Year End Tax Planning: 7 Smart Moves to Cut Taxes Before New Year’s Eve

Deadlines matter. These seven year end tax planning moves still give you leverage before the year closes.

When the clock strikes midnight on December 31st, we sing the Scottish song Auld Lang Syne to honor times long past. Just don’t let the year fade out before you lock in your tax planning moves.

You still have a short window to make decisions that can meaningfully shape your tax bill and your long-term plan. This date is a hard stop. Miss it and the opportunity disappears until next year.

Before you start pulling levers, build a tax baseline. Ask your CPA for a pro forma 2025 return. Have your advisor run a year-to-date tax summary showing income, gains, losses, and deductions. That snapshot tells you which moves actually help and which ones just reshuffle taxes.

From there, here are seven high impact strategies to consider before year end.

1 Maximize retirement plan contributions

Traditional 401(k), 403(b), and most 457 plan contributions reduce taxable income. For 2025, you can defer up to $23,500 from salary. If you are 50 or older, add a $7,500 catch up. If you are between 60 and 63 and your plan allows it, the enhanced catch up can bring total deferrals to $34,750. These contributions must be made through payroll by December 31st. (IRS.gov)

For business owners with no employees beyond a spouse, the opportunity expands. A Solo 401(k) allows both employee deferrals and employer contributions, with total contributions reaching roughly $70,000 or more depending on age and income. The plan must be established by December 31st, with only partial funding required by year end. (IRS.gov)

For higher earners, a Cash Balance plan can push deductible contributions to $100,000 or more per year. These plans must also be set up by year end, with contributions generally due by the tax filing deadline.

The planning move is simple. Decide how much you want to shelter, then align your remaining 2025 paychecks and early 2026 funding to hit that target. We have made quite a few outbound calls to our clients to remind them of these options and opportunities while helping them to execute on their solutions.

2 Put HSAs to work

If you are in a high-deductible health plan, your HSA may be your best tax shelter. Contributions are deductible, growth is tax deferred, and qualified medical withdrawals are tax free. For 2025, the HSA limit is $4,300 for self only coverage and $8,550 for family coverage, plus a $1,000 catch up if you are 55 or older. (IRS.gov)

Unlike FSAs, there is no “use it or lose it” rule. Unused balances roll forward and can be invested. Between now and Tax Day you can still decide whether to top off 2025 contributions. Year end is a good moment to confirm that you are on track relative to the full annual limit.

3 Use Roth conversions strategically

Roth conversions let you pay tax now in exchange for tax free growth and no future RMDs on those dollars. There is no income cap on conversions, and the deadline for 2025 conversions is December 31st.

The math works best when your current tax bracket is lower than what you expect later, once RMDs, Social Security, business income, or pensions stack up. Conversions raise adjusted gross income in the year they are done and can trigger higher Medicare Part B and Part D premiums through IRMAA. That makes multiyear modeling essential. This is not a one-year decision.

Many affluent households use a bracket management approach, converting just enough each year to “fill up” a targeted tax bracket rather than doing one large conversion at once. This can smooth taxes over time and reduce the risk of overshooting into higher rates.

Retirees often ask whether converting after they stop working is a smart move. The logic is simple. Pay tax now at a known rate to avoid tax later at an uncertain one. The reality is more nuanced. A conversion immediately reduces the size of your account by the tax bill. The Roth then has to earn its way back through tax free growth before it beats the traditional IRA path.

That makes timing and funding critical. A full conversion at an effective 40% tax rate cuts an IRA almost in half unless the tax is paid with outside liquid assets. The strategy works best when you have a long-time horizon, access to non-retirement funds to pay the tax, and confidence that future tax rates will be higher than today.

4 Harvest losses and manage gains in taxable accounts

Tax loss harvesting is one of the cleanest ways to reduce this year’s bill from your brokerage accounts. If you realized capital gains in 2025, you can sell positions at a loss before year end to offset them dollar for dollar. If losses exceed gains, up to $3,000 can offset ordinary income, with the rest carried forward.

The priority is often to use losses to offset short term gains, which are taxed at ordinary income rates. Long term gains face lower rates in the 0% to 20% range.

You still need to avoid the wash sale rule by not buying the same or “substantially identical” security within 30 days before or after the loss sale. Swapping into a similar but not identical ETF or fund lets you stay invested while booking the loss.

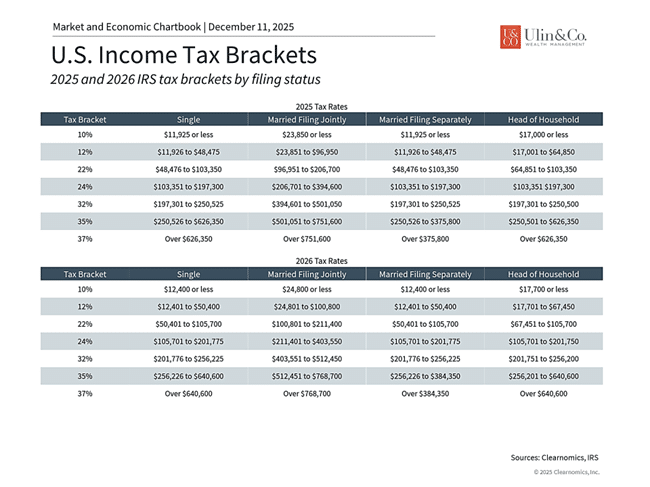

Whether you are considering a Roth conversion or harvesting losses from your taxable portfolio, the chart below shows the income tax brackets for 2025 and 2026. Our job is to help you pinpoint your true blended tax rate for the year, review any carryforward losses, and balance out taxable gains created by trimming overconcentrated positions or reducing a holding that surged and is now overweight during rebalancing.

