Retail may Rack Up a Christmas Rally for Santa Clause and Investors

Online to brick and mortar retail spending is looking up to bring Christmas cheer to the street and investors by year end.

While we do not adhere to investing based on seasonal patterns, market maxims or crystal balls; market fundamentals do seem intact to deliver the goods going into 2020 despite increased market volatility and growing pessimism in the headline news against the aging bull market.

Just remember the old cliché that “the market can remain irrational longer than you can remain solvent.”

Last December 26th the Dow Jones (DJIA) Index was down almost 20% in bear territory, making it feel more like a Christmas crash than a Santa rally bash before greatly rebounding by April this year.

The Santa Clause Rally refers to the propensity for stocks to rally over the last week of December into the first few days of the New Year. Several notions exist for its existence, including increased holiday shopping, optimism fueled by the holiday spirit to many short sellers being on vacation.

In many ways, the U.S. consumer has been the bedrock of the economy over the past decade. During a period when investment spending by corporations has been unusually low, government budgets have been problematic and our trade deficit has expanded, the average consumer has continued to spend money.

Of the roughly $21 trillion U.S. economy, 68% of all spending is done by consumers. On the other side of the coin is the fact that the average consumer’s income statement and balance sheet – i.e. their wages and household net worth – are also healthy. It’s no surprise that investors and economists consistently look to consumer spending to support economic and stock market growth.

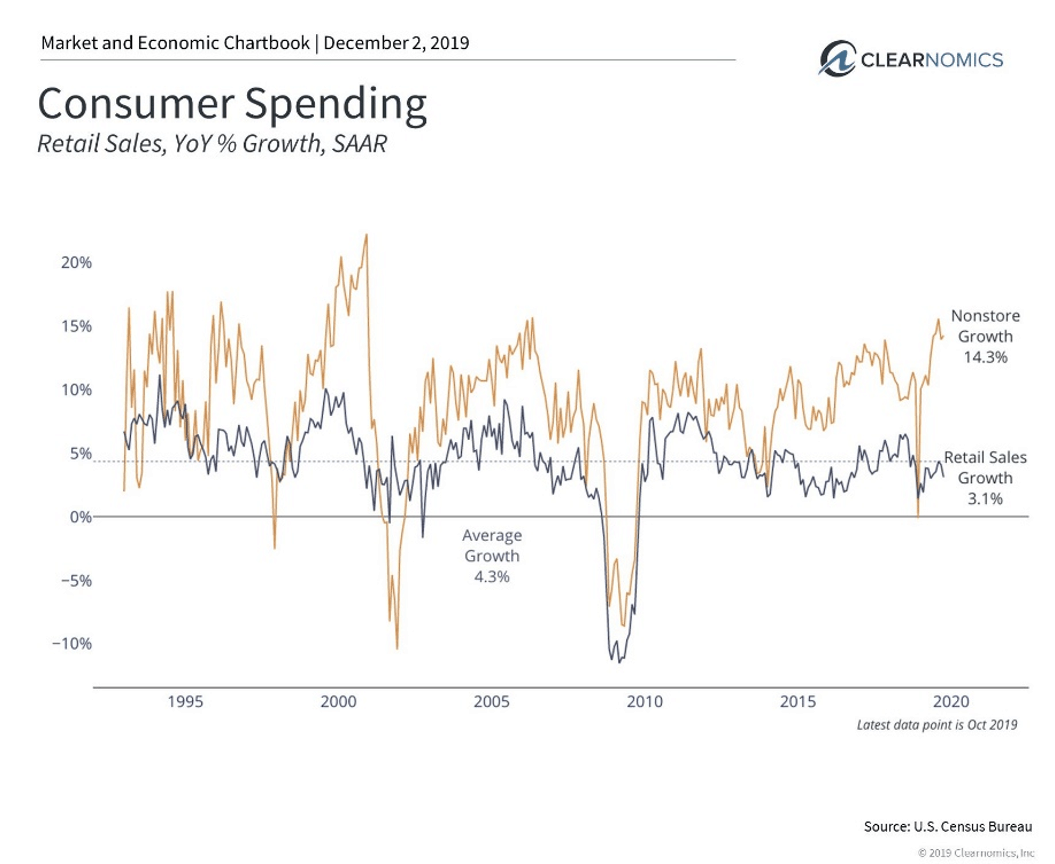

Of course, there are a number of nuances beneath this positive but over-simplified view. First, the consumer has evolved significantly over the past two decades. It’s no secret that consumers are increasingly shopping online rather than in stores. This is showcased by the retail sales data in the first chart below where non-store sales are growing at double digit rates compared to in-store sales. So, while overall consumer spending is healthy, the companies that benefit have shifted dramatically.

