Calibrate Your Investment Vitals

Vital signs (vitals) are the four most important indicators of the body’s vital (life-sustaining) functions which include body (1) temperature (2) blood pressure (3) pulse (heart rate) and (4) breathing rate.

These measurements are taken to help assess the general physical health of a person, give clues to possible diseases, and show progress toward recovery. There is no better time than the present with extra time on your hands through year two of COVID19 to meet with your primary care physician and your financial advisor to check on your physical and financial vitals, put a plan in place and make any needed adjustments.

Just remember your health affects your wealth and your wealth affects your health. The most important vitals that can be financially life sustaining to help meet your personal and retirement goals over time are related to your investment policy statement.

Investment Policy

Investment Policy Statements (IPS) provide specific guidelines for informed decision-making between advisors and clients, while serving as an overall financial blueprint to investing to help meet your long-term goals.

An IPS addresses four vital financial indicators including your (1) risk tolerance assessment (2) investment goals (3) asset allocation strategy and (4) financial objectives according to your plan. The IPS should also cover the standards for selecting investments and products as well as the specifics of how – and how often you will monitor and benchmark the process and results.

Your IPS can change year to year based on your age, beliefs, feelings about risk and life events (such as retirement, divorce or loss of a job or spouse.) Investing your life savings without an IPS is like driving across a foreign country without a GPS or road map. The IPS can help you to better “stay the course” mentally through market volatility and frightening financial headlines, while maintaining a less emotional and more disciplined process.

Your underlying financial objectives as part of your IPS blueprint may further break down your Retirement Policy Statement (RPS). The RPS should clarify the specifics of your retirement cash flow goals: your targeted income needs and how much of them will be covered by Social Security, pensions, annuities or other recurring revenue streams; your portfolio spending (distribution) rate (to make up any shortfalls) and the extent to which it might change over time; and whether you are utilizing an income-centric, total-return, or blended portfolio income approach to investing.

Balance Fear and Complacency at Market All-Time Highs

Year-to-date, the stock market has continued to grind higher despite short-term worries around the pandemic, a retail trading frenzy, the Fed, inflation, tech stocks, potential tax law changes, the Suez Canal blockage and more. Even as we write this, there are new questions around forced block trades from a failed hedge fund and the potential ripples across the market. It is in times like these that investors ought to focus on the long-term trends rather than the day-to-day headlines vying for their attention.

