Should you Bet Against Real Estate?

Many sectors are getting whipsawed in different directions through the COVID19 recovery since the market bottom March 2020. It is undeniable that people are spending money and on the move. Outlays on durable goods increased at a spectacular 41.4% annual rate for the first quarter on cars, jewelry, appliances, home furniture and other substantial goods.

The most significant sector headline story and trends on google involve residential real estate prices and whether we are heading into a new housing bubble. While the national appreciation of home values average around 3.5% per year over time, many forecasts predict new-home sales will jump 21% and existing-home sales will climb 9% in 2021.

“Truth Is Like Poetry and Most People Hate Poetry” was a memorable quote from The Big Short. This Oscar nominated flick deftly covered the 2008 banking crisis and US housing market crash that took down Wall Street.

2008 Housing Bubble

Contrarian investors antennas are up with 272 million search results on Google this week for “when is the housing market going to crash. Let’s address the elephant in the room. Are we due for a repeat of the 2008 housing bubble? Most likely not. Today’s real estate boom is not a house of cards built on high-risk loans but may experience a pull back over time due to other economic factors as well as supply and demand.

The stock market and housing crash of 2008 had its origins in the extraordinary growth of the subprime mortgage market beginning back in 1999 with the US government relaxing banking and lending regulations. The September 15th, 2008, bankruptcy filing by investment bank Lehman Bros. was the most memorable tipping point in the news, while nearly 9 million people lost their jobs and at least 10 million lost their homes.

These high-risk borrowers, some with no income, no job and no assets (referred to as NINJA loans) were provided home loans with little money down and allowed to take out adjustable-rate mortgages. Their time ran out at about the time real estate crashed putting them all “under water.”

While it may be remarkable to see record money flowing into real estate during a pandemic that resulted in a market crash, this time truly is different. One of the beneficiaries of the lockdowns and social distancing measures of the past year has no doubt been the housing market.

