5 Factors for Investors to be Thankful For

There are more opportunities and reasons arising to be diversified and invested for your long-term goals today while most assets classes are on sale, than since the credit crisis crash and great recession 14 years ago at the bottom of 2008.

While the Buffet maxim to be “fearful when others are greedy, and greedy when others are fearful” is easier said than done, buying low through methods of dollar cost averaging (DCA), rebalancing, risk optimization and lump sum investing may help put you in a better position over time than taking action from cash after future headlines note that “a new bull market has arrived” and everyone is celebrating like it’s New Year’s Eve. If you ever have had a regret in the past from paying top dollar for any type of asset or experience, this is your opportunity to get cracking to “buy low.”

Fueled by Thursday’s cooling CPI reports, major stock index averages posted their biggest one-day rallies since 2020 on the tailwinds of investor euphoria and optimism of better days and quarters ahead. The DJIA, S&P 500 and Nasdaq indices surged near 1,200 points, 5.5%, 7.4% respectively.

Jon here. While we have stuck with our three top mantras this year through the worrisome bear market to “hope for the best but plan for the worst” and “don’t fight the Fed fighting inflation,” as well as “market timing is a fools game,” we never had been close to traveling on the Armageddon headline train of the S&P 500 tanking the current bear market by another 30%+ by the billionaire’s-club of noteworthy financial commentators and CEO’s including Jamie Dimon, Nouriel Roubini, Michael Burry and Elon Musk excitedly mulling over dire market predictions like meteorologists on the Weather Channel analyzing a hurricane formation.

If anything, the extreme negative investor sentiment could be taken as a buying signal by contrarians. While CPI is still quite a bit off from Fed Chair Jay Powell’s 2% goal, the markets advancing this past week should be taken with a dose of optimism more so than a temporary head fake. There are more than a few positive factors brewing that may be catalysts into the next bull market that investors can be thankful for in addition to a cooling CPI – including a strong labor market, lower stock P/E ratios, higher bond dividends, GDP stabilizing, the Fed getting closer to their Fed Funds target rate heading into Thanksgiving and the holiday season.

Top 5 Factors

- 1 Halloween Indicator: This indicator may signify the best six-month cycle of year for stocks has arrived. The Halloween indicator states that global equity markets generate higher returns in the six-month period from the first trading day of November to the last trading day of April than they do in the other six months of the year.

- 2 Bear Killer: Twelve of the post-WWII bears died in October after the seasonal selloff creates bargains.

- 3 Grid Lock is Good: Wall Street loves it when the Capitol is neutralized by divided power, and where politicians can inflict less harm to the economy.

- 4 Midterm Momentum: Since 1942, after midterm elections the S&P 500 index going into the third year of a U.S President cycle has performed adequately.

- 5 VIX Indicator: The VIX (fear index) is down below 24 this week and getting closer to the historical average level of 20. The CBOE Volatility Index (VIX) signals the level of fear or stress in the stock market using the S&P 500 index as a proxy for the broad market.

.

Don’t Fight the Fed Fighting Inflation

Investing is often as much about psychology as it is about facts and figures. Even though many investors understand that staying invested is the best way to achieve long-term financial success, doing so across all phases of the market cycle can be difficult. Negative headlines and economic news grab our attention while positive trends can be slow-moving and sometimes invisible. The holiday season, especially given the market rebound over the past few weeks, is the perfect time for investors to remember that there is still much to be thankful for amid uncertainties.

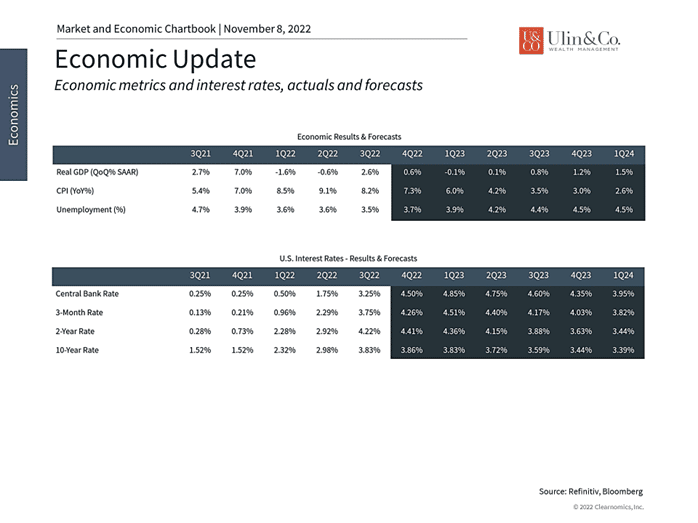

Economic uncertainty continues to affect financial markets, as it rightfully should since, in the long run, stock prices follow trends in economic growth. Investors are wondering how high interest rates might rise, whether there will be a deep recession (or if we’re in one already), when inflation might begin to recede, if unemployment will tick up, and more. Unfortunately, speculation on these issues and how the Fed might react is widespread and has put the market on edge, resulting in sizable swings in both directions. Consider the following trends.

