Fed Shifting Interest Rate Gears

The Federal Reserve has begun raising interest rates for the first time since 2018. This process is commonly referred to as “liftoff” because policy rates have remained grounded at zero percent since the Fed’s pandemic rate cuts two years ago in response to the COVID19 crash and resulting recession.

While the initial market reaction has been positive, investors have faced a wide range of concerns as inflation has worsened and the Russia/Ukraine war has intensified. Perhaps the most important fact to remember is that rate hikes are a normal part of the business cycle. The Fed’s job is to help keep the economy steady by achieving maximum employment and stable prices.

Monetary Policy

“Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” -Einstein

No matter whether you are applying for or refinancing a college loan, credit card, business loan or home mortgage, or are attempting to “squeeze” income out of your nest-egg in retirement, most of us at any age are not immune from the movements of interest rates.

When driving a car, you may only have a vague idea of how the underlying engine mechanism works. Internal combustion engines can contain any number of combustion chambers (cylinders), typically between four and twelve. Yet you should know that the accelerator speeds you up and the breaks slow you down.

A bit opposite of the effects of the accelerator and brakes on your car, when the economy is decelerating the Fed downshifts short term rates (the Fed funds rate) into lower gears as a monetary policy mechanism to help speed up the economy while encouraging lending and investing in the stock market. When the economy is accelerating along with inflation as it is today, the Fed up-shifts short term rates into higher gears to help slow it down.

Retirement Income

Many people are being squeezed by soaring inflation. This may have retirees on a fixed income concerned about getting by or running out of savings during their golden years. Inflation rose 7.9% in February from 12 months ago, the highest we have seen since the early 80’s, according to the Labor Department.

Next year, retirees may receive a 7.6% cost-of-living adjustment (COLA) boost to Social Security, according to a preliminary estimate from The Senior Citizens League, a non-partisan senior group. The recent bump for 2022 in January was 5.9%, the highest in 40 years.

Interest rates matter to investors for many reasons. Most obviously, interest rates are directly related to the amount of income investors can expect to generate from their portfolios. As a measure of the “risk-free rate,” the yields on U.S. Treasuries represent a baseline level of interest that can be earned by investors across different maturities. Choosing to take on additional risk allows investors to potentially increase their yield above and beyond this risk-free rate.

Many of our retired clients in their 60’s 70’s and 80’s hold a solid footing in equities with a balanced 60/40 diversified portfolio to help take a bite out of inflation, reduce exposure to interest rate risk and to help better meet their financial goals as long term investors.

Exposure to stocks can help provide retirees a cushion against rising prices and elevated inflation today more so than cash, CD’s, bonds or many less liquid alternative investment products that are often sold by brokers as a fear-hedge to market volatility and crashes.

At the same time, holding a high percentage of savings in cold-hard cash while spending down your principal each month can be of greater risk to run out of money over time for retirees than riding out volatility in the market, especially with today’s running hot inflation debacle that may stick around for a while.

The Fed’s Tool Box

What is unique this year is that inflation is at its highest point since the early 1980s. Global supply chains still face many problems with important goods like semiconductors in short supply. Energy prices have spiked as a result of Russia’s invasion of Ukraine, driving the domestic average price of gasoline past $4.25 a gallon for regular unleaded. Inflation has been much more persistent than many economists expected, and it is directly impacting the wallets of consumers.

With this backdrop, it’s no wonder that many have been calling for the Fed to tighten even as markets worry about the implications of higher rates. In this environment, there are two important reminders from history that are relevant to the quarters and years ahead.

First, the Fed rate hike in March is only the beginning of the process. The Fed’s own projections show the federal funds rate reaching 1.75% by the end of the year. This would equate to six quarter-point rate hikes in 2022 across six remaining meetings.

