Quants and Humans Elevate Market Volatility

Historic 1000-point midday swings in the stock market this week are offshoots of investors’ fears over a more hawkish Fed ready to take swift action later this quarter to help put the brakes on inflation, now surging to 40-year highs through the junior year of the pandemic.

While 2022 has been one of the worst starts to a year for stocks with the S&P 500 down almost 10%, the NASDAQ down 15% and many tech stocks down well over 20% in bear territory, the volatility comes as no surprise as the market is “repricing in” the risk for future rate hikes, a slowing economy, geopolitical uncertainty and more. The fact of the matter is that 10% corrections occur on a regular basis most years going back to1946.

Jon here. While the current correction may be more striking if not surprising because it happened at the start of the year, perhaps this month was a swift kick in the butt to remind investors that the markets do not travel in a straight line or only go up.

The questions du-jour of the week include (1) whether humans or robots are causing such elevated stock volatility, and (2) how investors should navigate through corrections. The short answer to the first question is that it is a combination of both. There has been a whole paradigm shift and advancement with quants and AI integration into many industries since chess grandmaster Garry Kasparov resigned after 19 moves in a game against Deep Blue, a chess-playing computer developed by scientists at IBM back in 1997 before the dotcom fiasco.

AI Disruption is Brewing

Quantitative trading incorporates strategies based on quantitative analysis, which rely on mathematical computations and AI number crunching to identify trading opportunities. Price and volume are two of the more common data inputs used in quantitative analysis as the main inputs to mathematical models. These tech systems can be reading tweets overnight and then selling specific stocks or sectors at the opening bell – before you even finish your morning coffee.

There are studies indicating that algorithm-driven “quantitative investing” systems account for more than 60% of stock trades, especially in more volatile environments. Trading algorithms respond to the same evidence as humans and are trained to sniff out, yet quickly trade on broad indexes to individual companies if they recognize certain triggers.

More than just facts and numbers, it is perhaps more concerning that robo-algorithms can even gauge the words, speaking tone and inflection of a human, such as Fed Chair Mr. Jerome Powell, while identifying signs of how people may trade from his outlook. These quant-driven trades can end up triggering panic among humans to start selling stocks- thereby feeding a brutal cycle that leads to more quant trading.

While we cannot control the robots, we can control our own behavior in the short term to not panic with our disciplined, long term investment strategy based on a belief that major events such as global epidemics or future rate hikes, war, tariffs or tax policy changes will throw the global markets and the quants into a state of chaos.

Strategically and tactically managing and diversifying your portfolio while incorporating different sectors (cash, bonds, stocks, alternatives, etc.) while maintaining a global approach can help buffer the effects of short-term AI trading and market pullbacks.

Navigating Uncertainty

While short-term market pullbacks are normal and inevitable, especially within volatile parts of the market led by tech, many investors are naturally concerned about what this means for the year ahead. Now, more than ever, investors ought to stay disciplined and view market moves with the right perspective.

As we have discussed in many of our past newsletters as an ongoing theme, the primary challenge of investing isn’t necessarily related to financial or economic analysis, facts and headlines. Instead, achieving financial goals has more to do with our emotional and behavioral reactions to short-term adversity.

While our innate fight-or-flight response may tell us that market corrections are a time to sell and give up on our financial plans, the irony is that this is often when the market is the most attractive. History shows that investors who stay disciplined through these periods are often rewarded.

After all, financial markets naturally reflect the different views, goals and needs of a diverse set of investors, both large institutions as well as everyday individuals. When these factors change unexpectedly, markets can swing wildly over short periods of time. On top of this, the stock market tries to take into account what could happen in the future, today. This means that, over any short period, the stock market might get it wrong or overreact (overcorrect) because it is too optimistic or pessimistic. Over the longer run, as new information arises, markets expectations and reality converge.

Tech Sector: Dot Com vs Today

This helps to explain many of the challenges investors have faced with fast-growing stocks, primarily in tech, which reflect a number of different themes and trades. For some, tech stocks represented a short-term trade that benefited from work-from-home and the pandemic lockdowns. For others, tech stocks represent the growth of digital tools across sectors over the course of years. Just as there was significant investor enthusiasm during the dot-com bubble of the 1990s, with many stocks doing well for a short period, it ultimately took decades longer for the true winners of that period to be revealed. So, while the stock market and the tech sector may be stumbling, many long-term themes are still attractive.

