Will Interest Rates Disrupt 2021?

Interest rates play many roles for investors. Not only are they important for savers and borrowers, but their level and direction provide an important signal of the health of the economy and financial system.

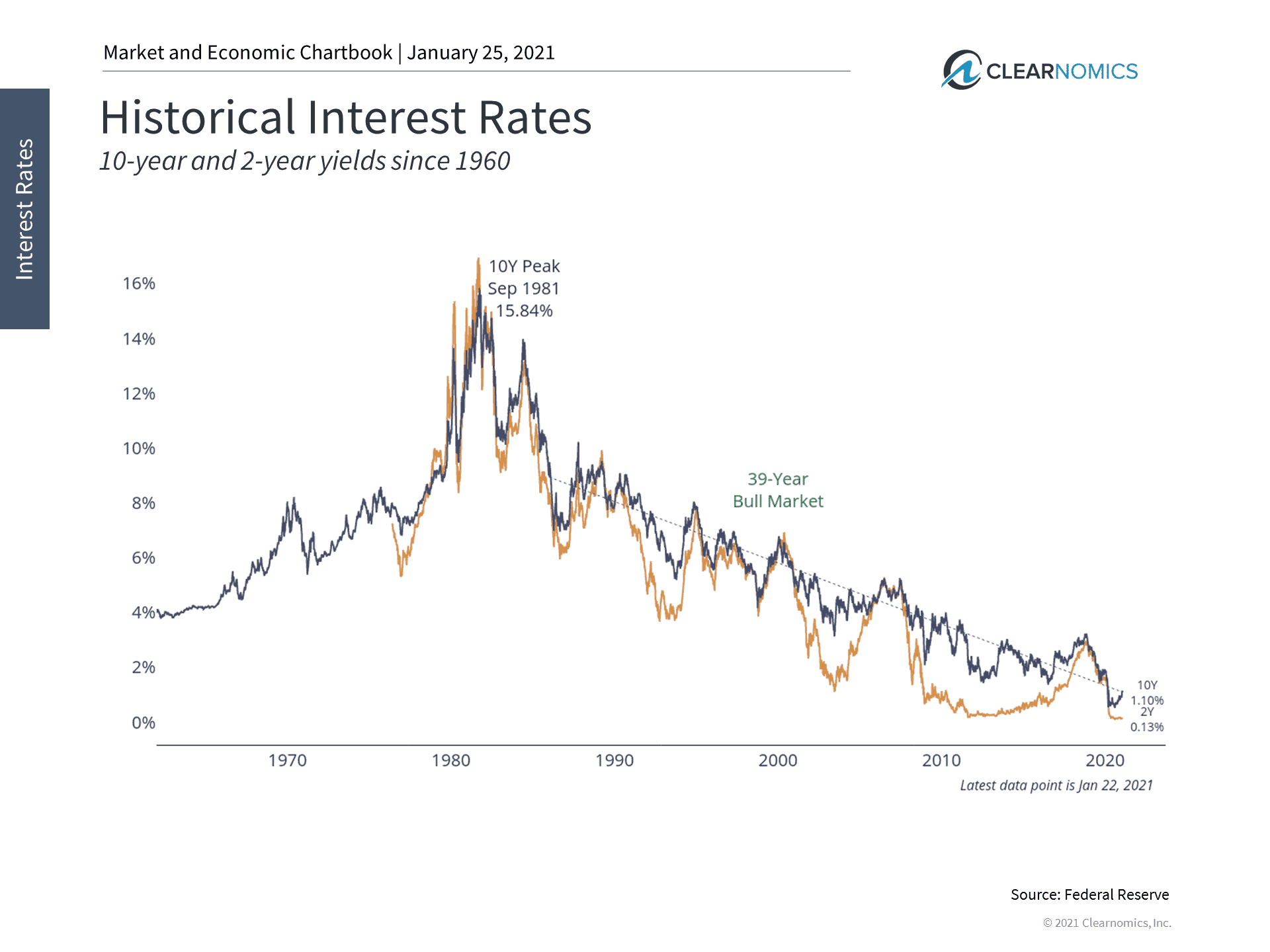

While the economy may continue to improve and briskly boomerang back out from the COVID-recession and US complete economic shutdown, we may not need to agonize any day soon over the past “all-time high” 18% 30 year mortgage rates fueled by a 13.9% 10 Year Treasury rate and 10.3% inflation when President Regan took the oath off office in 1981. You will see there is more to our story on investing and interest rates that precedes the current pandemic problems and hurdles.

