Stay the Course Amid Reddit Trading Frenzies

Investing your hard-earned savings should not look or feel like you are playing a video game or a roulette wheel in Vegas, where the house usually wins. “Bro” traders bidding up underperforming speculative stocks far from their fundamental values will eventually experience a traumatic ending when no one is left to buy their shares at exorbitant levels.

GameStop, an electronics, and gaming retailer with 5,500 locations, rose over 1,600% in January fueled by Reddit trading chat rooms, with some alleging to have become overnight millionaires. Interesting side note; Michael Burry, the famous hedge fund manager portrayed in The Big Short by Christian Bale (photo) who made millions from 2008 stock bets, made a fortune on GameStop from 3 million shares purchased in 2019.

It’s nothing new for investors to follow the herd, whether led by newsletters, sell-side research, famous stock pickers, TV personalities or, in this case, an online forum. Short squeezes are also part and parcel with normal market behavior, even if it does mostly affect hedge funds. What is unusual is that the size of the short squeezes and the dialed-up anti-establishment language helped to magnify the attention on this activity.

The Allure of Headline Manias

Greed, curiosity or fear of missing out (FOMO) propels investors off the sidelines when headline mania hits, as we have seen before from the 1999 dotcoms, 2007 real estate “flipping” craze and the ongoing Bitcoin run, all driven up by the madness of the crowd.

Jon here. What captures the attention of investors, the media and the general public is often not what matters most for portfolio success, saving for retirement or for achieving financial independence.

In the short run, events that involve individual stocks and market dislocations can be more interesting than slow-moving economic progress. After all, flash crashes, short squeezes, bankruptcies, accounting fraud, personal scandals and other eye-catching headlines are naturally eye-catching. Whether the economy grew by 4% or 4.2%, much less so. Yet, it is this slow smoldering growth, not a flash in the pan, that truly helps everyday investors to achieve financial freedom over time.

Nearly a century of research and experience have shown that taking a disciplined, long-term strategic portfolio theory approach is how investors can help achieve their financial goals. Doing so is usually neither flashy, fun nor fast. It requires enduring difficult periods of market stress and resisting the natural urge to react to every new development. But, over time, doing so allows savings to grow into real wealth, without the stress and need to constantly find the next hot stock tip.

