Retirement Investing Challenges- the Road Ahead

From the assassination attempt on former President Trump, President Biden’s announcement that he will not be seeking re-election, two major ongoing wars, elevated interest rates, and a deft rotation out of tech stocks leading to heightened market volatility, recent events have added to investor concerns, especially for those in or nearing retirement.

It’s natural for investors to be concerned about where the market is headed, especially as the presidential election season heats up and the Fed prepares for its first rate cut this cycle. However, history shows that it’s important for investors to stay focused on the long run and not overreact to every news headline. It is also important to avoid getting sucked into fearmongering non -traditional investments being pitched by unscrupulous advisors online and at steak dinners. Just remember the motto there is no such thing as a free lunch.

Jon here. Investing for retirement and getting rich over time should not be a gamble like the state lottery, Vegas or horse betting, yet many successful individuals and families that worked hard for years and decades still get thrown off course by get rich schemes. Attaining wealth can be achievable, but maintaining financial security and a lasting legacy takes discipline, work, time and education. As an accredited CFP® pro, I have found that helping clients get their “financial house” in order while creating and executing a realistic retirement roadmap, is as critical for long term financial success as our fiduciary, fee-based investment strategies through our Charles Schwab and Fidelity custodian partners. This all fits into our Plan your best life® maxim while providing concierge-level service.

Death, Taxes and Inflation

To paraphrase Benjamin Franklin, nothing is certain except death, taxes and inflation. The past few years of post-pandemic record high inflation combined with robust stock market gains, was a powerful reminder for retirement investors of all ages to stay the course with their portfolio to help keep up with inflation over time and not be sitting on the sidelines with the lion’s share of their 401(K) and savings in cash due to fear or uncertainty. Many advisors and investors we speak to seem to forget to include inflation adjustments into their retirement assumptions and income projections.

Looking back in time, the sizzling 14.9% CPI high of the early 80’s when then President Regan took office may not return to haunt us anytime soon but may still be providing retired investors with PTSD memories of more challenging times from the past. Looking forward, if CPI moderates over time to just near the 3.2% historical average, your cost of living will increase by 50% over the next decade and double over the next 20 years. This means that whatever your annualized budget may be if you retire by age 65, you may need 50% more income to meet your goals by age 75 and double that amount by age 85, if you are blessed with longevity.

Much has changed over the past five decades for retirement investing individuals, especially with medicine and longevity. With many people now experiencing more than a two- or three-decade retirement, staying composed and calm is the best way to help achieve long-term financial goals. Between 1970 and 2023, life expectancy at birth increased from just over 77 years to nearly 85 years for women and from just over 72 years to nearly 82 years for men. This was an increase by almost 8 years for women and 9 years for men.

Three-Legged Stool No Longer Applies

Gone are the days of working for the same company for decades and retiring at age 65 to then receive a gold watch and an employer pension. The tradition of giving gold watches originated back to the 1940s with The Pepsi Co. The concept of “you gave us your time, now we are giving you ours,” made sense when people stayed with a company for years and the price of gold was about $34 an ounce. Today, the average length of job tenure is roughly five years and the price of gold hovers near $2,390 an ounce.

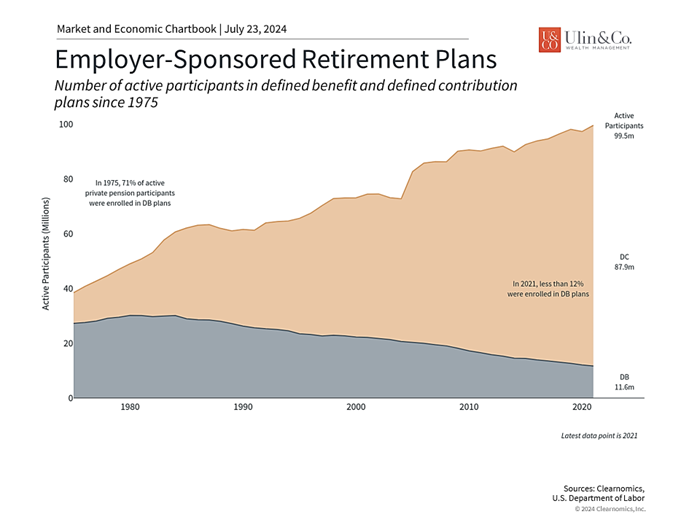

The “three-legged stool” is an old term for the trio of common sources of retirement income: Social Security, pensions, and personal savings. One leg of the stool, pensions, have been replaced by defined-contribution plans that place the investment burden on the individual. (see chart) Further pressure will be placed on retirees if or when Social Security benefits are reduced. More than ever, staying levelheaded (and educated) is the best way to achieve long-term financial success.

This is especially true when it comes to saving for retirement. For those with decades until retirement, it’s critical to start early and hold the right mix of assets that can generate sufficient growth. For those in or near retirement, sticking to an asset allocation that supports income needs while providing growth for longer retirement periods has never been more important. In both cases, investors today need an understanding of the retirement landscape and why they may need to take action to grow and protect their retirement savings.

