Factors Promoting Market Recovery and Homeostasis

Coming from a family of physicians with distinct memories of going on rounds with my father on Saturdays through the Hahnemann Medical College and Hospital in Philly, it may come as no surprise that I often utilize medical analogies in our client meetings and market discussions. Investing is truly an art and a science, like medicine, between the science of the data and the art of interpreting information to make informed, disciplined decisions.

Homeostasis is the ability of an organism or environment to regulate itself back to a state of equilibrium despite forces from outside factors and stressors. After experiencing one of the worst starts to the year, the Fed, markets, and economic mechanisms are helping to stabilize valuations for both the stock and bond markets while working to cool off heated inflation.

As we discuss in our client meetings, negative returns relate to price volatility and not permanent impairment of capital unless you cash out and capture losses that may never be regained. While no one knows if we are at the bottom of the bear market just yet or turning a corner for market recovery to the next bull market, there are financial indicators that the expectations for future bond and stock returns are more appealing today, just a few weeks into the second half of 2022.

Elevated inflation may not last forever or lead to 18% mortgage rates like the early 80’s. Banks and individuals are well capitalized with cold-hard cash to spend (fueled by pent up demand) and are not overly leveraged, like back in 2008. Unemployment numbers have fallen over the past quarter, and the VIX (fear index), hovering near 24, is not overly- heated as in past historic crashes and recessions. By the time you read about the markets and economy improving and hitting equilibrium prices will already be higher.

TINA and Bonds

TINA (there is no alternative!) had become a mantra of bulls since the COVID crash, contending that yields have been so low that bonds were hardly worth owning as an asset class, and to stick with stocks. The tides are now changing as higher bond yields are putting a lid on high-valuation stocks while drawing investors back to the table in droves to help de-risk their portfolio and to develop income.

For diversified investors, bonds are slowly regulating back to a state of homeostasis or equilibrium and working more as expected in diversified portfolios. While the financial sector tends to do well when rates rise, RUST equity sectors may be taking the brunt of the pivot to bonds from real estate, utilities, staples, and telecom stocks that pay decent dividends and are a staple in preferred strategies.

Diversification

As we discussed last week, the current bear market may already be in a mild recession that is painful but not “great” like in 2008-2009. For the first time in a while, bond and stock negative correlation is working. As noted by LPL research the diversification benefits of bonds may be improving as fixed income is again acting as an equity buffer.

“Now that interest rates have moved off the all-time lows set back in August 2020, there is more of a cushion for bonds to act like a diversifier during equity market drawdowns, which is what we’ve seen during the most recent equity market stresses over the past few weeks. Since the start of May, equities were down over 6% whereas core bonds are positive which is comforting.

Stock Valuations

Stocks are also regulating back to a state of homeostasis or equilibrium as stock PE valuations are lower and less expensive just over the past month. As the economy responds to inflationary pressures, investors continue to struggle with big daily price swings across the stock market leading to panic and uncertainty. Long-term investors should use valuations as a North Star to help guide them over the coming years and decades. Consider the following.

First, it’s important to discuss why valuations matter. In short, valuation measures are the best tools that investors have to gauge the attractiveness of the stock market over years and decades. Unlike stock prices on their own, valuations don’t just tell you how much something costs, but tell you what you get for your money in terms of earnings, book value, cash flow, dividends, and other fundamental measures. After all, holding shares of a company means you are entitled to a portion of its profitability, so paying an appropriate price for this can improve the odds of future gains.

Valuations are highly correlated with long-run returns

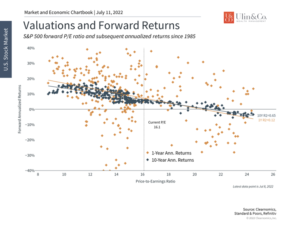

Valuations are correlated with long-term portfolio returns for this reason – i.e., buying when the market is cheap improves the chances of success, and vice versa. The chart above shows how the forward price-to-earnings ratio, which uses earnings estimates over the next twelve months, correspond to subsequent 1-year and 10-year annualized returns. The dots for 10-year annualized returns cluster more tightly around the trend line than do 1-year returns which can vary significantly.

The fact that any metric is this highly correlated with stock market returns is quite amazing. To a large extent, the reason this pattern exists is exactly because it is difficult to stay invested when markets fall and valuations are the most attractive. Just think about how most investors feel today, or back in March 2020, or during 2008. Staying patient is much easier said than done, but this data emphasizes how important it is in order to achieve financial goals.

There are other reasons valuations are much better indicators than prices alone. Prices can rise over long periods of time, just as they have for the U.S. stock market over the past century, despite bear markets and short-term corrections. Comparing prices today to previous peaks and troughs doesn’t make much sense across these distinct time periods. Valuations, on the other hand, “normalize” prices by some important measure such as sales, earnings or cash flow, and can thus be a guide across different market cycles. This adjustment makes prices more comparable over time to determine whether an asset class, sector or individual investment is attractive.

Today, various measures of value are far more attractive than they were even six months ago. As the chart below shows, the price-to-earnings ratio of the S&P 500 has fallen from near the peaks last seen during the dot-com bubble of the late 1990s and early 2000s, back toward the long run historical average. This closely-watched measure using next-twelve-month earnings estimates is hovering around 16.1x. Similarly, the Shiller P/E ratio, also known as the cyclically-adjusted P/E since it uses ten years of inflation-adjusted earnings, has declined to 28.9 from almost 39 at the end of 2021.

Stock market valuations are more attractive today

This same pattern can be found across a wide variety of valuation measures, from price-to-sales to dividend yields. Across asset classes, especially public equities, valuations are much more attractive today than at any point since mid-2020. Could valuations fluctuate further? Of course. If the market declines, valuation levels could look even more attractive. Conversely, if earnings decline as the economy decelerates, this could push valuations higher since lower profits mean that share prices are more expensive.

However, the point is that valuations are not a timing tool. As discussed above, valuations have very little historical correlation with returns over shorter time periods including one-year periods. It’s over several years or more that they begin to correspond to more attractive expected returns. For this reason, valuations are among the most important tools for constructing long run portfolios. This is true even though markets can continue to rise or fall regardless of valuations in the meantime.

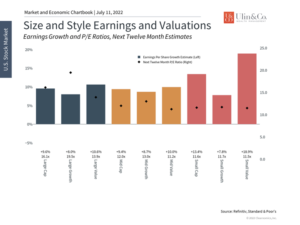

Different sizes, styles and sectors are more cheaply valued

Thus, in today’s difficult market environment in which all asset classes face significant uncertainty, investors ought to focus on valuation measures and not just daily price swings. The broad market is now cheaper than it has been in years, and many sizes, styles and sectors are more attractive as well. Large-cap growth stocks are still quite expensive after their significant run, despite this year’s drawdown. However, market sentiment has shifted in favor of areas such as value whose valuations are still much lower. Ultimately, diversifying across all of these areas, with an eye toward relative attractiveness, can help investors to position for future growth.

The bottom line? Where valuations go from here will be important for the direction of long run returns. Market recovery is being driven by many factors from Fed actions to market and economic activity. Investors should continue to stay invested and diversified as the cycle shifts from a bear market to an eventual recovery.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.