Livin’ on the Edge: Stock Market Highs and Acrophobia

Living on the edge. You can’t help yourself from falling – Aerosmith, 1993

As we navigate through the complexities of today’s economic landscape, it’s natural for investors to wonder about the longevity of the current market cycle amid various economic and global challenges. With inflation concerns brewing, trade wars arising, stock valuations peaking, and geopolitical tensions adding uncertainty, some may fear we’re at unsustainable market peaks. Should you be afraid of heights as a long-term retirement investor and sit on the sidelines? The short answer is no.

Acrophobia

Something’s wrong with our eyes. We’re seeing things in a different way

Acrophobia is an extreme or irrational fear or phobia of heights. It belongs to a category of specific phobias, called space and motion discomfort. Acrophobia sometimes develops in response to a traumatic experience involving heights, such as: falling from a high place or watching someone else fall from a high place. For investors, this may bring back PTSD recollections of the 2000 and 2008 market heights and subsequent stomach-wrenching plunges.

Jon here. This is especially true for retirement age investors over age 60, having survived from the dotcom crash to the great recession, a period otherwise known as the “decade to forget” with zero returns for the S&P 500. Back then in their 40’s and 50’s, as Mick Jagger would agree, boomers still had time on their side. Now, post the pandemic crash, the stakes are even higher for those in- or nearing retirement with less appetite for risk.

No Free Lunch

We could let it go, But I would rather be a hanging on

Retirement-age clients understand the risks on both ends of the spectrum – being too conservative in cash won’t beat inflation, while chasing high-yield or complex, less liquid alternatives can lead to trouble. Our mantra: focus on both “return on your money” and “return of your money.” There’s no such thing as a free lunch.

We remind our clients every quarter that the best way to navigate volatility is to stay patient, diversified, and aligned with their financial plan – avoiding emotional decisions driven by headlines or short-term market swings. The recent turbulence on Wall Street knocking the S&P 500 index back four months to November’s election day valuations may be more a “buy the dip” opportunity than buying a bigger mattress.

Volatility in Vogue

After a rocky January—marked by Trump’s tariff talks, DeepSeek’s AI launch shaking the tech sector, and a 17% ($600M) Nvidia sell-off—market turbulence shouldn’t come as a shock. Uncertainty fuels volatility, and markets, by nature, hate uncertainty.

Big moves aren’t just about fundamentals – they’re driven by a mix of algorithmic trading (“the quants”), AI, and good old-fashioned human emotion (“animal spirits”). When fear spikes, computers and crowds react, amplifying swings that are further blasted across news and social media.

That’s why, after the 1987 Black Monday crash, regulators implemented circuit breakers and other safeguards to curb panic selling, high-frequency trading, and market manipulation.

Time In the Market

Despite short-term swings, history proves that markets tend to grind higher over time. Since 1928, the S&P 500 has averaged 14 new highs per year—while also experiencing an average 14% annual correction. Timing the market is a fool’s errand; time in the market is what matters.

Negative sentiment, when fundamentals remain intact, is often a contrarian buy signal. While 2025 could be choppy—potentially slowing big tech while lifting undervalued sectors – staying invested remains key. Missing the market’s best days can be far more damaging than enduring its worst.

Credit Valuation Bellwether

While stock valuations dominate headlines, credit markets often provide an early warning signal of future corrections, crashes, or recessions—and so far, they remain calm. High-yield spreads are historically tight, suggesting minimal credit stress for now, though periods of extreme tightness can also indicate investor complacency.

Currently, high-yield bonds are yielding around 7.2%, while the 10-year Treasury sits near 4.2%, resulting in a spread of approximately 3% (or 300 basis points)—still relatively tight by historical standards. A widening spread (e.g., high-yield at 8% while the 10-year holds at 4%) would suggest rising credit stress, while a tightening spread (e.g., high-yield at 6% vs. 4%) reflects investor optimism and increased risk appetite.

If economic growth slows, corporate defaults rise, or inflation pressures the Fed to resume rate hikes, credit spreads could widen, signaling growing stress in risk assets. Meanwhile, with the 10-year Treasury yield likely to hover between 4% and 5%, mortgage rates may stay elevated for some time, while credit card, HELOC, and small business loan rates—more directly tied to the (short term) prime rate – remain sensitive to Fed policy decisions.

In the near term, markets may continue reacting to both good and bad news with heightened volatility. History offers perspective: even during Trump’s first term, 2018 saw a 20% market correction from the first round of his China trade-wars, before dialing back the pressure.

Market Pessimism and the Importance of Staying Invested

Recent market swings have exposed a disconnect between investor sentiment and actual market performance. As Warren Buffett famously advised, it often pays to be “fearful when others are greedy and greedy when others are fearful.” While that may feel counterintuitive amid economic and political uncertainty, history shows that staying invested is one of the most reliable ways to build wealth over time.

