S&P 500 Passes 5000 – Headlines vs Reality

Despite the S&P 500 index firmly passing 5,000 on Friday fueled by cooling inflation, low unemployment, a resilient economy and a potential Fed soft landing in sight, it should come as no surprise that many media pundits are continuing to capitalize on distressing headlines that may help their ratings more so than providing useful guidance for investors.

It’s like watching the history or weather channel anchors mull over past catalysts for major world wars and CAT-5 Hurricanes, both impossible to predict, but may seem obvious due to hindsight bias. While those who do not remember the past are condemned to repeat it, mulling over past crashes can create paralysis by analysis for investors.

For example, just under a Market Watch headline this week providing a celebratory post for the S&P 500 5K milestone, another click-bate article noted that “the stock market right now resembles the Y2K surge of the late 90’s dotcom frenzy, and that didn’t end well.” Headlines, predictions, or market maxims may be fun fodder to examine, but should only be taken with a grain of salt.

Maybe it’s time for a “digital detox” in the midst of year two of the current bull market despite crash and recession talks, two wars, lingering inflation, elevated rates, and a banking crisis. While the tech boom now in the generative AI phase has made us smarter and more productive, it has also made it very easy for us to consult ourselves like a doctor on every physical and financial ailment. Self-diagnosis can end up doing more harm than good, especially if you are not a physician or a financial advisor.

Bullish Sentiment

The AAII Sentiment Survey headline recently noted: “Optimism Skyrockets While Bearish and Neutral Sentiment Decreases.” Bullish sentiment, expectations that stock prices will rise over the next six months, increased 9.8% to 49.%. Bullish sentiment is at an unusually high level and is above its historical average of 37% for the 13th consecutive week. Should you place a contrarian/ negative bet against the crowd and the new market momentum of all new highs? Probably not. Once the herd gets going, the momentum and trends seem to continue onward for quarters or years.

Yet even with a good bit of stock and bond sectors in positive territory year to date, decreasing inflation, potential Fed rate cuts, and improving economic conditions, many investors are still panicking due to regency bias of the past couple of years tumultuous economic and world events combined with ongoing uncertainty.

New Highs

Investing is a marathon not a sprint. In other words, we need to pace ourselves.

There is an old saying that happiness equals reality minus expectations. This is relevant when it comes to financial wealth management during times of uncertainty. Having unrealistic short-term expectations of investment returns and financial outcomes, as many often do, can lead to discouragement and missteps,

Before we dig a bit deeper into the three stressors for investors in 2024, consider that through all your worrying, the stock market continually making new highs should not alter your behavior or your investment strategy in the short run. Staying invested in a diversified strategy through all-time highs is not counterintuitive or crazy. Cashing out your portfolio at an all-time high because of fear – or pouring all your cash back into the stock market because of FOMO (fear of missing out) is not a disciplined strategy for long-term investors.

While the market is finnicky and cyclical, it goes up most of the time over years and decades. History has shown us that record highs usually lead to more record highs – though there is a pullback or crash every five or six years. About 80% of the S&P’s records since 1950 led to at least one more all-time high the following week. (etoro).

Fed, Banks, and the Economy Expectations

When it comes to markets, day-to-day price swings are often more about what investors expect than the underlying facts. This is because markets are designed to anticipate future events and assign them a price today. This gap between reality and expectations has driven stock and bond market volatility in recent days due to the Fed’s latest announcement and headlines in the banking sector. Consider the following points to make sense of these headwinds.

First, the Fed announced on January 31st that it is keeping rates steady and closed the door on additional rate hikes. However, they also stated that the FOMC would need “greater confidence that inflation is moving sustainably toward 2%” before cutting rates, and Chair Jay Powell emphasized at his press conference that a rate cut is unlikely at its next meeting in March. This led to a shift in market expectations around the beginning of rate cuts, leading the S&P 500 to close 1.6% lower.

However, this was then followed by positive returns of 1.2% and 1.1% on the next two days as markets quickly adjusted. At the moment, markets have downgraded the path of policy rates by one cut, expecting a total four or five by year end. Clearly, this is a case of the market getting ahead of itself with lofty rate cut expectations. The gap between what the Fed has previously communicated – possibly three cuts this year – versus what the market anticipates, is an ongoing source of market uncertainty.

Bank Stressors – New York Community Bank (NYCB)

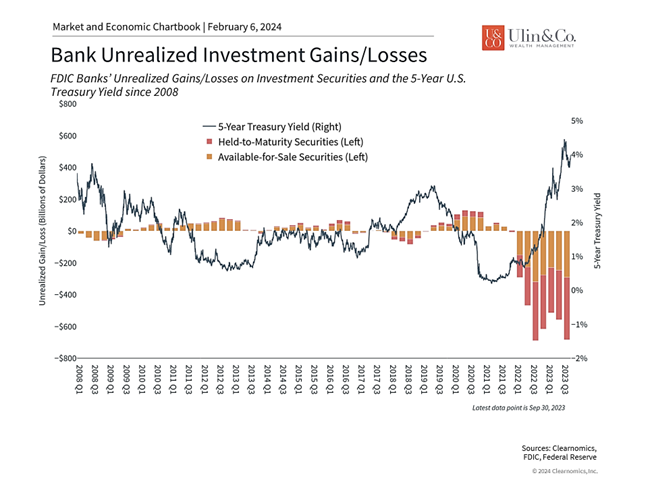

Second, the latest worry on investors’ minds is New York Community Bank (NYCB) and its deteriorating commercial real estate loan portfolio. Last year, NYCB acquired $38 billion in assets and assumed $36 billion in liabilities from Signature Bank which failed during the banking crisis. The accompanying chart (above) shows the unrealized losses in bank bond holdings that helped to spark last year’s crisis along with a slowing economy and the crash in cryptocurrencies in 2022. The other banks that made headlines were Silicon Valley Bank and First Republic which were acquired by First Citizens Bank and JPMorgan, respectively.

