Investing Through Bear Markets: Mid-Year Outlook

It’s said the stock market is the only place things go on sale and people run out of the store screaming. Even If there is a mild recession through the current bear market, by the time you read the headlines on the aftermath, the stock market may already be churning up. Selling stocks when it feels the best and buying stocks when it feels the worst is easier said than done.

Disciplined long term investors may be excited to be put money to work this summer investing every month into their employer retirement accounts, while those in, or closer to retirement, with larger lump sum cash holdings may be getting off the sidelines and into stocks. We have mulled over the Vanguard study more than a few times discussing that lump sum investing beats dollar cost averaging about two-thirds of the time, even through bear markets. Putting skin in the game while the market is down will help you to take advantage of future returns and not have your cash deteriorated by inflation.

On the flip side, nervous investors absorbing ominous opinions and forecasts from the news experts to friends on social media have greatly elevated their own anxiety and thoughts of cashing out, fueled even more by the near 1000 point daily market swings of the S&P 500 index. This time is different and unexpected by all measures. At the same time investors’ behavior never seems to be different, if not worse, from the PTSD symptoms of bear markets past.

Jon here. Consider it’s all a matter of perspective. This week’s WSJ headline notes “Consumers Say 2022 Is the Worst Economy Ever” with the Misery index up sky high. Yet Americans are spending cash, traveling, going to concerts and out to dinner while not being over-leveraged like 2008, all while backed by historically low unemployment numbers (that would typically be high in a recession.) As the VIX “fear index” is not skyrocketing, perhaps we are all in fact a bit miserable about many things from inflation to government policy, but not panicking or fearful.

Not Every Recession is Great

As discussed in We’re Not In a Recession, the debate about whether we’re in a recession should be about real economic pain, not academic-style semantics, or whether we fit some technical definition. There is not much pain or gain right now- though underlying indicators are holding up.

While recession fears are spreading like wildfire, it’s helpful to remember that not every recession is as painful and severe as the Great Recession. In “3 Reasons It Is So Bad It is Good “ LPL Financial examined that “as bad as this year has been for investors, the good news is previous years that were down at least 15% at the midway point to the year saw the final six months higher every single time, with an average return of nearly 24%.”

Robots Driving Market Swings

The huge daily swings down and up are not fueled by clients calling up their brokers across the country and shouting at them to “sell everything.” We have discussed in past newsletters that there are studies indicating that algorithm-driven “quantitative investing” systems account for more than 60% of stock trades, especially in more volatile environments. Trading algorithms respond to the same evidence as humans and are trained to sniff out, yet quickly trade on broad indexes to individual companies if they recognize certain triggers.

More than just facts and numbers, it is perhaps more concerning that robo-algorithms can even gauge the words, speaking tone and inflection of a human, such as Fed Chair Mr. Jerome Powell, while identifying signs of how people may trade from his outlook. These quant-driven trades can end up triggering panic among humans to start selling stocks- thereby feeding a brutal cycle that leads to more quant trading.

7 Insights for the Second Half

There are no two ways about it – bear markets are always difficult as anyone who invested through 2000, 2008 or 2020 can attest. However, experienced investors know that bear markets occur periodically and are an important part of each cycle.

For those in a position to do so, these periods present opportunities to invest when valuations are attractive and position for future recoveries and growth. While the future is always uncertain, there is no doubt that all investors wish they had taken advantage of attractive prices during past bear markets. After all, the reason that investors are rewarded in the long run for owning stocks is the ability to stomach short-term uncertainty.

Below, we discuss several insights from the first half that will carry through to the remainder of the year. These include the relationship between stocks and bonds, inflation, the Fed, asset allocation and more. Those investors who can heed these lessons and stay disciplined will likely be better positioned to help achieve their long-term financial goals.

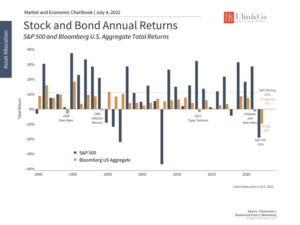

1 Stocks and bonds have both struggled this year

What has made this year challenging is that both stocks and bonds have performed poorly. This is because the sudden jump in rates due to inflation has hurt all asset classes at the same time. This bucks the normal pattern of bonds supporting portfolios in difficult markets.

At the same time, investors who stayed invested have still done well over the past few years. Since 2019, the S&P 500 has gained 51% despite this year’s poor performance. Investors who have stayed focused over the past decade have also done extremely well, despite numerous periods of volatility. This is why the most important principle of investing is still to stay patient and not try to time the market.

