Government Shutdown and Debt Ceiling Dilemmas

Congress faces two significant dilemmas over the next month if its members can’t overcome partisan gridlock over the $3.5 trillion social policy bills and potential tax hikes. Failure to fund the government budget results in a painful shutdown, but failure to increase the debt ceiling would lead to a “first-ever” U.S. default on October 18th along with a financial meltdown. Will our leaders resolve both of these issues?

“You Never Can Tell” is the title of the Chuck Berry song that highlighted the famous John Travolta- Uma Thurman dance scene in the Oscar-Nominated 1994 film Pulp Fiction. The same four words can be said for potential actions by congress with its members and the whole country combative like no other time in U.S. history.

Congress has raised or extended our nation’s debt ceiling limit 78 times since 1960. The 78 total is split 49 times under a Republican president and 29 times under a Democratic president.

The clock is ticking on is the almost $29 Trillion U.S. debt. Just the interest on the debt is $378 billion for past year. That’s debt owed to individuals, businesses, and foreign central banks like China. The debt is held in the form of Treasury bills, notes, and bonds, as well as Treasury Inflation-Protected Securities (TIPS), savings bonds, and other securities.

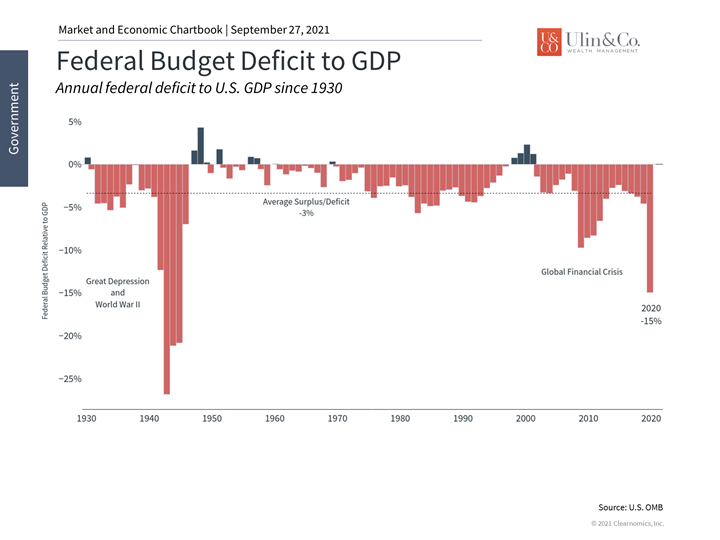

Hitting the debt ceiling would mean that the U.S. government would no longer be able to pay its bills as our nation runs only partially on annual revenues received. The World Bank says a country reaches a tipping point when the debt-to-GDP ratio approaches or exceeds 77%. In the third quarter of 2020, the U.S. debt-to-GDP ratio was 127%.

Jon here. Over the long term, the growing federal debt is like driving cross-country on a quarter tank of gas. Failure to raise the debt ceiling could terminate payments that millions of Americans rely on, including paychecks to federal workers, Medicare benefits, military salaries, tax refunds, Social Security checks and payments to federal contractors while potentially putting millions of jobs in jeopardy.

2011 Debt Ceiling Fiasco Revisited

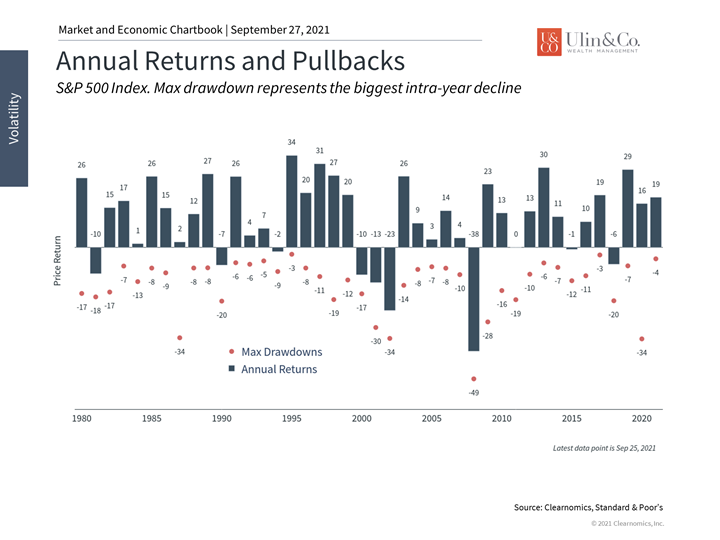

A sneak-preview of this scary movie occurred during the 2011 debt-ceiling crisis under then President Obama and Vice President Biden when politicians struggled to reach a deal till just two days before the stated default date! As a result, Standard & Poor’s downgraded the U.S. debt which then triggered a 19% stock market correction.

