Soaring Oil Prices Fueled by War

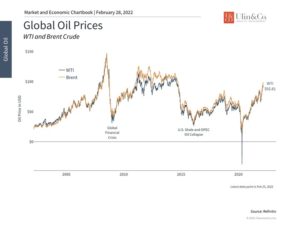

Oil prices soared nearly 50% last year helping to fuel inflation even before the Russia/Ukraine war debacle with demand outstripping supply as countries came out of hibernation from the pandemic-driven lockdowns. Businesses and people have rapidly resumed driving, cruising, building, shipping, manufacturing and international travel.

Demand for oil is here to stay in the coming decades and any decline will only be very gradual, despite the wishes of environmental activists that big oil firms stop pumping oil immediately and leave the world to run on green energy.

Crude oil touches quite a bit of our lives and is utilized as a base for more than just jet fuel, gasoline, diesel fuel, heating and electricity generation. It is also part of petroleum byproducts for tar, asphalt, paraffin wax, and lubricating oils, to chemical use in fertilizers, perfumes, insecticides, soap, and vitamin capsules. Plastic use involves use in heart valves to plastic bags otherwise carbon fiber in aircraft, PVC pipes, windmill parts and cosmetics.

Just this past October, Russia was blamed in part for intensifying the energy crisis by limiting its global exports to help drive prices higher, while using its leverage to win approval of Nord Stream 2 underwater natural-gas pipeline from Russia to Germany.

Energy Crisis

With the surge in fossil fuel prices, headlines are noting the potential path to a global energy crisis, but perhaps for the short term. Russia’s oil exports combined with the attack on Ukraine risks adding inflation to an already sizzling-hot inflationary environment. Don’t be shocked if you eventually see $6 to $7 per gallon of gas at the pump this year and headlines noting “soaring” commodity prices.

In the early 1970s, a different type of energy crisis gripped the U.S., caused partly by an oil embargo led by major Middle East oil producers, as consumption surged, and America was dependent on imported crude.

Are you old enough to remember the long lines at the gas stations? The oil crisis of the 70’s was brought about by the Yom-Kippur (Arab- Israel) War of 1973 and the Iranian Revolution of 1979. Both events resulted in disruptions of oil supplies which created difficulties for the nations that relied on energy exports from the region.

Bulls are Unsympathetic

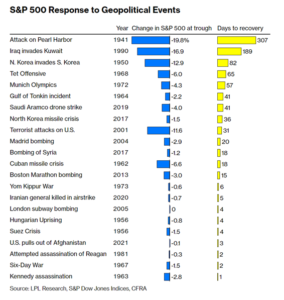

From pandemics to war, terror attacks and presidential assassinations, a review of over 20 major geopolitical events going back to World War II indicate that stocks had fully recovered losses within an average of 47 trading days after an average maximum drawdown of 5%, according to a CFRA study, further illustrated by LPL Financial. (see below) The offset of the Russian invasion of the Ukraine may further amplify and extend the already heightened oil, energy and inflation troubles, but may not cause the US economy to fall into a recession, as the main drivers of stocks are corporate revenues and earnings. Bull markets, stocks and investors are truly unsympathetic.

In the stock market, there is an old investment maxim that’s fitting: “buy on the sound of cannons, sell on the sound of trumpets.” This means essentially buying on bad news and selling on good news. Simply put, the worse off the market is, the better the opportunities are to profit. That’s seemingly the credo for contrarian investing.

Baron Rothschild, an 18th-century British nobleman, was credited with saying that “the time to buy is when there’s blood in the streets.” He should know. Rothschild made a fortune buying in the panic that followed the Battle of Waterloo against Napoleon.

Contrarian investing is a strategy of going against prevailing market trends or sentiment. The idea is that markets are subject to herd- behavior enhanced by fear and greed, making markets periodically over- and underpriced.

What Soaring Oil Prices Means for Investors

While the humanitarian impact of Russia’s invasion of Ukraine is the top concern, investors also continue to face a challenging market environment as the conflict intensifies.

The challenges created by the Russia/Ukraine conflict only add to storylines of the past two years. During the initial stages of the pandemic lockdown, the front-month oil contract fell into negative territory. This had never occurred in history and was due to a lack of oil storage capacity driven by the collapse in demand. In other words, contract holders were so desperate to offload their oil that they were willing to pay others to take this otherwise valuable commodity.

