Y2K vs Today: Investing Trends for 2023

2022 was a difficult year for investors with bear markets in bonds, stocks, real estate, tech and crypto. History rhymes and repeats as investors may be developing PTSD-like symptoms reminiscent of the “Great Inflation” from 1965 to 1982, the 2000 Dotcom crash, to the 2008 Great Recession, all combined from recent events.

Major market swings and aggressive Fed rate hikes can cause whiplash for even the most experienced investors. Like an earthquake that then causes a tsunami, the sudden pandemic driven drop in 2020 followed by a resurgence in business and consumer demand, fiscal and monetary stimulus, and global supply chain capacity created shock waves across the financial system through last year.

While they do cause immediate damage, even the largest shocks eventually settle as we are starting to see developments evolving from the Fed’s jolt to interest rates. Unfortunately, the news and media streams seem to pick up on more on the headline grabbing Armageddon doom and gloom opinions and predictions from the “experts” than provide actual evolving data points and analysis as we strive to do here with our weekly newsletters.

Y2K vs Today

One of the main stories coming out of 2022 is comparing the recent tech crash to 23 years ago upon the onset of the dotcom crash after the Y2K fiasco as the clocks clicked down on New Year’s Eve. Y2K is the shorthand term for “the year 2000.”

Despite the similarities between today and Y2K, things are very different now, especially with the innovation of tech into most all industries with major disruptions from DNA sequencing, robotics, energy storage and artificial intelligence, to blockchain. The tech crisis of 2022 was less about businesses disappearing overnight and had more to do with investors waking up to reality as many tech companies plummeted back down to earth after hitting a post-pandemic sugar high, and at more reasonable valuations.

The notorious “dot-com” bubble, also known as the “tech boom” or “internet bubble” that popped in 2000 was at the beginning stages of a “new era” for tech and start-up companies where thousands of startups were launching, and very unlike tech companies today that are more established with proof of concept and backed by years of cash and growth under their belts. Today’s companies offer a bit more real products and services that provide tangible value, and many of them are doing so at extremely high profit margins. The crypto crash and other blockchain fiascos may be a bit still in its infancy stages like tech in Y2K.

5 Key Insights and Trends for 2023

Despite historic shifts in the economy and markets over the past year, the principles of long-term investing haven’t changed as we cover in most of our newsletters. Staying disciplined, diversified and focused on longer time horizons is more important than ever.

For some, it may feel as if markets can’t catch a break, but this is how it felt in March of 2020 when the world was shut down (literally) before the rapid recovery, in 2008 before a decade-long expansion after the real estate crash, and during countless other times across history. Keeping one’s footing as markets rock back and forth is still the best way to achieve financial goals. Below, we review five insights from the past year that can help investors to maintain a proper long-term perspective in 2023.

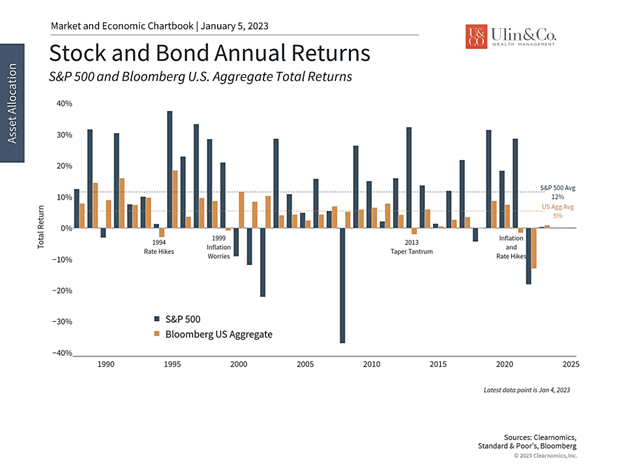

1 Historic surge in interest rates affected stocks and bonds

Beneath all of the headlines and day-to-day market noise, one key factor drove markets: the surge in interest rates broke their 40-year declining trend. Since the late 1980s, falling rates have helped to boost both stock and bond prices. Over the past year, the jump in inflation pushed nominal rates higher and forced the Fed to hike policy rates. This led to declines across asset classes at the same time.

