Investing Through The Great Resignation

The American “Big Quit,” or “Great Resignation” is a viral post-vaccination trend that is affecting everyone from fast-food McDonald’s workers to software engineers at Apple. Major companies and industries have gone from Covid19 layoffs or furloughs in 2020 to mass resignations regardless of sign-on and salary incentives to more creative benefits packages.

The Great Resignation, a term first coined in 2019 by Texas A&M’s Anthony Klotz to predict a mass, voluntary exodus from the workforce has arrived in full force. It’s caused a massive rethinking of how employees can affect wages, stock prices and the economy in general.

Whether this is a wake-up call or slap in the face to human resource managers and employers, workers in all industries from blue to white collar are feeling empowered to take control of their work and home life. This may be about more than pay and safety measures, but about seeking something more fulfilling that may include a career change with higher pay, perks and benefits with flexibility to work from home.

This shift in work has been brewing for years before COVID19. An intuit tax filing report back in 2018 noted that “real-time applications and data analysis platforms predict that 50% or more of workers will either supplement their income or work full-time independently by 2030.”

Gig Economy

The 2020 quarantine and the resulting lockdown may have then accelerated a permanent change to work while fueling innovative ways to earn a living. This paradigm shift was fueled by technology and innovation around remote work to tapping into the gig-economy. Gig workers are independent contractors, online platform workers, contract firm workers, on-call workers and temporary workers from Uber drivers to the likes of digital and creative experts as well as many other niches on Upwork and Fivver.

As the Big Quit could significantly affect the economy over time, investors cannot ignore this movement. After focusing on “shelter-in-place” stocks to then the “reopening stock” trends, investors might now want to keep an eye on how their portfolio sectors and stocks fare through “gig-economy” stocks with no surprise to see a boost to staffing, freelance and other gig-focused stocks across many industries.

The Great Resignation May Not Deter Investors

Jon here. The Great Resignation has led to climbing wages, and in-turn higher prices as businesses rush to fill positions to help service increased demand. Concerned investors believe that with employees in such high demand, increased wages may continue to stoke the already hot- running inflation debacle. But like many economists, we believe the labor shortage is transitory and will ease into next year as workers return to the job market.

The labor market affects all investors in many ways. The most obvious manner is that it directly impacts our personal lives, in addition to those of our families, friends and neighbors. For instance, whether or not inflation-adjusted wages have kept pace is a core issue in the wealth inequality debate. It’s no secret that both the 2008 global financial crisis and the pandemic worsened these effects.

In addition, work is more than a paycheck. Right or wrong, it often defines who we are and can be an important part of achieving personal fulfillment. While this effect is not directly financial in nature, it does affect societal and economic trends.

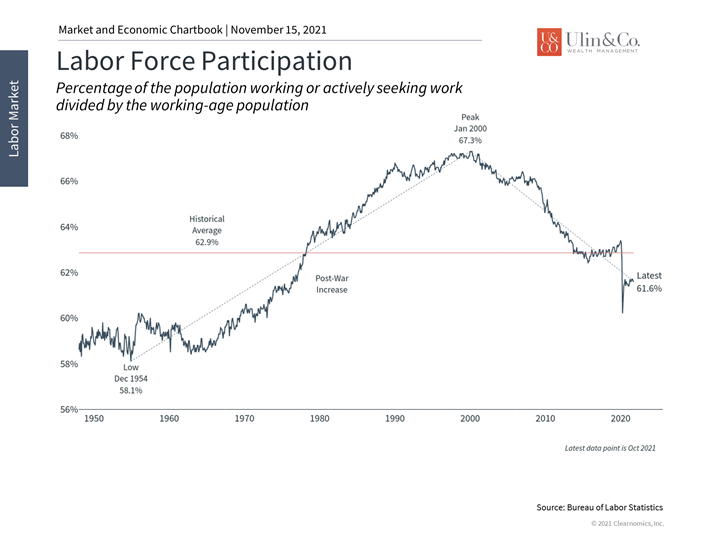

Thus, one of the most difficult challenges for the economy over the past two decades has been the decline in the “labor force participation rate.” This occurred as large numbers of working-age people gave up on finding jobs. The participation rate peaked in 2000 and has been falling due to a number of factors including an aging population, globalization and technology. (see below) These latter factors have allowed for goods and services to be produced elsewhere and with fewer workers.

