3 Methods to Manage Market Uncertainty

When kicking back in the sun with a cold drink over this Memorial Day weekend, make sure to keep an “eye out” for fear lurking beneath the fairly calm surface of the brisk “COVID19 market and economic rebound for bears waiting to take a big bite out of your savings.

Contrarian investors of all ages may ponder that there are significant risks hiding everywhere from soaring valuations, significant liquidity and high optimism that could lead to rising inflation and interest rates, or a big selloff of growth stocks like the dot-com days.

While we may not be partying this year like it’s 1999, investors with perhaps too much time on their hands are scrambling around to make significant changes with their portfolios to either reduce (or increase) risk before the next critical “black-swan” event occurs, rather than simply staying the course. Perhaps this pent-up angst and behavior may be driven in as much from boredom with the complacent markets in as much uncertainty or greed.

How we handle risk and daily decisions from the amount of speed we choose to drive our car down the highway to selecting health insurance coverage and deductibles, getting a COVID vaccine shot, or even just getting on an airplane for the next family vacation are all examples of risk baked into our daily lives from the choices we make.

Investor Misperceptions

You can study all the maxims and investment risk rules of thumb (such as invest your age in bonds) till the cows come home, but there is no proven direct correlation between your “investment IQ” capabilities to whether you are in Mensa, graduated from an Ivy league college, or work as a surgeon or a Fortune 500 high tech engineer.

Having a misperception of your risk tolerance and ability to disseminate elaborate products might make you more vulnerable to scammers where you end up buying a complicated, high risk investment as a “hedge” to stock market volatility from an investment newsletter or workshop. Just the same, holding the majority of your 401(K) in company stock, while betting your liquid savings on “hot” crypto, cannabis or tech start-up typed stocks is more speculative (Vegas) and not indicative of a disciplined wealth management process.

Jon here. We remind our clients and investors that it’s as important to consider the “return of your money” in as much the “return on your money” with each trade or purchase. There is no product or “silver bullet” solution that provides super high dividends or returns (outside the norm) without other unique risks baked in. My favorite four-letter word is EXIT. No matter whether purchasing investment property, art, watches, jewelry, classic cars, limited partnerships, crypto or stocks, (to name a few) always consider valuations, costs and liquidity (ease and access to your investment when needed to cash out.)

Business as usual

For some investors, it may feel as if financial markets are more uncertain than ever. Day-to-day stock market swings have increased due to concerns over inflation, interest rates, potential tax policy changes, Fed policies and more. Those who follow financial headlines are met with ominous topics such as Russian cyberattacks, economic uncertainty, and on-going COVID-19 outbreaks in other parts of the world. Even cryptocurrencies, which experienced a dramatic bull run this year, have plummeted over the past week across the board.

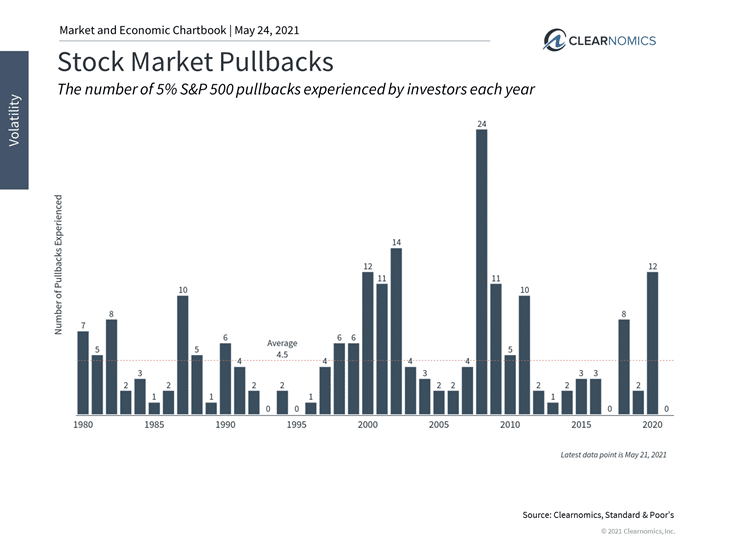

The reality is that stock market swings are not only normal but have been quite calm by historical standards. The VIX index, a popular measure of stock market volatility, is right around the long-term average of 18. Despite some day-to-day swings, there have been no pullbacks as large as 5% this year, even though the typical year experienced several. The biggest peak-to-trough pullback has only been 4%, compared to the annual average of 15%. Thus, there is a disconnect between the rocky waves that many investors perceive and the natural ebbs and flows of the market. (see below)

Of course, the calm of the broader market may not apply to those with concentrated positions in hard-hit areas. It’s also undeniable that stock market valuations such as based on the S&P 500 index are above-average, begging the question of whether they are too optimistic. So, for some investors, there may be a fear that there is a market-disruption lurking around the corner. For everyday investors, there are three broad ways to manage these concerns.

Three methods to manage concerns

The first is to simply retreat to cash and forego the wild swings of the stock and bond markets. On paper, cash can appear to be the most stable asset since account balances don’t change on their own. However, this can be misleading since the true purchasing power of cash can erode over time, especially if inflation is accelerating. Moreover, this doesn’t consider the opportunity cost of missing market gains. Together, these unseen “losses” can be significant over long periods of time.

