Animal Spirits Fuel Stock Market Cheer

After four years of post-pandemic market whiplash, marked by record-high inflation, rising interest rates, and a steady stream of inaccurate recession predictions, this holiday season offers a moment to reflect on market resilience, economic stability, and the opportunities ahead. While animal spirits fuel stock market optimism and cheer, it’s crucial to ensure your portfolio aligns with your long-term goals and risk tolerance.

If 2024 was defined by the buzz around AI, 2025 might well be shaped by GDP. With new wall street friendly GOP presidential policies taking center stage, the U.S. economy is poised to continue surprising Wall Street to the upside as the recovery broadens beyond the infamous Magnificent 7 stocks, spreading into other sectors and asset classes.

Animal spirits are stirring in financial markets, as the S&P 500 closes out a historically strong year. For many investors, the fear of missing out (FOMO) is outweighing concerns about potential losses. With the U.S. bull market entering its third year, one question arises: Could this momentum reflect more than a classic melt-up driven by euphoria? The signs suggest it might.

Animal Spirits

Wall Street is buzzing with renewed vigor, driven by what economists call “animal spirits” following a Republican sweep on November 5th. Coined by Keynes, this term captures psychological forces—confidence, enthusiasm, and risk-taking—that can drive markets as much as fundamentals.

However, unlike speculative frenzies like the dot-com bubble or the 2008 housing crash, today’s rally appears grounded in improving data. Optimism surrounding potential tax cuts, regulatory rollbacks, financial deregulation, and business-friendly policies has propelled gains. The S&P 500 rose 5.2% in November, its best month of 2024, with the Dow and Nasdaq following suit.

All Eyes on the Fed

As markets rally on renewed confidence, the Federal Reserve remains a crucial counterbalance, navigating a delicate path between growth and inflation control.”

While closing out a remarkable year, there’s plenty to appreciate beyond the political drama, with the Fed appearing to achieve its elusive soft landing. Until recently, officials thought the neutral Fed Funds rate hovered below 3%. Now, some on Wall Street believe it could sit well above 3%. This shifts expectations for fewer, if any, rate cuts in 2025, especially with a resilient economy potentially heading into reinflation under a second Trump administration focused on growth.

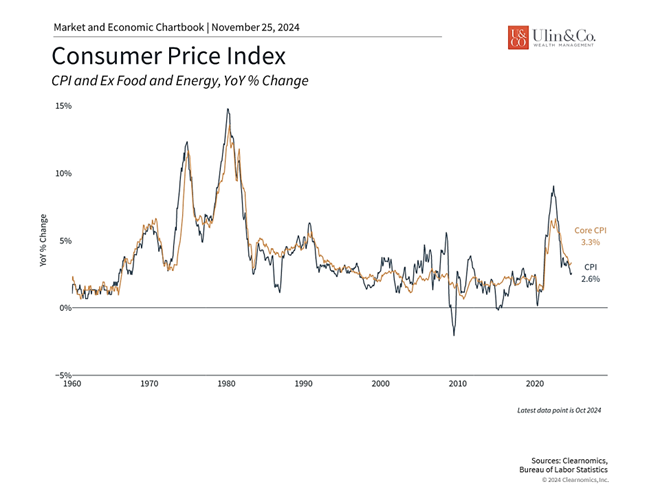

What Happened: Core inflation, which strips out volatile categories like food and energy, recently ticked up to 2.8% from 2.7%, marking its first increase since June. Some measures suggest it may even hit 3.3%. Sustained core inflation above the neutral level signals overheating, reinforcing the Fed’s cautious stance.

Three Reasons Investors Can Be Thankful This Holiday Season

Jon here. As we approach year-end, the S&P 500, Dow (DJIA), and balanced 60/40 portfolios are poised to break records—up nearly 25%, 18%, and 17% year-to-date, respectively. While some caution these gains could outpace reality, this doesn’t necessarily indicate a “melt-up.” Today’s rally is supported by resilient corporate earnings, cooling inflation, and stronger-than-expected economic data.

Investors would do well to stay grounded in their strategies rather than be swayed by headlines or political biases. Economic growth has exceeded expectations, with inflation returning to pre-pandemic levels, unemployment still low, and GDP growing steadily.

Just as many express gratitude in their personal lives, the holidays are a good time to do so in our investing and financial lives. This is important because investors tend to focus only on what can go wrong. Even after two strong market years, there is no shortage of concerns on issues such as market fundamentals, the direction of the economy, the size of the national debt, global instability, and more.