What Really Matters

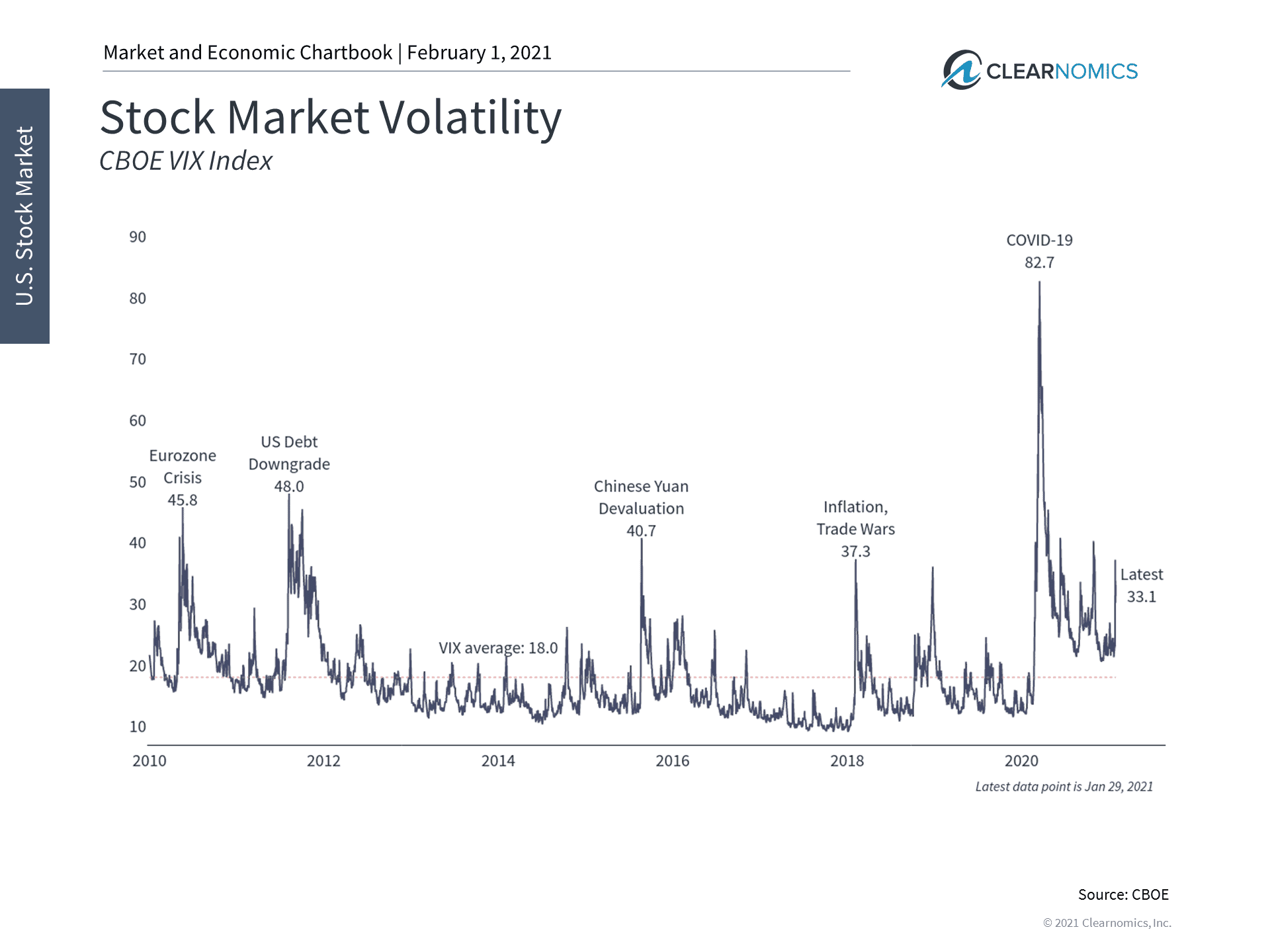

Stock market volatility increased over the past week just due to extraordinary activity in a few specific stocks and headline news. (see below). What was lost in the past week’s market coverage was much less exciting but easily more important to long-term investors.