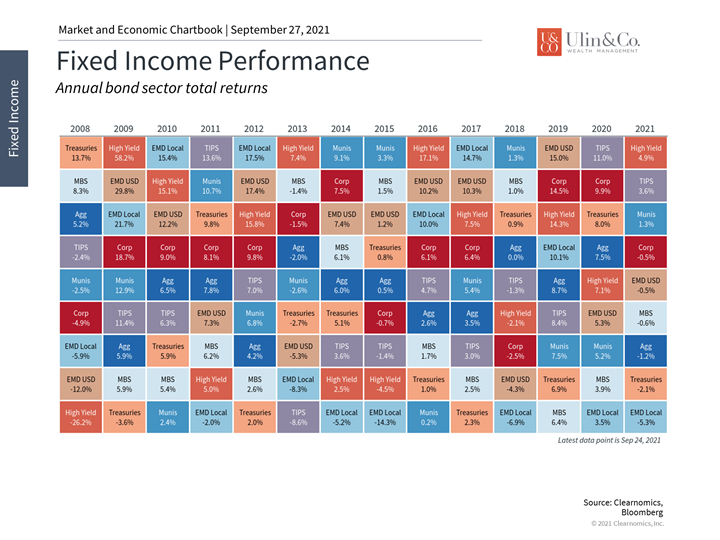

Ironically, the prices of Treasury securities increased during this period. (see below) Even though these were the exact securities being downgraded, investors still believed they were the safest in the world at a time of heightened uncertainty. Thus, they helped to balance portfolios even in extraordinary times.

Ten years later, this is still held as the worst-case scenario for problems in Washington affecting markets. As unfortunate as this period of brinksmanship was, markets eventually recovered, as they tend to do. The S&P 500 returned to its all-time high about four months later. Debt ceiling debates since then have resulted in much less market volatility despite anxiety and headlines.

Don’t’ Get Distracted

While it’s unclear how this will play out over the coming weeks, especially as ongoing debates over the trillions in dollars in new spending proposals continue, the fortunate news is that financial markets are taking these events in stride.

Political events, more often than not, serve only as distractions when managing toward financial goals for the long run. Even when they do result in market volatility, stocks have tended to recover quickly just as we witnessed last year with the COVD19 stock market rebound.

It’s important for investors to distinguish between their political feelings on government spending and how they manage their portfolios. Given that this is how the system works, what matters to long-term investors is whether a game of “fiscal chicken” will spill over into financial markets – even if the government does not default on its debt. Below are three charts that help provide perspective on current debt ceiling and fiscal challenges.

1 The federal debt is approaching the debt ceiling

Congress will need to approve an increase to the debt ceiling soon. This has accelerated in importance due to emergency pandemic spending and increases to the federal budget. Without a raise to borrowing limits, the Treasury will need to enact “extraordinary measures,” including a government shutdown, in order to keep paying the bills.

2 Even in 2011, markets recovered quickly

This last affected markets in 2011 when the debt ceiling debate resulted in the downgrade of the U.S. debt. This rattled markets and led to a 19% decline in the S&P 500. Although the index was flat for the year, markets recovered within months and generated a strong return the following year.

3 Fixed income fared well during the 2011 debt ceiling crisis

Fixed income securities also helped to balance portfolios in 2011, as they often do during times of market stress. This has been true even when interest rates have been low, such as during the COVID-19 pandemic.

The bottom line? Even just a delayed response by Congress on the debt ceiling could cause major market and economic headaches as we experienced in 2011 under the Obama/Biden White House. Regardless, investors ought to remain focused on their financial goals despite ominous, scary headlines out of Washington.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.