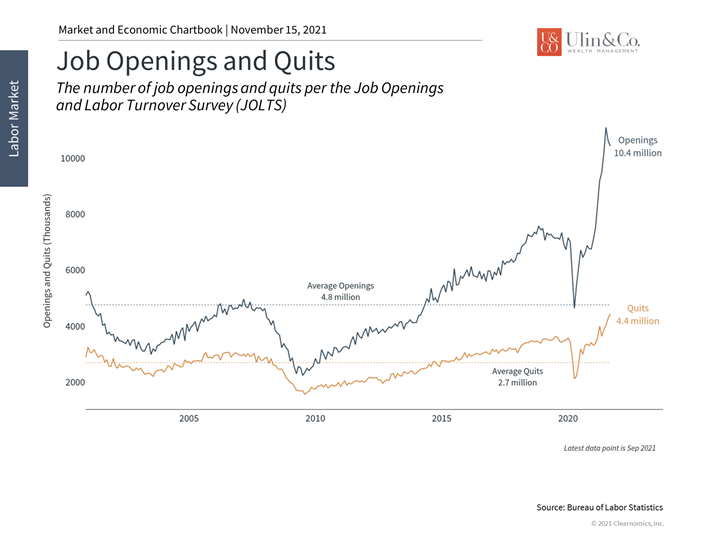

In the long run, this can create labor shortages in certain industries. In the short-term, however, job openings being near record levels – 10.4 million across the country in September – is positive news. This means that positions are available and businesses would like to hire at the fastest rate in history. (see below) That the quits rate has accelerated alongside openings to 4.4 million per month means that many are successfully finding attractive jobs or are confident they can find them quickly.

The caveat is that not all jobs are created equal. The fact that these positions are open means that businesses are having trouble finding enough qualified candidates in their industries. This may mean they don’t have the right skills, especially in high-tech sectors, aren’t in the right geographic location, or that there are other mismatches. Like other supply chain bottlenecks plaguing all businesses, a shortage of qualified workers can harm growth and expansion plans.

The hope is that, over time, job openings entice working-age people to come back into the labor force and the participation rate rises. Workers might re-train to match high-growth areas and wages might adjust based on hiring demand. This could help to accelerate economic growth in addition to improving personal financial situations.

From the perspective of long-term investors, the labor market is a broad signal of economic health. It’s for this reason that investors watch the monthly jobs report so closely. The fact that unemployment has fallen significantly, job openings are at records, wages are picking up, individuals are finding better opportunities, and labor force participation has stabilized are all positive signs. Below are three insights that can help investors better understand today’s job market shifts.

1 Job openings and turnover are near record highs

Job openings are near historic levels. This has prompted many to quit their jobs in search of better opportunities.

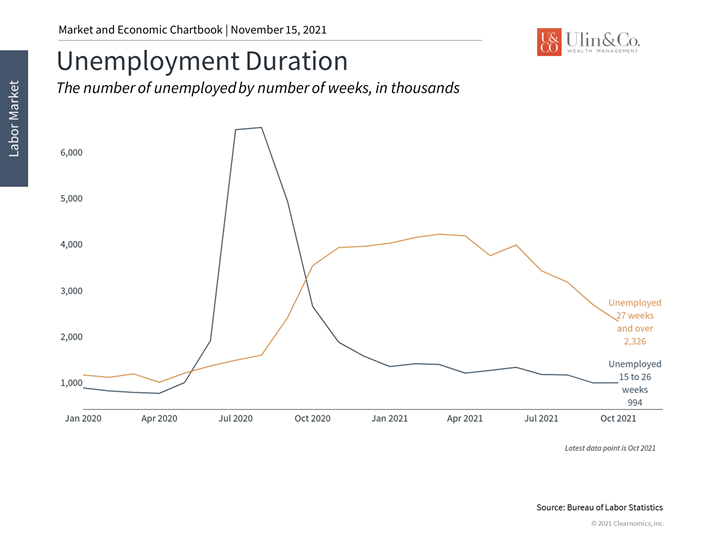

2 Long-term unemployment is falling

One group that has benefited from these trends is those who have been unemployed for half a year or longer. These long-term unemployed are fewer today due to the economic expansion and the sheer amount of hiring activity across industries.

3 Participation rates have stabilized

Unfortunately, the labor force participation rate, which measures the number of people who want to work, is still very low. This measure has been declining for decades due to a variety of factors which were worsened by the pandemic. Many hope that the level of job openings can help to get workers off the sidelines and back into great roles.

The bottom line? The level of job openings and those seeking new jobs through the Great Resignation are still positive signs for the economy. Long-term investors should view these indicators as a reflection of strong growth trends.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.