Short vs Long Term Rates

On a theoretical level, interest rates reflect expected GDP growth and inflation. If the economy is expected to grow quickly, and/or inflation is expected to pick up, this should also push long term interest rates higher. If consumers and businesses are optimistic about the future, borrowers may accept and lenders may require a higher “price” for capital, whether for buying a house, starting a business or building a factory.

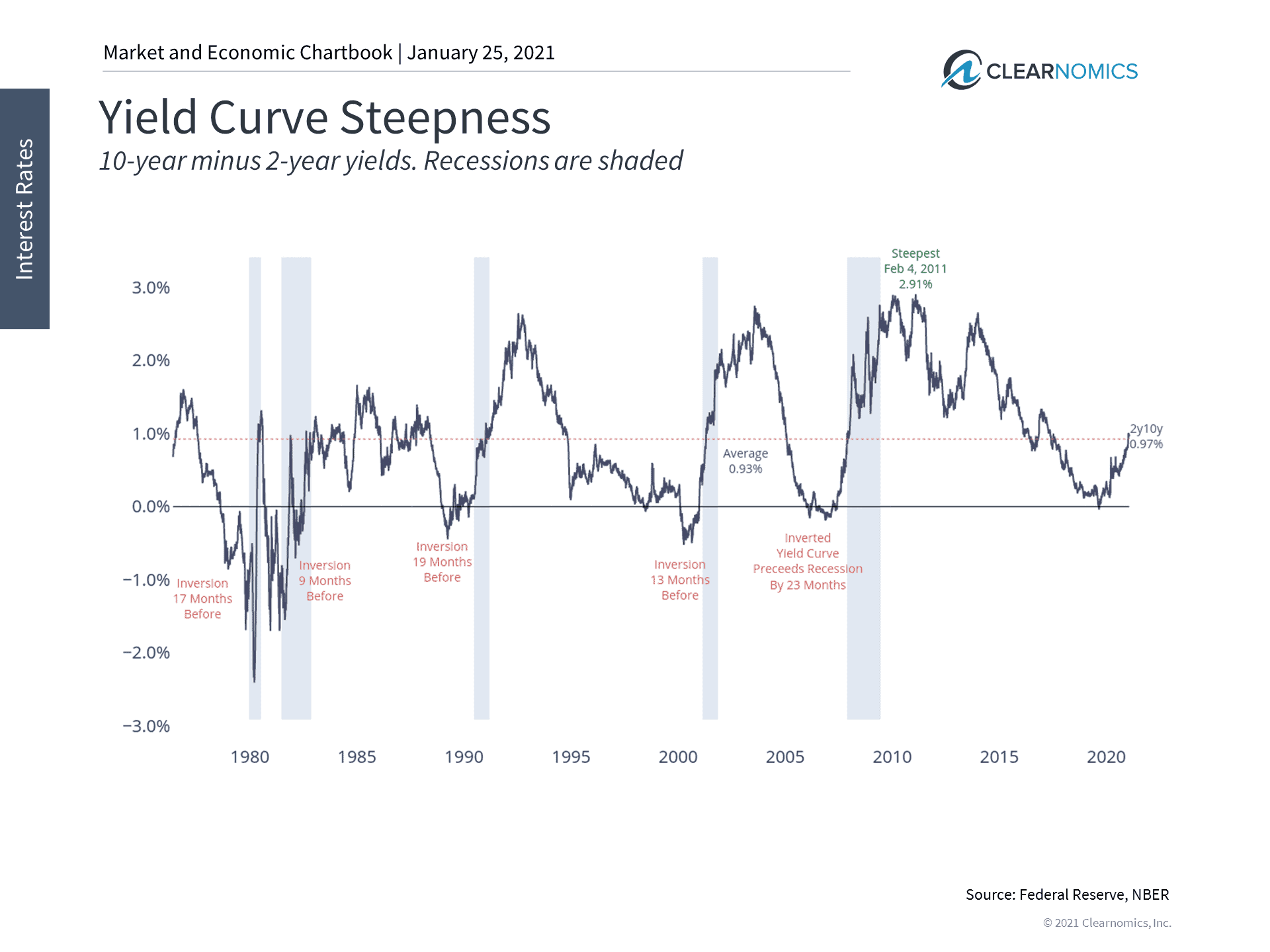

This also depends on the expected path and uncertainty of interest rates across different time frames. The fact that the shape of the yield curve is steeper today – i.e. long-term interest rates are higher compared to short-term ones – is generally a positive sign (see below). The yield curve is often quite steep early in a business cycle when there is growing optimism and the federal funds rate is still low. The opposite – a flattening curve and, at the extreme, an “inverted” yield curve – is often a sign of economic stress and even a looming recession as we saw last year.

On a more practical level, investors tend to buy Treasuries and other lower-risk bonds during times of economic stress and uncertainty. This increases the prices of these bonds and lowers their yields. The Fed has (again) added to this bond buying frenzy via ‘unlimited’ Quantitative easing (QE), a monetary policy whereby bonds are purchased in order to inject money into the economy to expand economic activity and to suppress rates. The opposite is true when there is economic and market optimism – bond prices will tend to fall as investors sell bonds and buy riskier assets, which pushes rates up.

2021 Outlook