Additionally, the consumer isn’t immune to global economic and geopolitical headlines around issues such as the U.S.-China trade war. These types of risks affect consumers in all parts of their lives, including their jobs, household incomes, their communities, and of course their investment portfolios.

*Many industries and parts of the country are hit harder by increased tariffs by both countries. Still, despite these risks, that there is limited talk of a recession and the stock market has recovered have kept consumer confidence high.

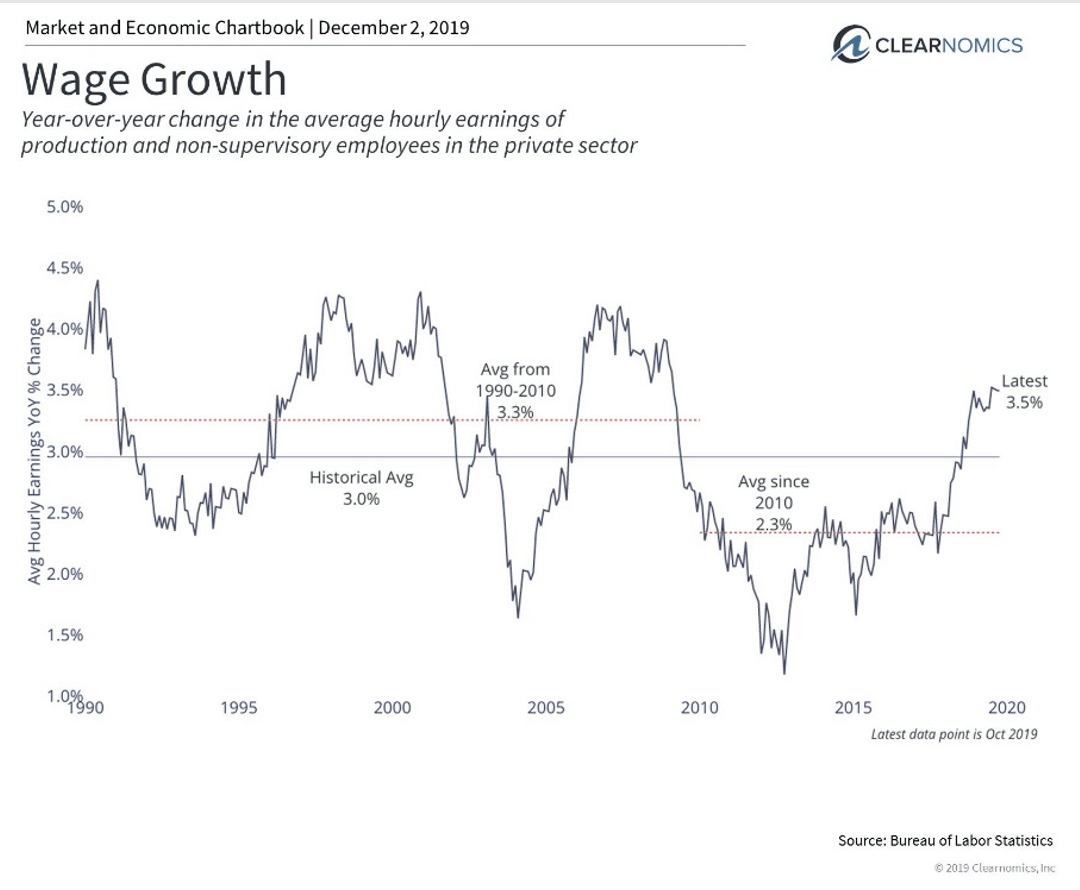

Perhaps the most important factor in this discussion is that the average American consumer appears to be in a healthy position. Of course, this isn’t the case universally, but overall household net worth now exceeds $113 trillion according to the Federal Reserve’s last estimate. Unemployment is still near 50-year lows, hovering around 3.6%. Wages are rising by 3.5% per year for many workers (see below), a rate that is outpacing inflation. Interest rates are still low, a phenomenon that is negative for savers but positive for spenders. Home prices have recovered in many places and have reached new record levels in others.

Thus, while there are questions about whether the global economy will truly rebound in 2020, the U.S. consumer will likely be the foundation of continued U.S. economic growth. Below are three charts that put this in perspective.

