Black Swans and the Balancing Act of 2021 Recovery

Black swan events are defined as rare, unexpected and catastrophic occurrences that are impossibly difficult to predict. The term was popularized by former Wall Street trader and finance professor Nassim Nicholas Taleb, who wrote about the concept in his 2001 book Fooled by Randomness.

The term is based on an ancient saying that presumed black swans did not exist, a saying that became reinterpreted to teach a different lesson after black swans were discovered in the wild.

Taleb describes a black swan as an event that 1) is beyond normal expectations that is so rare that even the possibility that it might occur is unknown, 2) has a catastrophic impact and 3) is explained in hindsight as if it were actually predictable.

Black Swan events are becoming more frequent rather than being a rarity, from the dot.com crash (2000), 9/11 Terrorist Attacks (2001), Iraq War (2003) SARS Virus (2003), Global Financial & housing Meltdown (2008), Fukushima Nuclear Disaster (2011), Crude Oil Crash (2014), Black Monday China (2015), Brexit (2016) and of course, COVID19 (2020). These events seem to tie financial and non-financial events together with a reach affecting people globally well beyond Wall Street.

Whether you are an optimist or a pessimist, fear and greed can subconsciously drive your decision making process in many areas of your life. With the significant rise and use of technology and social media over the past decade, headlines, and negative news from local to world events can make it feel like there is a 20- foot megaphone next to your ear magnifying the voices in your head.

It’s All In Your Brain

Behavioral biases in your brain triggered from existential events can lead to poor investment decision making and contribute to underperformance over time. The critical bias of “loss aversion” is the tendency to avoid losses over attaining equivalent gains and can lead to market timing into cash at exactly the wrong time when volatility hits.

So lets’ take a page from Warren Buffet. When asked by a CNBC personality in 2009 how it felt to have “lost” 40% of his lifetime accumulation of capital, he said “it felt about the same as it had the previous three times.” The bottom line, market corrections do not equal a financial loss unless you panic and sell.

Unfortunately, investors often find it more natural to be pessimistic. After all, with one’s hard-earned savings on the line, it’s hard not to focus on what can go wrong and go into panic mode. In contrast, real progress tends to happen slowly – often at a barely perceptible pace. Even so, this drives the stock market higher over the course of years and decades.

For more than a century, diversified portfolios have helped create wealth for those who have stuck to their plans despite uncertainty. Ensuring that short-term pessimism is not at the expense of long-term optimism is a key to successful investing.

Balancing Act

This balancing act through the COVID19 recovery is perhaps trickier than ever. On the one hand, the economy and stock market have rebounded since last March, COVID-19 vaccines are being distributed and additional stimulus measures are in the works. On the other hand, the recovery has decelerated, valuations are near all-time highs and many hard-hit businesses are still suffering. These are challenging times for policymakers, corporate leaders, small business owners and individuals. From an investment standpoint, however, it’s important to balance the good and bad news.

As an example, last week’s jobs report for January provided a mixed view of the economy that could be interpreted as the glass being half empty. Only 49,000 jobs were created in the first month of the year when 105,000 were expected by economists. Last November and December’s numbers were also revised down by 159,000 jobs based on new data by the Bureau of Labor Statistics. This suggests that the economic deceleration at the end of 2020 was perhaps worse than originally believed.

