Focus on Fundamentals, Not Headline News

Weighing opinions in the news against actual data can be an exhausting exercise. Just remember the old cliché that “the market can remain irrational longer than you can remain solvent” and that “he who lives by a crystal ball soon learns to eat ground glass.”

For those drinking the “doom and gloom” cool aide, this week’s headline news from the Duke Global Business Outlook Survey notes that nearly half (48%) of CFO’s are predicting our economy will be in recession next year right before the 2020 Presidential election.

Just thinking about this potential outcome could cause nervous nellies to start investing in a bigger mattress and CD’s because the headline news confirms their beliefs that something bad is about to happen.

This is an example of anchoring bias, when we put too much trust and emphasis on the first bit of information we find when making decisions. First impressions can be hard to shake because we tend to selectively filter, paying more attention to data that supports our actual opinions while often ignoring the rest.

For the more disciplined investors focusing on the fundamentals, the economic outlook is a bit more upbeat. U.S. corporations will soon begin reporting their second quarter earnings amid an environment of macroeconomic uncertainty.

Global trade headlines between the U.S. and China continue to drive volatility and affect short-term company results. The Fed has also complicated matters since they are widely expected to cut rates later this month. This has once again created an environment where good news is treated as bad news. Case in point: last Friday’s strong jobs report which showed that 224,000 jobs were added in June now adds an inkling of doubt about the Fed response to lower rates.