The world has changed significantly since then. Over the past two years, oil prices have recovered alongside the economy, with a few bumps due to growth concerns and COVID-19 variants. As a result, rising energy prices have been a major contributor to rising inflation. Last month’s Consumer Price Index report, for instance, showed that energy prices rose 27% over the previous year and gasoline prices skyrocketed 40%.

From an economic perspective, energy affects everything. The world is still primarily driven by fossil fuels as we discussed above, despite an increased focus on renewables among investors. The International Energy Agency (IEA) estimates that global oil demand will reach 100.6 million barrels per day this year, surpassing its pre-pandemic level.

Three Ways Energy Prices Affect Investors

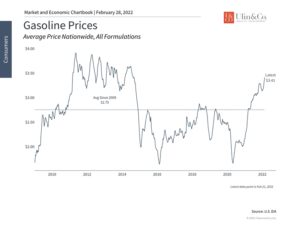

First, rising energy prices could continue to support higher inflation rates for some time. This hurts consumer pocketbooks and reduces discretionary income, effectively functioning as a tax. For businesses, higher energy prices can boost the cost of products and services directly and indirectly. Gasoline, for instance, has risen from a nationwide average of around $1.75 a gallon in early 2020 to over $3.40 today. (see below)

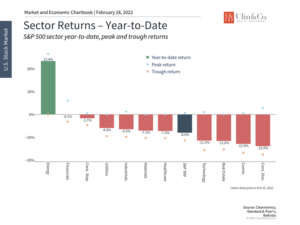

Second, the energy sector of the stock market has benefited from the oil price recovery of the past two years. Energy stocks have done well with the S&P 500 energy sector rising 23.4% year-to-date and 41.5% over the past year. It is the only sector in the black this year and has far outpaced all other groups over the past twelve months. (see below)

However, for those who are properly diversified, the energy sector accounts for just under 3.5% of the S&P 500’s market capitalization. The fact that the sector has made these gains emphasizes the importance of investing within and across markets. This is a significant shift from the areas that performed well during the initial economic reopening, i.e., technology and growth stocks. This underscores the fact that it’s difficult to know what may or may not outperform in any given year, especially once a sector falls out of favor, and thus it’s important to be broadly diversified.

Third, higher inflation and prices could act somewhat as a drag on the overall economy. However, growth is expected to slow anyway from its feverish reopening pace. While rises and collapses in oil prices have been correlated with bull and bear markets, this has more to do with their common connection to the economy. When growth is strong, oil prices tend to rise as does the stock market. Thus, focusing on the underlying fundamental trends is ultimately more important when considering market performance over the course of years and decades.

The next several months will be challenging for investors as the conflict in Ukraine plays out. However, investors are always faced with potential problems whether it’s trade wars, the pandemic, lofty valuations, rising interest rates, geopolitical conflicts, or other issues. Understanding the key issues while resisting the urge to overreact is still the best approach to achieving long-term financial success.

Below are three charts that help provide perspective on global energy prices and one chart on our discussion of geopolitical events and the markets.

1 Oil prices have spiked

Oil prices have jumped as the Russia/Ukraine conflict intensifies. Brent crude has surpassed $100/barrel, the highest level since 2014. However, oil prices have been rising steadily over the past two years and many expected oil prices to reach these levels in 2022 regardless of geopolitics.

2 Higher gasoline prices hurt consumer pocketbooks

Perhaps the most direct impact of rising energy prices is at the pump. Consumers have experienced a near-doubling of gasoline prices since 2020, alongside other factors driving inflation. Higher gas prices serve as a tax on consumers and act as a drag on the economy. In Boca Raton I have seen over $4 per gallon at the pump this week.

3 The energy sector has outperformed over the past 12 months

The energy sector has rebounded strongly this year and over the past twelve months. This underscores the need to stay diversified across sectors since leadership within the market can shift unexpectedly.

As discussed, from pandemics to war, terror attacks and presidential assassinations, a review of over 20 major geopolitical events going back to World War II indicate that stocks had fully recovered losses within an average of 47 trading days after an average maximum drawdown of 5%, according to a CFRA study, further illustrated here by LPL Financial.

The bottom line? Investors should stay invested and diversified through the Russian/Ukraine war and as energy and commodity prices continue to rise.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.