Seasonal Market Indicators Like Santa Don’t Always Deliver

Investors get drawn to headlines focusing on seasonal market indicators and maxims that invoke emotions of greed or fear to start rapidly trading in a euphoric manner like a table game in Vegas with their life savings. Unfortunately, as we mull over below, seasonal patterns and calendar effects like the “Santa Clause Rally to the Superbowl Effect do not always play out as planned to help jumpstart your portfolio through inclement economic weather.

Discipline Trumps Market Timing

After almost two years of negative returns for bonds, and sideways trading for the notorious balanced 60/40 portfolio, impatient investors brains were busy at work until the end of October contemplating moving to high yield cash instruments to risk off, or perhaps contemplating to pivot to more high risk tech stocks due to FOMO.

Discipline trumps market timing and calendar patterns when it comes to being a long-term investor. After a few WSJ articles noted in October that the well-known 60-40 investment strategy has had a rough year again after last year being the worst in history, the momentum significantly changed by November 1st. A tandem rally in stock and bond prices has helped deliver the best month for the 60/40 strategy since April 2020, and the second-best month in over 30 years, according to Bespoke Investment Group. The S&P 500 added an incredible 8.9% last month, which was the 18th best month ever (since 1950).

A combination of moderating inflation and expectations of Fed rate cuts in 2024, combined with declining Ten-Year Treasury yields, helped fuel the multi-asset rally that has lifted everything from bitcoin to gold, along with an excellent run-up in bonds- to even Kathy Woods tech stock ETF’s.

Follow the Data

Every quarter we chew over a few market maxims in our newsletters as compared to current events with more of a data driven approach. While these concepts make a good seasonal read, it is more pertinent to invest based on actual data points and trends that we cover in our charts while considering market history, more so than forecasts.

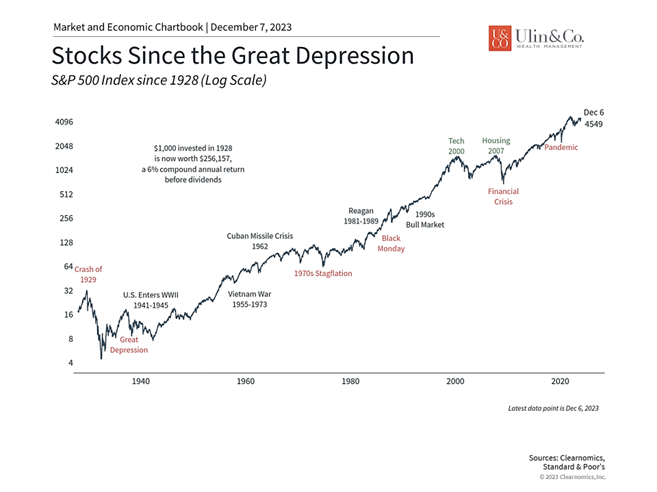

While investing often involves recognizing patterns in economic and market data, not all patterns are equally useful or valid. On the one hand, history shows that economic trends such as the business cycle and factors that drive corporate profitability, for instance, do impact markets.

On the other hand, there are countless other patterns that investors follow that may or may not affect returns. Distinguishing between these types of patterns is important not only for portfolio outcomes but also to prevent counterproductive financial decisions. Consider the following points around commonly discussed market patterns as you plan for the year ahead with your portfolio.

January Effect and Other Market Maxims Fading Over Time

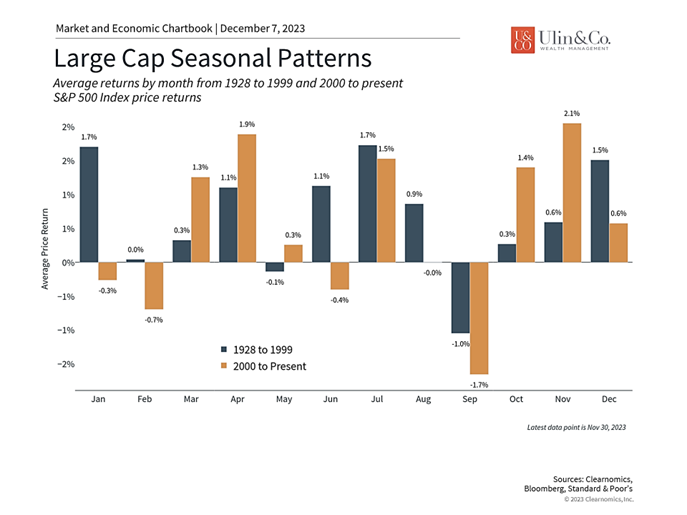

One difference between the two types of patterns in the chart below is whether they explain market movements based on some underlying trend, or if they are simply surface-level observations. The latter often capture investor interest and include seasonal or calendar-based patterns such as the “Santa Clause Rally,” the “January Effect,” and “sell in May and go away,” investing depending on the phase of the moon, or even based on which NFL division wins the Super Bowl. On face, some of these seem more reasonable than others. However, they all persist because there may have been statistical evidence to support their existence at some point.