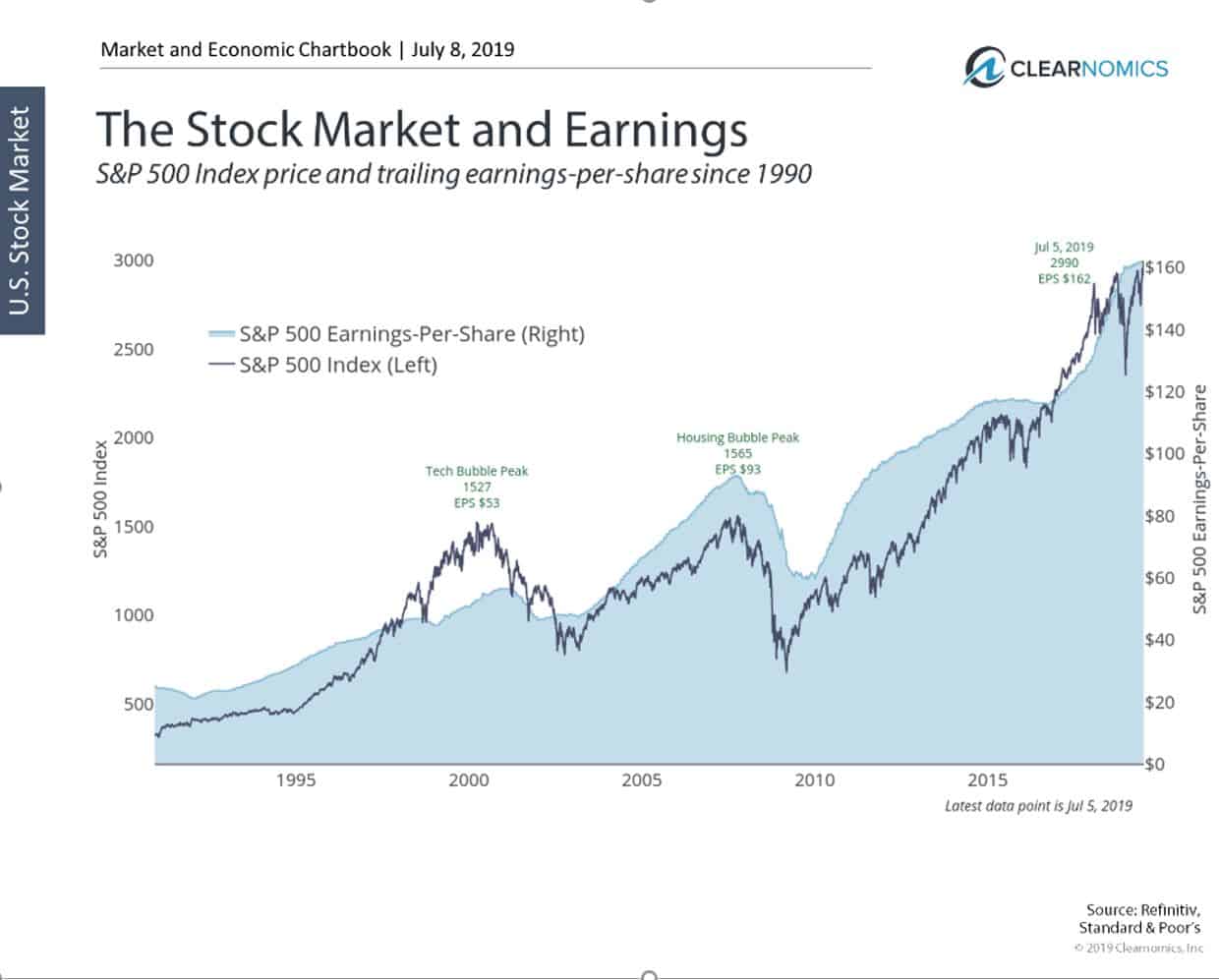

For long-term investors, it’s important to not miss the forest for the trees by getting caught up in day-to-day headlines and market volatility. Over the long run, the stock market tends to follow the path of corporate earnings, which in turn follows economic trends. This historic bull market has been no exception. While earnings may be decelerating alongside the broader economy, it’s likely that they are still strong enough to support portfolio returns.

Specifically, the earnings-per-share of S&P 500 companies has grown by 172% since the bottom in 2009, and 74% since the last cycle peaked in 2007. While this growth in profits is a combination of both revenue growth – driven by a healthy economy – as well as margin expansion – a result of cost cutting, technology and globalization – the net result has been strong fundamental performance for U.S. corporations.