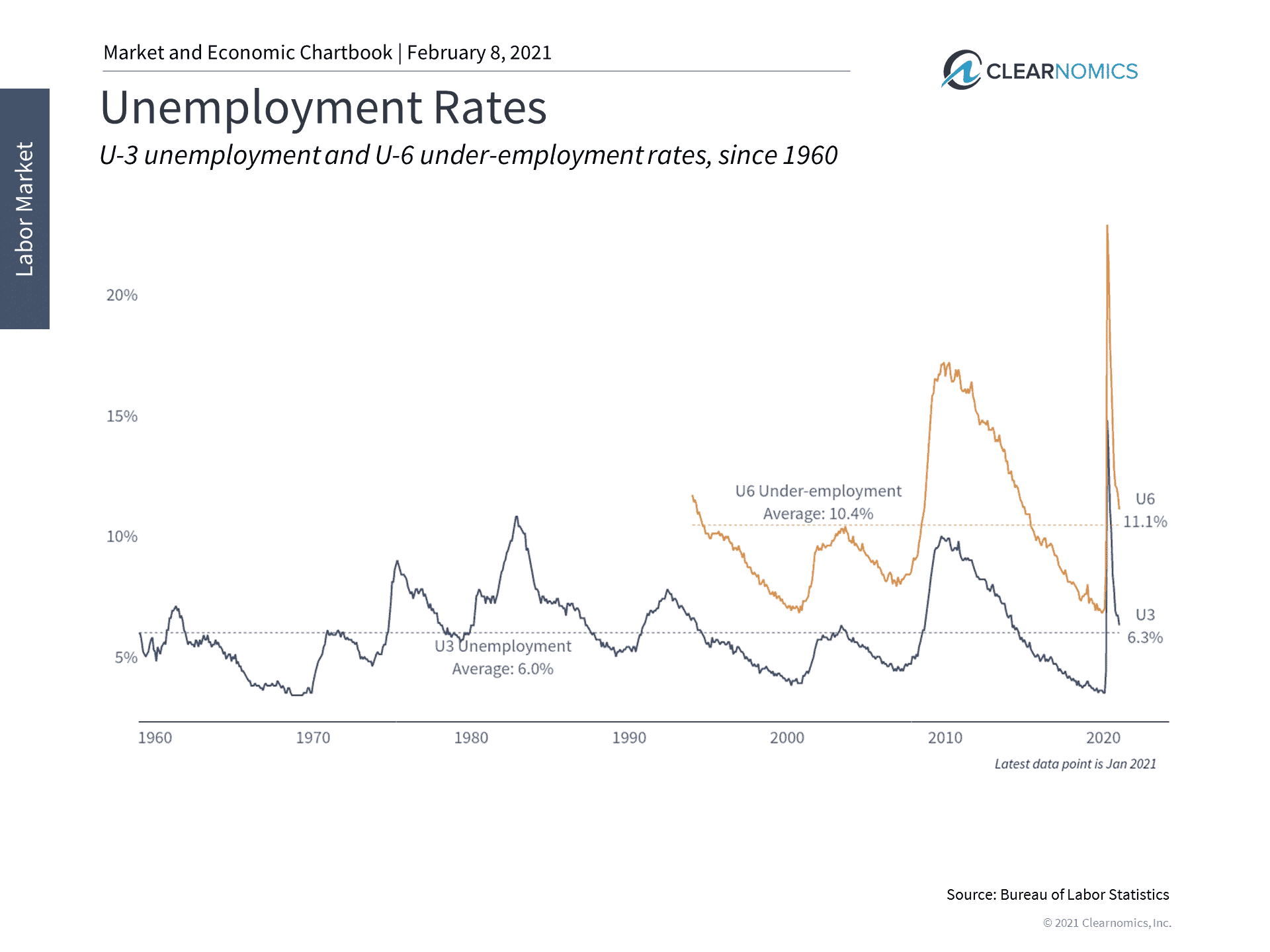

At the same time, the unemployment rate fell to just 6.3%, very near its historical average. (see below) Even the under-employment rate, which includes many who have given up on finding jobs, has plummeted to only 11.1%. While much of the sudden month-over-month decline is due to data adjustments, this doesn’t change the fact that unemployment has fallen sharply since the economic lockdown began last year.

