Fed Intervention While Consumers Party Like its 2019

Massive 1000-point midday swings in the stock market this year may be partial- offshoots of investors’ fears of a hawkish Fed putting projections and words into action with interest rate hikes to help put the brakes on record high inflation. With various polls and surveys predicting the end of the Bull market by year end, is it time to cash out? Is maximum bearish sentiment a good contrarian indicator to stay the course? The short answer is the latter theory.

While 2022 has been one of the worst starts to a year simultaneously for stocks and bonds, the volatility comes as no surprise as the market is “repricing in” the risk for future rate hikes, a slowing economy, geopolitical uncertainty (war) and more after quite the “V” shaped recovery through the pandemic (albeit brief) recession.

Jon here. Volatility is why investors are paid to own stocks – and is the cost of admission. After a year of minimal volatility in 2021, perhaps 2022 provided a swift kick in the butt to remind us that the markets do not travel in a straight line nor only go up. This year is also a evidence that while the economy helps to drive stocks, headlines combined with human fear and greed drive the markets in extreme conditions up to a point.

Quants vs. Humans

There are studies indicating that algorithm-driven “quantitative investing” systems account for more than 60% of stock trades, especially in more volatile environments. Trading algorithms respond to the same evidence as humans and are trained to sniff out, yet quickly trade on broad indexes to individual companies if they recognize certain triggers.

More than just facts and numbers, it is perhaps more concerning that robo-algorithms can even gauge the words, speaking tone and inflection of a human, such as Fed Chair Mr. Jerome Powell, while identifying signs of how people may trade from his outlook. These quant-driven trades can end up triggering panic among humans to start selling stocks- thereby feeding a brutal cycle that leads to more quant trading.

While we cannot control the robots, we can control our own behavior in the short term to not panic with our disciplined, long term investment strategy based on a belief that major events such as global pandemics, Fed rate hikes, war, tariffs or tax policy changes will throw the global markets into a crash or recession.

It’s the Consumer

Consumer spending is the backbone of the U.S. economy, constituting over two-thirds (70%) of our $20 trillion GDP. This includes spending on all goods and services, large and small. In normal times, many factors affect the level of consumer purchases including consumer confidence, the job market, household net worth, inflation, the stock market and more.

Under the panic of ominous headlines, the driving force under the surface of the stock market volatility is that consumers and businesses are operating with low to moderate levels of leverage unlike the environment before the 2008 crash and have cash on hand. People are finally getting out of the house and spending their money not just on goods and services but on travel and leisure activities.

The Wall Street Journal recently reported that American consumers are shopping, traveling, going to concerts and working out like it’s 2019. Many people have returned to their old habits in many ways, while focused to make up for lost time over the past two years stuck at home.

Stay the Course

As we discussed last week, giving into predictions, surveys, opinions, the madness of the crowd and investing with an emotional approach is hazardous. Not in as much as being a contrarian voice to the pessimistic media pundits, maintaining a disciplined, diversified, risk managed strategy can help minimize emotions from the equation while working to provide a bit more sleep and a smoother ride.

Long term Investors should not make any major changes to their balanced portfolios based on the direction of interest rates or short-term stock market volatility but stick to their financial plan. Overall asset allocation should remain unchanged to avoid market timing.

Rate hikes can affect your investments inside and outside your 401(K) accounts. Bond prices react negatively to rising rates which is a factor of duration risk. It may be prudent to prune your non-retirement portfolio for tax harvesting by selling longer duration bond funds at a loss and buying back shorter duration vehicles including floating rate and Treasury Inflation protected (TIPS) sectors if you think rates may continue to go up.

Rising rates can be detrimental for stocks from adding headwinds to company profits especially in the tech and growth sectors. As new bond issues offer higher rates, investors may put additional pressure on stock prices by selling stocks and buying bonds to help de-risk their portfolios and increase income.

Perhaps we are not only at maximum bearish sentiment, but maximum inflation peaking that may tamper down a bit due to rising interest rates headwinds along with a strengthening dollar. The Fed may be able to thread the needle of putting the brakes on inflation with tighter policy without having a hard landing.

