3 Lessons Learned by Investors in 2020

As we finally approach the “bitter end” of 2020, the stock market is remarkably hovering near record highs. While there have been many lessons learned for investors this year, there were developments that will matter in the years to come that may have permanently changed how we live, work, shop and travel.

In January no one could never have ever predicted (or believed) a black swan event in the form of a deadly virus from China would somehow affect all of civilization, resulting with the US Markets plunging 35% by a man-made economic shut-down and recession.

In the second quarter, we witnessed one of the worst single-quarter GDP contractions ever, and saw the unemployment rate rise faster than at any point in history. Amid the chaos of the pandemic, we witnessed four records including:

- The steepest and quickest bear market decline ever marked by the S&P 500 (16 trading days to surpass -20% down)

- The highest “VIX” volatility “fear index” reading on record rising up 85.47 in March

- The first-time crude oil futures contracts pushed into negative territory with WTI futures at -$40 per barrel

- The fastest recovery from a bear market to new highs 5 months later by the third quarter

From COVID-19 to the presidential election and protests, big events rattled markets but also showed the importance of patient perseverance. Just as having the right perspective on a problem can help to solve it, having perspective in investing is about addressing the right issues while knowing what we can and cannot control as individuals.

The main lesson we learned this year (yet again) is that “this time is always different” when it comes to catastrophic events, market crashes and subsequent rebounds, but “this time is never different” when it comes to our own behavior. It’s important for investors to hold onto these lessons by focusing on key trends and habits as we discuss below, rather than daily market swings and headline news.

1.Maintain Balance

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” (Peter Lynch)

In our everyday lives, it makes sense to heed expert advice on travel restrictions and take basic, sensible precautions. Additionally, while it’s important to stay well-informed, it’s just as important to listen to true experts and not those spreading misinformation. For a few, building and hiding in a bunker may be a tempting knee-jerk reaction, but is likely to be an unnecessary overreaction.

If you are properly diversified and know your portfolio “risk budget” matches your time frame and financial goals, “doing nothing” if properly diversified may provide a better outcome for your investing and retirement goals than making a lot of unnecessary changes or executing a “fire sale” during a bear market. This was never more true than the through the gut-wrenching market slide in March of over 35% for the DJIA followed by a historically swift recovery by November.

Market timing is a fool’s game. Investor studies indicate that the human brain is not a rational economic actor. When faced with uncertainty, even the best investing minds may throw good money after bad, sell at the first sign of trouble or make all manner of jumbled financial decisions when stress and volatility hits.

For the past two decades since the Clinton era, the average US investor has returned only 3.88%/yr and greatly lower than the 10% /year US markets based on Dalbar studies. This 6% ‘behavior gap’ indicates that many investors are guilty of a combination of poor market timing and lack of a disciplined investment process. But it’s actually much worse considering taxes and inflation.

For long-term, disciplined investors, the answer to market volatility isn’t to jump in and out of the market. Instead, it’s to stick with a well-balanced, diversified portfolio that can weather upcoming bear attacks. Sound Investing truly is about your “time in the market” and not “timing” the market while staying balanced.

2.Don’t Reach for Yield

“Everything should be made as simple as possible, but not simpler.” (Einstein)

Reaching for yield in a low interest rate and highly volatile stock market environment can cost you greatly. Always remember that there is no such thing as a free lunch (TINSTAFL.)

If the 10 Year Treasury yield (considered the “safe” money” backed by Uncle Sam) is paying near a 1% yield, and your investment fund or product is paying 7% (7X greater) don’t’ rush to brag to you friends on “how smart you are.” With any investment you may be substituting one risk for another, such as loss of principal.

Many fancy (complex) alternative and insurance-based products pitched at steak dinners (now webinars) as a stock market “hedge” to risk adverse boomers and retirees while promising “high dividends” and or “guarantee of principal” can many times end up with poor outcomes.

When seeking yield before or through your retirement years in a low interest rate environment, it’s important to take steps to properly diversify both the fixed income and equity sides of your portfolio for yield and total return- in as much as working to help manage exposure to credit, interest rate, liquidity and other various investment risk “usual suspects.”