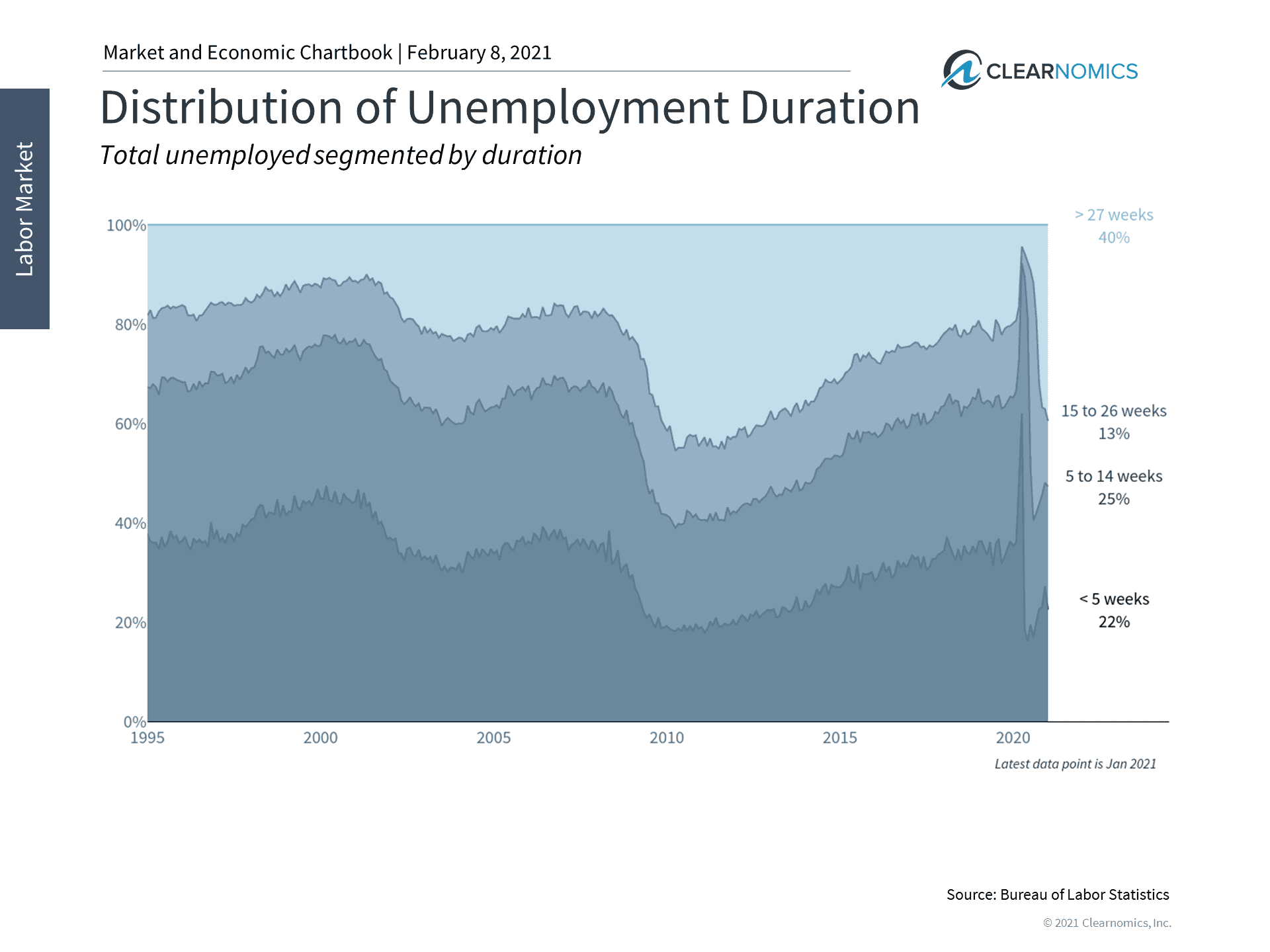

Still, the labor force participation rate, which measures the percentage of the working-age population that is employed or looking for work, remained steady. This highlights the unequal distribution of unemployment across the economy since a growing fraction have been without work for 27 weeks or longer. (see below) This is also consistent with our everyday experience of pandemic-related lockdowns and restrictions affecting some businesses and individuals more than others.

A short-term pessimistic view might focus on the fact that the economy cannot recover until it is safe for retailers, restaurants, hotels, airlines, service workers, and more to fully return to work. In the worst case, life may never fully “return to normal” as many might hope.

Jon here. A longer-term view doesn’t dismiss these challenges but recognizes that this will eventually pass. It also recognizes the fact that businesses large and small from many industries have been able to maintain and even expand their workforces, productivity and sales over the past year and have made adaptions that may be permanent post COVID.