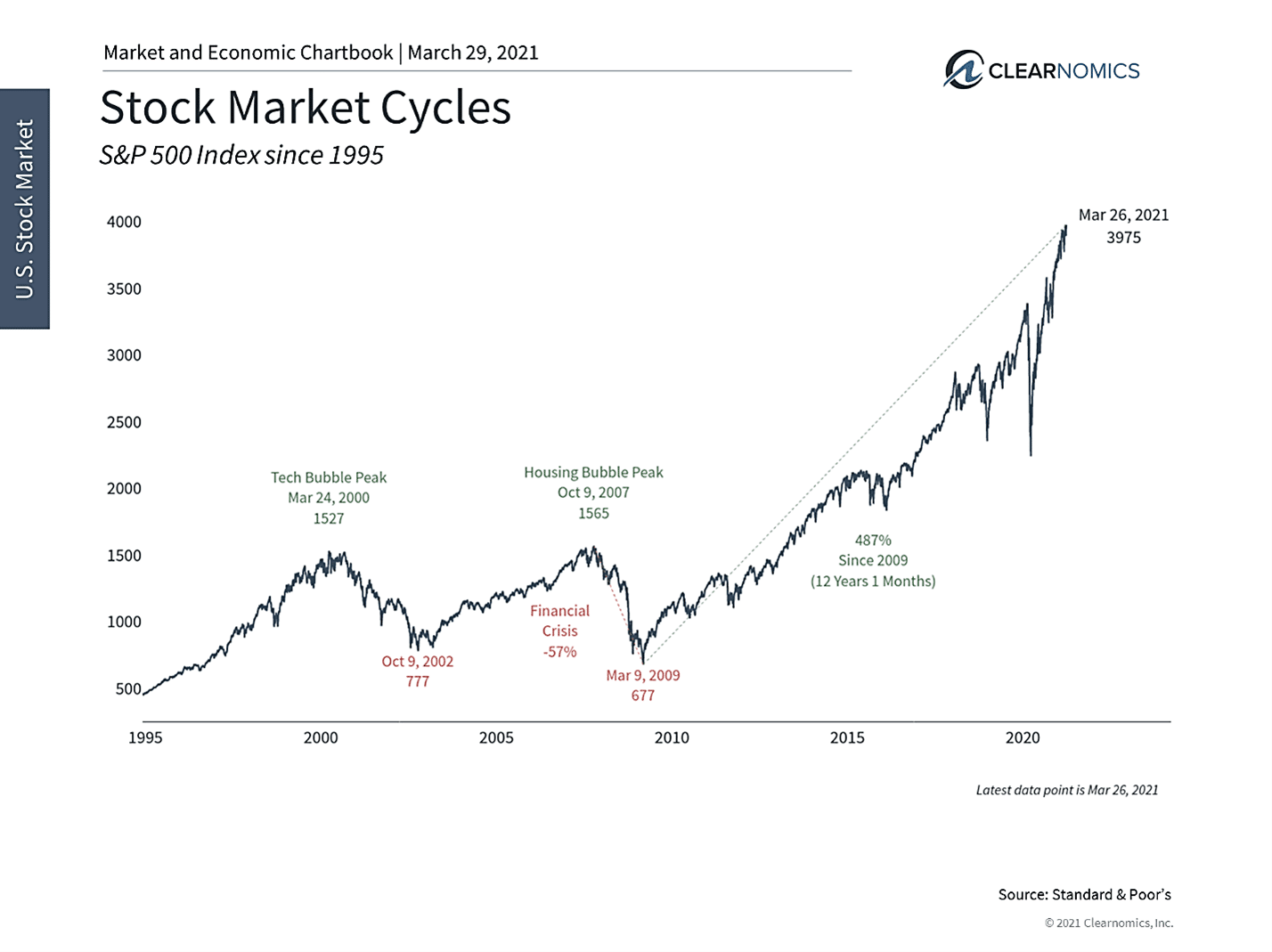

It may surprise some investors to learn that this is the 35th time the market has achieved a record level since the recovery began just one year ago. That may seem unbelievable except that, by definition, the stock market often spends most of its time at or near all-time highs as it rises during bull markets. This has certainly been the case since 2013 when the S&P 500 recovered from the global financial crisis.

