How the Israel Hamas War Impacts Investors

The war between Israel and the Palestinian militant (terrorist) group Hamas over the Gaza Strip has been noted as “the worst attack on Jews since the Holocaust in WWII,” and “comparable to September 11th,” with already near 3,000 deaths plus hostages in the first week. This is horrific and heart wrenching, no matter your color, religion, race, or political agenda.

The surprise attack on Israel incepted October 7th on the cusp of the Israel/ Saudi Arabia peace talks, brings back memories of the Yom Kippur War between Egypt, Syria and Israel in October 1973 during then President Nixon’s term in the White House. This 50th Anniversary of the October War may bring back recollections of the Arab oil embargo of 1973 where OPEC destabilized our economy by causing fuel shortages that quadrupled oil prices and created historic long lines at gas stations fueled by panic-buying.

The human tragedy and geopolitical implications aside, it’s vital for investors to consider what may or may not trigger market and or global economic instability from these events. Consider the stock market had a strong start to the first half of the year despite a slowing economy, the ongoing Russia/Ukraine war, a banking crisis, the debt ceiling debacles, elections in Washington, the auto union workers (UAW) strike, lingering inflation, China economic slowdown, record high interest rates, and a hawkish Fed.

Should you now bail out of stocks and buy a larger mattress, gold, crypto, annuities and structured products? The short answer is no. Consider that the market is not always rational and at the same time most economists are never correct with their forecasts as we have seen over the past year. Always remember that the stock market is looking forward by 6+ months while the data confirming a recession or other factors utilized by the Fed and economist is looking backwards.

What May Not Occur

Financial markets have to price the new headlines and carnage periodically, we get that. Yet, unfortunate as it is, markets don’t really focus that much about economic supply/ demand in Israel (28th ranked GDP in 2022, per the World Bank) or near half of one point of world GDP. One of Israels biggest exports are cut Diamonds, with little effect to major global economic headwind contributors such as crude (OPEC), or semiconductors (Taiwan).

Not to say Wall Street is insensitive to chaos, but the global engines of industry, stocks and tech keep running in the background to keep the world running despite the headlines as the VIX “fear” index has not moved up much at 17, while the S&P 500 index has advanced near 3% over the past week.

What will not happen is an OPEC oil embargo. OPEC now has a more politically conservative approach to their actions than decades ago before the green energy movement, and now that America has become a leading producer and exporter of energy. The 13 OPEC countries members are Algeria, Angola, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, the Republic of the Congo, Saudi Arabia, the United Arab Emirates and Venezuela.

Getting to 150-200 WTI crude oil resulting from Israeli -Iranian direct confrontation and war seems unlikely with the US military involvement. Even the thought they would fly missiles at each other for the next month is remote thinking.

What May Occur

Getting above the 100 WTI crude oil mark may be likely and cause more headaches for the Fed fighting inflation through 2024, but short lived after the war ends. With the Wall Street Journal reporting that Iran helped Hamas to plot the attack on Israel from Palestine, it may not be unlikely for Biden and America to put the squeeze on Iran’s oil exports through new sanctions after finally putting a freeze on the $6 billion in Iranian money he gave back to them a few months ago for a hostage release agreement.

Iran currently produces near 3.67 million barrels a day of crude, only 4% of the worlds total. Still, Goldman Sachs estimates that every 0.1-million-barrel-a-day cut to Iranian production next year would raise the oil price by $1, so this on its own could push up prices though 100.

What also may also likely happen in addition to rising crude prices may include a nosedive in Israeli stocks, as well as an increase in gold and treasury futures as a risk-off for investors. The direct impact on higher crude to prices at the pump will have to be seen as there are other factors at play. 545/ 730

Impact of Middle East Conflicts (Looking Back)

Unfortunately, for long-term investors, geopolitical risk is unavoidable. Without minimizing or trivializing the severity of this conflict, especially the humanitarian consequences, many investors will have questions and concerns about the impact on markets and on their portfolio in the coming weeks. Let’s dive into this by looking back at history through regional wars and their implications for the markets and the economy.

These events are difficult to analyze and their market outcomes challenging to predict. As a recent example, many of the predictions around Europe’s access to oil and gas following Russia’s invasion of Ukraine, fortunately, did not play out. So, while short-term traders may be tempted to guess the direction of oil prices, the S&P 500, and interest rates, it’s often better for long-term investors to hold a properly diversified portfolio and stay level-headed as events unfold.

At the risk of oversimplifying matters, the numerous attempts at achieving peace by the U.S. since the mid-twentieth century have been largely unsuccessful. While the Camp David Accords in the late 1970s and the Oslo Accords in the 1990s did improve relations and helped to end conflicts at the time, violence has erupted many times over the past decade.