Despite concerns over the economy, tariffs, and interest rates, many fundamental market drivers remain strong. In volatile times, the key isn’t reacting to every market move but maintaining a disciplined, well-constructed portfolio that aligns with your long-term goals. Consider these three points to keep perspective:

Investors are increasingly pessimistic

According to the latest AAII Investor Sentiment Survey, which measures how investors feel about the market, bearish attitudes have recently outpaced bullish ones by as much as 19%. This is the most pessimistic investors have felt since late 2023 when some expected the economy to fall into recession. It’s clear from the accompanying chart that these feelings can change quickly.

There is often a gap between how investors perceive markets and how they actually perform. Despite day-to-day market swings and worsening sentiment, major stock market indices have experienced positive returns over the past several months. This underscores the fact that investor sentiment is often a contrarian indicator. As Warren Buffett’s quote suggests, the greatest market opportunities tend to present themselves when investors are the most worried.

Historically, this is because investor emotions can change quickly and don’t always accurately reflect what will drive markets in the future. There are many historical examples of markets rallying despite investor negativity. A few include the “unloved bull market” after the 2008 global financial crisis, in 2017 amid trade war concerns, in 2020 following the pandemic, after 2022 when the market hit bear market levels, and many others. In reality, it’s when investors feel exuberant that extra caution is needed.

Proper portfolio construction balances risk and reward

Investor sentiment headlines can be misleading without historical context. The same applies to our own portfolios—market swings may feel unsettling, but a well-structured financial plan is designed to withstand volatility and stay aligned with long-term goals.

Despite concerns, economic fundamentals remain strong: unemployment is near historic lows, manufacturing is rebounding for the first time since 2022, CEO confidence is rising, and productivity has improved over the past year. However, with stock market valuations approaching historic highs, broad market indices could face challenges ahead.

Rather than attempting to time the market or exit during periods of uncertainty, a well-constructed portfolio helps manage both risk and reward. The accompanying chart (above) illustrates how different portfolio allocations have historically delivered returns relative to risk. If certain asset classes appear overvalued, it may be an opportunity to rebalance toward areas with stronger risk-adjusted potential.

Successful investing is about discipline. A diversified mix of stocks, bonds, and alternative assets accounts for shifting market conditions while keeping you on track. Market pullbacks can present opportunities to rebalance and add quality investments at more attractive prices. This is where working with a trusted advisor helps ensure your strategy remains aligned with your long-term goals.

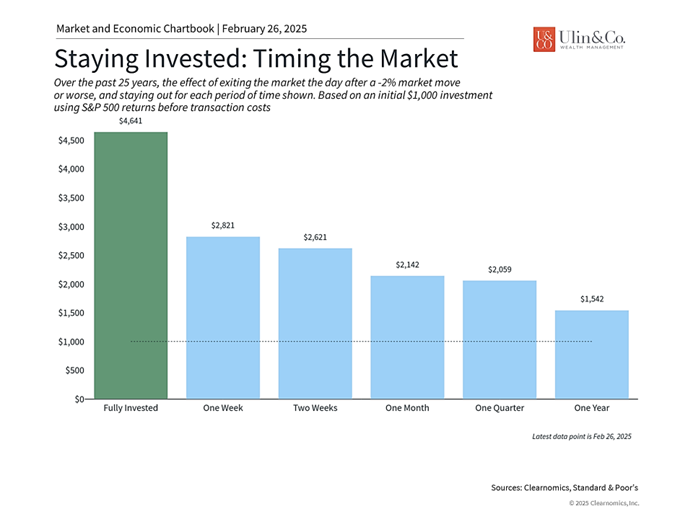

Staying invested is the best way to navigate volatility

For these reasons, there is perhaps nothing more important for long-term investors than to simply stay invested. History has consistently shown that staying invested through market cycles is one of the best ways to build wealth over years and decades. Regardless of the causes of short-term market uncertainty, trying to time the market is difficult and often backfires.

The accompanying chart (above) shows that, over the past 25 years, holding on after pullbacks was superior to getting out of the market, even for brief periods. Sitting out one year over the past 25 years would have resulted in 70% less returns. While past performance is no guarantee of future results, the fact that investor sentiment can shift so quickly is why those who are able to stay disciplined are often rewarded.

The bottom line? It’s natural to be concerned about recent market swings and negative headlines. However, history shows that long-term investors who hold properly constructed portfolios and stay disciplined are best positioned to achieve their financial goals. Stock Market highs and acrophobia should not go hand and hand for retirement investors.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Note: This content is for informational purposes only and should not be construed as financial, legal, or tax advice. Please consult your financial advisor, attorney, or tax professional regarding your specific situation.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.