Keep Calm and Invest on Through Omicron

COVID19 is evolving into an endemic like the flue and seems likely to be here for the long run. Hopefully a less severe variant may eventually overtake the more serious ones and help minimize its impact over time. The newest Omicron strain is yet another wakeup call for long term investors to keep calm and invest on through ominous headlines and market turbulence.

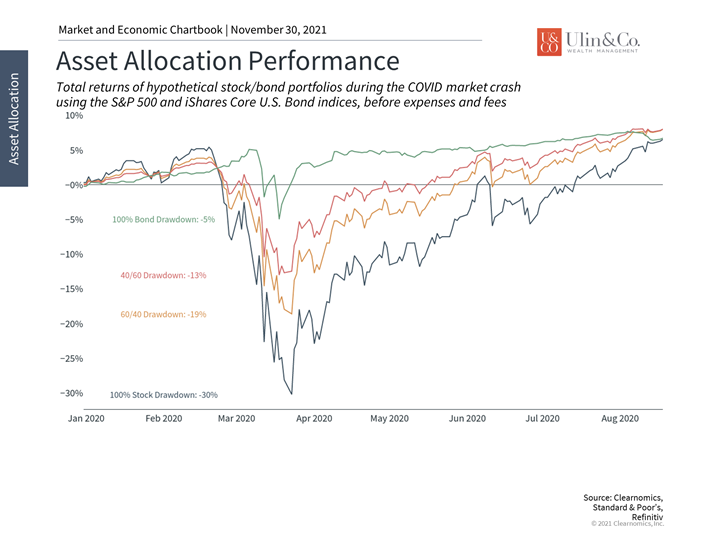

Holding fast with an appropriate strategically diversified portfolio has been the best approach for investors throughout each COVID19 strain otherwise past unforeseen black-swan events. (see below) Sudden dips and rebounds are a reminder to focus on investing and not panicking. While it is human nature to impulsively act to eradicate pain, fear or uncertainty, swift action in the short term can lead us to take counterproductive measures with our investments that can derail our desired outcomes.

At the onset of the pandemic, the exponential pace and spread of the virus created significant anxiety and challenges for everyone, not least of which was the emotional toll of isolation and social distancing. Fortunately, the situation today is quite different if not normalized. Individuals and businesses alike have fresh experience and playbooks for adapting to and dealing with the pandemic in addition to the vaccine rollouts and other evolving pills and remedies in development.

Without diminishing the public health challenges ahead, this means that there is a stark distinction between how officials should respond to the ongoing crisis how investors should respond in their portfolios to market volatility.

Watch the quants:

Jon here. Investor sentiment can be a significant driver of the stock market (fear and greed) yet as we have discussed before (Bloomberg) a third or more of trades are placed by quants and algorithms (WSJ) in extreme market conditions (high frequency trading) while accelerating stock velocity beyond human control. While money never sleeps, perhaps neither do the robots.

Deep learning computers powered by AI are reading tweets and the news overnight while you have been sleeping and are trading away at the opening bell. This is “rewiring” Wall Street itself, sending billions of dollars towards data centers and computer-science jobs.

Run a Stress Test

When volatility arises in the stock market as we have experienced over the past week, one way to help reduce your anxiety would be to “stress-test” your portfolio against an appropriate blended benchmark to view how your strategy is holding up while adjusting accordingly. Many investors make the mistake to utilize the “headline news” DJIA index as their “go-to” benchmark while they may be holding a more strategically balanced asset mix.

Selecting the wrong benchmark to stress test your portfolio can lead to trauma or missteps in the short term in as much as your doctor prescribing treatments or medication based on incorrect height, weight, and blood pressure metrics for someone of your own gender, age and health evaluation.

Lessons Learned

It’s more important now than ever before for investors to distinguish between public health issues – which can be fraught with politics and strong personal beliefs – and what’s best for their portfolios. If the pandemic has taught us anything, it’s that staying focused on the long run is the best approach.