The impact of regional wars on markets depends on the economy

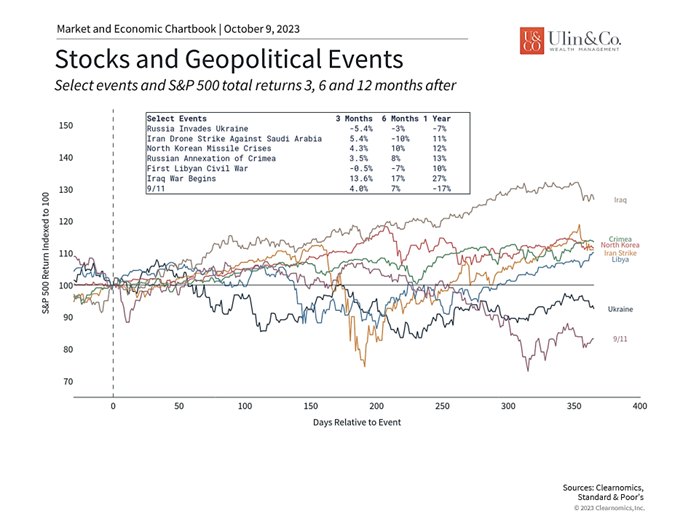

From the perspective of investors, it’s always important to separate feelings and beliefs around politics and global matters from portfolio decisions. As the first chart above shows, the impact that wars have on markets varies depending on the business cycle. Some events such as 9/11 and the ensuing wars in Iraq and Afghanistan were met with market declines. This was because these events coincided with the dot-com crash which, while unrelated, required years to stabilize.

In contrast, most of the conflicts since the 2010s, including wars in the Middle East, the annexation of Crimea by Russia, and the on-going nuclear threats in North Korea and Iran, were against the backdrop of an expansionary economic cycle. Jon here. While some of these periods experienced market declines over the following three to six months, economic growth tended to lift markets higher over longer time horizons despite geopolitical uncertainty. The history of strong bull markets in the 20th century across World War II, the Vietnam War, and the Cold War further underscores this point.

Keep an Eye on Crude

Of course, last year’s invasion of Ukraine by Russia is still ongoing and, so far, markets have not yet recovered their previous peaks. Again, this is largely due to the interaction with other economic forces, namely rising inflation, supply chain disruptions, and elevated market valuations following the pandemic.

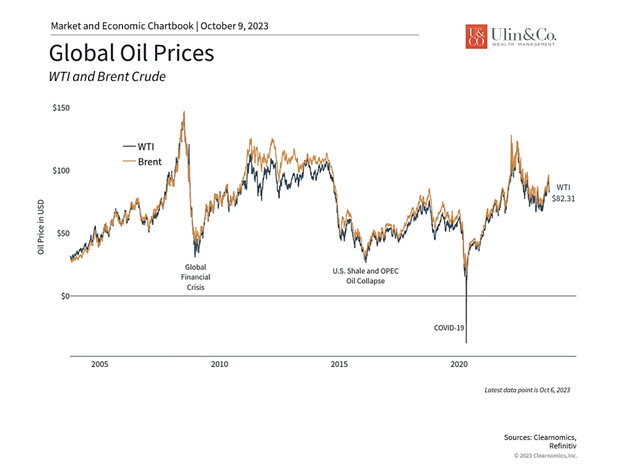

One direct impact of the Ukraine war and uncertainty in the Middle East is on energy prices. Oil prices did jump following the recent attack on Israel, with Brent crude rising from $84 per barrel to above $87, partially reversing the decline over the past two weeks from a high of about $97. However, this pales in comparison to the sharp rise in oil last year when prices approached $128. There was little direct impact on oil when Russia annexed Crimea in 2014, and even the 2019 drone strikes against Saudi Aramco by Iran and others, which knocked out 5% of global oil production overnight, saw only a short-lived reaction in oil markets. Thus, the impact on energy prices from Middle East conflicts is far from a sure thing.

Oil prices have risen following the attack on Israel

Perhaps the broadest implication for investors is the idea that markets depend on global stability, the rule of law, and business/consumer confidence. Regional conflicts, especially those that involve the United States and its allies, increase the “risk premium” on financial assets because the future becomes more uncertain. This uncertainty is the idea that even the possibility that markets and businesses could be affected is enough to hurt investor confidence. This is why many investors tend to focus on questions around global dynamics as the world shifts from the U.S.-centric, unipolar world since World War II to a multipolar one.

Many of these issues are deeply challenging and often theoretical. As such, their impacts on markets, the economy, and corporate activity are far from certain. History shows that it’s a mistake to make dramatic shifts in portfolios in response to geopolitical crises. Properly diversified portfolios, especially those built around long-term financial plans crafted in partnership with a trusted advisor, are designed to handle exactly these periods of uncertainty.

None of this is to dismiss or detract from the severity of the conflict in Israel, especially from a humanitarian perspective. While the situation will be closely watched as events unfold, investors should avoid overreacting with their portfolios.

The bottom line? While the hope is for stability in the Middle East, investors should maintain perspective when it comes to their portfolios. History shows that it’s often better to hold onto a diversified, properly constructed portfolio than to try to time the market due to geopolitical events.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.