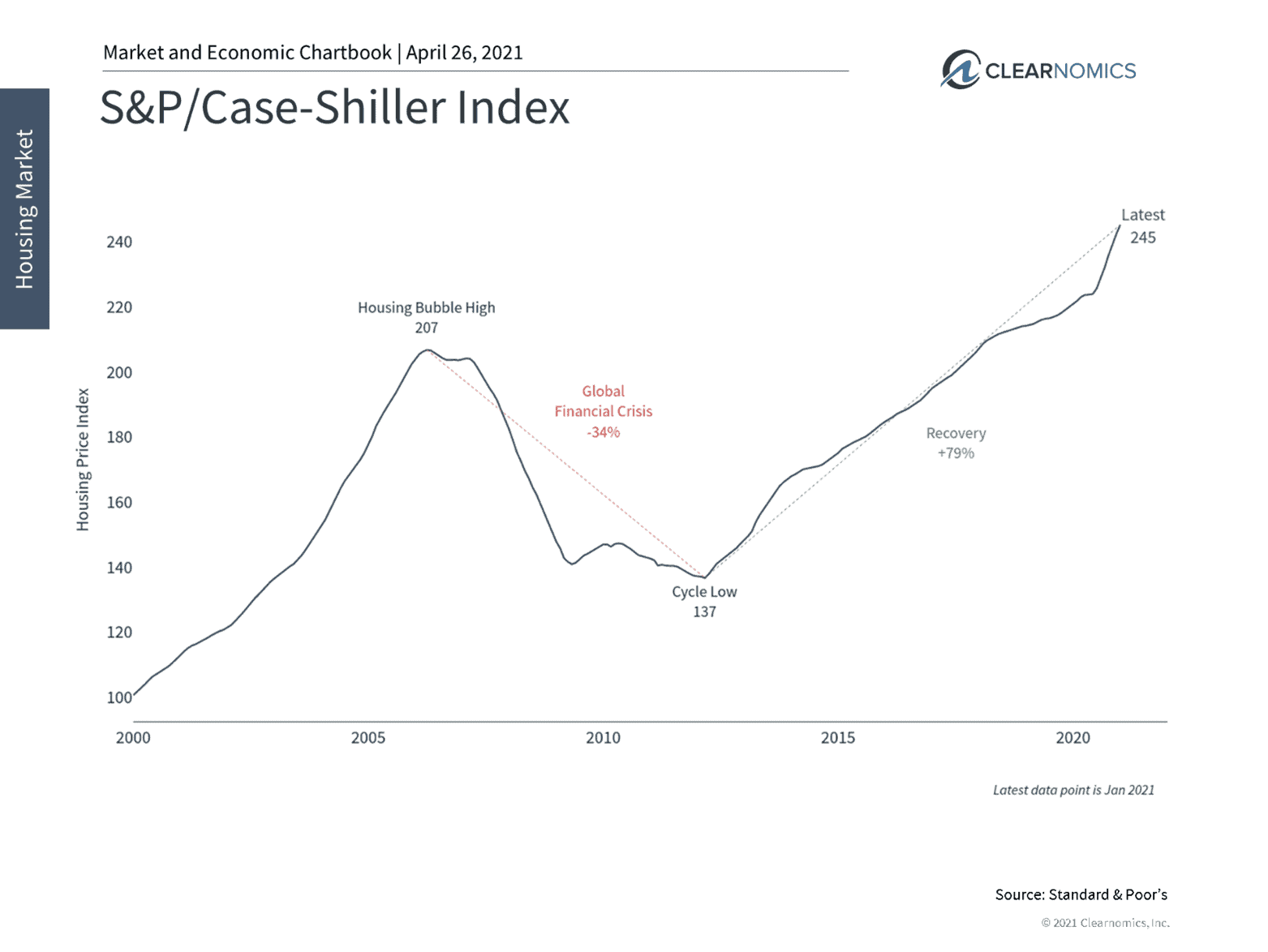

It is well known that many Americans are flocking to the suburbs, moving to warmer climates like South Florida, and traded up their homes over the past year, fueled in part by record low interest rates in addition to “escaping” pandemic issues from apartment living. Furthermore, many of the 72 million millennials are getting older, and focused more on home ownership. As a result, home prices have continued to reach new all-time highs that have eclipsed the mid-2000’s housing boom. (see below)

How Record Housing Prices Can Influence the Market

Driven partly by the pandemic and resulting quarantine, the home has become the “new” epicenter of our life, work and family before and after retirement. Housing is a basic human need and has a profound impact on our everyday lives. From an investment and economic perspective, the housing market is both itself an investable asset class as well as a macro-economic indicator of financial health. Recent data paint three important pictures from these perspectives.

First, the housing market can tell us about the economic health of consumers since homes are the largest asset for many households and mortgage payments are usually the largest expense. This creates a “wealth effect” associated with the value of one’s home – the higher and more stable that value is, the higher their perceived net worth and the more willing consumers are to spend. Although real estate is illiquid, even the perception of changing asset values may be enough to spark changes in behavior. Thus, rising housing prices have likely contributed to consumer and investor confidence – both of which have jumped in recent weeks.

On the other hand, fast-rising home prices make it more challenging for new homebuyers. Fortunately, interest rates are still low by historical standards even after climbing in the first quarter. The average 30-year fixed mortgage rate is still around 3%, well below the 4% average since 2008 and 6% longer-run average. So while low rates have contributed to higher home prices, they also help to offset them and increase affordability.

