Don’t Sell in May and Cash out

The notorious Wall Street market timing maxim “Sell in May and Go Away,” popularized by The Stock Trader’s Almanac, proposes investors should cash out of their equity holdings this month and re-enter the market in November, based on the historical tendency of stocks to underperform over the summer months.

There is also a more ominous version: the annual alert to sell stocks now and stay far away until Halloween. The “Halloween Effect” phenomenon, like Sell in May, also alludes to a greater return by stocks during the six months after Halloween than it does the rest of the year.

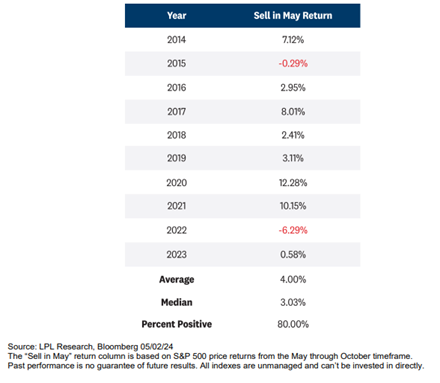

While just recently 2022 and 2023 saw market bottoms, corrections and crashes in October bringing back PTSD memories of the historic October market crashes of 1929, 1987 and 2008, technical and fundamental factors point to upside potential for this year beyond the average 1.7% “Sell in May” gain period as opposed to the 7.2% average gain between November and April since 1950 per LPL/Bloomberg. As illustrated below by LPL Research, recent years have yielded better results of a 4% average return with 80% of summer periods generating positive results.

Jon here. Investing and timing the market based on market maxims, headlines, hunches, hemlines, or zodiac charts can be more harmful than helpful for long-term investors. Successful investing is about managing risk, not avoiding it, as you can’t predict what may be around the corner.

Why Not to Sell in May

While we focus to keep an eye on metrics and trends more so than headlines, consider that even Fed Chair Jerome Powell is only human with his opinions and outlook after making an incorrect “transitory inflation” call back in 2021.

Still, Powell had a quote for the ages at last week’s Fed FOMC meeting when he was asked about the risk of stagflation, and he was quoted as saying, “So I don’t see the “stag” or the “flation.” He further stated that he was around for stagflation in the ‘70’s, with 10% unemployment and high-single-digit inflation.” This comment, along with no indication of a reversal to future rate hikes provided a strong start to this month.

While lingering, pesky Inflation seems to be the most significant driver of stock volatility and headlines more so than high rates, two wars, bank crashes and oil volatility, consider the following five points to not cash out your nest egg after a bruising April sell off.

1 We are only in year number two of a young bull market and most bull markets last 5-6 years on average. Whether stocks return 1% or 5% over the hot summer months, market timing for long term, diversified investors is a fool’s game.

2 Most years that stocks hit double digit gains for the first quarter, the rest of the year was positive. Too boot, while consumers drive 70% of GDP and corporate profits are slowing down, the economy is still going strong. Slowing down does not signal a recession or a hard landing. Still the big amount of “funny money” cash in the system from COVID relief to wage inflation and excess reserves is finally draining down as credit use is greatly increasing from credit to auto loans.

3 Bad news is good news as we keep drilling down in most of our recent newsletters with the unemployment rate increasing to 3.9% last month combined with the slowdown in wage growth in April, helps aid the situation for the Fed to eventually cut interest rates at some point later this year.

4 Though inflation should slow down over time, consider that over 37% of CPI is shelter/rent. The CPI for shelter also includes lodging away from home and tenants’ and household insurance. It could take another couple years’ for these elements to cool off. Overall, the fed appears to be higher for longer and has not indicated they would need to reverse course and hike rates higher -which was also a positive sign at Powell’s last meeting -helped stocks regain footing for a strong start to May this month.

5 Stocks typically perform well during pre-election years. As recently noted by the Carson Group, the best year for stocks is a pre-election year (like 2023), while midterm years (like 2022) are the worst. Election years gain 7.3% on average and are higher a very impressive 83.3% of the time. They further noted to be aware the majority of that 7.3% gain tends to happen later in the year, as stocks are historically down near the first quarter of an election year before rallying after the election into the end of the year as markets gain clarity on what they must work with in the White House.

Whether or not history will again repeat as well as rhyme is unknown, but keeping an eye on past stats going back decades can help to develop your viewpoints. Having invested clients’ portfolios through major calamities and through bear and bull market cycles for over two decades has helped our team also develop time tested tools and strategies to help navigate through all types of weather.

Why Cash is not a Long-Term Strategy

In times of market uncertainty, investors often seek the safety of cash. This has been true over the past several years as markets have swung due to the pandemic, geopolitical events, Fed rate hikes, inflation, gridlock in Washington, technology trends, and more.

