FOMO or FOJI & the Taco Trade

Staying Sane — Investing is Not Rolling Dice in Vegas

If it feels like the investing world is spinning like a hurricane lately — and we are all in the eye of tariff and U.S. debt storm, you’re not alone. From “Tacos” to FOMO and FOJI, this year’s markets have become an acronym soup of emotion and reaction. Let’s break it down.

TACO Trade

The S&P 500 has rebounded nearly 20% in recent months, climbing back to near break-even for 2025 — thanks in part to what some are calling the TACO trade: short for “Trump Always Chickens Out.” The idea? Markets have begun to anticipate a pattern of tough tariff ultimatums followed by a walk-back under political or market pressure, creating tradable dips and rebounds.

More than 50 new or revised trade policies have been announced in recent months — many targeting China, the EU, Mexico, and Canada. Key sectors in the crosshairs include steel, aluminum, autos, and electronics, with global giants like Apple and Tesla especially exposed due to their deep international supply chains.

While the volume and pace of announcements may appear chaotic, some investors see a method to the madness. Those leaning into the TACO playbook tend to buy the dip, betting that the latest tariff salvo — whether aimed at semis, EVs, or weight-loss drugs — will soften just as the last ones did.

But these policy swings don’t come cheap. Global companies have absorbed an estimated $34 billion in higher input costs, supply chain shocks, and lost revenue — particularly in tech, autos, airlines, and consumer goods — all of which rely heavily on global logistics and pricing stability. (source: Reuters)

It’s forecasted that rising trade costs and volatile policy could shrink U.S. GDP from 2.8% in 2024 to about 1.6% in 2025 and to 1.5% in 2026 (OECD), stressing that uncertainty—not just tariffs—is weighing on investment, growth and a potential increase in inflation leading to our tepid market outlook for 2025 in our newsletter Road to Nowhere.

Add all this to all-time market highs, the snowballing U.S. debt, recession fears, and whiplash around Fed rate decisions — and it’s no wonder investors are caught in a psychological storm.

FOMO or FOJI: Greed and Fear in Acronym Form

Two of the biggest emotional traps we’re seeing now:

*FOMO – Fear of Missing Out

*FOJI – Fear of Joining In

Some investors are chasing surging stocks, terrified they’ve already missed the rally. Others are frozen in cash, scared that buying now means stepping into a trap.

Here’s the kicker: Both mindsets can wreck your long-term strategy. FOMO and FOJI are just modern labels for Wall Street’s oldest nemeses: greed and fear. And as Warren Buffett famously quipped, “Be fearful when others are greedy, and greedy when others are fearful.” Easy to say. Hard to live by.

Why? Because we’re wired to chase momentum after big runs, sell winners too early to “lock in gains” and hold losers too long hoping to get back to even

Right now, the TACO Trade — mega-cap tech with a current focus on Tesla and apple, AI, chips, and anything semis — has investors salivating. But as we’ve written before: when everyone is on the same side of the trade, it’s time to check your life jacket. Over-concentration can cook even the tastiest taco.

Vegas vs Wall Street

Jon here. Investing for retirement shouldn’t feel like Vegas — but lately, too many investors are placing emotional or concentrated bets instead of making disciplined, strategic decisions within a well-diversified portfolio.

Let’s put this in perspective: The house always wins: Casino games like roulette, blackjack, and slots offer barely 50/50 odds. They’re designed to entertain you — not reward you. The lottery is worse: Americans spend $72 billion annually on lottery tickets. Yet your odds of winning the Powerball? 1 in 292 million. (Fortune)

Yet the stock market is a different story: Historically, the S&P 500 has posted positive returns in 87% of all 5-year rolling periods. (Schwab) The key difference? The major U.S. indices like the S&P 500 are built to benefit long term investors. Wealth is built gradually — not by timing tariffs or betting on Black 17. If your portfolio is globally diversified and aligned with your goals, your odds of long-term success are far better than at the tables in Vegas.

