Diversify in May and Stay

The month of May is notable for Cinco de Mayo, National Teachers Day and Mother’s Day. It’s a month that culminates the transition from spring to the first day of summer as patterns in life and nature continue.

A bit more ominous, Mayday is an emergency procedure word used internationally as a distress signal in voice procedure radio communications. It derives from the French phrase “venez m’aider”, meaning “come help me”. Could this distress signal be a precursor for the stock market adage which warns investors to “Sell in May and go away?”

This market-maxim is based on the concept of seasonality, specifically that stocks perform better in the six winter/spring months than they do in the summer/fall. In such strategies, stocks are sold at the start of May, then are bought back again in the fall around Halloween.

Seasonal Patterns

While we are skeptical of seasonal calendar market-timing patterns and maxims that rhyme, the S&P 500 gained +7.1% and advanced +77.5% of the time during the six months ending in April (since 1950), versus a +1.7% average gain during the six months ending in October while increasing only +64.8% of the time.

What this tells us, is that historically the summer months have been slower than the winter months. There is less activity on the street with many institutional traders and Wall Street tycoons heading out to the Hamptons and perhaps now down to South Florida for summer break.

Still, the odds have more recently been in investors favor. As April showers brings May flowers, in 8 of the past 10 years up till last summer, stocks have risen during the May-October “undesirable” summer- stretch. Four of those years brought in returns of 7.1% up to 12.3%.

Rate Hike Cycles

We discussed last week that while stocks have exhibited volatility in the face of past Fed rate hike programs, they tend to find their footing once they adjust to higher rates. In the last six hiking cycles, the average S&P 500 return was over 13%. Still, this time may be different. The markets are experiencing combined headwinds of heated oil and commodity prices, the Ukraine war debacle, China macro- issues, continual global pandemic outbreaks and record high inflation.

Around two-thirds of investors (61%) expect more market volatility over the next 12 months, according to a Nationwide investor poll. Seven in 10 (70%) said they were concerned about a recession over this same time period.

Jon here. Giving into predictions, surveys, opinions, the madness of the crowd and investing with an emotional approach is dicey. Not in as much as being a contrarian voice to the pessimistic media pundits, maintaining a disciplined, diversified, risk managed strategy can help minimize emotions from the equation while working to provide a bit more sleep and a smoother ride. At the same time, investor sentiment looking very bad can be a very good contrarian indicator.

Under the surface of the US market lingering in correction territory near 10% for the S&P 500 YTD and many major bond indices down even more, some investors may be experiencing severe Dot-com bubble PTSD symptoms from the recent pounding taken by the NASDAQ index along with major tech stocks including Amazon, Tesla, Meta, Netflix, Paypal, NVIDIA and Shopify down in the range of 20%-72% year to date. You would think we were in a worse-crash scenario than the Dot-Com era, but that is not the case.

Value and defensive stocks have performed sufficiently this year indicating that perhaps there has been a shift in momentum from growth and tech “shelter in place” sectors and stocks going beyond the poster-child Peloton and Zoom headline fiascos the end of last year.

Suffice to say you may have a few options being (1) consume less news and stay invested, liquid and diversified (2) cash out, take a loss and get eaten alive by inflation (3) invest in complex, illiquid insurance and alternative investment vehicles pitched at steak dinners as a hedge to market volatility. Our consensus would be to stick to option number one.

Diversification Helps Investors Through Elevated Volatility

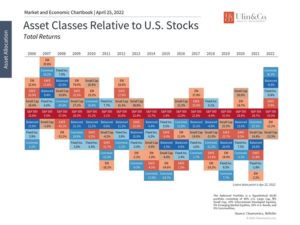

Most investors intuitively understand the value of diversifying across asset classes such as U.S. stocks, fixed income, international assets, small caps, and more. The purpose of diversification is neither to outperform on any given day, week, or month, nor is it to do better than the S&P 500 or Dow in the long run. Instead, diversification is about generating healthy returns while properly managing risk. By combining different types of assets in an appropriate way, it’s possible to construct portfolios that have attributes aligned with the investor’s long-term goals.

This is important because investors who stick to their financial plans, invest for the long run, and stay diversified are more likely to achieve their financial goals. Unfortunately, those parts of the market that outperform tend to receive the most attention, leading to a temptation to chase what’s already worked even if it’s just a flash in the pan. Conversely, asset classes that underperform over a short period are often shunned by investors, even when their fundamentals are sound and could play a critical role in a portfolio.

Today, there are a few key issues driving performance across asset classes. Perhaps the biggest challenge is that interest rates spiked again last week with the 10-year Treasury yield rising as high as 2.94%. This was its highest level since 2018 and breaks the 40-year trend of falling rates.

On the one hand, sudden jumps in interest rates can have ripple effects across stock and bond markets. Not only do higher rates mean that future cash flows may be less valuable today, which hurts current asset prices, but they can also make interest-bearing assets more attractive. All told, this means there is often a shift from “riskier” stocks to “safer” bonds.

Taking a broader perspective, it’s very normal for interest rates to rise during the growth phase of a business cycle. And while inflation is certainly much higher than in the past, there is no reason yet to believe that individuals, businesses, and financial markets can’t adapt to higher rates.

Another issue has to do with international concerns. The war in Ukraine continues to evolve, putting pressure on international relations, Europe, and energy prices. Additionally, China’s ongoing lockdowns amid its zero-COVID strategy could further worsen supply chain disruptions and manufacturing output. In the worst case, this could exacerbate inflation in certain goods. At the same time, history in China and other parts of the world suggest that issues do resolve themselves over time.

Thus, while every market pullback is challenging and each new situation feels unique, the reality is that diversified portfolios tend to stabilize and recover over time regardless of the underlying causes. Resisting the urge to overreact to every new headline is a sound way for investors to help achieve their financial goals. Below are three charts that put the importance of diversification in perspective.

1 Most asset classes are negative this year

Most asset classes are in the red this year due to rising inflation, the Fed, geopolitical risk, and other challenges. However, diversified portfolios have done somewhat better throughout this period and provide a better balance of return and risk over time.

2 In the long run, being diversified creates a smoother ride

Diversification has helped investors going back to the global financial crisis. When the stock market came roaring back after the pandemic shutdowns, diversified portfolios benefited. In times of market distress, diversification can help to protect on the downside. Ultimately, it’s better for investors to hold portfolios that may allow them to sleep well at night.

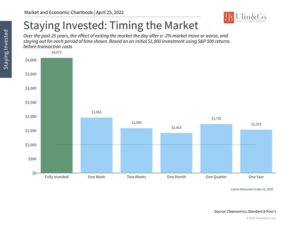

3 Staying calm helps investors to achieve their goals

This chart highlights the importance of not overreacting to negative market days, including recent pullbacks. Staying invested even when the market is down 2% in a single day has historically been far superior to trying to get out and then back in.

The bottom line? Long term investors ought to diversify in May and stay invested through today’s challenging market environment.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.