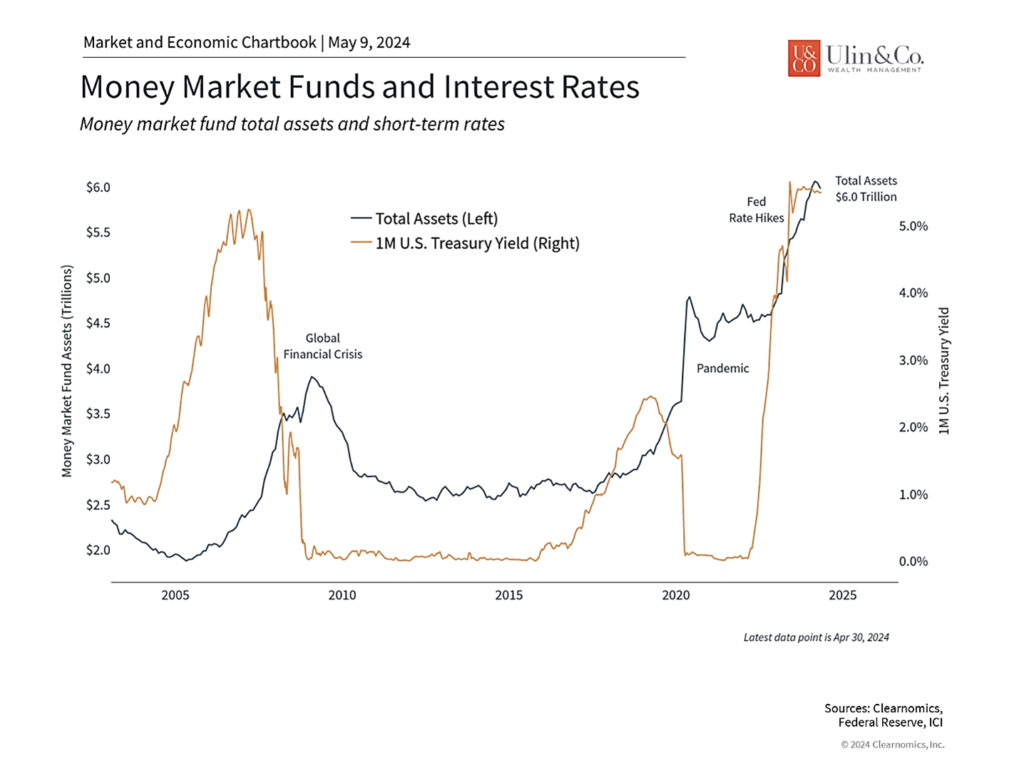

After a decade of near zero rates, the Fed rate hikes have led many investors to hold more cash than in the past. Money market funds, for instance, have attracted inflows with total assets reaching new all-time highs of $6 trillion while paying investors near a 5% yield. (see chart) This is more than double the assets held in money market funds prior to the pandemic when interest rates were near zero for the better part of a decade. As the accompanying chart shows, money market fund assets have typically grown in times of economic distress or when interest rates have been high.

Big Inflows to Money Market Funds

Cash is an essential part of any financial and investment plan. From a financial planning perspective, cash provides the liquidity needed to cover expenses and important life events. The down payment on an upcoming home purchase, for instance, should primarily be held in cash-like instruments. Similarly, it’s important to have enough cash to serve as an emergency fund in case of unexpected personal events such as injury or illness or broader events such as an economic downturn.

From an investment standpoint, cash can also serve important roles including reducing overall portfolio risk and by allowing investors to take advantage of attractive market prices, hence we do utilize cash, treasuries, and money market instruments as part of our client portfolio strategies.

Inflation erodes the value of cash

While cash is important, it can become problematic when investors hold too much cash. This is because cash is not truly risk-free for two important reasons. First, inflation quietly erodes the purchasing power of cash over time. (see chart) So even if yields appear to be high, the real value of your money could decline. As the accompanying chart shows, the inflation-adjusted income on cash has consistently been negative when considering average certificate of deposit rates.

While there are many cash instruments that could generate more yield than these averages, the problem is that these rates are not “locked in.” By definition, short-term rates need to be rolled over often as instruments mature and expire, introducing what is known as “reinvestment risk,” or the idea that future rates may not be as attractive.

The second challenge with holding excess cash is the opportunity cost of not investing in stocks or bonds. Just as interest rates have risen for cash, yields have also jumped across many types of bonds. The average yield on U.S. investment grade corporate bonds, for instance, is now 5.5% – far more attractive than the average of 3.7% since 2009. Unlike cash, these yields are longer-term in nature and these bonds could experience price appreciation if rates do decline.

Stocks and bonds have outpaced inflation

Similarly, the stock market has performed extremely well despite many investor concerns over the past few years. The S&P 500 is still up 8% with dividends and has gained about 47% since the market bottom in 2022. While the past is no guarantee of the future, these returns have far outpaced inflation over years and decades and would have helped to offset the erosion of purchasing power across a portfolio.

The prospects for cash will only worsen if the Fed does begin to cut rates later this year. Investors would be forced to reinvest their cash either at lower interest rates or in stocks and bonds whose prices would most likely have already risen. The possibility of falling rates has been an important driver of the overall stock market that will likely continue.

The bottom line? Investors should hold off on market timing maxims like sell in May and instead review their cash holdings to deploy back in the market as the stock market continues to rally and the Fed prepares to cut rates. In the long run, holding a proper allocation of stocks and bonds is still the best way to achieve financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.