The economy and inflation are expected to decelerate over the next year

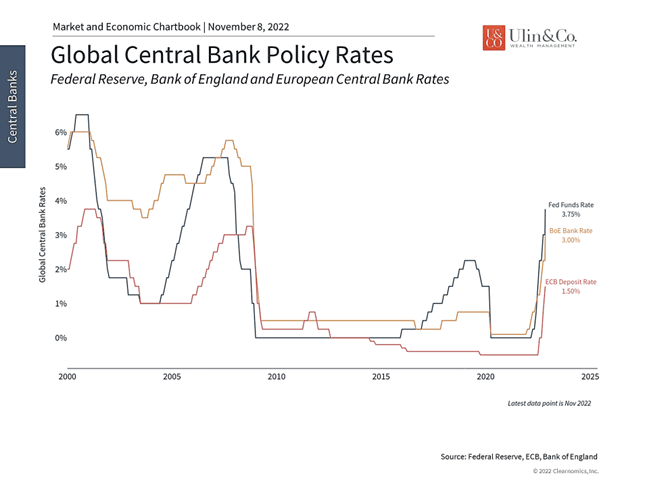

Perhaps the biggest recent event is that the Fed raised the fed funds rate by 75 basis points (three-quarters of one percent) for the fourth time in a row. It’s important to remember that the Fed’s policy rate was zero as recently as March due to the pandemic. The central bank has now raised rates six times in as many meetings this year, one of the fastest paces on record.

The market now expects the Fed to raise rates by at least 50 basis points in December, ending the year with a fed funds target range of 4.25% to 4.5%, in line with the Fed’s September projections. The market also expects the Fed to raise rates through the first half of 2023 to reach a target rate above 5%. With inflation still much higher than the fed funds rate – core CPI, PCE and PPI are 6.6%, 5.1% and 7.2%, respectively – some wonder why the Fed would slow down at all.

This is where Fed Chair Powell attempted to shift the conversation at the latest press conference. Rather than focus only on the path of rate hikes, he suggested that it’s more important to consider the “terminal” rate and how long it might stay at those levels. Recent market rallies and pullbacks have been driven by alternating hopes and fears around the Fed taking its foot off the brake pedal. While investors may have jumped the gun during the market rally from June to August, it did show that the market is able to recover once it has digested the Fed’s plans.

Central banks around the world are following the Fed’s lead

What makes it hard for the market to anticipate the path of rates is that there is only one good point of comparison when it comes to Fed rate hikes driven by inflation: the late 1970s and early 1980s under Fed Chair Paul Volcker. The similarity is that both that period and today were driven initially by external shocks such as high energy prices. However, unlike the stagflationary Volcker era, many parts of the economy today are robust and the unemployment rate is still quite low. So, there is understandably a great deal of speculation as to how today’s inflationary pressures might affect the economy and markets.

When Good News is Bad News

To make the issue murkier, the latest jobs numbers for October were stronger than expected. The economy added 261,000 jobs over the month, exceeding forecasts of 193,000. The prior month’s payroll figure was also revised up from 263,000 to 315,000. The unemployment rate did rise slightly to 3.7% but wages also improved at a faster-than-expected rate of 0.4% month-over-month. Overall, the labor market continues to be resilient to Fed rate hikes despite the central bank’s best attempts to combat inflation.

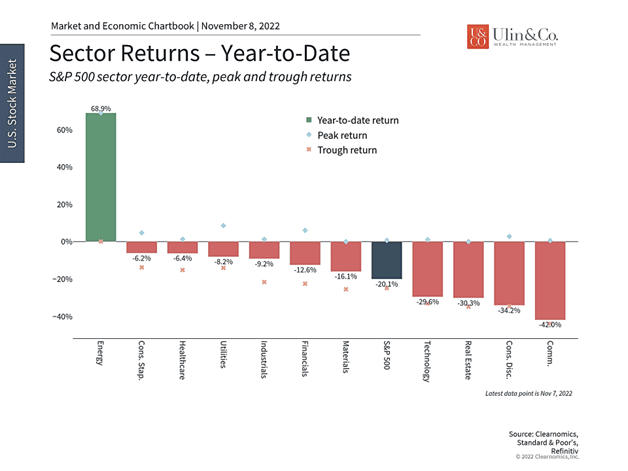

Rising rates are having differing effects across sectors

If rates are having any impact, it’s likely occurring on an industry-by-industry basis. Clearly, rate-sensitive sectors such as real estate are struggling and are likely already in recession. The housing market has experienced a notable slowdown across permits, housing starts, construction activity, and sales prices. The prices of housing-related commodities such as lumber have plummeted since March.

The same is true for technology stocks spread across the Information Technology, Communication Services and Consumer Discretionary sectors of the S&P 500. In theory, tech stocks are sensitive to interest rates because their stock prices reflect growth far off into the future. The more rates change, the more they affect the present value of future cash flows. The tech sector is also where the majority of layoff announcements have been concentrated. In contrast, the energy sector has held onto year-to-date gains due to higher commodity prices.

Market Timing is a Fools Game

In this uncertain environment, how should long-term investors interpret the latest Fedspeak and market reaction? The Fed continues to be between a rock and a hard place as it attempts to calm inflation while avoiding a recession. If inflation begins to subside in the next several months, then rate pressures may also ease, reducing the strain on rate-sensitive sectors and the overall market. Investors have gotten ahead of themselves at several points throughout the year, but this just shows how quickly markets can react to positive news.

Unfortunately, the nature of the inflation data is that they are only released monthly at best, and Fed meetings occur only once every six weeks. While investors can speculate in the meantime, it’s likely better to simply remain patient as economic events play out and the narrative evolves. Focusing too much on each data release, or trying to guess every market reaction, is not only impossible, but can be counterproductive.

The bottom line? History shows that market recoveries can occur when they are least expected. How investors react to these challenging times will have a significant impact on their long-term financial goals. There are factors for investors arising through the holiday season to keep an eye on that may provide positive impact on the recovery.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetically used for illustrative purposes only and do not represent any actual investment.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment

objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without IFP’s express prior written consent.