Finding Optimism Through Maximum Pessimism

For some investors it may feel as if the market can’t catch a break. After what has already been a difficult start to the year, last week’s GDP report confirmed that economic growth slowed for the first time since the pandemic began. This news, along with higher interest rates and faster Fed tightening, drove the S&P 500 back into correction territory and the Nasdaq into a bear market. However, there is also positive news beneath the surface that could matter more in the months, quarters and years ahead.

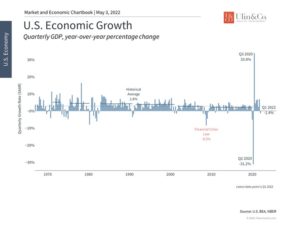

The latest GDP report for the first three months of the year showed that the country’s gross domestic product shrank by 1.4% on an annualized, quarter-over-quarter basis. (see below) This simply means that there was less spending in some parts of the economy last quarter. While this was a negative surprise, even the 1% growth rate that economists had expected would have been a deceleration. At this point, the drags on the economy are well known – high inflation and energy prices, rising rates, Fed rate hikes, the war In Ukraine, and more.

Under the surface, there were actually some positive signs. Consumer spending grew 2.7% even after adjusting for inflation. Also, while economic growth slowed compared to the previous quarter, it still rose 4.3% when compared to the prior year. It was mostly a decline in government spending, a worsening trade deficit and changes to business inventories that made overall GDP negative last quarter – factors that could rebound too.

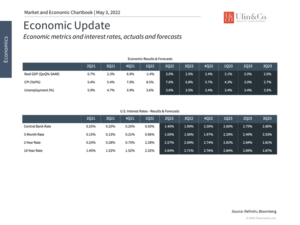

Still, the negative headline number has naturally raised concerns over a possible recession. Recessions are casually defined as two consecutive quarters of negative growth. However, the organization that officially decides recession dates, the National Bureau of Economic Research, considers a variety of economic data. Fortunately, these data still look robust, even if they are not perfect. The job market, in particular, is exceptionally strong with unemployment of only 3.6% and wages for hourly workers rising 6.7%.

For long-term investors, what matters is not that the economy is perfect – it’s that overall growth will support corporate earnings and thus market returns. Companies are still doing well in spite of high inflation and other sources of uncertainty, with an S&P 500 earnings-per-share estimate of $237 a year from now. Over the course of full business cycles, it is profitability that propels stocks and portfolios ahead, allowing investors to achieve their financial goals.

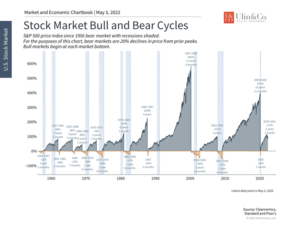

Even if a recession were likely, the reality is that they occur every five to ten years across history. The pandemic-driven recession, for how severe and destructive it was, only officially lasted two months. In other words, these are not surprise events – they are a natural part of the full business cycle of expansion and contraction.

In other words, investors ought to hold long-term portfolios that are designed to withstand these periods, ideally with the guidance of a trusted advisor, rather than adjust portfolios on-the-fly. While pessimism can occasionally pay off in the short run, it almost never helps in the long run. Even when the situation fails to evolve as investors hope, investment portfolios that are properly positioned often find a way to perform well nonetheless.

Thus, the more optimistic perspective for investors is that the economy can continue to grow at a steady pace once it gets over the near-term speed bumps. Below are three charts that put the economy in perspective.

1 Economic growth slowed during the first three months of the year

The economy contracted slightly for the first time since the pandemic began. This was driven by government spending, business inventories, and the trade deficit. Consumer spending was robust during this period despite rising inflation.

2 Bull and bear markets behave very differently

Recessions and bear markets are natural parts of the economic and market cycle. Investors should hold portfolios that can withstand these periods rather than treat them as special cases. Still, bull markets tend to be long, lasting several years if not a decade or more, compared to recessions and bear markets which tend to be much shorter.

3 Economists expect steady but moderate growth

The negative GDP number for Q1 was driven by factors that are widely known. Economists expect steady but moderate growth in the coming quarters as the economy and world get back on track. This is the case despite inflationary concerns, Fed rate hikes, and more. Investors ought to focus on these long run trends and not a single three-month period.

The bottom line? Investors should continue to stay invested and diversified in a portfolio that can withstand short-term market challenges.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.