The recent rise in long-term interest rates over 1% as represented by the 10-year Treasury reflects the same factors that have boosted the stock market. There is greater economic optimism since businesses began to reopen following the nationwide shutdown, there is less uncertainty following the presidential election and inauguration, and COVID-19 vaccines are being distributed across the U.S. and around the world. Although many people continue to struggle with pandemic restrictions, the economy and financial markets are no longer in crisis mode. Thus, it is reasonable to expect rates to slowly return to pre-pandemic levels if the recovery stays on course.

Jon here. It’s also important to keep the broader historical context in mind. Interest rates have been declining since the late 1970s for a variety of reasons that have nothing to do with short-term crises. Technology, globalization, worldwide cash savings, and other factors have conspired to push interest rates lower decade after decade. These effects pre-date the pandemic and even the 2008 financial crisis. The fact that the Fed responded to these emergencies with extraordinary monetary policy (QE), alongside other central banks, has only magnified their impact.

Of course, there have been periodic spikes in interest rates over the past decade that could arise this year. This happened in 2013 when the Fed announced its “tapering” program to begin shrinking its asset purchases. Today, the Fed’s balance sheet has instead grown by an additional $3 trillion. This also occurred after the 2016 presidential election, partly due to reduced political uncertainty and partly to expected pro-growth policies. In both episodes, the 10-year yield rose above 3% briefly before falling again.

Thus, despite recent interest rate movements, investors ought to stay balanced with their portfolios when considering the gravity of long-term rates and diversify their fixed income holdings between different durations, sectors, industries and credit quality as well as countries. While it’s positive that the economic and market recoveries have pushed rates higher, they are still near multi-decade lows and most likely will not end up in the Regan years territory anytime soon.