1. Consumer spending is robust

Retail sales have grown steadily over this business cycle. However, there’s been a dramatic shift from traditional retailers to “non-store,” online sales. The latter, growing by double digits each year, has benefited many different types of companies than in the past.

2. Wages are rising

Wages have been rising faster than inflation for some time. This is due in no small part to the “tightness” of the labor market – i.e. many workers already have jobs and employers are struggling to fill positions. In fact, there are over 7 million unfilled positions today. This goes to show that many companies would hire more if they could and, when they do, they most likely need to pay higher wages.

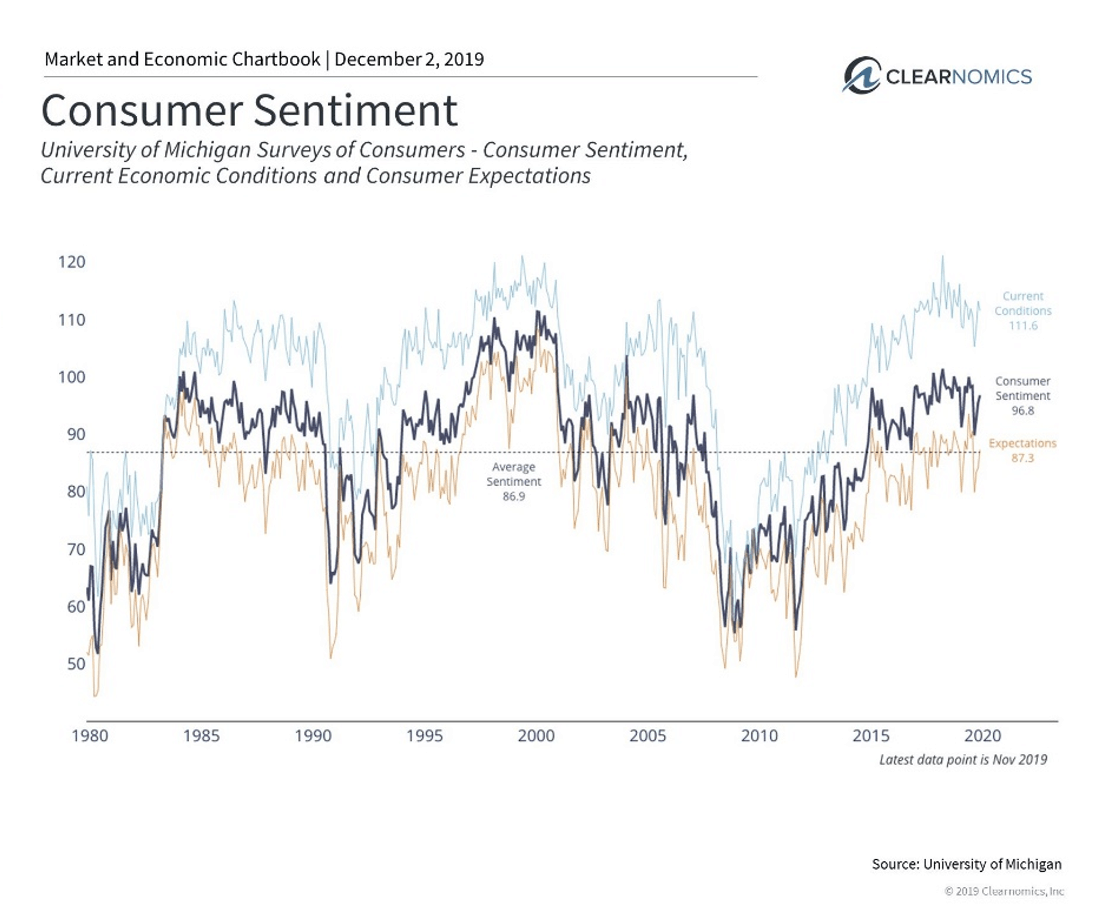

3. Consumer sentiment is still high

Consumer confidence remains high despite many negative headlines in the news on a daily basis. This is partly because very few are fearful of a recession over the near-term. While consumer confidence can be a lagging or even contrarian indicator of the economy and stock market, the data do suggest that consumers still feel positive and may continue to spend on goods and services as a result.

The bottom line? The consumer has been a bright spot in the economy over the past decade and may continue to support the economy and markets. Most important lesson is to work to ensure your investment strategy is set based on your goals for the long run and not on market maxims or seasonality predictions.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.