“Mise en Place” Is a Must in Your Kitchen & Portfolio

Mise en place is a French culinary phrase roughly implying to “put everything in its right place.” It refers to the precise setup chefs utilize to prepare and organize numerous ingredients in advance that will be utilized for different menu items.

A chef’s station is an extension of their nervous system, with different flavors and components ready to work together, such as sea salt, pepper, spices, white wine, fresh garlic, olive oil, meats, sauces and chopped vegetables. Whether cooking for two, or two hundred, you could almost find everything blindfolded, as you know where all the ingredients sit.

Portfolio management, like cooking, is also about planning ahead with various ingredients, while maintaining an organized, yet fluid process. Your investing “station” should be composed of several items that may include different variations of liquid cash, bonds, stocks and alternative investment elements as part of your portfolio “recipe” and construction based on your risk tolerance, financial goals and market outlook.

Like cooking, the “sum of the parts” working together for your prepared dish or portfolio strategy is of more importance than each individual ingredient on its own. Mise en place for a disciplined, globally and strategically allocated portfolio involves the knowledge and utilization of many flavors and sectors working together to help advance and conserve wealth overtime, more so than solely focusing on just the four primary headline index metrics of the S&P 500 index, Ten Year Treasury, gold and cash.

Zero Sum Game

After an amazing turnaround through COVID19 in the last half of 2020, the first quarter of 2021 brought sobering results for long term treasuries and many bond sectors greatly ending up in the red in response to the acceleration up of long-term rates over the past few months with many equity sectors rising.

Rather than panicking and discarding your portfolio’s asset allocation “recipe” and pivoting from bonds to more stocks, annuities and or other less liquid investments (that may cause other pains,) there are options to diversify your portfolio to hedge or lessen the downward pressure from potentially rising rates and inflation.

