Brace for Bond Market Turbulence

The historic bear market in bonds last year was a shock to investors and raised questions around the role of fixed income securities in portfolios. This is because, until 2021, inflation had been steadily falling for 40 years since the 80’s, pushing interest rates lower and bond prices higher.

Beginning last year, record high inflation and elevated interest rates fueled by an aggressive Fed rate hike cycle hit the 60/40 portfolio method in the chin after delivering the worse performance for bonds in history along with one of the most terrible annual returns for the 60/40 approach as discussed in WSJ 1.6.23 “Your Investing Strategy Failed.”

After a strong start this year for bonds with inflation cooling off, the U.S. 10 Year Treasury yield surprised to the upside a full point since April, ringing a record high bell of 4.255% by mid-August while wiping out most intermediate to long term bond returns for the year. With added pressure on credit and fixed income from a combination of lingering inflation, high rates, a hawkish Fed, the banking crisis, and the recent Fitch U.S. credit downgrade, is it time to bailout of your bond holdings and pivot to concentrated positions in gold, crypto and other alternative assets? The short answer is a resounding no, if you are a long term, diversified investor.

The Best Offense

Jon here. TINA is still dead despite recent sightings, referring to the acronym for “there is no alternative” to stocks. Even with increased volatility of bonds in 2023 fueled by gyrating interest rates, bonds are holding up and helping to insulate diversified portfolios from volatility while paying dividends not seen in over 15 years. The main concept through this week’s economic overview is that annual bond declines of 2%-5% are typical and not out of the ordinary.

From investing to football success, having a plan in place with key players on the field and in your portfolio is vital to help weather uncertainty. As the Patriots head coach Belichick is often quoted as saying, “the best offense is a good defense,” though it may not always lead to a winning season. Just the same, investor portfolios playing a strong defense with bonds and diversification did not hold up as usual in 2022 and may currently appear a bit on shaky ground. Just remember that bonds work as the insurance policy to your portfolio, though they do not pay out all the time.

Bonds Are Vital for Diversification

While 2023 has so far been a better year for bonds after last year, rising interest rates over the past four months have acted as a headwind and are worrying investors. The U.S. Aggregate bond index has gained now near zero this year, down from a peak return YTD of 4.2% in April. High yield bonds, which are volatile and often behave more like stocks, have interestingly hung onto their gains with a YTD return of near 6%. At the same time, rising yields mean that bonds are able to generate more portfolio income than at any other time over the past 15 years.

Consider the following factors regarding recent swings in the bond market that have created more uncertainty.

The bond market is having a better year than in 2022 despite recent volatility

First, consider that annual bond market turbulence, like stocks, is not unusual. Recent events have led to swings in interest rates beginning with the U.S. debt downgrade by Fitch Ratings on August 1. This jump in rates had ripple effects across the market since U.S. Treasury securities serve as a benchmark for riskier bonds. However, just a week later, Moody’s downgraded 10 banks, placed six under review, and shifted the outlooks on 11 to negative. These ratings and outlook changes briefly renewed concerns over the financial system which caused interest rates to fall. Since then, there have been concerns around the supply and demand of Treasury securities, worries over China’s housing sector and economic instability, and more.

All told, these events caused large intra-day rate swings with the 10-year Treasury yield rising to 4.2%, then falling to 3.9%, before surging again over the past few days. This volatility directly impacts bonds since prices and interest rates are two sides of the same coin. In general, rising interest rates lead to lower bond prices, and vice versa. One intuitive way to understand this is that the cheaper you can buy a bond with a specified payout schedule, the higher your eventual return, or yield, will be.

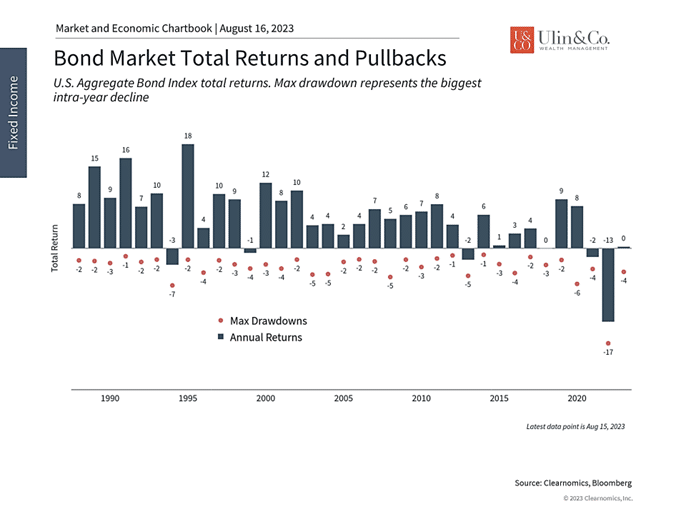

Despite these changes in rates and bond prices, it’s important to maintain perspective on the bond market behavior of the past two years. Last year’s historic surge in inflation resulted in the worst bear market for bonds in recent history, as shown on the accompanying chart. This year, bond returns have mostly been positive, and the largest intra-year decline of 4% is well in-line with historical patterns since most years experience similar declines between 2% and 5%.

