Mr. Bond is Back! TARA vs TINA

TARA making a comeback against TINA may sound like top contestants competing on Americas Got Talent more so than an analysis of the application of Wall Street acronyms.

With inflation down over the past 18 months from 9.1 helped in part by falling energy prices, higher long term bond rates and subsiding supply side issues, Fed Chair Powell signaled three potential Fed Funds rate cuts for 2024 while ringing the bell that the Fed is near wrapping up their job fighting inflation and said that that the economy is ‘normalizing.’ The now dovish Fed could bode well for Mr. Bond in part by TARA making a comeback.

Just recently as mid-October the WSJ noted in an article that “The Trusted 60-40 Investing Strategy Had Its Worst Year in Generations” last year and this year has not been a walk in the park. The 60-40 portfolio lost 17% last year, its worst performance since at least 1937 – that even with stock gains this year, bonds have been in the red since 2021 not helping the cause.

Not shocking, as some panicked investors in October were aggressively calling their advisors to cash out of the market and pivot into cash, insurance, annuity, alternative and other private asset markets, everything changed in November with the “everything rally,” one of the best months in years, if not decades for stocks, bonds and many asset classes including crypto, with balanced portfolios jumping up near 5%.

TINA: There Is No Alternative

TINA essentially suggests that, in certain market conditions, there might not be a better alternative to a particular investment. This concept is often applied to stocks when interest rates are low, and the returns on other assets, like bonds or cash savings accounts, are not as attractive. Even risk adverse retirees may dip their toes in stocks during years of near zero rate environments despite the risks in equity asset classes from preferred stocks to dividend paying stocks.

After more than a decade of low rates on bonds, punctuated by a bond bear market over the past couple of years, TINA was in fashion for investors seeking income and or capital appreciation. That is all changing.

TARA: There Are Alternatives

On the other hand, TARA suggests that there are alternatives available and encourages investors to explore different investment options. This approach recognizes that different market conditions may favor various asset classes at different times. Now, let’s discuss why TARA might be more relevant in the context of bonds with falling interest rates.

Why TARA Supports Bonds

1 Higher Yield on Existing Bonds: When interest rates fall, the yield on existing bonds becomes relatively more attractive. Investors holding these bonds may benefit from higher market values and continued income.

2 Diversification: TARA encourages diversification, and in a falling rate environment, investors may seek alternative fixed-income investments that offer competitive yields. This diversification can help manage risk and enhance overall portfolio performance when volatility comes around during the next correction or crash.

3 Potential for Capital Appreciation: If interest rates continue to decline, there is potential for capital appreciation in existing bonds. Investors may see an increase in the market value of their bonds, providing a decent capital gain in addition to regular interest payments as gravity reverses itself.

4 Flexibility in Asset Allocation: TARA allows for a flexible approach to asset allocation. In a dynamic market, investors can adjust their portfolios to take advantage of changing conditions. This flexibility can be particularly beneficial in navigating uncertain economic environments.

Why Bonds Are Becoming More Attractive Going into 2024

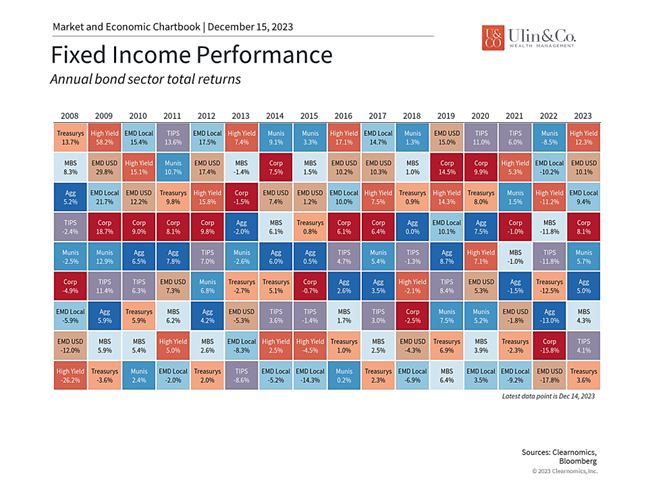

The bond market is now finally having a better year in 2023 despite ongoing swings in interest rates. The U.S. Aggregate bond index has rebounded 2.7% year-to-date after being in the red just a few months ago.