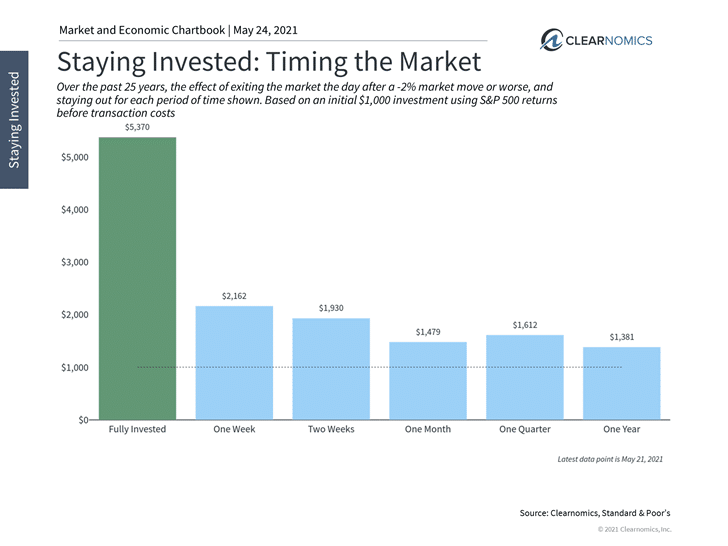

The second way to respond to market swings is to trade in and out of the market. Trying to time the market is alluring since the benefits seem large, especially in hindsight. Those who could have foreseen both the pandemic market crash and the market rebound shortly thereafter would have profited handsomely. (see below)

Of course, the problem is that decades of research have shown that it is very difficult – and perhaps impossible – to predict short-term market movements accurately and consistently. Events that are expected to move markets often do not, and events ignored by investors often do. Perhaps more important is the fact that investors often suffer from behavioral biases. After a market crash, when stocks are objectively the most attractive, is when investors are often the most fearful. After the market has recovered, and stocks are no longer cheap, is often when investors are the most optimistic.

The third (and in our opinion the best way) to respond to impending doom and volatility, is to stay invested in a well-diversified portfolio. Rather than swerving about to avoid a few potholes, the objective is to maintain a portfolio that can withstand the bumps. Similar to a realtor’s mantra of “location, location, location,” our investor’s mantra is “diversification, diversification, diversification.”

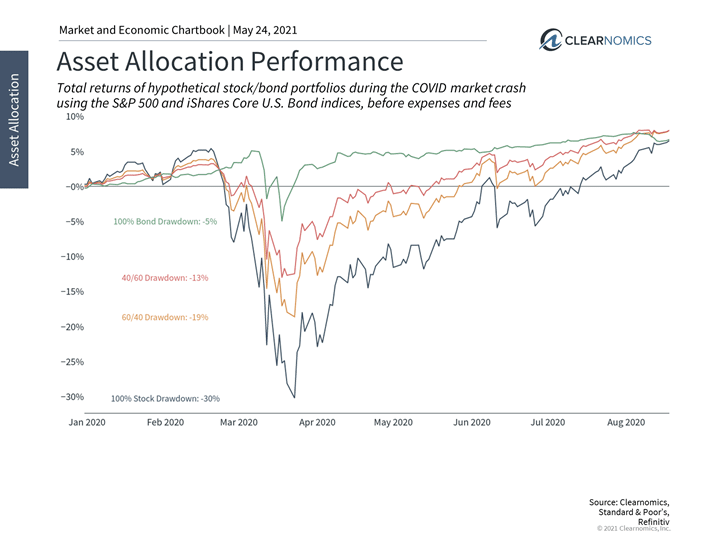

The benefits are numerous. Well-constructed portfolios take advantage of diverse asset classes to help smooth returns and risk over time in order to achieve financial goals. They can be optimized for taxes, income, growth and other important factors. Tactical asset allocation and portfolio tilts are still possible but can be done in the context of a broader plan. Perhaps most importantly, a diversified portfolio can help investors to sleep better at night without worrying about every market hiccup. (see below)

Long-term investors ought to keep these lessons in mind as market uncertainty grows. This is especially the case when volatility truly does pick up. Below are three charts that can put the importance of staying invested in perspective.

1 Diversified portfolios held up against the COVID-19 market crash

This chart shows the hypothetical performance of various asset allocation portfolios during the first eight months of 2020. A proper mix of stocks and bonds not only performed better during the market crash but recovered more quickly and held its value longer. Most importantly, investors who experience less volatility in their portfolios are also less likely to overreact.

2 Despite uncertainty, the stock market has been calm

By historical standards, the stock market has been quite calm in 2021. This may be surprising to many investors who experience large day-to-day swings and see alarming headlines regularly. The largest peak-to-trough decline in the S&P 500 this year has only been 4%. Investors should not be surprised by greater levels of volatility.

3 Simply staying invested has paid off historically

History shows that those who can stay invested in properly diversified portfolios, and avoid the temptation of swerving in and out of markets, are in a better position to achieve long-term goals.

The bottom line? Managing your money to help meet your long-term goals while assessing risk, should not involve emotions, darts, tarot cards or luck, like playing a roulette wheel in Vegas where the “odds are on the house,” but should involve a more controlled scientific approach to determining your willingness and ability to tolerate risk while implementing a defined investment process.

Although market uncertainty continues and there have been large swings in certain asset classes, long-term investors ought to stay disciplined and focused on their financial goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.