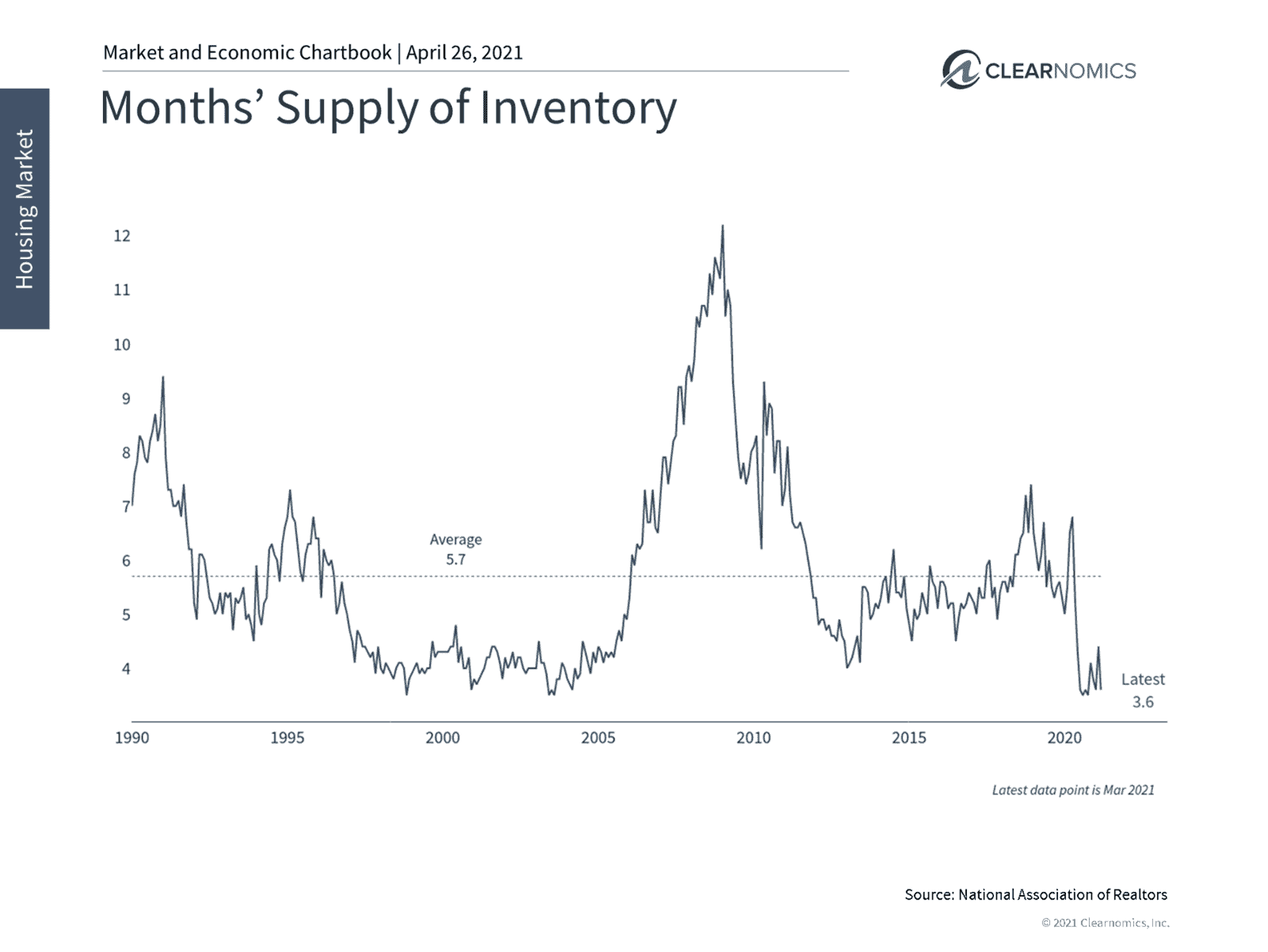

Second, the housing market itself continues to face high demand and significant supply constraints, even with COVID-19 restrictions subsiding. The supply of homes available for sale, measured in terms of the number of months needed to sell, is near historic lows of 3.6 months. (see below) As a result, both building permits and housing starts have zoomed past historic averages. That this surge has been concentrated in single-family homes is consistent with the anecdotal experience of those seeking more, and better, living space.