This is also in stark contrast to 2022 when the bond market fell 13% as interest rates rose swiftly. So, while the bond market is having a better but not exceptional year, the economic climate may be shifting in its favor. Consider the following few factors for bonds:

Bonds are highly sensitive to interest rate fluctuations

Bond market volatility has remained elevated this year due to the banking crisis and the rate jump that began in late summer. The 10-Year Treasury yield has risen from 3.9% at the start of the year to 4.2% today, briefly hitting 5% along the way. For perspective, the 10-Year yield was only 1.5% at the beginning of 2022 and fell as low as 0.5% in 2020. Both the level and change in rates impact the prices and returns of the bond market, affecting portfolio returns.

These dynamics have called into question the traditional role of bonds as portfolio stabilizers and consistent sources of yield and returns. Ideally, bonds rise when stocks fall, leading to more balanced portfolios. This was generally the case from the mid-1980s until recently as steadily declining interest rates led to higher bond prices over 40 years.

One way to understand why bond prices tend to fall when interest rates rise is that investors can now buy bonds with higher yields, reducing the value of previously issued bonds. The reverse is also true – when interest rates fall, bond prices tend to rise, all else equal. On a more technical basis, rising rates mean that the present values of future bond payments are worth less than before. This is true when interest rates rise for any reason but can be especially challenging when this is due to inflation.

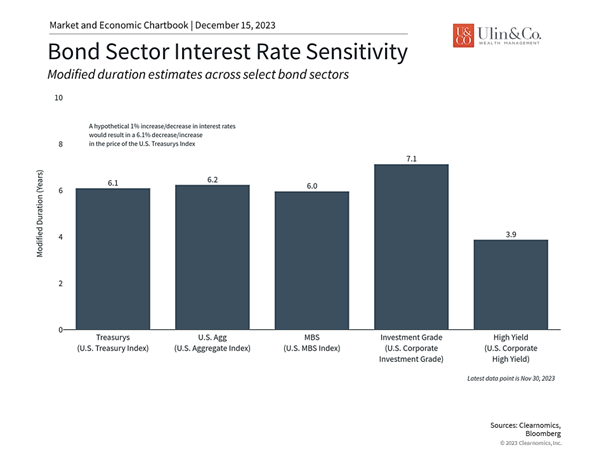

To measure the effect that changing interest rates have on bond prices, investors often use a concept known as “duration risk.” In its simplest form, duration tells us how much the price of a bond (or bond index) would gain or lose if interest rates were to fall or rise by one percentage point. For example, the accompanying chart above shows that the U.S. Treasury Index has a duration of 6.1 years, implying that a 1% rise in interest rates would result in a 6.1% decrease in the price of the bond index, and vice versa.

Despite being only an approximation, duration is a valuable concept that can help investors understand how bonds perform. For example, the 10-Year Treasury yield rose 2.4% in 2022 which would predict about a 14% decline in Treasury prices – not far off from the realized 13% figure.

Many bond sectors have rebounded in 2023

Duration varies across bond sectors depending on their characteristics. High yield bonds, for instance, tend to be highly correlated with stocks and have shorter maturities so are less sensitive to interest rates alone. They are among the best performing parts of the market this year as risky assets have surged. High quality corporate bonds, on the other hand, tend to be more sensitive to interest rates since investors buy them for their coupon payments. See above for chart analysis of bond sector performance YTD along with past years back to the 2008 Great Recession and financial crisis.

Bond market stability and not volatility is welcome

So, while the jump in interest rates over the past two years has raised questions for some asset allocation strategies, the bond market reaction is easy to understand. These concepts suggest that more stable rates would be a welcome sign for investors and could help to reestablish bonds as portfolio stabilizers. Since duration calculations go in both directions, bond prices could benefit if rates were then to decline. The possibility that the Fed could cut rates next year has already supported bond prices and could continue to do so if long-term interest rates begin to ease as well.

The bottom line? While bonds have struggled as interest rates have risen, there are signs that rates could stabilize in the year ahead. Long-term investors should remain diversified across stocks and bonds as they work toward their financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.

Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Adviser. IFP and Ulin & Co. Wealth Management are not affiliated.