3.Employ Cash Smartly

“Everybody has a plan until they get punched in the mouth” (Mike Tyson)

Maintain at least 12 to 24 months of cash in your “cash reserves bucket” of essential household expenses for when inclement weather hits, especially in your retirement years. Have your savings deployed between a bit in high interest rate savings and money market accounts to cover a few months of expenses and the balance deployed in a liquid, low cost, tax efficient portfolio of investments positioned conservative to moderately conservative in risk.

If you lose your job or are forced into an early retirement, you do not want to have to sell stocks at a low point during a bear market or take a taxable distribution (or expensive loan) from your 401(K) account or IRA because you are cash poor. If you are under 59 ½ you may also end up paying a steep 10% penalty on top of taxes for any retirement account distributions.

Don’t overly position your liquid net worth in cash, especially if you are seeking income in retirement as most low yielding cash vehicles will not help protect you against inflation and rising cost of living adjustments over time. Spending $50K per year from a $500K cash account will last you less than ten years, considering that the cost of living may go up 50% every decade (along with your expenses) from just an estimated 3.3% inflation rate over time. In other words, $500K today may only “buy” you $250K in goods and services by 2030 based on this scenario.

Cash does, and can help to protect you against rising interest rates more so than bonds to help preserve principal. We are in a historically low rate world where I have said before that it appears rates are more likely to rise going out of COVID and into the Biden Presidency than into negative territory. Interest rate risk is the risk that arises for bond owners from rising rates. How much interest rate risk a bond has depends on the bond’s time to maturity and the coupon rate.

Why the Stock Market Rising

One reason for the recent market rally is that the presidential inauguration in January appears less uncertain than it did just a few weeks ago. After all, what may be more important to markets than who is in the White House is that there is a peaceful transition of power. In general, history has shown that investors often focus too much on election results. Although elections can cause short-term volatility, economic growth is ultimately what moves markets over the long run. The current period appears to be no exception so far.