Markets move in cycles. Since 1966, the S&P 500 has experienced a bear market about every 7 years — usually followed by a 6-year bull run. That stat alone won’t make you feel invincible, but it’s a reminder: the long view wins.

Three Factors to Watch in the Second Half of 2025

The swift market rebound following April’s Liberation Day selloff came in spite of a murky macro backdrop: new trade spats, mixed economic signals, and renewed anxiety over U.S. fiscal discipline. While the data continues to show surprising economic resilience, consumer sentiment remains stuck in the doldrums. Here are three key areas we’re watching as the second half of the year unfolds:

1 The Federal Debt Snowball

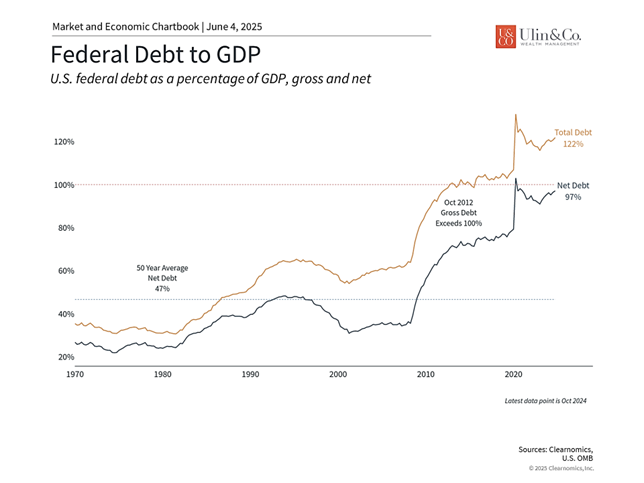

One of the biggest headlines in May was Moody’s downgrade of the U.S. credit rating from Aaa to Aa1 — a move that echoed prior downgrades by Fitch (2023) and S&P (2011). While the market largely shrugged, the downgrade underscores growing concern over America’s long-term fiscal trajectory. (see chart)

The numbers tell the story:

- Total U.S. debt rose to 122% of GDP in 2024, approaching record territory.

- Net debt — which excludes intra-government obligations — is now at 97% and rising.

Washington’s budget battles and unfunded promises are beginning to show their weight. While Treasury auctions continue to find buyers, persistently high deficits may eventually put upward pressure on borrowing costs — especially in a world where the Fed is no longer suppressing yields.

While the U.S. isn’t at immediate risk of default, but the long-term math is getting harder to ignore. Investors should expect more volatility around debt ceiling debates, fiscal showdowns, and credit agency headlines in the months ahead.

Despite the historic nature of the U.S. debt downgrade, markets hardly reacted. This is because the downgrade is mostly backward-looking, and investors are already familiar with the nation’s fiscal challenges. The muted response also reflects lessons from the 2011 Standard & Poor’s downgrade, when Treasury securities continued to be viewed as safe haven assets.

Perhaps it was not a coincidence that this downgrade occurred as the House of Representatives was passing a comprehensive tax and spending bill. The approved bill would extend the individual tax cuts from the Tax Cuts and Jobs Act. This includes a 37% top rate, child tax credits, higher State and Local Tax deduction caps, and exemptions for tips and overtime pay, among other measures. According to the Penn Wharton Budget Model, the legislation could increase deficits by $2.8 trillion over the next 10 years.2 The bill will now be debated and potentially modified in the Senate.

While many would agree that these fiscal challenges require long-term solutions, the U.S. dollar remains the world’s primary reserve currency and there will continue to be demand for Treasurys for the foreseeable future.

2 Trade negotiations show progress

There was some progress on trade negotiations in May, taking many of the worst-case scenarios off the table. The administration reached agreements with both the U.K. and China, while negotiations continued with other major trading partners. The U.S.-China trade agreement included a 90-day period of reduced U.S. tariffs on Chinese goods.