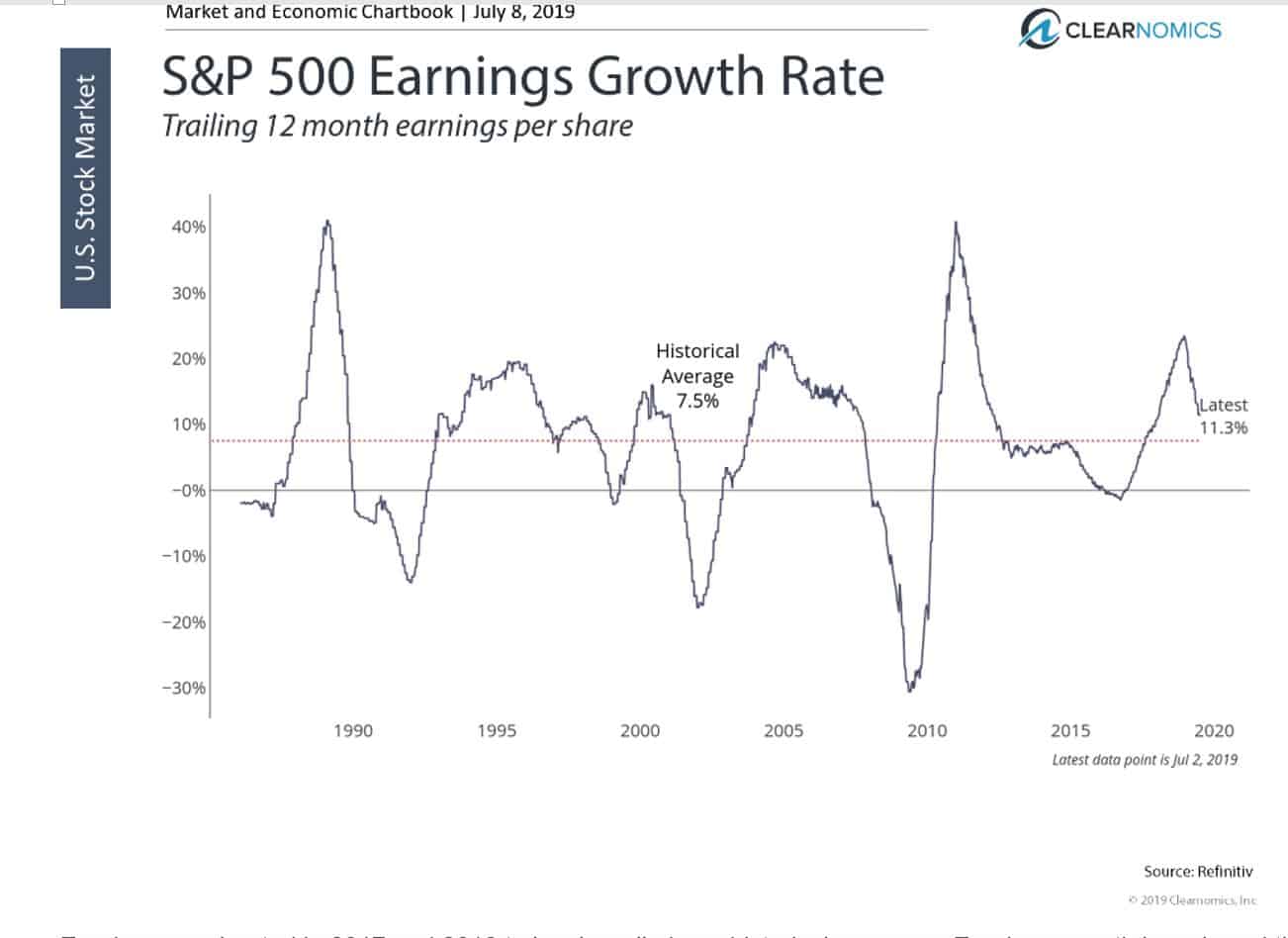

There’s no doubt that earnings growth has decelerated this year, with the first quarter coming in flat on a quarter-to-quarter basis. Still, looking over longer timeframes, earnings are expected to grow by roughly 3% across full-year 2019, and by 7% over the next twelve months.

There are three important things to highlight here. First, earnings grew at an unsustainable breakneck pace in 2018, fueled by tax cuts and strong global growth. The earnings growth chart below shows how far above average it had accelerated. Second, as a result of exceptional earnings last year, year-over-year comparisons are much more challenging. So, while annual earnings are not expected to decline on an absolute basis, they are not as impressive on a percentage basis.

Finally, even an earnings growth rate in the neighborhood of 7% over the next year should, in theory, be enough to support strong stock market returns for investors. In fact, this is close to the historical average for the S&P 500. For those with long time horizons, it’s important to keep earnings and stock return expectations in check in order to stay disciplined and invested.

Below are three charts that highlight this important investment discussion.

1. Over the long run, earnings support the stock market

The stock market, over the course of cycles, tends to follow corporate earnings. While stock prices may fluctuate on a daily, weekly and monthly basis, strong earnings are a long-term fundamental reason to own the shares of companies. Prices can diverge from these fundamentals for periods of time, but historically they often re-adjust.

Corporate earnings have been exceptionally strong over the past decade. There are numerous factors which have contributed, including healthy economic growth and improved profit margins. While earnings have decelerated, they are still attractive in the broader historical context.

2. Earnings growth has decelerated in 2019, but are still healthy

Earnings accelerated in 2017 and 2018 to levels well above historical averages. Earnings growth has slowed this year and may do so further as companies report their second quarter results. Still, consensus Wall Street analyst estimates are calling for over 7% earnings growth in the next year. This is a healthy growth rate that is comparable to the long run average. Investors should maintain proper expectations for both earnings growth and stock returns.

