Stay Balanced Through the Ai Bull Market Valuations

Wall Street is back partying like it’s 1999 or even as recently as 2021, with bitcoin to tech stocks from the new Ai bull market forging forward. Investors couldn’t care less about the Fed fighting inflation, and they are winning. Irrational anxiety from the 2022 tech-led crash and ominous recession headlines have led to irrational exuberance and euphoria for investors of all ages.

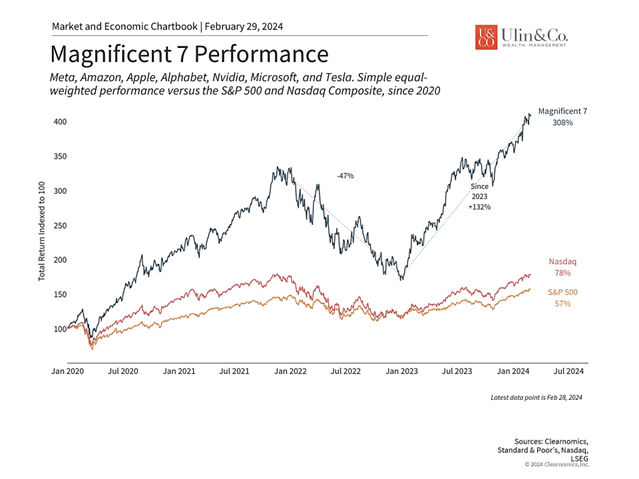

Stocks continue to reach record heights, driven by cooling inflation, a stronger-than-expected economy and big-name tech stocks led by the Magnificent Seven, many of which have market capitalizations of a trillion dollars or more. This is nothing like the startup/ IPO frenzy of the late ‘90’s punctuated by startups like pets.com with the famous sock-puppet mascot, that shut down in November 2000, nine months after it went public but not before appearing in Time Magazine and even a Super Bowl ad spot in 2000.

Jon here. In this environment, it’s hard to decipher headlines from reality where the madness of the crowd from the news shows to social media and message boards can drown out and overwhelm quant trading robots to human investor’s brains in making short term decisions that may not be supportive of their long-term goals. Not as much getting on the 2021 GameStop short squeeze and skyrocketing price memorialized in the 2023 film “Dumb Money,” tech companies valuations driven up by the hype of generative Ai will eventually benefit materially from its use in most all fields and industries.

Investors’ Mindset

Everyone is a genius in a bull market.

Our client’s willingness to engage in these discussions varies based on individual temperament, age, investment experience, and confidence in our work managing their portfolio.

Some of our clients are ready to rebalance and reduce risk after the near 23% run by the S&P 500 index since the end of last October, especially if they are concerned if the hawkish Fed policy, upcoming Presidential elections, snowballing federal debt, a banking crisis or the U.S. direct involvement in a war could put the markets into a tailspin. Even just a 3% drop in the S&P 500 index gets them a bit concerned.

However, a good majority of our clients, even our retirees in their 60’s and 70’s are emailing or calling us to praise their gains, while enjoying the bull market party like its 1999 and are inclined to maintain the “let it ride” mindset. Still, we must carefully communicate the importance of diversification and risk management, highlighting the potential downsides of maintaining an overly concentrated portfolio.

Ultimately, successful portfolio management requires a balance between capitalizing on market opportunities and managing risk. Financial advisors play a crucial role in guiding clients through these decisions, ensuring their portfolios remain aligned with their long-term financial plan and objectives while navigating the complexities of today’s dynamic market environment.

Find Balance Through the Ai Bull Market

“Life is like riding a bicycle. To keep your balance, you must keep moving.” Einstein

In the current scenario, where tech stocks have been driving the market to new highs fueled by the hype of Generative AI with all eyes on NVIDIA leading the way, investors in balanced portfolios regardless of age should evaluate whether they have become overweight in tech and in stocks in general.

If tech stocks and stocks now represent a disproportionate percentage of the portfolio, it may be prudent to rebalance by trimming positions and reallocating to other areas that offer diversification and potentially lower risk from other stock, bond, alternative and international sectors. This is par for course of “selling high and buying low” while staying fully invested and diversified.

Where to Deploy

Skate to where the puck is going to be…” Wayne Gretzky

Given the dominance of tech stocks in driving recent market gains, we are particularly focused on rebalancing tech-heavy portfolios to mitigate concentration risk. We are reassessing allocations within portfolios to ensure they align with our clients’ risk tolerance, investment objectives, and time horizon. This reassessment may involve scrutinizing sector exposures, geographic diversification, liquidity risks, credit quality and asset class allocations.

If clients are reducing their exposure to concentrated positions in stocks and tech, advisors must determine where to redeploy the proceeds effectively. This decision depends on various factors, including the client’s risk profile, age, tax bracket, financial plan, investment goals, and market outlook.

When the Fed starts cutting rates and inflation cools off a wee bit more, we are focused on reallocating cash to sectors or asset classes that offer lower valuations along with diversification benefits and have the potential for growth without the same level of volatility as tech stocks. This could include beaten down areas such as real estate, long duration bonds, dividend stocks, value plays, small caps, banks and financials and emerging markets, along with alternative investments like commodities, energy, or real assets.