While the banking sector has stabilized since then, commercial real estate has continued to struggle especially in the office and multifamily segments which make up a significant portion of NYCB’s loan portfolio. Their acquisition of Signature Bank assets also pushed NYCB above $100 billion which means it is subject to higher capital and liquidity requirements. Combined, NYCB reported a significant and unexpected quarterly loss.

Naturally, investors are worried about a repeat of last year’s bank failures. While the situation is still developing, the issues facing NYCB can be characterized as a continuation of the problems that Signature Bank faced due to higher interest rates and a slowing economy. This means that it’s possible for these issues to be bank-specific rather than reflect problems across the entire financial system. Indeed, while the regional banks sub-industry of the S&P 500 has fallen 2.4% this year, the broader financials sector has risen about 3.5%.

Tailwinds: The job market is still historically strong

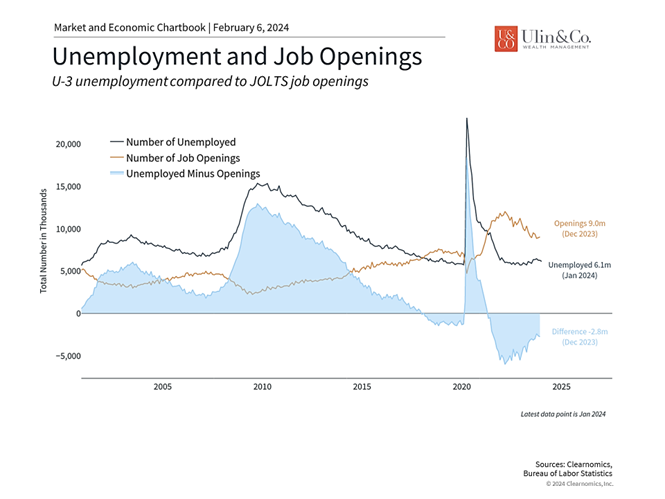

In contrast to many of these investor concerns, there are many signs that the economy is fundamentally strong. The latest jobs report showed that 353,000 new jobs were created in January, far more than the 185,000 economists expected. December payrolls were also revised up sharply to 333,000, bringing the average monthly gain over the past year to 244,000, a very healthy pace. The unemployment rate remains at 3.7%, one of the lowest in history. The accompanying chart shows that while job openings have declined as the Fed has raised rates, there are still nearly 1.5 job openings per unemployed person across the country.

This is the case despite layoff announcements from large companies as they attempt to reduce costs and maintain profit margins. Many of these layoffs are a reversal of the rapid hiring that occurred during and after the pandemic, especially among large technology companies such as Alphabet, Microsoft, PayPal and many others. While these layoffs clearly have an impact on individuals and households, perspective is needed when considering the effects on the economy and markets. The jobs data show that while the Information sector gained “only” 15,000 jobs last month, sectors such as Professional and Business Services, Health Care, and Retail Trade added 74,000, 70,000, and 45,000, respectively.

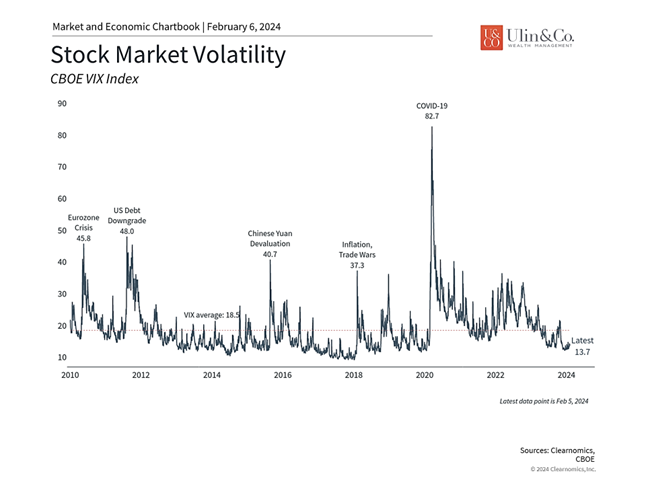

Despite recent market swings, volatility remains subdued

Thus, there is always both good and bad news that must be weighed by investors. It’s often the case that as events unfold, markets settle and expectations converge on reality. Interestingly, the accompanying chart shows that the VIX index, a measure of stock market volatility, is still fairly subdued despite recent events. Investors should continue to anticipate and prepare for market uncertainty by staying diversified and focused on the long run.

The bottom line? Recent events around the Fed and banking sector have led to market swings but have not deterred the S&P 500 from attaining all new highs. Investors should continue to stay focused on the long run and not overreact to daily headlines.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.