While this has created challenges for diversification, there is also reason for optimism. Most inflation measures are showing signs of easing, even if they are still elevated. This has allowed interest rates to settle back down in recent months even as the Fed continues to hike rates. While still highly uncertain, most economists expect inflation and rates to stabilize over the next year rather than repeat the patterns of 2022.

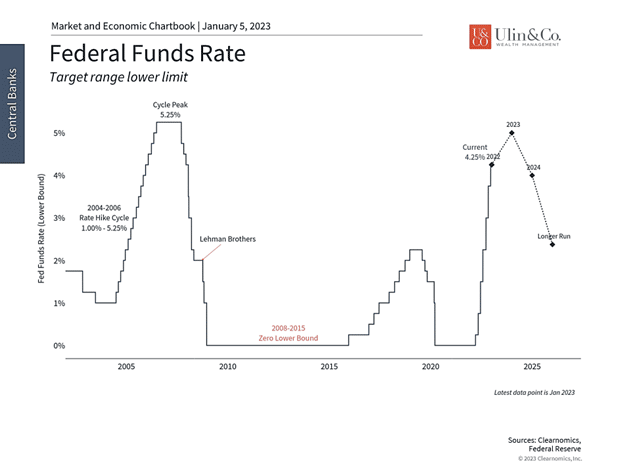

2 The Fed raised rates at a historically fast pace

The Fed hiked rates across seven consecutive meetings in 2022 including four 75 basis point hikes in a row. At a range of 4.25% to 4.50%, the fed funds rate is now the highest since the housing bubble prior to 2008. In its communication, the Fed has remained committed to raising rates further and keeping them higher for longer in order to fight inflation.

Current market-based measures suggest that the Fed could push policy rates to 5% by mid-2023. The central bank continues to face a balancing act between inflation and a possible recession. Despite two negative quarters of GDP growth in the first half of 2022, few consider the economy to be in recession already. Instead, some forecasters expect the U.S. and many other countries to experience a recession in 2023, although most also expect it to be shallow. Slowing growth may mean that the Fed takes its foot off the brake pedal sooner.

This is where the market arguably had unrealistic expectations last year. The market rally from June to August and again in October and November occurred when investors believed the Fed might begin loosening policy. When these hopes were dashed, markets promptly reversed, causing several back-and-forth swings during the year. These episodes show that good news that is supported by data can be priced in quickly but that investors should not get ahead of themselves.

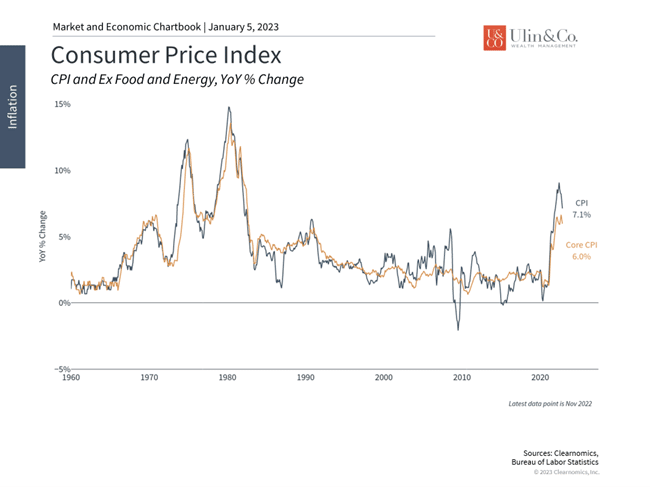

3 Inflation reached 40-year highs but has improved

While inflation has not been “transitory,” it may still be “episodic.” This is because the factors that drove these financial shocks were, for the most part, one-time events. Many of these are already fading as supply chains have improved, energy prices have fallen, and rents have eased. Still, the labor market remains extremely tight and wage pressures could fuel prices that remain higher for longer.