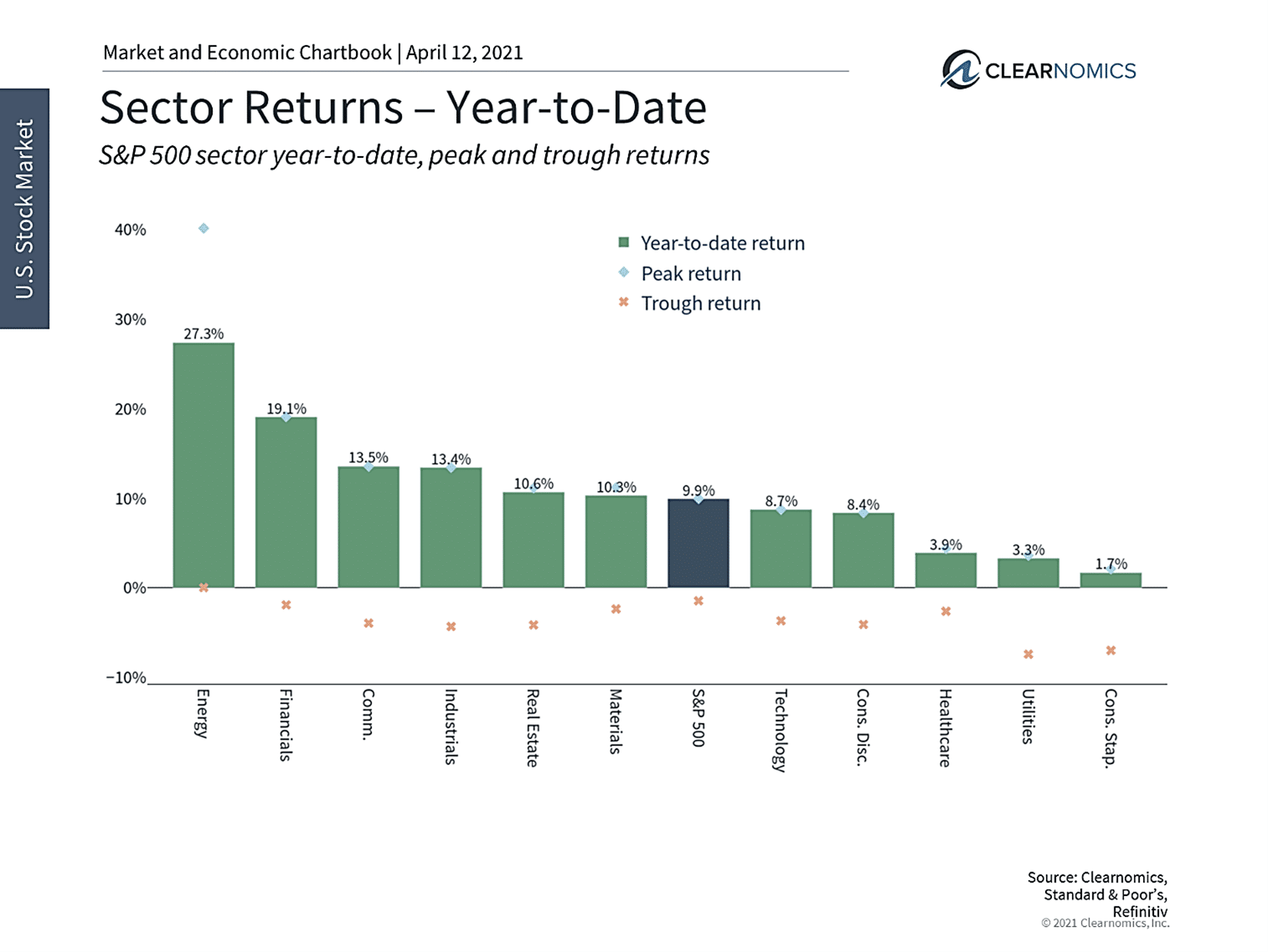

While the broad market continues to climb higher, sectors and areas driving this have changed over the past several months. (see below) Areas such as small caps, value stocks, retail, energy (oil), commodities, financials (banks), socially responsible (SRI) and more have surged during the recovery after greatly falling behind tech and growth stocks last year.

Thus, it’s important to not only focus on the “headline index numbers” but to understand what is driving performance beneath the surface even within the S&P 500. It’s also important to focus on how each of these areas fit into a well-constructed portfolio, perhaps with tilts to undervalued sectors and alternatives in more of a globally diversified portfolio.

Investors ought to stay focused in the months to come. Stock market pullbacks are impossible to predict but are inevitable nonetheless. The goal of long-term investors is not to swerve in and out of stock (or bond) markets based on recent returns, but to stay invested in an appropriate portfolio through both good times and bad.

While rates may continue to climb modestly in 2021, we are not going to see a return to the high rates of the Regan years anytime soon. Still, it may be prudent to adjust the bond (ingredients) side of your portfolio where warranted for interest rate, sector and credit risks that may arise.

Stay Focused

It goes without saying that rising markets are positive for investors. However, as with all things, maintaining balance is the key to long-term success. Just as investors often find it difficult to stay invested when markets pull back, many also find it challenging to stay focused when markets are roaring. After all, it’s human nature to chase returns and to be afraid of missing out. Even when investors intellectually understand that market gains cannot accelerate forever, there can be emotion-driven excuses for why “this time is different.” This is true even for investors who may have been fearful of returning to the stock market just a year ago.

If history teaches us anything, it’s that staying invested with a well-thought-out portfolio and financial plan is the key to long-term success. Doing so helps investors to capture the upside as markets rise over long periods while protecting from downside when they inevitably decline over shorter ones. Just as a sensible sedan, SUV or minivan may not be able to keep up with a race car on an open highway, they will handle the inevitable potholes and traffic jams much better. And, in the end, they will reach their destinations in a safer, more comfortable manner.