Perspective on the Magnificent 7 and Valuations

Only when the tide goes out do you discover who’s been swimming naked. Warren Buffett

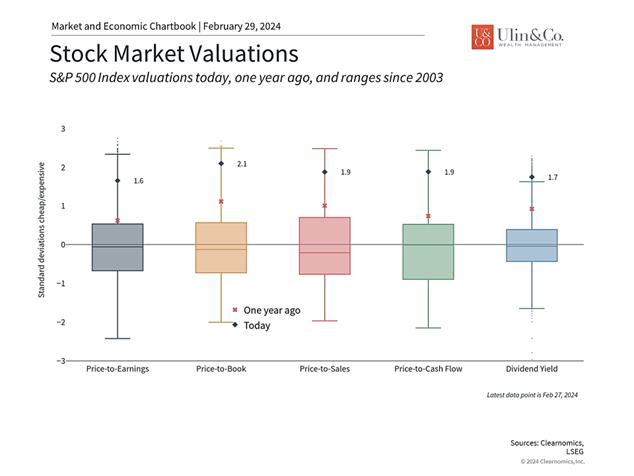

Perhaps the most important consequence of the bull market rally of the past year is that valuation levels are no longer as attractive. The S&P 500 has gained about 28% during this time while the Nasdaq and Dow Jones Industrial Average have risen 40% and 19%, respectively. As a result, the price-to-earnings (P/E) ratio for the S&P 500 is now 20.4, meaning that investors are willing to pay $20.40 for every dollar of expected earnings. While this is below both its peak before the 2022 bear market as well as the historic high during the dot-com bubble, it is still well above its long-run average of 15.6. Not surprisingly, the P/E ratio of the Information Technology sector of the S&P 500 is one of the loftiest at 28.1.

Why are valuations important to long-term investors? Simply put, valuations are among the best tools that investors have to gauge the attractiveness of the stock market over years and decades. Unlike stock prices on their own, valuations don’t just tell you how much something costs, but what you get for your money. After all, holding shares of a company means you are entitled to a portion of its value which ideally grows over time. Valuations are correlated with long-term portfolio returns for this reason – buying when the market is cheap can improve the chances of success and buying when the market is relatively expensive can be a drag on future returns.

Large technology stocks have propelled the market

However, valuations are neither market timing tools nor do they explain all market movements. Instead, they are simply guideposts that can help investors determine appropriate asset allocations based on their financial goals. As the accompanying chart shows, most valuation measures are now well above their long run averages including price-to-book, price-to-sales, dividend yield, and more. This is partly because the underlying fundamentals are still catching up with the market rally. As sales grow, earnings improve, and interest rates stabilize, valuations could begin to improve as well. Thus, higher valuations are not a reason to avoid stocks but are instead a reminder to focus on diversifying both within the stock market as well as across asset classes.

Valuations have increased over the past year

Case in point: the rally in mega cap technology stocks is an important reason to be diversified across a variety of sectors. Not only do diversified investors benefit from the returns experienced by the Magnificent Seven and the technology sector more broadly, but they also protect their portfolios from downside risk and position themselves to take advantage of growth in other parts of the market. As all investors know, past performance is no guarantee of future returns. Investors with long time horizons ought to remain balanced across a variety of sectors and styles that are tied to trends in the underlying economy.

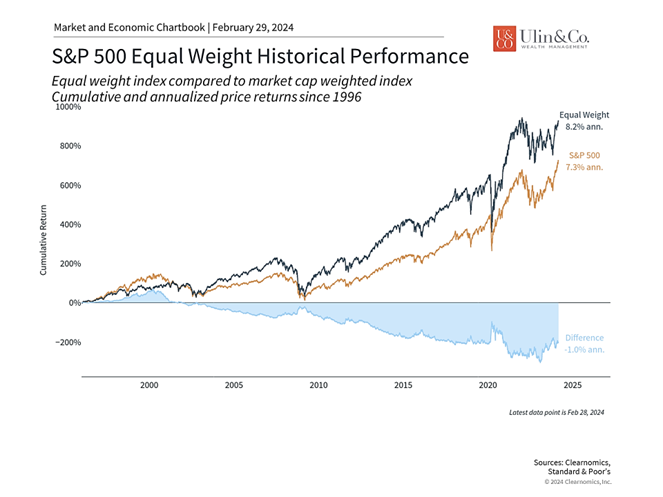

Beyond today’s valuations and returns, another concern that some investors have is that a small group of companies is having an outsized impact on the overall stock market. Perhaps the simplest way to see this is to compare the standard S&P 500 index, which places a weight on each stock based on its size, to one which gives an equal weight to each stock. Both weighting methods are useful in different ways: using market cap weights provides a more accurate sense of the composition of the stock market – i.e., where the dollars are. Using equal weights helps investors to benefit from a broader base of companies to naturally diversify.

Historically, stocks of all sizes have contributed to market returns

As the accompanying chart shows, it’s not the case that large companies have always dominated stock market returns. For much of the history of the stock market, the largest companies were often seen as the most boring (e.g. “blue chips”) and primarily served as a source of stable dividends. Over the past 15 years, the equal weight S&P 500 index has actually outperformed the market cap-weighted index since it benefits from returns across a wider array of stocks. Although the largest companies have outperformed in recent years, taking a longer perspective paints a different picture. It’s important for investors to keep this in mind as they make portfolio decisions.

The bottom line? With the market near all-time highs and seemingly driven by a small group of stocks, investors ought to focus more on valuations and staying diversified. History shows that doing so can help investors to achieve their long-term financial goals regardless of market conditions.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.

Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Adviser. IFP and Ulin & Co. Wealth Management are not affiliated.