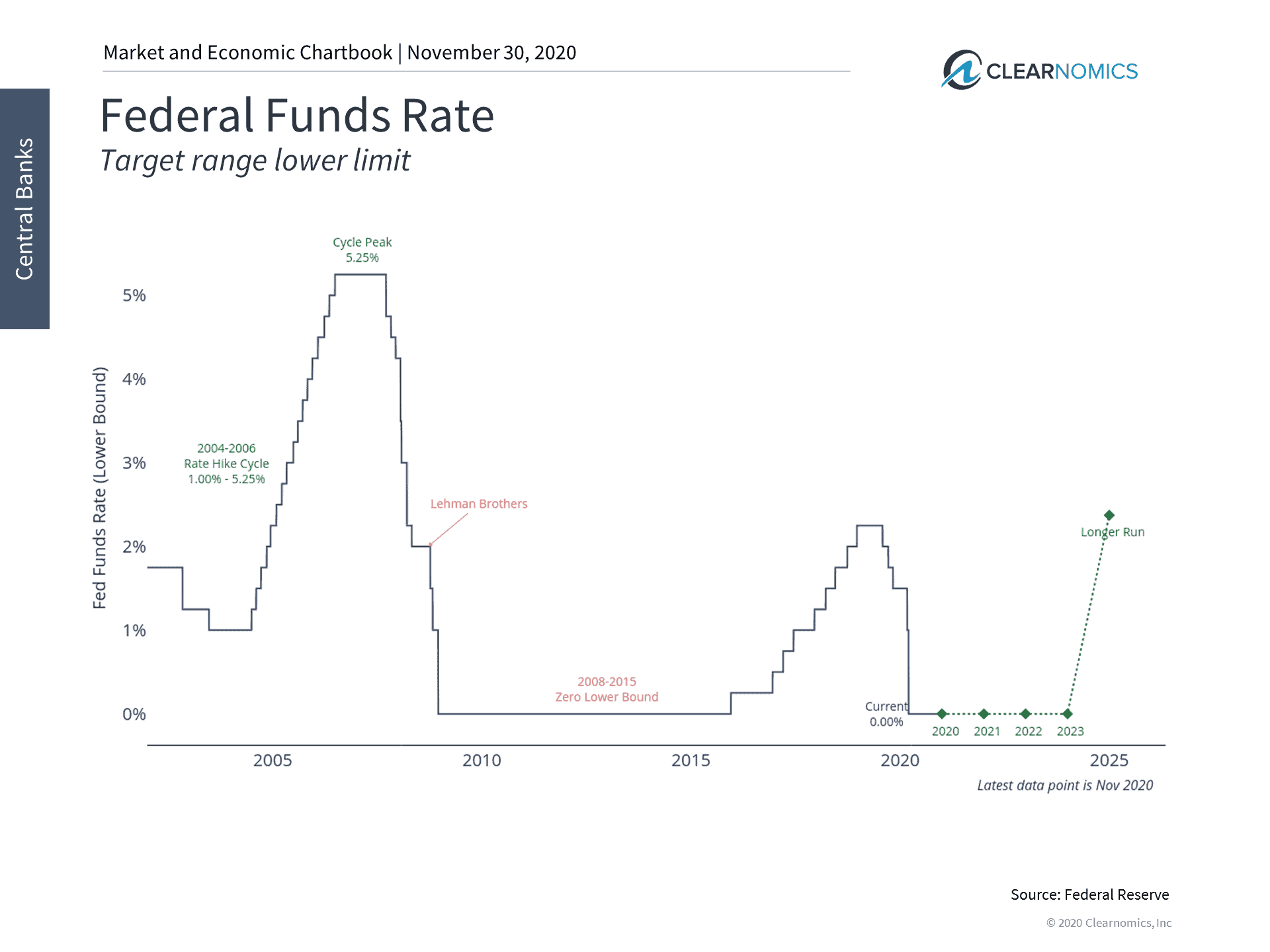

In addition, the potential nomination of Janet Yellen as the next Treasury Secretary is likely seen as a welcome sign by many investors. It’s clear from her track record as Fed chair that Yellen would promote fiscal stimulus and seek to finalize a new COVID-19 economic bill. After all, it was under Bernanke and Yellen that the Fed kept interest rates at its zero-lower-bound from 2008 to 2015. Whether one agrees with these policies or their possible long-term consequences, it’s likely that they will help to support financial asset prices. The stock market has cheered these developments in recent days.

Finally, there are also multiple vaccine candidates being developed by Pfizer, Moderna and Oxford/AstraZeneca. Although there is still a great deal of uncertainty and any reported timeline should be taken with a grain of salt, this is further evidence that there is a light at the end of the tunnel.

While GDP growth for the fourth quarter is projected to be “only” 4%, after falling 31.4% and rising 33.1% in the second and third quarters, respectively, this has been enough to keep earnings steady. Clearly, vaccines or other public health innovations would help businesses large and small in the coming years.

There are many reasons that the stock market is near record highs. It’s important that investors continue to focus on these factors rather than short-term noise. Below are three charts that can help put recent developments in perspective.