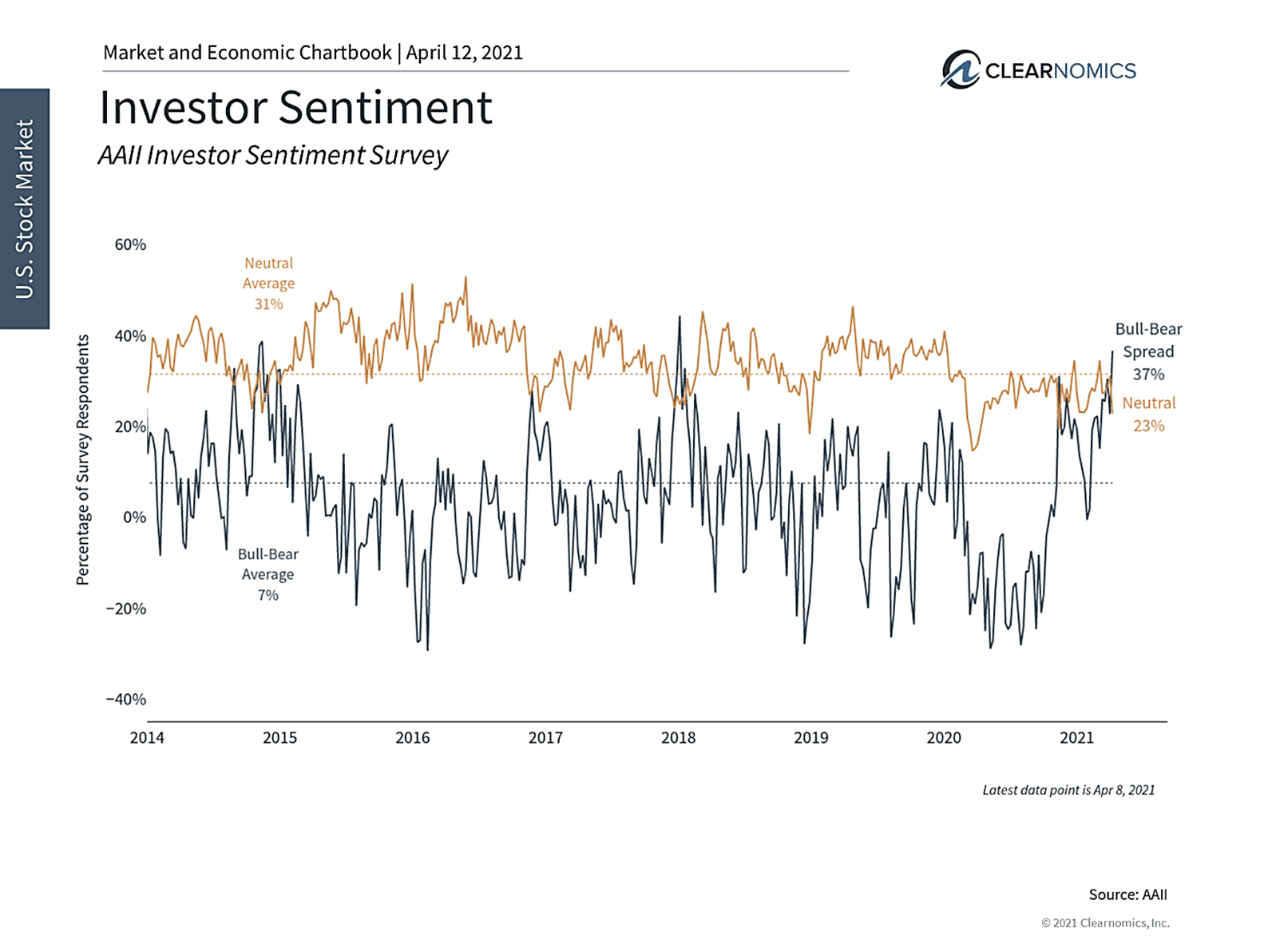

Bullish Investor Sentiment

Today, there are two key reminders for investors as markets continue to reach new all-time highs. First, recent surveys of investor sentiment suggest that bullishness is now near historic levels among everyday investors – a stunning reversal from a year ago. That this is occurring in lockstep with rising markets should be no surprise, especially with the S&P 500 and Dow each having returned over 10% this year with dividends. Investors – fueled by past returns, media coverage, low interest rates and interesting new assets – are seeking new ways to invest.

However, history shows that investor sentiment is often a contrarian signal – a sign that investors are focusing too much on return and too little on risk. This was certainly true during the dot-com era and the housing boom, but has also taken place periodically over the past decade. While this is by no means a timing indicator – markets can rise much longer than many expect – it is a reminder for long-term investors to avoid being distracted from their plans.

Second, while many fundamental factors have continued to push markets higher, investors should not expect markets to accelerate forever. At this point, the expectation for GDP and corporate profits to recover later in 2021 is widely understood and priced-in. Broad market valuation levels remain close to dot-com era highs based on these expectations, but can improve over time as the recovery advances. In general, there are no significantly undervalued sectors across the stock and bond markets. This further emphasizes the need for discipline and risk management.

Below are three charts that highlight the challenges investors face as markets continue to rise.

1 Investor bullishness is near record levels

The spread between bullish and bearish everyday investors is at its highest level in years. In general, investor sentiment tends to be a contrarian indicator and signals when investors are overly optimistic. However, by no means is it a timing indicator. Thus, today’s readings tell us that investors ought to remain disciplined as markets continue to climb to new peaks.