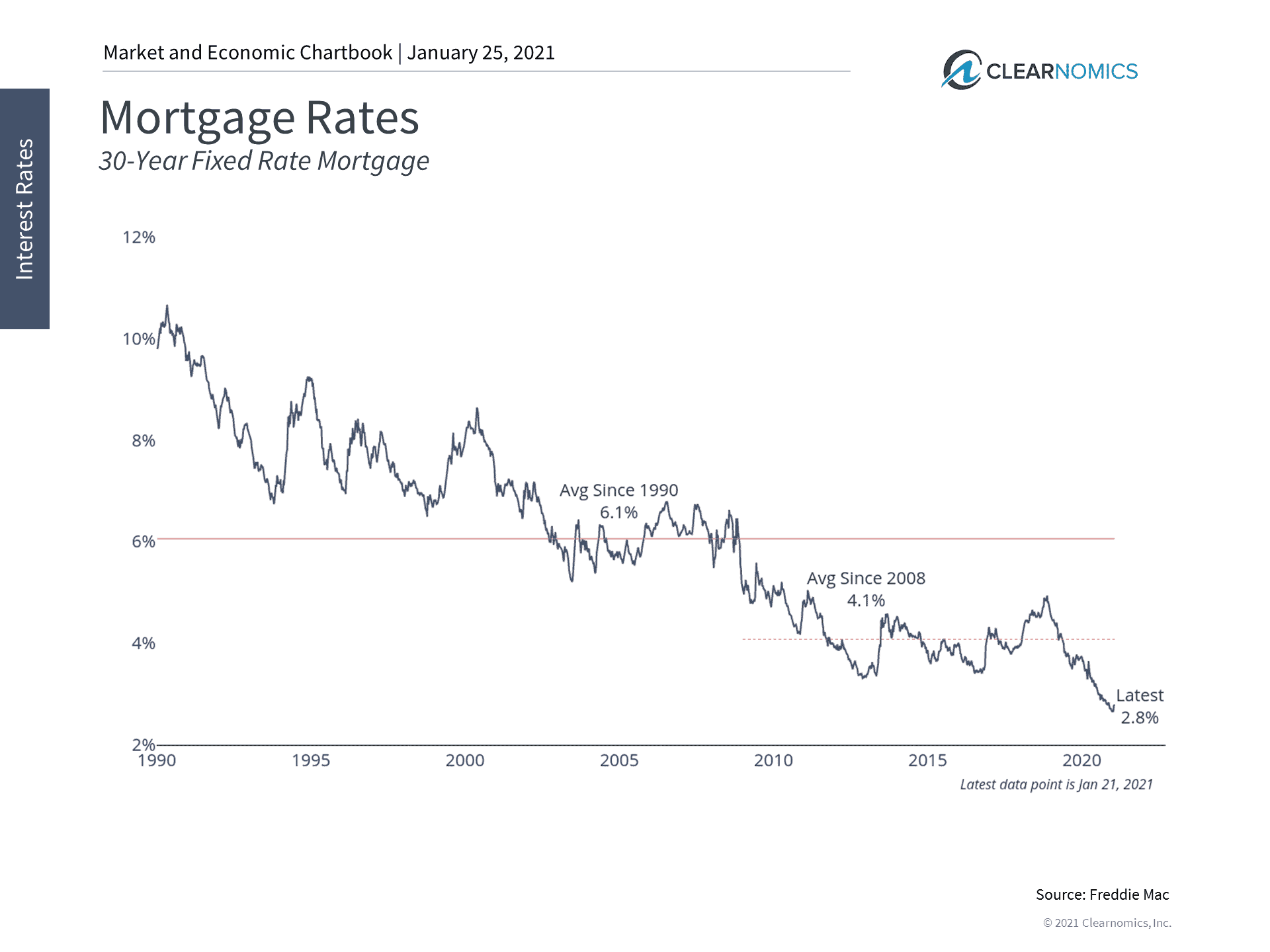

For borrowers and homeowners, mortgage rates remain very attractive. At the moment, the average 30-year fixed mortgage rate is hovering around 2.8%. Along with pandemic-related homebuying demand, this has helped boost housing prices around the country.

For savers, the challenge of generating sufficient income from cash and high-quality bonds will likely continue. This potentially means that finding alternative sources of income, from high-yield bonds and preferred stocks to dividend-paying stocks. Below are three charts that provide perspective on interest rates over the past several years and decades.

1 Interest rates have risen recently but are still near multi-decade lows

Interest rates have been rising since last summer and have accelerated higher in recent weeks. Still, rates are near multi-decade lows due to long-term economic trends.

2 The yield curve has steepened which is a positive economic sign

The yield curve have steepened due to rising long-term rates at a time when short-term rates are still pinned down. This is generally a sign of economic optimism and tends to occur early in business cycles.

3 Lower rates are still great for borrowers and a challenge for savers

Lower rates are a mixed blessing, depending on whether you are a saver or borrower. For the overall economy, lower rates could help to promote home buying and other commercial activities.

The bottom line? Despite recent interest rate movements up, investors ought to consider the gravity of long-term rates being affected in as much by technology, globalization, worldwide cash savings, and other factors that predate the COVID crisis. Investors, especially those in or near retirement, will likely need to stay balanced and continue to find alternative sources of portfolio income.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.