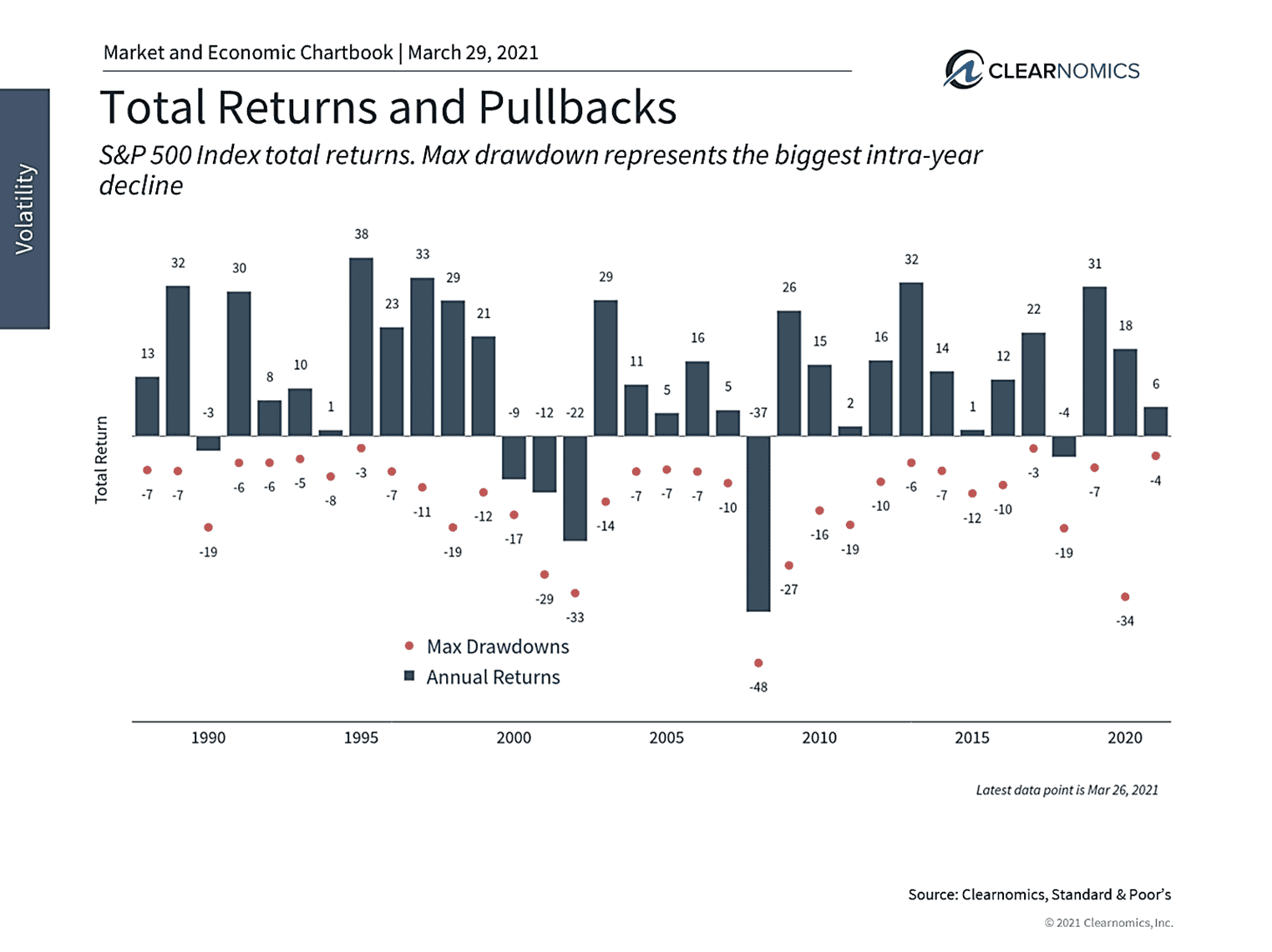

Additionally, despite bouts of market turbulence this year, the biggest decline in the S&P 500 has only been 4%. (see below) This may feel unusually small to some investors given how large the move in interest rates and certain sectors, such as tech, have been. Fortunately, the rotation benefitting areas originally hit hard by the pandemic, including energy, materials and industrials, has offset poor performance in high-profile sectors.

Jon here. As we discuss in many our client review meetings and workshops, that bear market year or not- it’s important to remember that the annual (average) decline at some point every year of the US stock market (S&P 500) tends to be closer to a <15%> correction on average, before recovering and ending on a positive note. (see below.) The ultimate impact on investor portfolios depends on whether they stick to their plans through changes and turbulence while investing through COVID19.

Watch Future Trends

What matters more than what stocks have done recently since the rebound are the underlying trends that affect profits, and valuations. Thus, this early phase of the market cycle requires investors to carefully balance two factors. First, the economy continues to recover which is driving markets higher. It likely makes sense to stay invested as the new business cycle evolves and to stick to long-term asset allocations. There will no doubt be more hiccups around inflation, monetary policy, the U.S. dollar and more as this develops. However, history has shown that stocks tend to rise over long periods of time as the world improves. We are just in the beginning phases of a new bull market.