The yields on riskier bonds have fallen

Second, consider that a soft landing is possible. While the Fed is expected to keep policy rates high, there is less pressure to hike rates again as inflation improves. The latest Consumer Price Index report shows that price pressures are not only easing, but that headline inflation is already back to the Fed’s 2% target when considering the latest annualized rate. Core CPI is also just under the target at 1.9% on an annualized basis and the trend is deflationary when shelter costs are also excluded. These numbers are important because they represent what is happening to consumer prices today, compared to the more commonly cited year-over-year measures that tend to be more backward-looking.

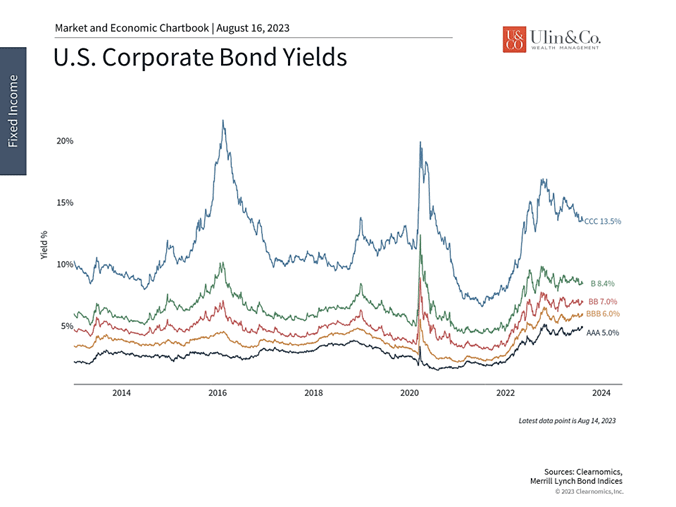

So, while the Fed has penciled in one more rate hike this year, markets believe this may not be necessary. The probability of a so-called “soft landing” has increased as economic growth has remained steady as well. This has helped to reduce credit risk concerns which were elevated during the banking crisis. As the accompanying chart shows, yields on riskier bonds have come down as recession concerns have faded and corporate earnings have beaten low expectations. Ironically, only the yields on the highest rated bonds have increased due to the U.S. debt downgrade. All in all, this means that even if a recession does occur, markets expect that it would be mild and that companies would still be well-positioned to repay their debts.

Bonds are offering attractive yields for long-term investors

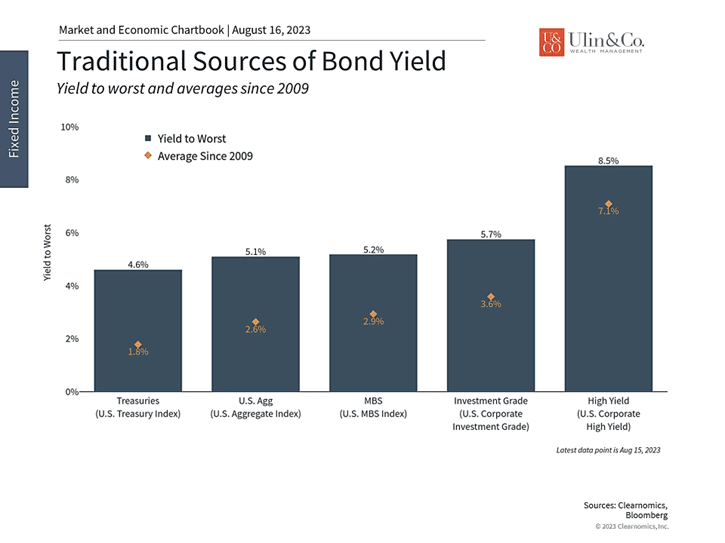

Finally, investors can be better positioned to generate portfolio income today from their portfolio management strategy without “reaching for yield” by taking inappropriate risks, than at any point since the global financial crisis. A diversified index of bonds now yields 5% – nearly double the 2.6% average since 2009. Investment grade corporate bonds generate 5.7% and high yield bonds 8.5%. In contrast, the forward-looking dividend yield on the S&P 500 is now only 1.9% after this year’s strong rally. This is further evidence that diversifying across stocks and bonds continues to be the best way to construct well-balanced portfolios that can achieve income and growth, while withstanding different market environments.

The bottom line? The bond market turbulence continues to be driven by the uncertain economic environment. Still, this year’s bond performance is a sharp reversal of last year’s bear market, and the level of volatility has been in-line with the typical year. Most importantly, attractive yields underscore the need for bonds in long-term portfolios as inflation improves and the economy recovers.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.

Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Adviser. IFP and Ulin & Co. Wealth Management are not affiliated.