At this point, the direction of inflation may matter to markets more than the level. Investors have been eager to see signs of improvement across both headline and core inflation measures, and good news has been priced in rapidly. There are reasons to expect better inflation numbers over the course of 2023.

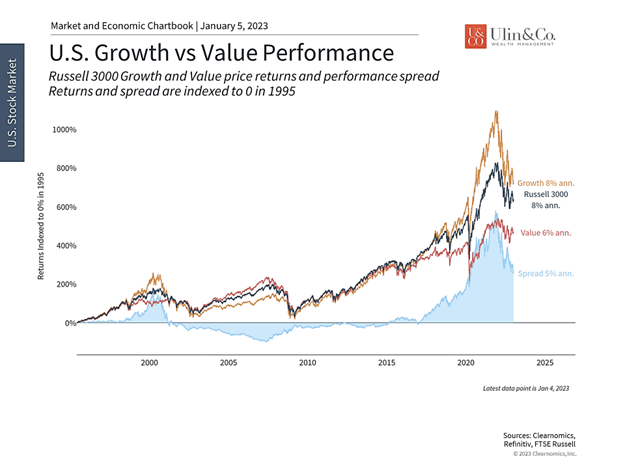

4 The rallies in tech, growth and pandemic-era stocks have reversed

The past year also experienced a reversal of the rallies in 2020 and 2021 that were concentrated in the tech sector, Growth style, and pandemic-era stocks. For the first time in years, Value outperformed Growth as former high-flying parts of the market crashed back to Earth as the economy slowed and interest rates jumped.

The key takeaway for investors is that diversifying across all parts of the market is important. This includes different size categories (large and small caps), styles (Value and Growth), geographies (U.S., developed markets and emerging markets), sectors, and more. It’s also a reminder that rallies can extend for long periods, during which investors experience FOMO and pile in with little thought to risk management. Staying disciplined during these periods, which occur periodically, is important to achieving long-term success.

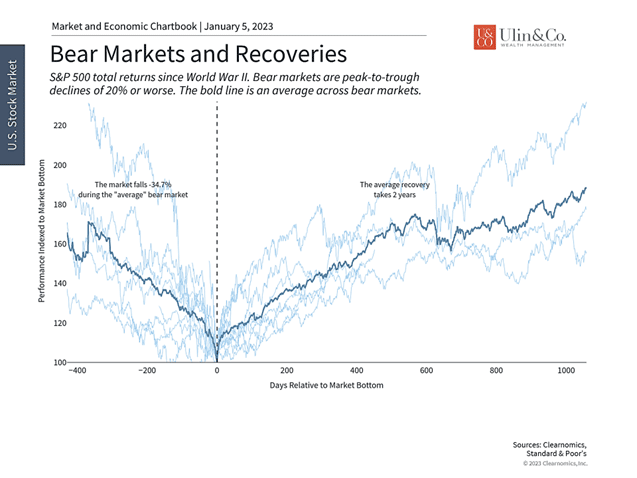

5 Bear markets eventually recover when it’s least expected

While 2022 was challenging, history shows that markets can turn around when investors least expect it. While it can take two years for the average bear market to fully recover, it’s difficult if not impossible to predict when the inflection point will occur.

Many investors have wished that they could go back to mid-2020 or 2008 and jumped back into the market. If research and history tell us anything, it’s that it’s better and easier to simply stay invested than to try to time the market. This could be true again in 2023, just as it was during previous bear market cycles.

The bottom line? Y2K vs today is quite different on all fronts from the boomerang effects of the pandemic to todays’ tech and innovation. While the past year was difficult, those investors who can stay disciplined, diversified and focused on the long run will be on a better path to achieving their financial goals in 2023 and beyond.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.