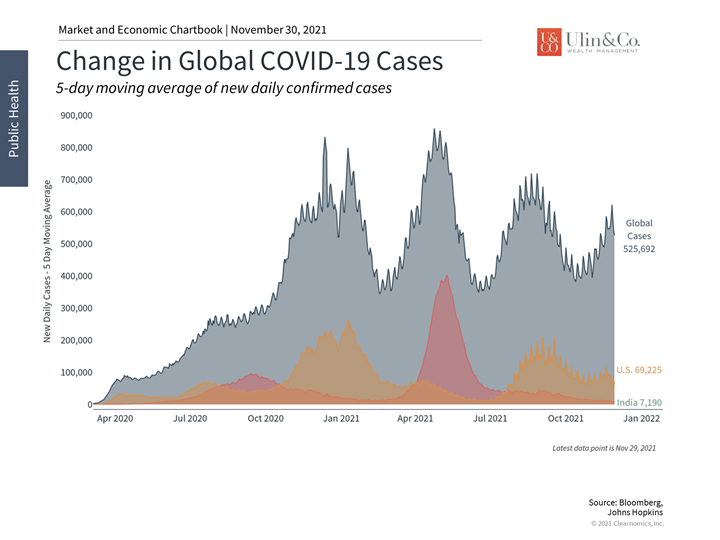

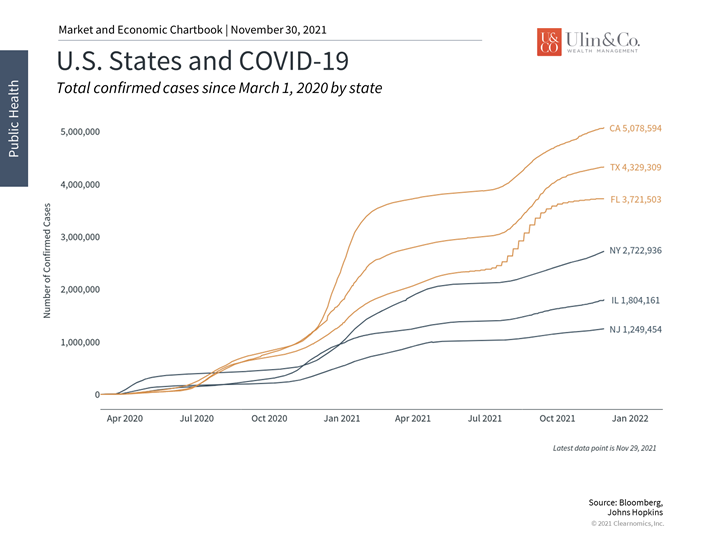

The delta variant wave that began in the summer showed that this is the case. (see below) Although infections spread rapidly, the mortality rate remained relatively low. Most importantly for investors, the economic and market impacts were minimal, especially when compared to the initial shutdown measures in 2020. Through that wave and the more recent uptick in cases, economic growth has been strong, hiring activity has accelerated, profits have reached record levels, and the stock market has continued to achieve new all-time highs. All this despite concerns around inflation, supply chains, politics, the Fed and more.

Of course, investors should always expect periods of market volatility. This is true even in the best of times, let alone when markets are at new highs and valuations are still above average. It is still true that the market has been quite calm by historical standards this year, despite occasional shallow pullbacks. What has made this possible is the strength of the economic expansion which is now over a year and a half in age. While there may be periods of short-term turbulence ahead, business cycles tend to last for many years if not decades.

In the end, portfolio diversification is still the primary tool for investors to help achieve their financial goals while working to safeguard their nest-eggs from downside risk. The market crash that began in February 2020 emphasized that while trying to sell holdings and moving to cash are tempting, a rebound can occur when investors least expect it. (see below) Holding fast with an appropriate portfolio was the best approach throughout these periods. Below are three insights that can provide perspective on staying invested and diversified during periods of uncertainty.

1 There are growing public health concerns over the new COVID-19 variant

Investors have experienced multiple waves of COVID-19 during the pandemic. Still, the most impactful was the first wave when the economy was shut down. Subsequent spikes, including due to the delta variant, have not even come close in terms of their economic and market impacts.

2 Even before this, cases were rising as winter nears

Cases have been rising even before omicron due to the colder fall and winter months. Despite this, economic activity has remained solid and job gains have accelerated somewhat.

3 Diversification is still the best approach for navigating the years ahead

Whether or not the latest variant of concern becomes a serious public health and economic issue, diversification and staying invested are the best ways to invest through this evolving endemic. This was true during the initial market pullback last year. While the past is never a guarantee of the future, those investors who stayed focused were rewarded within a matter of months.

The bottom line? Investors ought to keep calm and invest on through the omicron variant despite worrisome headline news and increased market turbulence.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.