Despite these deals, there will likely continue to be uncertainty around trade. More recently, China and the U.S. have both accused each other of violating the trade truce, and the administration wants higher tariffs on steel and aluminum. At the same time, negotiations with the European Union produced optimism when the White House delayed its scheduled 50% EU tariff after positive discussions. This suggests that diplomatic solutions remain possible, even when initial positions appear far apart.

The administration is also facing legal challenges to its tariffs. In May, the U.S. Court of International Trade struck down many of the newly enacted tariffs, ruling that they exceed presidential power under the International Economic Emergency Powers Act. While a federal appeals court paused the ruling, allowing tariffs to remain in place for now, this legal challenge adds another layer of uncertainty to the trade landscape.

It is important to remember that trade policy typically unfolds over months and years rather than days or weeks. The recovery in May is a reminder that investors should not overreact to trade headlines, especially now that the worst-case scenarios are less likely to occur.

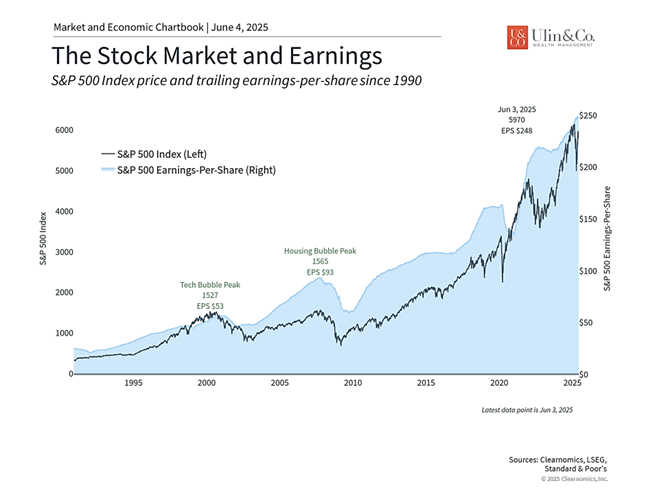

3 Steady earnings growth supports market

First quarter corporate earnings reports presented another reason for optimism. S&P 500 companies delivered positive earnings per share surprises and 64% reported positive revenue surprises, according to FactSet. 3

This strong earnings performance highlighted the underlying health of corporate profitability, with technology companies showing resilience as they navigate trade uncertainty.

In contrast, consumers have been pessimistic this year due to tariffs and inflation concerns. However, recent sentiment indicators began showing signs of improvement that align more closely with positive earnings and economic data. The University of Michigan’s most recent survey for May showed inflation expectations decreasing slightly and sentiment stabilizing. While it’s important not to read too much into a single month’s data, this improvement represents an encouraging development. A strong economy and improving sentiment could help to support markets.

The bottom line? May was a positive month for investors. While the U.S. debt downgrade and fiscal concerns created new challenges, progress on trade deals helped to boost markets. For long-term investors, these developments underscore the importance of maintaining perspective and staying focused on fundamental trends rather than short-term policy headlines.

Emotion is the enemy of sound investing. But discipline, perspective, and a plan? That’s how you win. FOMO or FOJI: Whether it’s a fear of missing out or a fear of buying in, don’t let short-term market noise throw you off your long-term game. If you’re feeling overwhelmed by the headlines or tempted to make a move based on emotion — let’s talk. Your future deserves more than a gut reaction.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

- Standard & Poor’s, Nasdaq, Bloomberg. All month end figures are as of May 30, 2025.

- https://budgetmodel.wharton.upenn.edu/issues/2025/5/23/house-reconciliation-bill-budget-economic-and-distributional-effects-may-22-2025

- FactSet Earnings Insight May 30, 2025

Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Note: This content is for informational purposes only and should not be construed as financial, legal, or tax advice. Please consult your financial advisor, attorney, or tax professional regarding your specific situation.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.