The January Effect, for instance, is often discussed around this time of the year. This is based on the observation made in the mid-20th century that the month of January often experiences much stronger stock returns than other months. Some research even found that a large proportion of each year’s return is generated during just a few days in January. Naturally, this implies that investors should dedicate their investment or trading activity to the month of January to take advantage of this effect.

The accompanying chart shows that there may have been some truth to this when it was first discovered. From 1928 to 1999, the month of January did experience attractive positive returns on average, especially when compared to most months except July and December. Yet is appears the past couple of decades this trend reversed.

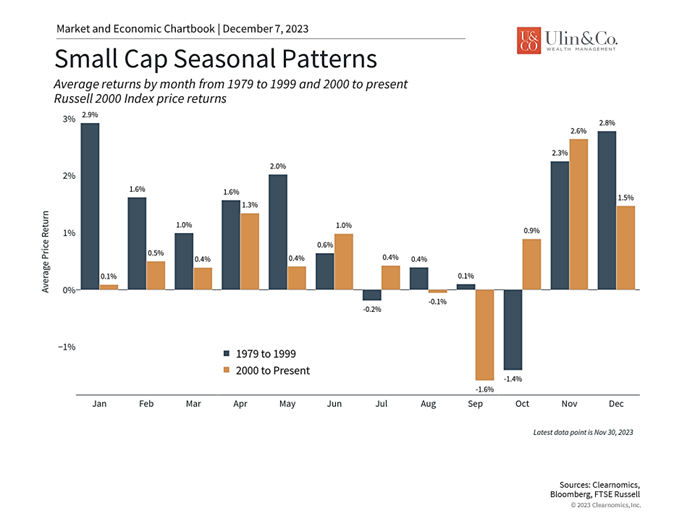

Small Caps are also Seeing a January Effect Reversal

The next chart shows that this effect was even more prevalent in small cap stocks. The fact that this was persistent and statistically significant for part of the 20th century naturally piqued investor interest and was the subject of much investment research.

From a theoretical perspective, patterns such as the January Effect should be expected to be short-lived since investors would seek to take advantage of them, reducing their effects over time. Otherwise, this would violate the “efficient market hypothesis” which states that public information should already be reflected in stock prices. For this reason, patterns that do persist are of great interest to investors who seek sources of returns and for researchers who seek clues as to how markets operate.

Patterns such as these are referred to as market anomalies since standard theories for understanding stock returns can’t easily explain why the January Effect should exist. Thus, it requires other explanations such as: tax loss harvesting in which investors sell stocks for tax purposes and buy them again in January, households investing holiday bonuses in January, portfolio managers selling stocks in December and buying again in January (“window dressing”), and many more. These explanations are often formulated after the fact, the reverse of the typical scientific process in which hypotheses are formulated first and then tested.

One alternative is the possibility of a legal or structural reason behind the pattern that makes it difficult to take advantage of, or if it comes with greater risk. For instance, it’s well known that the best way to “buy low, sell high” and generate strong positive returns is to invest during a market correction or bear market. This would have been the case during the 2008 financial crisis, in March 2020 during the pandemic bear market, or across 2022 when inflation spooked markets. However, despite this knowledge of history, investors tend to avoid these periods exactly because they seem risky. This is partly “irrational” since it’s human nature to be fearful when markets are down. It’s also “rational” since measures of volatility and uncertainty rise during these periods, affecting expected return calculations.

Whatever the reason is for the January Effect, there is clear evidence that it has faded across both large and small caps since 2000. The charts above highlight this clearly. This underscores another fact about surface-level patterns: they often work until they don’t. Without a clear explanation on what drives this performance, it’s hard to know whether it can be relied upon after it is discovered.

This is also related to the statistical idea that patterns will emerge in any dataset, even if the data is inherently random. For instance, in a large group of people flipping coins, it’s natural to expect a few individuals to flip heads many times in a row just by chance. These individuals might then be viewed as being skilled at flipping coins, capturing the attention of others. Similarly, it’s not unexpected for a particular month to have larger-than-average returns over many years just by random chance or due to large outlier events. In these cases, one might expect these anomalies to fade over time as they “revert to the mean,” which is exactly what the charts above show.

Investors should focus on long run trends instead

What does this mean for investors? Even when there is truth to surface-level patterns or seasonal effects, it’s unclear what drives them or if they will continue. From a practical perspective, history suggests that it’s better to focus on well-established drivers of markets which tend to operate over long-time frames. The business cycle, corporate earnings, valuations, and other fundamental measures are not perfect predictors of market performance but they do tend to be correlated with returns over years and decades.

The bottom line? Investors should remain focused on long-run trends rather than seasonal market indicators, patterns and maxims as they work toward their financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.