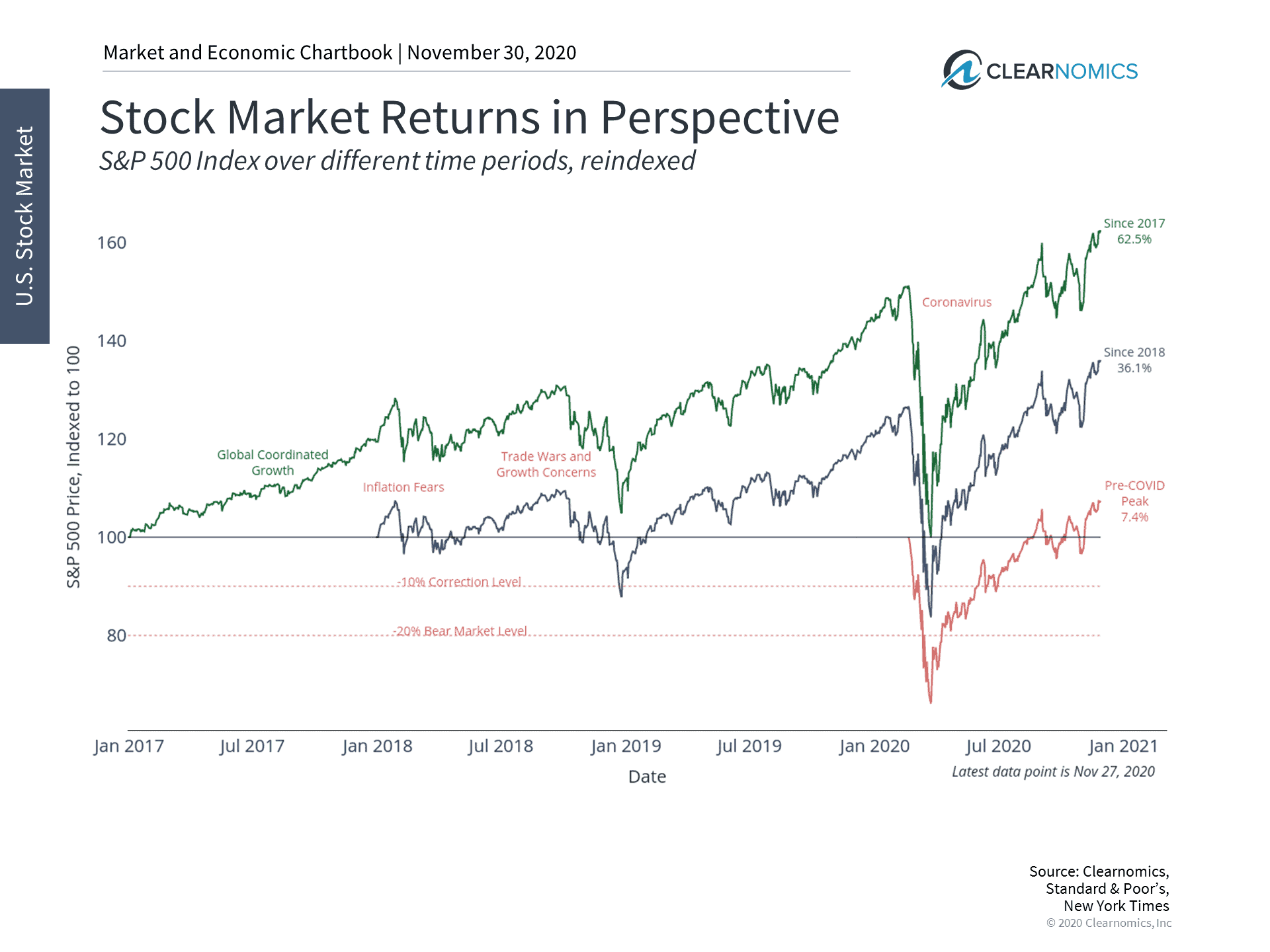

1 The stock market has reached new all-time highs

The S&P 500 has risen over 13% this year with dividends despite the COVID-19 bear market crash. The NASDAQ has performed even better at 36%, and even the Dow Jones Industrial Average has gained almost 6%. All of these major indices are also above their pre-COVID peaks.

2 The Fed is expected to keep rates low, continuing the policies enforced by Janet Yellen

The potential nomination of Janet Yellen to head up the Treasury department in the incoming administration has been cheered by markets. This is partly due to her track record in supporting policies that have helped to boost asset prices indirectly.