We continually consider tax loss harvesting throughout the year for our clients in their fee-based model- portfolios when executing our quarterly rebalancing and optimization.

5 Use current gift and estate rules while they last

For 2025, the federal estate and gift tax exemption is $13.99 million per person, or $27.98 million for a married couple. Under current law, that exemption will rise to $15 million per person in 2026 instead of being cut in half as originally scheduled. (IRS.gov)

If you have a taxable estate and unused lifetime exclusion, yearend is a logical time to review larger gifts, trusts, and family entity strategies. The question is not just “how much can I move” but “how much can I move without putting my own retirement at risk.”

On the annual side, you can give up to $19,000 per recipient in 2025, or $38,000 per recipient as a couple, without using any of your lifetime exclusion. (IRS.gov)

This is a use it or lose it benefit. Parents and grandparents often use this to fund 529 plans where growth and qualified withdrawals avoid federal income and capital gains tax.

6 Tighten up your charitable strategy for strong Year End Tax Planning

If you itemize or expect to itemize, year-end is when you decide how charitable giving fits into your tax picture.

A few levers to consider:

- Cash gifts to qualified charities are generally deductible up to 60% of AGI when you itemize.

- Donating appreciated long term securities avoids capital gains tax and can create a deduction for full fair market value, typically up to 30% of AGI.

- If you are 70½ or older, qualified charitable distributions from IRAs let you send up to $108,000 in 2025 directly to charity. The QCD counts against your RMD but is not included in taxable income.

QCDs can be especially powerful in years when you do not need all of your RMD for spending, or when reducing AGI helps with Medicare surcharges or the taxation of Social Security. (IRS.gov)

7 Handle RMDs thoughtfully, even if they are years away

Required minimum distributions are still one of the most important moving parts in retirement tax planning, even if you are not yet 73. The SECURE 2.0 rules now start RMDs at age 73, rising to 75 in 2033. The penalty for missing an RMD is 25% of the amount not taken, potentially reduced to 10% if corrected in time. (IRS.gov)

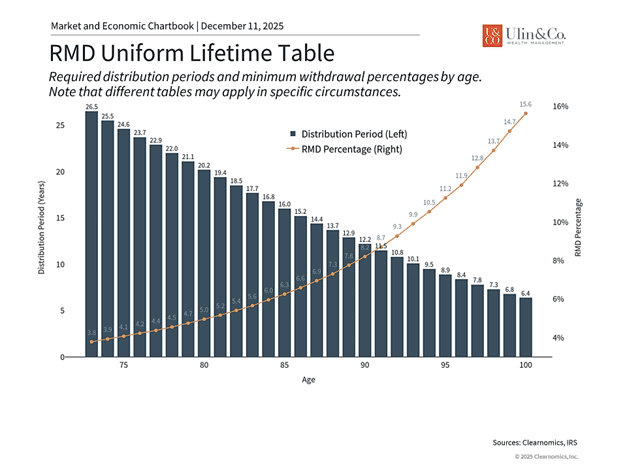

The chart above shows the latest distribution periods, in years, and the required withdrawal percentages that apply to most account owners. The withdrawal amount is based on the account balance as of December 31 of the prior year, adjusted by a life expectancy factor published by the IRS. While these numbers are based on relatively straightforward calculations, the planning considerations can be much more complex.

For those already subject to RMDs, the December 31st deadline is critical. You need to coordinate:

- Which accounts you pull from

- How RMDs interact with Social Security and other income

- Whether to use QCDs to satisfy part or all of the amount

For those not yet 73, RMDs are a reason to think ahead. Partial Roth conversions, bracket management in your 60s, and the order in which you draw from taxable, tax deferred, and Roth accounts can all reduce future required withdrawals and the tax drag they create.

The real goal: Year-end tax work is not about chasing every deduction. It is about lining up your tax picture with your long-term plan.

Build your baseline. Use the remaining weeks to decide which of these seven strategies fit your situation. Then coordinate with your CPA and advisor so the moves you make before December 31 actually move the needle for you and your family.

For more information on our firm or to request a complimentary investment and retirement check-up, call (561) 210-7887 or email jon.ulin@ulinwealth.com.

Author: Jon Ulin, CFP® is the founder and Managing Principal of Ulin & Co. Wealth Management, an independent advisory firm based in South Florida for over 20 years. As a fiduciary wealth advisor, Jon helps successful individuals, families, and business owners nationwide with multi-generational planning, investment management, and retirement strategies. Learn more about Jon and our team at About/CV.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.

Advisory services offered through NewEdge Advisors, LLC, a registered investment adviser