Current market dynamics also highlight the need for diversification across sectors, styles, and asset classes for a few reasons. First, tech stocks are no longer isolated to the Information Technology sector. Instead, sectors as diverse as Communication Services and Consumer Discretionary (retail, automotive, recreation, etc) consist of what many would consider to be major tech companies.

Second, market rotations among sectors and across Value and Growth occur regularly. Since it is difficult, if not impossible, to predict the timing of these shifts, investors often do better by holding an appropriate amount of each. Third, asset classes like fixed income, which struggled in 2021 as interest rates rose, still provide stability to portfolios during uncertain times. Many investors benefited from holding an appropriate allocation of bonds during the initial pandemic crash in 2020.

Finally, perspective matters. Although corrections are never pleasant, investors who held on over the past few years have experienced the S&P 500 gain of 30% since the pre-COVID peak. The fortitude to handle near-term uncertainty is what allows investors to benefit from long run gains throughout the market cycle. Below are three charts that highlight the importance of staying disciplined in the months and years to come.

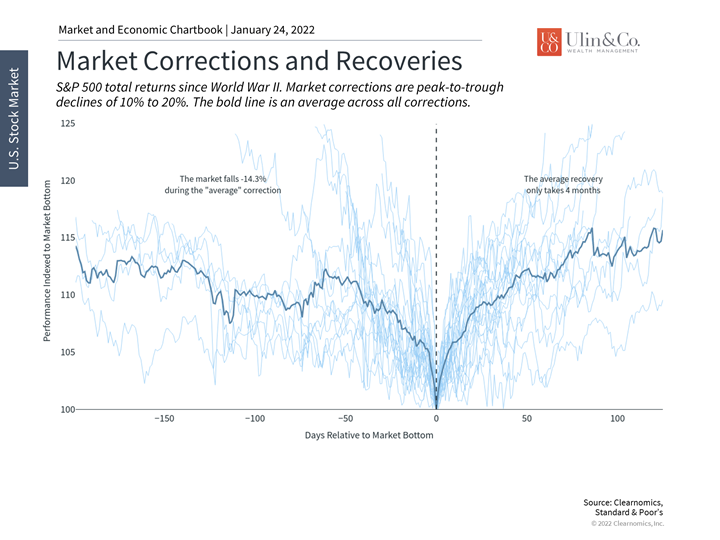

1 Stock market corrections are normal and historically recover quickly

Market pullbacks and corrections are normal, unavoidable, and can occur at any time. Rather than panicking during these episodes, it’s important for investors to focus on long-term goals. Markets often turn around when investors least expect it, with the average correction recovery taking place in four months or less.

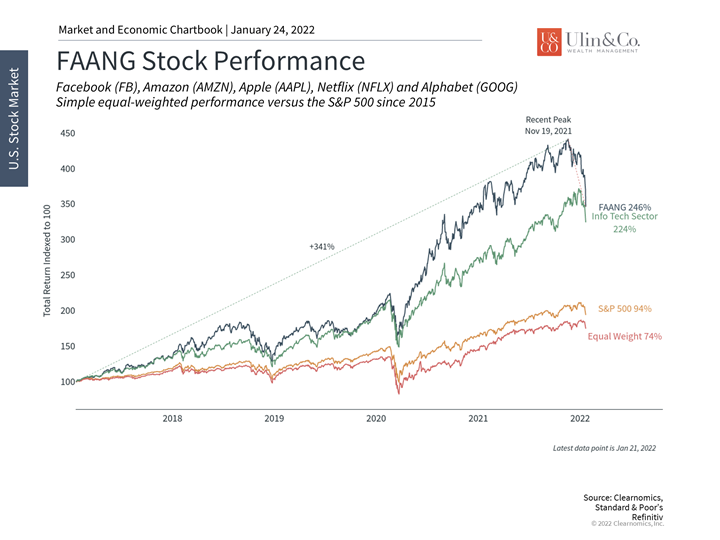

2 Tech stocks have significantly outperformed over the past few years

It is no secret that tech stocks have done very well not just since the pandemic, but also over the last several years. And while these stocks are down significantly over the past few weeks, long-term investors have still done quite well. This highlights the importance of staying diversified across sectors and having the right time horizon.

3 Having the right time horizon is critical

While the market is in or near correction territory, those with longer perspectives may see a different picture. Even when measured from the highest point before the pandemic crash, stocks are up nearly 30%. They have done even better over longer time horizons, underscoring the need to stay long-term when markets are the most uncertain.

The bottom line? While market corrections can now be equally driven by quants and humans, they are normal and unavoidable. History shows that investors who can stay focused and disciplined during these periods can improve their odds of financial success.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.