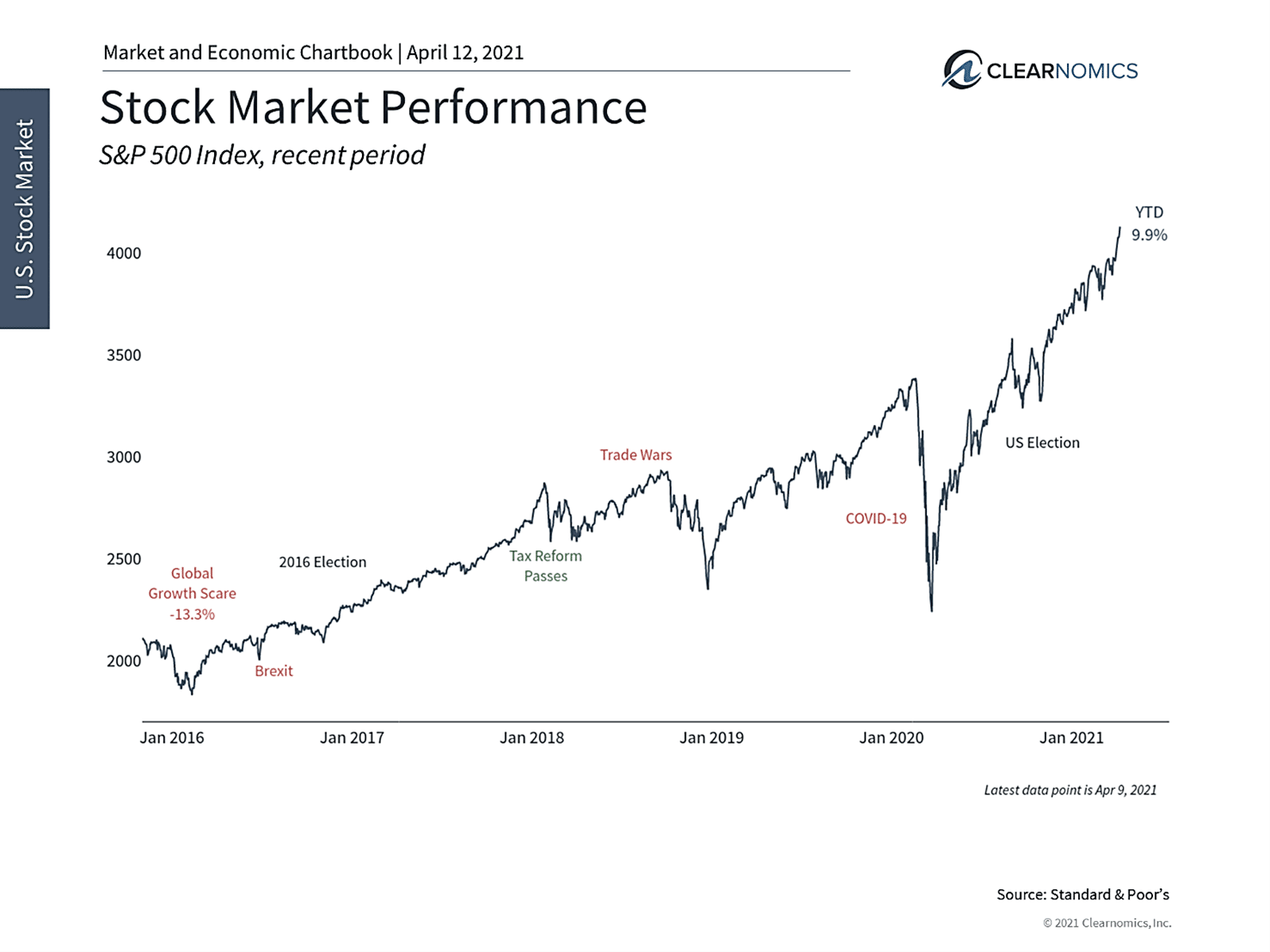

2 The overall market continues to reach new all-time highs

Broad stock market indices continue to rise, fueled by strong economic growth and corporate profits. What has driven this under the hood has shifted over the past year, however.

3 The areas driving this outperformance have shifted this year

The rotation in the market, driven by the reopening of the economy, has resulted in changes to sector and style leadership. While growth and technology stocks performed well last year, this year’s performance has been broader. Areas such as value, small caps, energy, financials and more have led the way. It’s important for investors to periodically re-evaluate their asset allocations to make sure they are aligned with their long-term objectives.

The bottom line? Although the first quarter brought a divergence between bonds and stocks reminiscent of 2013, investors ought to remain disciplined as the economy continues to recover from the pandemic-led shutdown. From your kitchen to portfolio, organize and use your ingredients wisely.

Greatly deviating from one’s investment strategy based on current headlines or what “may” happen later this year can end up being as harmful to your portfolio and retirement as consulting yourself with “Dr.” Google” on health-related matters.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.