Over the past 50 years, the burden of planning for retirement has shifted from corporations and the government to individuals. Understanding the labyrinth of investment vehicles, tax consequences, how to construct an appropriate portfolio, as well as what to do in times of market volatility can be challenging for even the most sophisticated investors. This is one reason to always seek professional advice to ensure that you’re on track to achieve your financial goals.

Investors are increasingly responsible for their own retirements

How has the retirement landscape shifted? Looking back, the American Express Company (a railroad business at the time) introduced the first pension plan in 1875. This kicked off a trend of employers providing benefits for employees in retirement. For much of the next century, these were largely “defined benefit” plans, meaning employers contributed to a shared fund and eligible employees would receive benefits in a set amount once they became eligible. Defined benefit plan participants would have the assurance that if they met the qualifications, they would be able to count on regular paychecks in retirement.

Of course, when most people think of receiving checks in retirement, government programs such as Social Security are what come to mind. Social Security was introduced in 1935 when the Great Depression caused unemployment to soar to over 25%. It began providing income to workers once they turned 65 and was responsible for mainstreaming the idea of a retirement age and providing a safety net for older Americans.

However, it’s widely known that shifting demographics and longer life expectancies have put the future of the program in jeopardy. According to the latest report by the Trustees of the Social Security and Medicare trust funds, Social Security reserves are expected to be depleted in 2035 unless Congress acts, at which point fund income will be sufficient to cover only 83% of scheduled benefits. It’s been the case for decades that individuals cannot simply rely on Social Security for their retirement needs.

Investors must determine the most appropriate asset allocation for their goals

Today, the investing journeys for most individuals begin with their company’s defined contribution plans, such as a 401(k) or 403(b). The key difference is that defined contribution plan participants must select and manage investments themselves. As a result, they receive benefits in retirement from only what they have saved and invested, unlike under a traditional defined benefit pension plan. The same is true for other retirement vehicles that individuals can open on their own, such as IRAs.

Given this broad shift over the past half-century, the burden of investing properly now falls squarely on the shoulders of individuals. For this reason, it is essential for all individuals to understand the key principles of investing, especially because they are not typically taught in school.

First, investors should hold a properly constructed portfolio tailored to their specific needs, including their life stage, risk tolerance, and more. In the short run, choosing the right mix of assets can help investors to weather the inevitable market swings that occur quite often, such as during the market pullbacks that have occurred throughout this year.

For example, stocks tend to generate larger returns but are also much riskier, as shown in the accompanying chart. In contrast, bonds are typically more stable but also have less potential upside. An appropriate asset allocation allows investors to take advantage of the positive attributes of both asset classes to create a portfolio that is more than the sum of its parts. Investors can then adjust this asset allocation throughout the various stages of their lives and as they approach retirement, in addition to making tactical and strategic shifts based on market conditions.

Starting early and staying invested are critical for retirement

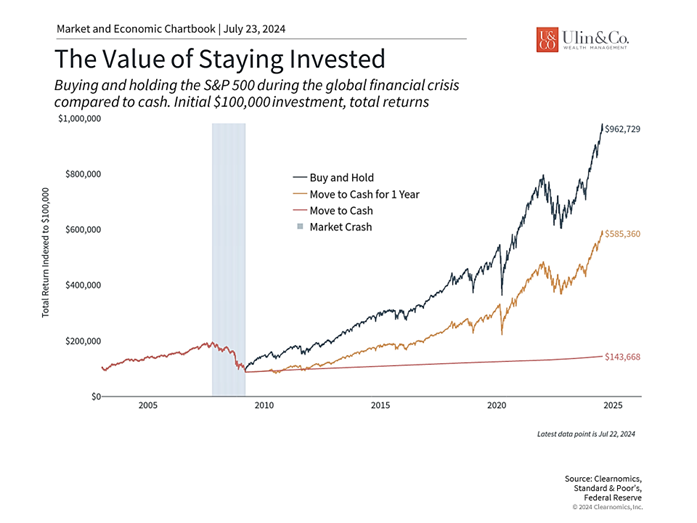

Second, saving early can help investors build wealth due to the power of compounding. The earlier an individual begins investing, the more time their money has to grow before withdrawals are needed. This is true even during periods of market turbulence such as over the past few years. While staying out of the market or keeping cash in a checking account may feel safe, the true opportunity cost is the forgone gains that could have helped to provide a more secure retirement.

Finally, it’s important to always stay focused on the long run rather than worrying about day-to-day market fluctuations. Investing early and staying invested through the ups-and-downs of market cycles are the best ways to achieve financial goals. Trying to time the market or make sudden changes to a portfolio is not only difficult but can be counterproductive since it derails investors from their true objectives.

It can often feel as if there is always another crisis on the horizon whether due to politics, the Fed, interest rates, or tech stocks. However, while there are no guarantees when it comes to investing, history shows that investors who save steadily and follow these key principles will be in a better position to grow their retirement savings.

The bottom line? Today’s retirement investing landscape requires individuals to take responsibility for their own financial future. With pensions on the wayside and potential cuts to Social Security on the horizon, having a financial plan is essential. While this all seems challenging, it also creates opportunities for investors to tailor their retirement plans to their specific needs.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.