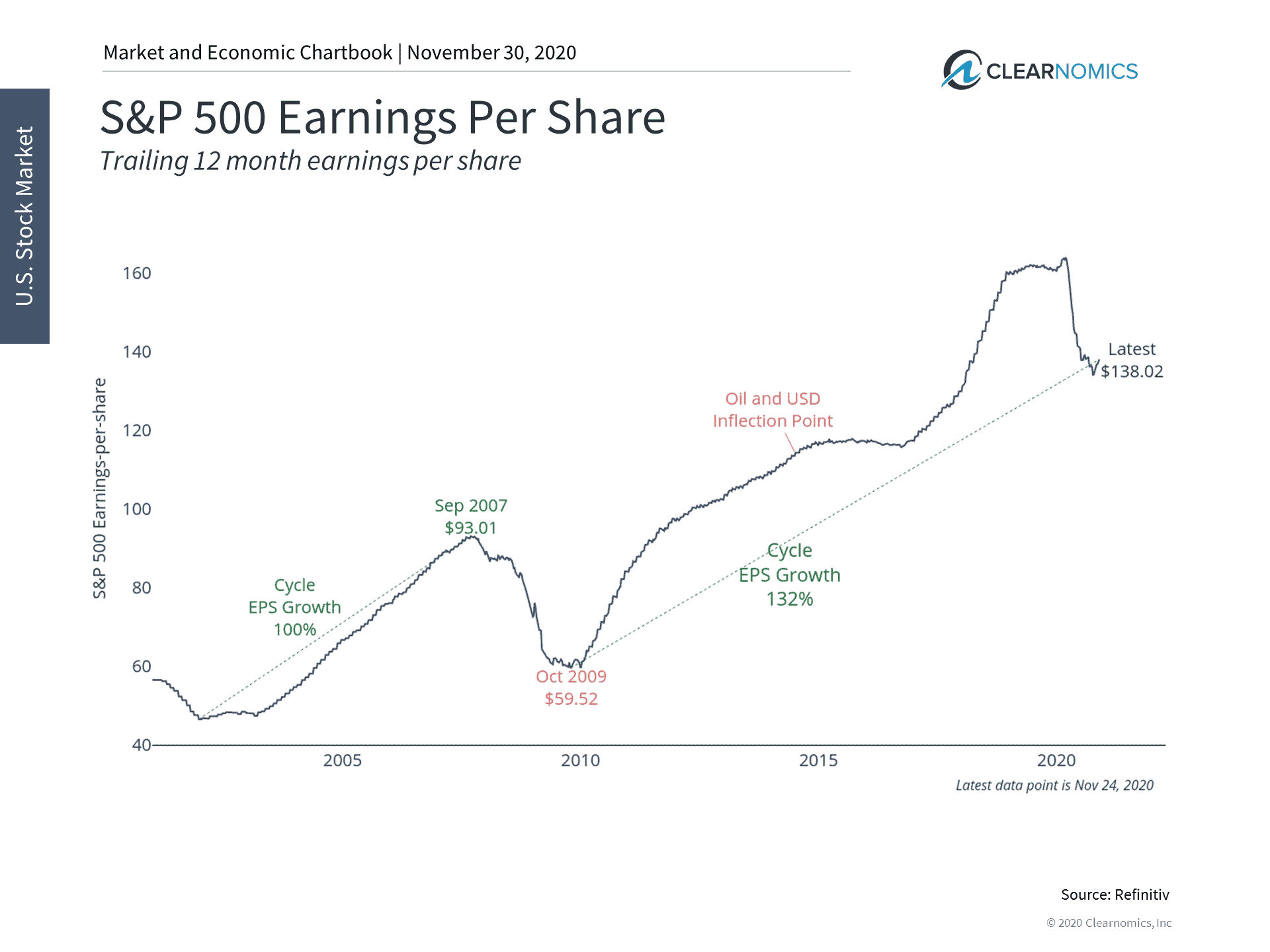

3 Corporate profits have stabilized ahead of possible vaccines

Although there is positive news on the multiple vaccines being developed, much is still uncertain. Despite this, corporate earnings have been stabilizing as a balance is truck between economic growth and public health. A widespread availability of a vaccine over the next year could help earnings to recover even more.

The bottom line? Fear and greed are magnified in bear markets – as some people get a bit too overconfident while others panic, both operating on emotion – not strategy or process. You may make most of your money in a bear market, but you may not recognize it at the time.

Ultimately, investors should hold portfolios that allow them to see through current market concerns and also allow them to sleep better at night. Regardless of how this episode unfolds, the long history of the market suggests that periodic pullbacks are both normal and expected – no matter the root cause. Staying focused throughout these periods is not only important for achieving financial goals – it is the defining ingredient.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.