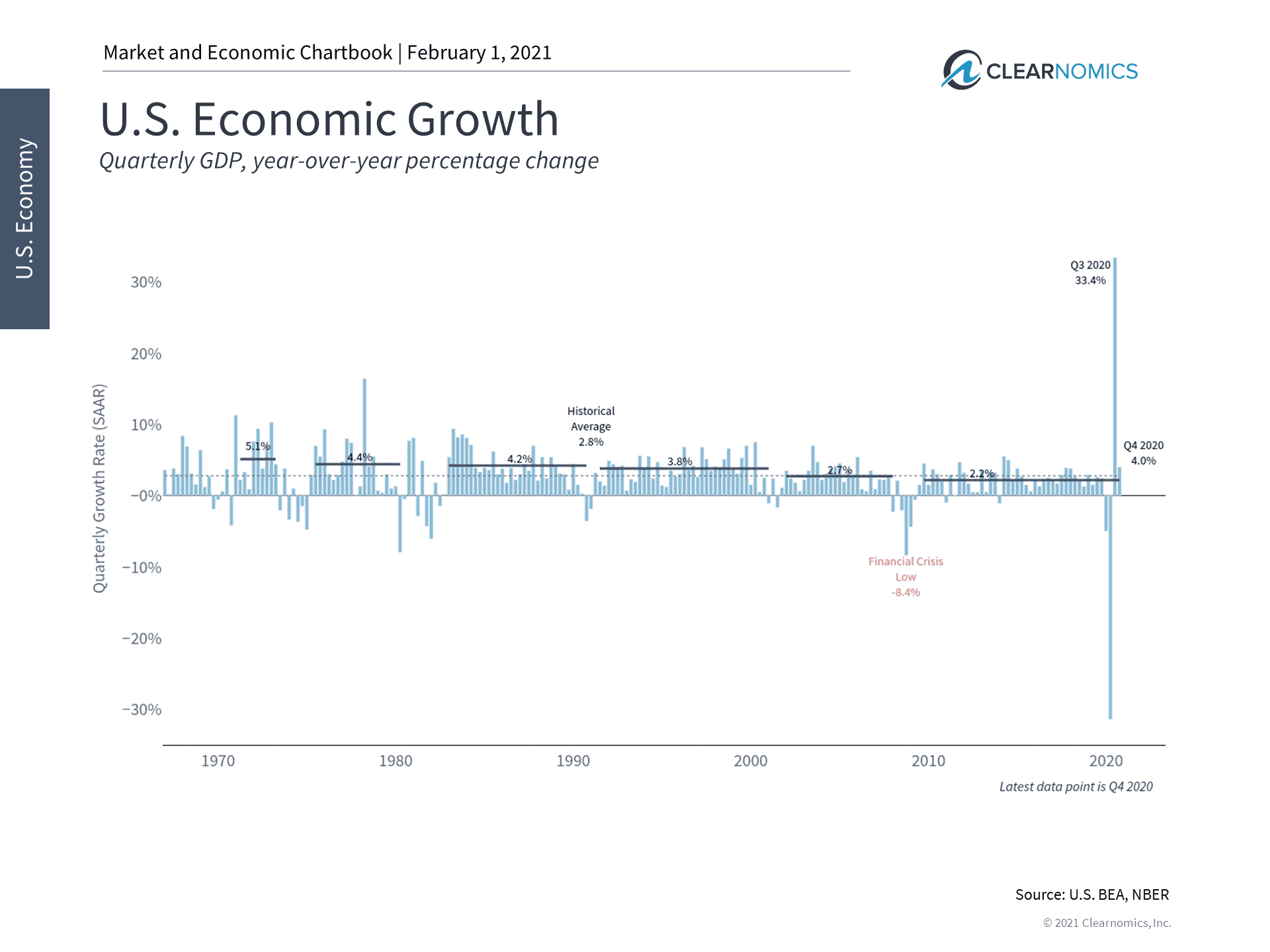

First, the latest GDP report showed that the final quarter of 2020 grew at a pace of 4% and, overall, the economy shrank by 3.5% last year. (see below) While this is negative, it is far better than many had expected at the onset of the pandemic when there were fears of a second Great Depression. At the moment, economists forecast that GDP could return to pre-pandemic levels around the end of 2021. This has been one of the drivers of the stock market’s steep recovery over the past nine months (optimism.)

Second, the Fed made no changes to policy and emphasized that it will keep interest rates low for the foreseeable future. At his press conference, Chair Powell emphasized that this will likely be the case even if inflation rises as the economy rebounds. Additionally, the Fed will continue to expand its balance sheet at a pace that will add $1 trillion every 8 to 9 months. For those worried about a sudden change in policy, Chair Powell emphasized that many lessons were learned during the previous “tapering” of asset purchases on how to properly communicate it well in advance. In the meantime, central bank policies around the world will likely continue to support the economy and financial markets.

