Key Component for Investing Success Through Market Volatility

Are you concerned with the long-term effects of stock market volatility on your investments and retirement? You are not alone. Market volatility ups and downs are unavoidable like gravitational forces of the moon and earth on the ocean tides.

Market turbulence as we have experienced thus far through 2022 presents a good wakeup call to review your portfolio performance while making any timely adjustments to your underlying investments and overall strategic asset allocation strategy against your financial goals.

Volatility can spike whenever fear or uncertainty in the stock market arises due to a variety of conditions such as black swan events, subpar earnings reports, elevated inflation, geopolitical events (war), to the spillover effects of quants and high frequency algorithmic trading machines. Something as simple as an ominous financial headline or forecast can trigger a human/bot trading frenzy.

These gravitational market forces can spook some investors to take quick, immediate action with their savings and cash out completely at exactly the wrong time or sit on the sidelines. While the markets can be efficient over time while pricing in information according to the efficient market hypothesis (EMH), for many investors, the most significant hurdle to success may be more so from psychological factors than from the actual market volatility itself.

Although the gyrations of the markets can present significant investment risks, when this energy is correctly harnessed, it can also generate solid returns for shrewd investors. Even when markets fluctuate, crash, or surge, there can be an opportunity. The old maxim “time in the market beats timing the market” is still relevant today.

Stock Market vs Economy

The stock market and the global economy seldom move in sync for good reason, as the market is not the economy. Its job is to formulate investors’ consensus views about the future of publicly traded companies and in some ways can be thought of as a leading economic indicator. The 2020 “V-shaped” stock market recovery in the midst of the pandemic driven quarantine and resulting recession is one example of investors and the markets looking past the economic COVID19 carnage.

Jon here. As we discuss in our ongoing client review meetings, almost every year there is an outlier event that throws a monkey wrench into the gearbox of the market. Going back 42 years to 1980, the S&P 500 has experienced an average annual 14% peak-to-trough decline . Despite these selloffs, the annual return of the index was positive in 31 out of 41 years, or over 75% of the time. These odds are much better than going to Vegas or playing the state lottery.

Fed Lift Off

The headline du jour this week involves fears that the new (if a bit aggressive) Fed rate hike cycle to help cool off inflation may lead the economy into hard landing. Stocks have exhibited volatility in the face of past Fed rate hike programs, but they tend to find their footing once they adjust to higher policy rates. In the last six hiking cycles, the average S&P 500 return was over 13%. Rates are rising, but equities tend to rally during rate hiking cycles because they tend to happen when the economy is robust. Bond markets may have a tougher road ahead.

The lessons learned is that over months, years and decades the markets seem to recover and move forward. Investors that exercise a disciplined strategy may come out ahead over time. A great financial advisor can help you to develop and maintain a balanced investment strategy and financial plan, while at the same time help you to maintain a more patient approach. When you have a longer-term perspective with your portfolio, short-term volatility should not matter nearly as much. To quote the 1988 Guns N’ Roses song of the same title, perhaps all we need is just a little patience.

Patience

Adding in a wee-bit more of optimism to this discussion, consider that historically there have been very few instances when investing in the stock market for 10-year periods has resulted in negative performance, and zero instances for 20-year timeframes since the Great Depression. While the past is no guarantee of the future, this underscores the importance of patience as a key component for investing success over time.

Thus, the biggest hurdle to achieving financial goals for long term investors is not about modeling interest rates, forecasting the Fed actions, or predicting geopolitical moves and oil prices – it’s overcoming one’s own biases and inclinations. Although S&P 500 is negative for the year, the reality is that the S&P 500 has gained 96% since the pandemic crash and 30% since the pre-pandemic peak. (see below) There is often a disconnect between short-term perception and long-term reality when it comes to market behavior, no doubt amplified by constant headlines.

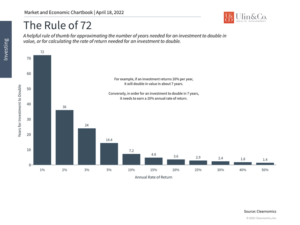

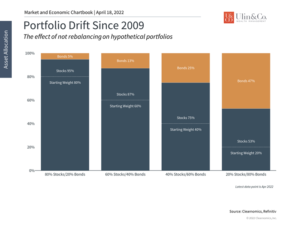

Like many things, the power of compounding works slowly and positive returns over any individual day, week or month are never guaranteed. Market pullbacks and corrections may grab attention and headlines, but it is the slow building of wealth in the face of never-ending market fear that works in investors’ favor over the course of years and decades. While there are valid market concerns around the business cycle, inflation, interest rates, the Fed, and more, the bottom line is that economic growth is still robust. Patience, discipline and perspective are needed as this business cycle matures. Below are three charts that put the power of long-term investing in context.

1 Compound interest works over long periods of time

Compound interest is what creates true wealth for investors over long periods of time. Not only do investment returns add to a portfolio, but those returns generate their own returns, and so on and so forth. The rule of 72 is a simple way to understand this compounding effect. It is a rule of thumb that estimates how quickly a rate of return would lead to a doubling of a portfolio, or similarly, what return is needed to double a portfolio in a certain amount of time. The rule of 72 is a reminder that for reasonable historical rates of return, it can take many years to grow a portfolio. Investors should thus set their expectations accordingly.

2 Stocks perform better over longer time frames

The stock market can swing wildly over very short time frames. However, over the course of years and decades, stocks have historically trended upward and done quite well based on the business cycle.

3 Investors should focus on their overall portfolios instead of individual assets

While speculation is a natural inclination for investors, it should be done so on a foundation of a portfolio built to achieve long-term goals. This chart shows the importance of focusing on this portfolio first by rebalancing and maintaining an appropriate asset allocation mix.

The bottom line? Investors ought to remember that there is no substitute for patience and discipline when investing to achieve long-term goals through Market Volatility.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.