Outlook

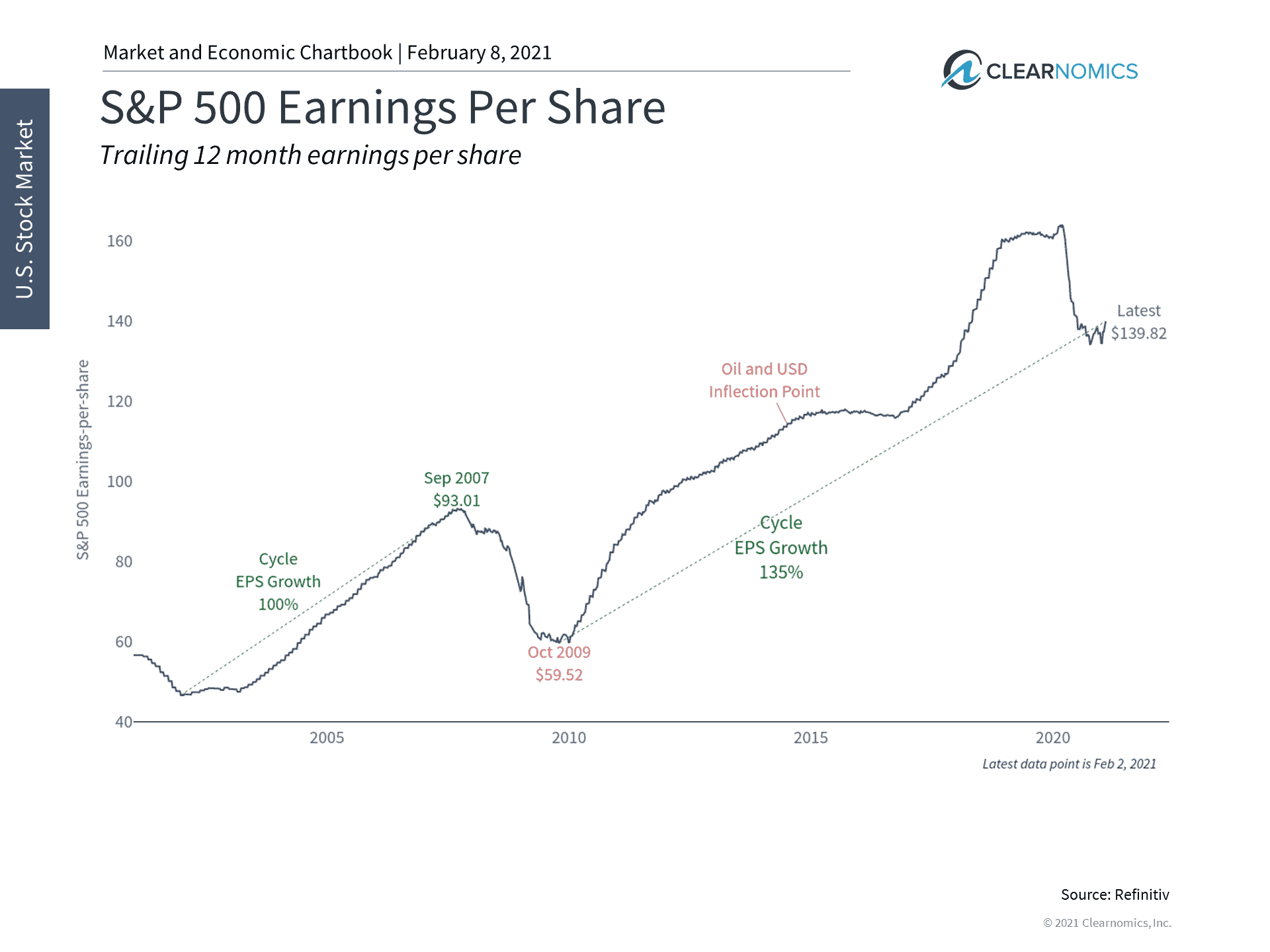

From an investment perspective, these longer-term trends will likely matter more. For instance, the current projections for S&P 500 corporations suggest that profits have stabilized and could grow by over 20% in the next twelve months. (see below) In fact, full-year 2021 earnings could grow to $168 per share, 7% above pre-pandemic levels. Thus, although valuations are by no means cheap for broad market indices, there are still reasons for optimism.

In the end, achieving financial goals is not about avoiding risks over days and weeks but about preserving and creating wealth over years and decades. Below are three charts that provide perspective on economic trends and reasons for optimism.

1 Unemployment continues to fall despite the pandemic

The unemployment rate fell in January, partly due to data revisions by the Bureau of Labor Statistics. Regardless of the reason, the current level is now near its long-term average – a level that was not expected to be achieved for years at the onset of the pandemic.

2 However, many without jobs are increasingly long-term unemployed

However, those hit hardest by the pandemic continue to struggle. An increasing fraction of those who are unemployed are now in the 27-week-and-over category. It will likely be difficult to support this group without vaccines and additional stimulus.

3 For investors, corporate profits could support stock market returns

From an investment standpoint, corporate earnings are expected to grow over the next twelve months. This could support stock market returns and valuations over the long run as economic growth and profits get back on track.

The bottom line? While there are always reasons for pessimism when black swan events hit, long-term optimism is what creates wealth for investors. The current market environment driving through the damage done from the COVID pandemic is mixed but there are reasons to be hopeful.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.