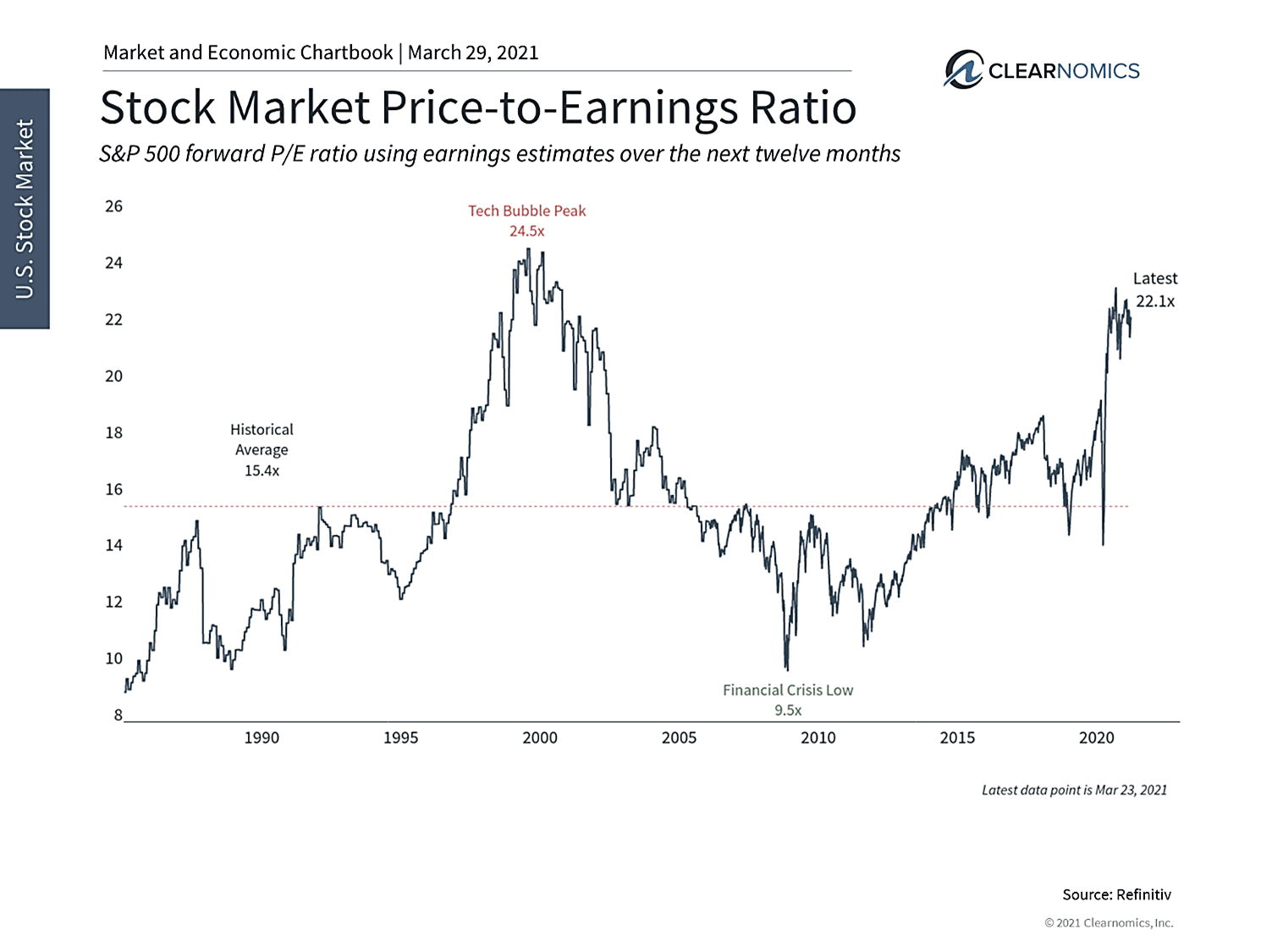

Second, even as they stick to their financial plans, investors ought to remain disciplined and avoid complacency, especially while valuation levels are elevated. At the moment, the broad market trades at a price multiple of 22 times next-twelve-month earnings – near its historic peak of 24.5x during the dot-com bubble. (see below) Of course, this is due to the collapse in earnings during the pandemic lockdowns. If earnings can fully recover and achieve new levels by the end of 2021, as many expect, this ratio could slowly fall to more attractive levels.

The same is true when assessing the valuations across sectors and styles. Tech-related industries and growth stocks are still relatively expensive after their bull runs last year. While some of these investments can still make sense, it may be necessary to re-evaluate these holdings and consider portfolio adjustments. This is an area in which having a trusted advisor is crucial, since the goal is often to make tilts to well-thought-out asset allocations, not to abandon them altogether.

Thus, investors face a balancing act between taking advantage of the business cycle and staying disciplined. While this is a difficult balance to strike amid constant distractions, history has shown that those who are able to do so have a better chance at achieving their financial goals. Below are three charts that help to put recent market highs in perspective.

1 The stock market continues to reach new highs despite short-term concerns

The stock market reached new all-time highs recently – the 35th time they have done so over the past year. This should not surprise experienced investors since the underlying economic trends are favorable. At the same time, investors ought to stay disciplined.

2 The largest pull back this year has only been 4%

Although many of the episodes that have grabbed investor attention have felt volatile, the largest intra-year decline has only been about 4% this year. And although markets have swung in both directions, the S&P 500 is still positive for the year.

3 The market and certain sectors are not cheap

Despite positive markets, investors ought to remain disciplined. Valuations across the market are still elevated and are close to historic peaks. These could moderate over time as the economy and corporate profits improve. Now is the best time to evaluate asset allocations as the cycle evolves.

The bottom line? Investors should stick to their asset allocations and consider tilts in order to help them stay invested. Although there will no doubt be more market-moving headlines the rest of the year, the underlying long-term trends are positive. Investing is truly about your time in the market and not “timing” the market.

Most important, consider working with an accredited financial advisor such as a CFP® professional as your trusted “guide” that can help you get your “financial house” in order for the short term while providing a financial “blue-print” to get started and stay the course.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.