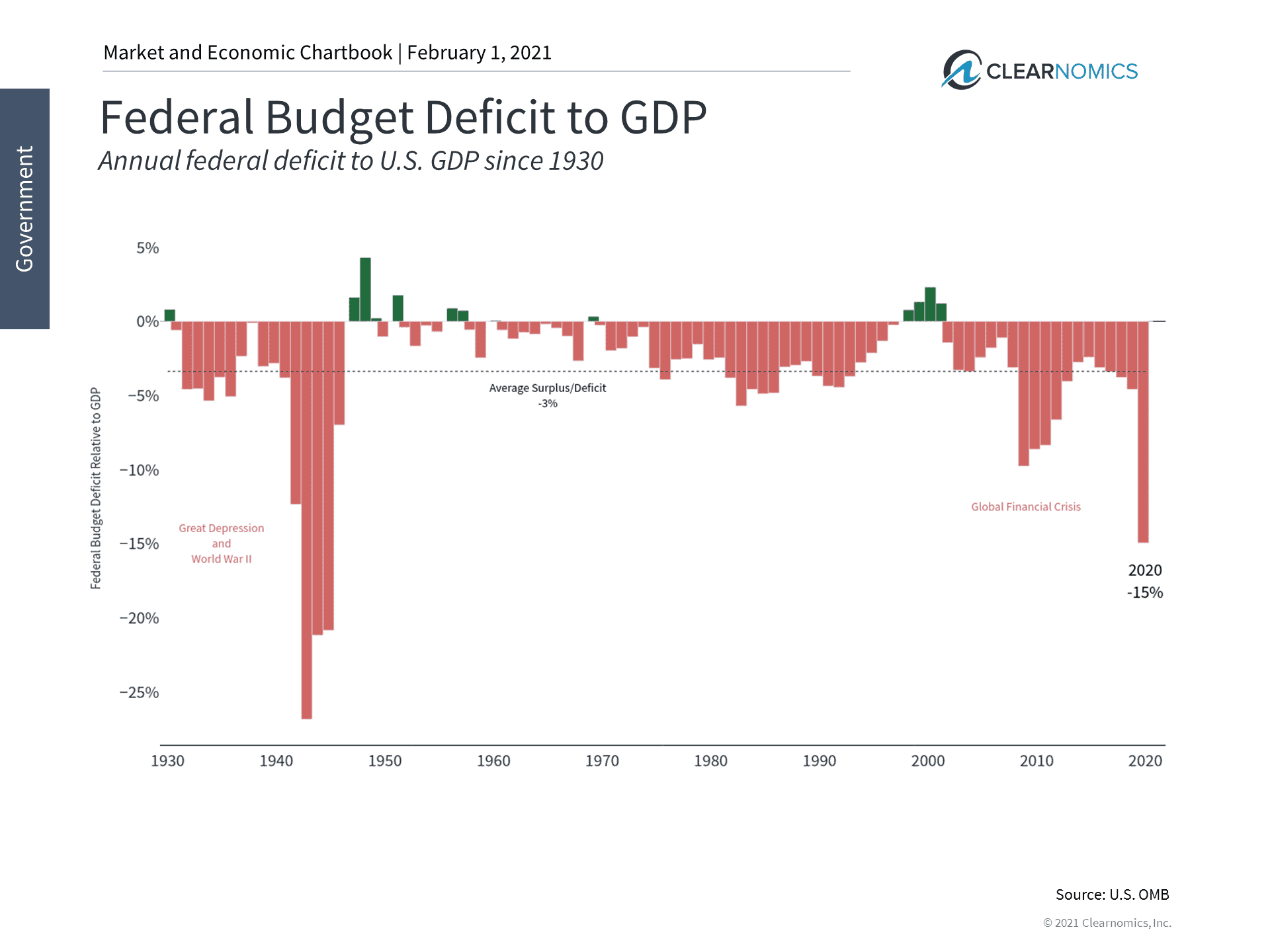

Third, the latest economic numbers mean that the deficit increased to 15% of GDP in 2020, three times its level the year before. This is the largest deficit level since World War II and surpasses the response to the 2008 financial crisis. (see below) However, it’s also well understood by investors that this is due to pandemic stimulus spending in order to avert an even worse crisis. Although most would prefer surpluses to deficits, the question isn’t whether the deficit is large – it’s whether it will shrink once the pandemic is controlled. History shows that although government spending spikes during times of crisis, it usually then moderates once the economy is back on track.

Below are three charts that provide perspective on recent events and economic data.

1 Volatility has picked up due to short squeezes and herd behavior

Stock market volatility increased over the past week due to extraordinary activity in a few specific stocks. This raised fears that this behavior could spread to other investments. While this is certainly possible, history has shown that investors who can maintain discipline and diversification are better off staying invested.

2 The U.S. economy shrank in 2020 but is on track to recover

U.S. GDP decelerated last quarter after an initial bounce-back once businesses reopened from lockdown. Although the overall economy shrank in 2020, this was widely anticipated. It is still expected that the economy can return to pre-pandemic levels in the coming quarters as COVID-19 is controlled, vaccines are distributed and businesses can slowly return to normal operations.

3 The federal deficit expanded to 15% of GDP due to the pandemic

Pandemic spending and a shrinking economy resulted in a federal deficit of 15% of GDP. Although this is the worst level since World War II, it is a direct result of stimulus spending through legislation such as the CARES Act. Historically, deficit spending falls once the economy begins to recover.

The bottom line? Disciplined Investors should continue to focus on long-term trends for their savings while employing a diversified approach, rather than day-to-day headlines on manias. Jumping in on a hot stock is more about gambling than investing. That means you should be prepared to lose every penny you put down. If you can’t stomach, that sort of loss, don’t play.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.