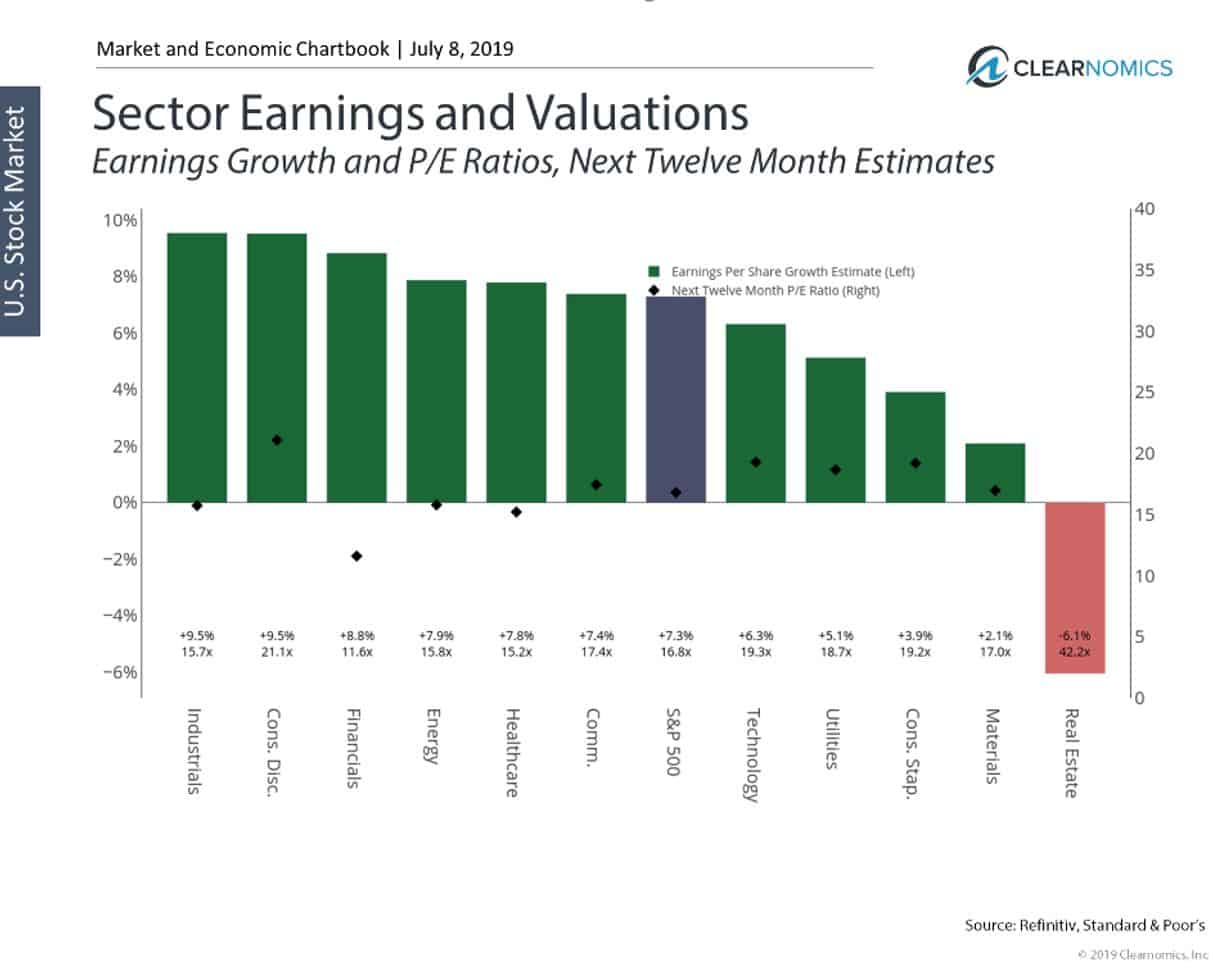

3. Fundamentals still look attractive across a wide range of sectors

The earnings story isn’t simply at the stock market level – it’s true for sectors as well. Most sectors are expected to grow earnings over the next twelve months, with a few sectors (industrials, consumer discretionary and financials) at high single-digit rates. There are likely to be many opportunities for investors who are properly diversified across the market.

As the earnings season gets underway, it’s important to stay focused on long-term trends and take in the headline (short term) news with a grain of salt. While earnings may decelerate in the short run, a steady economy should still support healthy corporate earnings growth.

The bottom line for investors, always remember the simple yet powerful maxim that investing is a marathon, not a sprint. Maintain your strategy based on forward looking fundamentals and only take the current event news with a grain of salt.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.