There’s No Free Lunch When Investing through War & Inflation

Just when you thought it was safe to go outside from the pandemic, the Russian/Ukraine war has greatly amped up inflation, commodity and oil prices to new highs while helping to push the NASDAQ index down 20% into bear territory. Spending $100 at the pump for a tank of gas can truly be a shocker, but may get worse with America no longer being energy independent.

More frightening than gas prices, it does feel a wee bit like the Soviet Union is trying to come back from the dead under Putin. The Cold War between the USA and the USSR lasted from 1945 to 1989, ending under President George W. It was called the Cold War because neither country declared war on each other, but it had a significant effect on foreign policy.

While we’re a long way of returning back to the 80’s interest rates and fashion trends, it comes as no surprise to see gasoline at $5 per gallon and 7% Inflation. At the same time, the 10 year Treasury is yielding 1.86% and a 5 year CD 1.3%. It’s quite the quandary that salaries to investment income have not kept up with the cost of goods and services and inflation. Compared to a year ago, costs are now up 7.9%, according to the CPI while many bond indices are in the red.

Reaching for Yield

“If you can’t explain it to a six-year-old, you don’t understand it yourself” – Albert Einstein

A good portion of the calls we are getting from investors seeking help involves the search for income. Obtaining an 10% CD to help meet your monthly household bills is not going to happen anytime soon. Bitcoin and gold do not pay dividends. We remind investors of the Warren Buffet maxim “don’t worry about the income, worry about the outcome.”

Instead of utilizing a low cost, diversified, liquid portfolio, many impatient investors of all ages are reaching for the highest returning or yielding alternative, real estate, crypto, investment, annuity, and insurance products (allegedly as a hedge to the stock market) while ignoring other baked-in risks from liquidity and duration risks to actual loss of principal. While it would be remarkable to find a safe- FDIC insured CD to keep up with inflation and taxes in an alternate universe- the thought instead drives people to take swift action and do unwise things with their money that can often get them into trouble, not excluding scams. Many of these products are in fact sold not bought.

When attending a free-steak dinner workshop, remember that there is no such thing as a free lunch (TINSTAFL). If it sounds too good to be true, it usually is. Finance writer Raymond DeVoe Jr. notably said, “more money has been lost reaching for yield than at the point of a gun.”

On the other side of the coin, being too cautious can provide other challenges. Cash may be of little value except for the maxim to buy low and sell high- like portfolio rebalancing. As we will discuss below, you may be at greater risk to hold cash in today’s high inflation world than market risk over time.

The Fed, Geopolitics and Interest Rates

Interest rates have swung wildly in recent weeks due to the Fed, the conflict in Ukraine, and the spike in oil prices. The 10-year Treasury yield briefly exceeded 2% last week before falling back a bit. For those who may not watch interest rates closely, these changes may seem insignificant. But not only do interest rates play important roles for investors, savers, and borrowers, they also provide an important signal of the health of the economy and financial system. How do rates at these levels affect investors and what do they tell us about the market environment?

On a theoretical level, interest rates reflect expected economic growth and inflation. Record levels of inflation over the past year have created upward pressure on rates. After all, an investor who buys a bond will require a higher interest rate if the dollars they receive in interest and principal payments will be worth less due to inflation. Strong economic growth also pushes interest rates higher since investors could find alternative ways to invest their money for higher returns.

On a more practical level, investors tend to buy Treasuries and other lower-risk bonds during times of stress and uncertainty as we’re seeing today. This demand increases the prices of these bonds which lowers their yields, especially for bonds that reflect additional risks such as longer maturities. In this way, bonds help to balance riskier parts of portfolios, as we have seen during periods of volatility over the past decade.

Thus, there are at least two competing forces acting on interest rates today. On the one hand, inflation is forcing the Fed’s hand as it plans to raise rates beginning next week. It is widely expected that the Fed will lift the federal funds rate by at least one-quarter of a percent for the first time since before the pandemic. The market still expects up to six rate hikes this year, or nearly one every Fed meeting, although this is subject to change. By raising rates, the Fed’s goal is to contain inflation by gradually stepping on the brakes.

On the other hand, the conflict in Ukraine, sanctions against Russia, and the impact on oil prices is creating significant market uncertainty. Many stock market indices, including the S&P 500, Dow and Nasdaq, and have fallen into correction territory and interest rates have declined as a result. Oil prices have spiked even further with Brent crude now trading above $110 per barrel. The threat to economic growth is a reason for the Fed to keep rates steady while rising energy prices are a reason to raise rates to further combat inflation. This naturally puts the Fed in a bind.

However, it’s also important to keep the broader historical context in mind. While interest rates have risen since the start of the year, they are only back to levels last seen at the start of 2020 and near their peaks in 2021. (see below) Over a multi-year horizon, interest rates are still significantly lower. In fact, it’s still the case that interest rates have been declining since the late 1970s for a variety of reasons that have nothing to do with short-term crises. Technology, globalization, worldwide cash savings, and other factors have conspired to push interest rates lower decade after decade.

So, while interest rates do rise and fall within each business cycle, the overall trend has been lower across cycles. At the moment, high inflation and strong U.S. economic growth are expected to keep pushing rates higher over the long run. In the near-term, however, geopolitical risk is creating an environment of uncertainty. This means that the challenges investors have faced with low rates throughout the last decade may continue for some time.

For instance, for borrowers and home buyers, mortgage rates remain attractive despite increasing over the past several months. For savers, the challenge of generating sufficient income from cash and high-quality bonds will likely continue. This potentially means that finding alternative sources of income, from high-yield bonds to dividend-paying stocks, is still as important as it has been since 2008, especially with valuations more attractive today.

Ultimately, this period highlights the importance of staying diversified across asset classes. Stocks and bonds each play unique roles in the portfolio. In times of stress over the past decade, fixed income has helped to keep portfolios stable when investors need it the most. Below are three charts that help provide perspective on interest rates.

1 Interest rates have had a rocky few years

Interest rates have increased this year across the yield curve due to inflation and the Fed. Still, the 10-year Treasury yield is only near levels last seen in 2021 and 2020, and is still significantly lower than it was in 2019.

2 Rates are still low by historical standards

While rates do rise and fall during business cycles, they have been declining across cycles for 40 years. With inflation surging, driven in no small part by energy prices, this time could be different. Still, investors could face the challenges of low rates in the near term as market uncertainty continues.

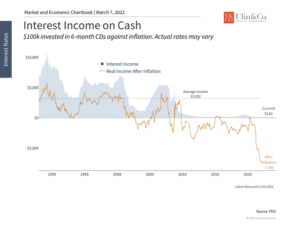

3 Portfolio yield is still scarce in this environment

One of the primary challenges of low rates is the scarcity of portfolio income. This is especially true once inflation is taken into consideration since this erodes the purchasing power of cash savings over time. This is an important reason for investors to stay focused on the long run by holding an appropriate portfolio that can generate sufficient growth to meet financial goals.

The bottom line? Interest rates continue to face significant uncertainty, creating challenges for portfolios. Investors ought to stay diversified across stocks and bonds and focus on the long-term trends when investing through inflation and war.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.