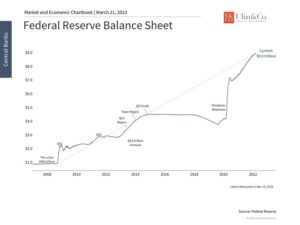

In addition, the Fed has communicated that they may begin to reduce their balance sheet as early as their next meeting. Their holdings of Treasuries and mortgage-backed securities have grown to $9 trillion, double their post-2008 peak. (see below) By not re-investing the proceeds when bonds expire, and possibly selling certain bonds outright, the Fed will effectively tighten financial conditions further. If the Fed has direct control over short-term interest rates via the fed funds rate, they have indirect control over longer-term rates via the bonds they carry on their balance sheet. If the previous cycle is any indication, this process will occur in the background over the course of years.

Second, history shows that Fed tightening is not usually something for investors to fear. Although markets performed well when Fed policy was loose, this is a matter of correlation rather than causation – both markets and the Fed are driven by strong economic conditions. Thus, it is not the case that Fed tightening directly causes bear markets, if they occur at all.

For all of the constant Fed-watching – including 2013’s taper tantrum, 2015’s Fed liftoff, last year’s taper announcement, and the recent rate hike – markets have done fairly well across cycles though most major bond indices are in the red thus far for 2022. To phrase it more strongly, investors who stayed invested throughout Fed policy cycles would have likely performed better than those who tried to time each decision. In fact, it can be argued that monetary policy will still be quite easy for some time to come. After all, what is a quarter-point rate hike when CPI is rising 7.9% year-over-year?

Of course, the biggest exception to this occurred during the 1970s and early 1980s when then-Chairman Paul Volcker was forced to tighten policy in order to tame inflation. Monetary policy does not magically cure inflation. Instead, it does so by reducing demand, thereby pulling prices down. During that period, the economy fell into recession but emerged with inflation under control.

While some are worried about a recession in the near future, this is not yet inevitable. Not only are the causes of today’s inflation quite different but the broader disinflationary trends (e.g., technology, a glut of worldwide savings) are still at play. Even oil prices have come down from their recent peaks. So, while a recession is always possible and inflation could stay higher for longer, overreacting to these trends could be counterproductive to long-term investors.

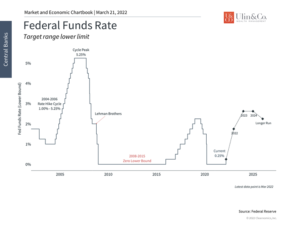

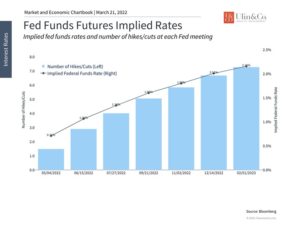

While the past is no guarantee of the future, history reminds us that those investors who have the time horizon to be patient can often benefit from market uncertainty. Below are three charts that help provide perspective on Fed liftoff.

1 The Fed has begun to hike policy rates

The Fed has begun to raise interest rates and is expected to do so throughout the rest of the year. In many ways, the Fed is “behind the curve” as it responds to elevated inflation.

2 FOMC members expect seven rate hikes in 2022

Both the market and Fed expect at least seven total rate hikes this year. If this occurs, it would imply one rate hike at each remaining meeting in 2022.

3 The Fed will shrink its balance sheet soon

The Fed has also communicated that it is ready to “run off” its balance sheet. How it does so is still uncertain but this tool does give it another option in tightening financial conditions, especially long-term interest rates.

The bottom line: The most important consideration for investors is whether or not their financial plans and portfolios support their long-term goals. Periods of disruption, which we’ve experienced throughout the first quarter of the year, can raise market concerns. But they can also create opportunities that benefit investors over time. At the moment, valuations are at their most attractive level in two years for the broader market and across certain sectors.

Investors should maintain perspective as the Fed begins to hike rates to combat inflation. Prior rate hike cycles were not a reason to panic and instead created opportunities for patient investors.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.

Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Adviser. IFP and Ulin & Co. Wealth Management are not affiliated.