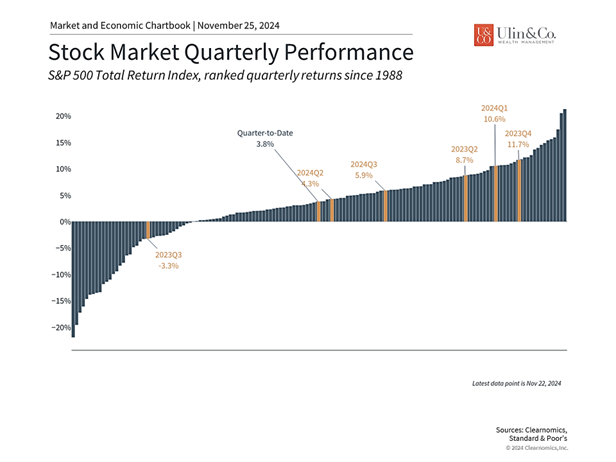

While past performance is no guarantee of future success, what history shows is that staying focused on the long run is the best way to achieve financial goals. Over the course of days, weeks and months, markets can fluctuate significantly just as they did in April and August, or in 2020 and 2022. However, over longer time horizons, markets have tended to rise due to the strength of economic growth. Consider the following three points heading into the holiday season.

Financial markets have performed well this year

First, the U.S. stock market has demonstrated exceptional strength this year. Robust corporate earnings, improving economic conditions, and rising investor confidence have driven gains. Except for one quarter, markets have seen steady returns, with eight of eleven S&P 500 sectors posting double-digit growth.

Valuations, however, are becoming stretched. The S&P 500’s price-to-earnings ratio sits at 22.3, nearing the dot-com peak of 24.5. While this isn’t a reason to avoid stocks, it underscores the importance of holding a balanced portfolio. Year-end is the perfect time to review your asset allocation, especially after such strong market movements.

Inflation is returning to normal levels

Second, investors can be thankful that inflation rates have slowed to pre-pandemic levels. While this does not mean that prices will fall for most everyday necessities, including food and rent, it is a positive sign, nonetheless. This is especially true for investment portfolios since they are sensitive to interest rates, which are directly affected by inflation.

Normalizing inflation has allowed the Federal Reserve to begin cutting policy rates for the first time since early 2022. Much of this year’s stock market volatility was the result of investors guessing when and by how much the Fed would do so.

In the end, trying to determine the exact timing was far less important than understanding the general trend of lower short-term interest rates. Thus, for investors with long time horizons, constructing a portfolio based on these factors, rather than the trends that have driven markets over the past several years, is more important than ever.

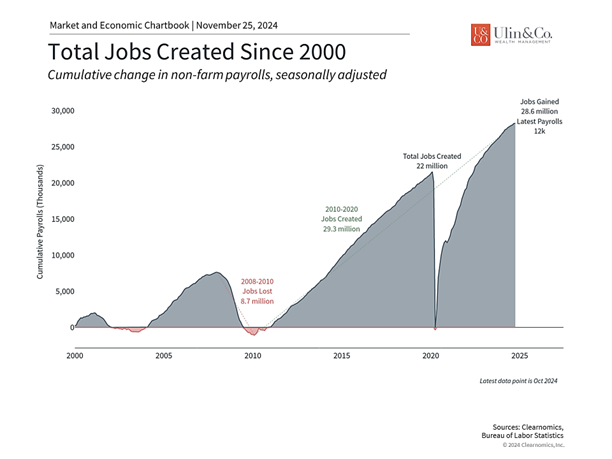

The economy and job market remain strong

Finally, for everyday individuals, there is perhaps nothing more important from an economic standpoint than the strength of the job market. The fear as the Fed raised rates was that the economy would face a “hard landing” – i.e., bringing inflation down would cause a collapse in hiring.

Fortunately, this did not occur. Unemployment is still near historically low levels and job gains have been steady. Wages have also risen, although not as fast as overall inflation. The accompanying chart shows that the economy has created 28.6 million new jobs since the pandemic, far eclipsing the previous level. While job gains differ from sector to sector, this means that many consumers are in a healthy financial position.

More broadly, the U.S. economy continues to demonstrate remarkable resilience, with real GDP growing at an annualized rate of 2.8% in the most recent quarter. This is largely due to the strength of consumer spending, which has contributed greatly to overall growth. While this can’t last forever – consumers have largely spent their excess savings from the past few years and debt levels are rising – the hope is that lower rates, clarity around tax policy, and increased business investment will continue to support the economy.

The bottom line? Markets never move in a straight line, and this year was no exception. Despite periods of volatility, returns have been historically strong. This holiday season, investors should focus on the positives, remain grounded in their strategies, and ensure portfolios are aligned with long-term goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.