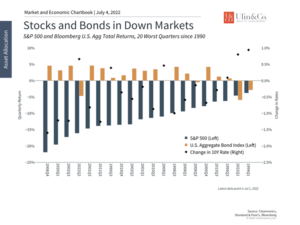

2 Bonds help to diversify portfolios except when rates rise

Of course, there are always reasons to believe that “this time is different.” In this case, the situation is unique because the inflation story has evolved over the past year. Rising interest rates as a result is why all asset classes have performed poorly.

While inopportune, there are many historical cases where similar patterns have occurred. The 1994 Fed rate hikes, the inflation worries in 1999, the 2013 taper tantrum and more were periods when rates spiked which hurt bond returns. In every one of these historical cases, interest rates eventually eased and bonds recovered. While the current situation is unique, there are still reasons to believe that bonds are still an integral part of a balanced portfolio. Even now, recession concerns are already pushing interest rates down, restoring some of this historical relationship.

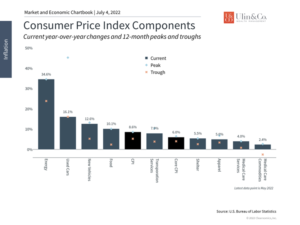

3 Inflation has increased across many categories

Inflation can be a tricky subject since it can be driven by many factors. Rising energy prices due to strong demand and the war in Ukraine have only made matters worse, especially for consumers at the gasoline pump. The fact that all prices have increased adds insult to injury and hurts consumer pocketbooks, reducing discretionary spending on other items. Recent data show that retail sales and spending have in fact declined.

In particular, gasoline prices near $5 per gallon has driven consumer confidence lower and raises expectations of higher inflation ahead. The primary determinant of gasoline prices is oil. This is why greater supply as geopolitics improve, and lower demand as the economy slows, could help to bring prices down in the second half of the year. If this happens, then inflation may begin to calm and markets may find a reason to be optimistic in the months ahead.

4 Valuations present long-term opportunities for patient investors

Stock market valuations are at their most attractive level in years. Rather than being close to all-time peaks last seen during the dot-com bubble, the forward price-to-earnings ratio on the S&P 500 is now back to historical averages. For patient investors, this presents an opportunity to benefit from this downturn in the years ahead.

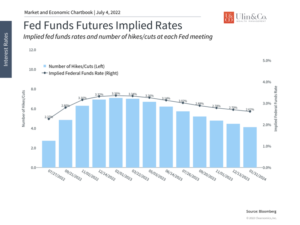

5 The Fed is tightening monetary policy

The Fed has ramped up its fight against inflation, stating that “the [Federal Open Market Committee] is strongly committed to returning inflation to its 2 percent objective” and “the Committee is highly attentive to inflation risks.” While the Fed cannot directly solve the supply problems across a variety of industries, raising rates and tightening financial conditions can prevent runaway inflation by softening demand.

This is why the Fed has accelerated its pace of rate hikes with the May increase reaching 75 basis points (three-quarters of a percent), the largest in 28 years. The market expects similar rate hikes throughout the remainder of the year with the fed funds rate hitting about 3.5% by year end.

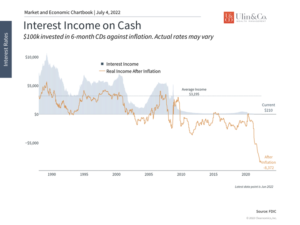

6 Cash is less valuable in inflationary periods

While it is tempting to “hide in cash” during times of market stress, inflationary environments are perhaps the worst times to do so. This is because inflation, by its very definition, erodes the value of cash. The consumer price index having increased 8.6% over the past year means that cash buys that much less in goods and services today. Only through investing appropriately can the value of money be preserved, even if it involves temporary challenges.

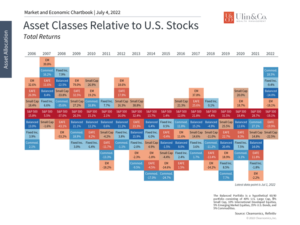

7 Diversification has helped this year

Almost all asset classes have performed poorly this year which adds to the struggles that investors and consumers have faced. Still, staying diversified has been the best approach to enduring this period and taking advantage of a possible recovery and future growth. A diversified balanced portfolio has still performed better than the overall market, and those who can invest today can take advantage of much more attractive valuations.

The bottom line? While investing through bear markets can be stressful and challenging, investors ought to view the current period with perspective. If inflation begins to ease, optimism may return to the market and economy. Taking advantage of the current market by staying invested and diversified are still the best ways to help achieve financial goals in the years and decades to come. Investing is truly about your time in the market and not timing the market. Still it may be prudent to continually update your outlook and strategy where warranted.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.