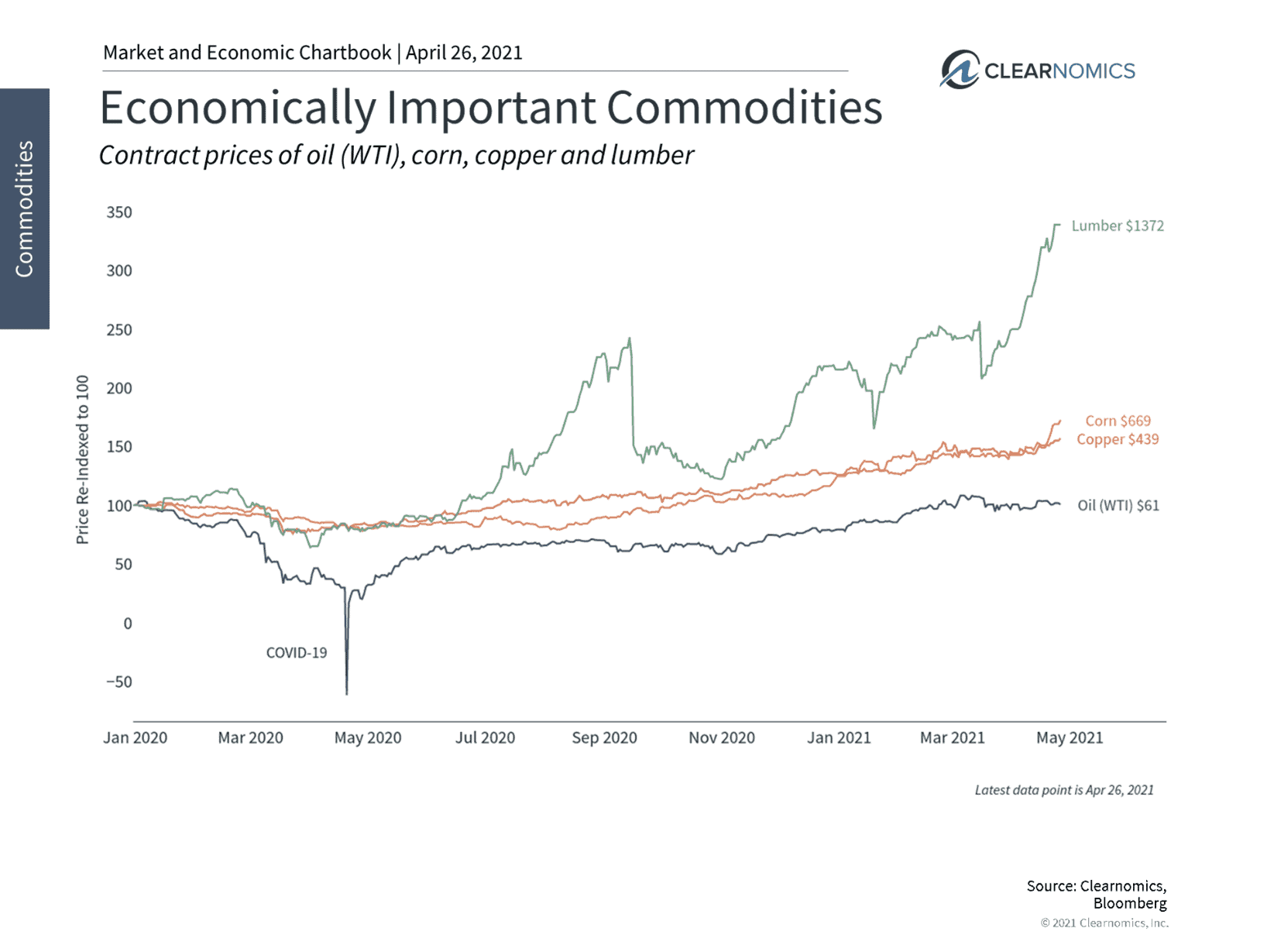

Rising housing demand also puts pressure on other parts of the market. Lumber prices, for instance, are at historic records, rising more than 5x from the April 2020 low. (see below) Other materials including granite, bricks, concrete blocks, paint and more have all increased. While there are micro-economic factors in each of these markets, some economists expect it could take years for some of these prices to normalize.

Finally, rising home prices have contributed to the real estate sector of the stock market gaining 16% this year after declining in 2020. While only a portion of this index is related to residential real estate, the re-opening of the economy has pushed many parts of the sector higher. Continued supply/demand pressures, low interest rates, the economic recovery and other factors could continue to move in the favor of some of these industries.

As always, this is a key reason investors should stay diversified and consider a wide variety of sectors and asset classes. The housing market has been a positive sign for the macro economy, individual homeowners and the broader stock market. Below are three charts that highlight recent data around this important sector.

1 Home prices are climbing to new historic highs

The S&P/Case-Shiller index of housing prices has climbed to new peaks – both nationwide and across the top 20 cities. This began to occur soon after the COVID-19 lockdowns as many sought more personal living space. Since then, the trend has only accelerated alongside the economic recovery.

2 The inventory of homes is near historic lows

All-time record home prices are due to limited supply and increased demand. At the moment, the months’ supply of homes is only 3.6 months – near historic lows. This has led to a surge in building permits and housing starts across the country.

3 The prices of lumber and other commodities have surged

New homebuilding activity has also resulted in historic records for the prices of lumber and other housing materials. This has surpassed even the recoveries in other economically sensitive commodities such as oil and copper.

The bottom line? The housing market has been strong during this recovery driven in part by historically low interest rates which is a positive sign for the economic rebound. Investors ought to remain diversified across sectors as the cycle evolves.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Asset Allocation and Diversification do not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.