, it’s not all bad news.

First, the Social Security Cost-of-Living Adjustment (COLA) for 2022 will be the largest since the early 1980s. This calculation is based on the average third quarter inflation rate for urban wage earners and clerical workers (known as CPI-W) each year, which means that it is on track to be above 8%. While this doesn’t necessarily make up for low COLA adjustments since 2009, it is positive for those collecting social security, especially if energy prices and headline inflation decline.

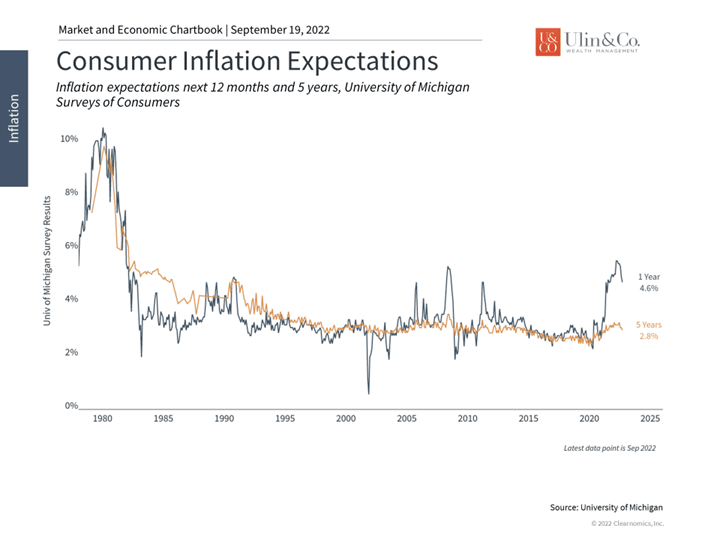

Second, there are signs that inflation expectations are easing. Consumer surveys, for instance, show that one-year expectations have fallen from 5.4% earlier this year to 4.6%. This is driven largely by falling gasoline prices, but is a good sign nonetheless of improving consumer sentiment. The key to the Fed’s balancing act is for consumers to remain financially healthy and to continue spending.

Inflation expectations are improving

Third, stock market valuations continue to hover around their most attractive levels since before the pandemic. The forward price-to-earnings ratio for the S&P 500 is 16.9x, only slightly above the long-run historical average of 15.5x, and well below the peak of 23x just two years ago. With companies still expecting positive earnings growth, there are still many trends working in the market’s favor. Having the discipline to invest when others are fearful is one of the hallmarks of successful investing.

Thus, despite recent market swings, it’s clear that investors ought to stay patient and maintain a longer-term perspective in this environment. Markets often need time to adjust to new data and expectations before moving forward again, just as they did from June to August when many Fed expectations were priced in. It’s also the case that markets almost never move in a straight line, but fluctuate just as rates, inflation and energy prices have this year. Even if the Fed is expected to keep rates higher for longer, the market has shown that it can stabilize and recover once it digests these facts.

The bottom line? Investors ought to remain patient as the market adjusts to new economic trends through aggressive fed rate hikes. Avoiding the urge to overreact to a few days of market activity is important as investors position for their long-term financial goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.