US Dollar Making a Comeback against Inflation

The U.S. dollar had a turbulent few years due to the pandemic, the global recovery, inflation and now the Russia/Ukraine war. Fueled a bit by the new Fed rate hike program while also working as a safe haven, the US dollar is making a comeback.

The dollar is backed by the full faith in and credit of the U.S. government. The first dollar notes were published as demand notes to fund the Civil War of 1861. They were known as greenbacks. The dollar as we know it today was printed in 1914, a year after the establishment of the Federal Reserve as the nation’s central bank.

The dollar is an important, yet sometimes overlooked economic indicator that, like interest rates, reflects a wide array of global trends. As the world’s reserve currency and most reliable medium of exchange across the planet, its value affects every part of the economy and everyday life. Most recently, the U.S. government is now delving into the prospect of creating a “digital dollar” via a Central Bank Digital Currency, or CBDC.

The pandemic propelled demand for cashless payment methods and many Main Street investors have embraced cryptocurrencies like bitcoin and ethereum, putting pressure on the US government not to fall behind on the trend.

Fed Punching Back

While perhaps a few days late and a few dollars short, the Fed finally kicked off its long-awaited rate hike plan to help tame inflation with a quarter point increase this week. When the Fed increases the short-term Fed funds rate, it boosts interest rates throughout the economy, helping to strengthen the dollar while attracting investors (foreign and US) with higher yielding Treasury bonds and interest-rate products.

The federal funds rate is the rate banks charge each other for lending their excess reserves or cash. More than just affecting the rates on savings accounts, mortgages, car loans and credit cards to corporate debt, shifts in the fed funds rate correlate with moves in the U.S. dollar exchange rate versus other currencies, while affecting many areas of goods and services.

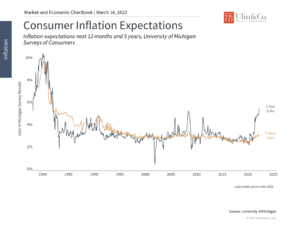

While we have received a few calls from clients concerned that we may return to the high inflation and interest rate days of the 70’s and 80’s while putting excessive downward pressure on bonds prices, we remind them that the world, markets and economy dynamics are quite different now to materialize such major changes due to headwind forces of globalization, technology and the aging population.

Exchange Rates, Markets, Inflation and Oil

A strengthening U.S. dollar means that it can purchase more of another currency. This can help to save US consumers money traveling abroad. Higher exchange rates can also cause US export sales to decline while at the same time making foreign imports less expensive, resulting in lower cost products at US stores, helping to decrease inflation.

At the same time, tourism and travel to the United States may decrease with US goods and services becoming more expensive for foreign consumers.

Many see the dollar as a barometer of the country’s importance on the global stage. Unfortunately, this doesn’t tell the whole story since a currency that may get too strong and overheat, can make U.S.-made goods less competitive in the global market. Thus, for long-term investors and economists, the dollar is an important gauge in at least three ways.

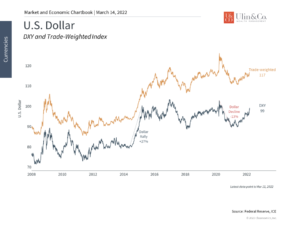

First, the dollar serves as a financial safe haven since it is backed by the full faith and credit of the U.S. government, making it attractive in uncertain times as discussed above. This has been the case recently amid the “flight to safety” spurred by the Fed and geopolitical risk. Not surprisingly, this also occurred during the initial stages of the pandemic when the S&P 500 was near its lows. At the moment, the dollar index (DXY) has risen to 99 from a low of 89 a year ago, its highest level since mid-2020. (see below)

Second, the U.S. dollar is an important indicator that reflects economic and policy expectations for the U.S. relative to the rest of the world. The dollar has been rising since May 2021 due to the strength of the U.S. economy and the prospect of higher interest rates. The Fed’s plans to tighten monetary policy, both by raising rates and reducing its balance sheet, could further strengthen the dollar. Investors naturally prefer currencies that pay higher interest rates and whose governments and central banks have more prudent policies.

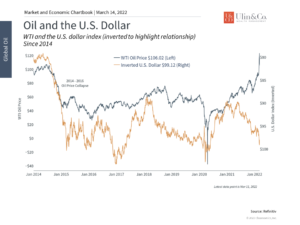

Perhaps the most unusual fact about the current value of the dollar is that it has strengthened alongside rising oil prices. (see below) This relationship is typically the opposite – since oil is mostly denominated in dollars, a stronger dollar lowers the listed price of oil (i.e., you need fewer dollars to buy the same amount). So, while the war in Ukraine has caused oil prices to jump, the dollar has risen due to the Fed and its safe haven status. While the situation is still evolving, it’s likely that the historical relationship between the dollar and oil will eventually be restored. Oil prices have already pulled back from their highest levels over the past few weeks.

Third, while the dollar is often strong because of its global importance, this is not necessarily positive for all parts of the economy. A stronger dollar often makes it more difficult for U.S. companies to compete abroad since goods and services priced in U.S. dollars become more expensive to foreign buyers. Around 2015, this resulted in an “earnings recession” due to its drag on corporate profits since international revenue has increased in importance for U.S. companies. Thus, having the dollar at a sensible level is often better than a dollar that is too strong.

At the moment, since inflation is the central concern for investors and consumers, a stronger dollar can be beneficial. This is because foreign-made goods can be purchased more cheaply when the dollar is stronger, and these are exactly the goods that have propelled inflation rates higher (namely computer chips, commodities, etc.). As long as this does not boost demand and thereby worsen supply chain disruptions, a stronger dollar could help to reduce the impact to consumer pocketbooks.

Thus, the way the U.S. dollar has moved recently has reflected the uncertainty faced in global markets. This could continue to be the case as the conflict in Ukraine continues. Below are three charts that help provide perspective on the dollar.

1 The dollar has strengthened due to the Fed and geopolitical risk

The dollar has been strengthening as the Fed normalizes monetary policy and the conflict in Ukraine worsens.

2 The dollar has risen despite a spike in oil prices

The dollar has strengthened even though oil prices have also jumped. This is the reverse of the typical pattern in which the dollar and oil move opposite one another, since oil is denominated in dollars. The chart above shows the dollar inverted against oil, highlighting the divergence in the historical relationship.

3 A stronger dollar could help to combat inflation

While this may take time, a stronger dollar makes it cheaper for those holding dollars to purchase foreign goods. This could help to ease some measures of inflation in the coming months.

The bottom line? The dollar is making a comeback. Know that the dollar is an important barometer for investors and consumers and has risen due to the Fed and geopolitical risk. Investors ought to remain disciplined as the dollar strengthens due to these factors.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest diorectly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.