Investing Through Acrophobia, Hawks and Inflation

Last year US inflation hit its swiftest pace since 1982 as pandemic-related supply and demand imbalances, along with the Fed’s $120-billion-a-month asset-purchase stimulus program designed to shore up the economy by maintaining a zero rate goal, propelled prices up at a 7% annual rate.

Fed Chair Jerome Powell’s pivot to bond “tapering” last quarter is paving the way for a more agile Fed, with a dot-plot outlook of three or four interest rate hikes expected in 2022. After historically low stock market volatility last year with four nominal 4%-5% pullbacks, doomsday prognosticators are back in full-force again forecasting a rough year ahead for the stock and bond markets fueled by the anxiety of potentially higher interest rates, stock values and inflation levels.

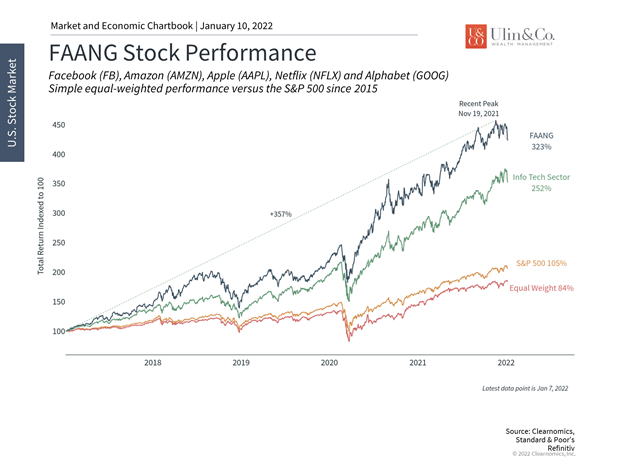

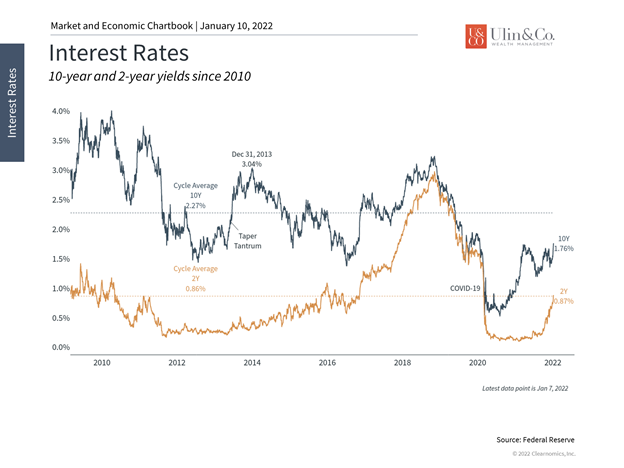

Right on que, stocks as evidenced by the S&P 500 Index have fallen a bit to start the new year as the prospect of a more hawkish Fed weighs on the markets. Areas with high valuations such as tech have been hit the hardest with the NASDAQ Composite down several percentage points. Interest rates benchmarked by the 10 Year Treasury have jumped to nearly 1.8%, the highest since before the pandemic, in just a matter of days causing bond values to decline.

Acrophobia Flying High

Acrophobia is an extreme or irrational fear or phobia of heights. It belongs to a category of specific phobias, called space and motion discomfort. Acrophobia sometimes develops in response to a traumatic experience involving heights, such as: falling from a high place or watching someone else fall from a high place. For investors this may bring back PTSD memories of the dotcom and housing market peaks and subsequent stomach- wrenching plunges.

It’s natural that the stock market will fall at some point without having a major bear-market crash. But whatever the reason for investors to lose their nerves – pandemic headlines, economic concerns, political uncertainty, Fed policy, etc. – the market eventually recovers.

Jon here. Trying to predict the exact timing and nature of future declines often backfires when taking short term action, doing more harm than good. When Fed policy and the economy is shifting gears through recovery, it is important for long-term investors to have the right perspective on stock heights and Fed intervention while staying invested in a disciplined portfolio, and not parachuting off an airplane mid-flight.

Hawkish Fed and Inflation

Heading through the junior year of the pandemic and third year of the current bull market, there are at least three key facts for long-term investors to remember.

First, although the calendar has changed, the underlying economic trends have not. After all, long-term investors construct their portfolios not based on which assets have done well over recent weeks and months, but based on what will likely benefit from economic growth trends over quarters, years and decades.

Specifically, inflation is elevated just as it was for much of 2021. This is one reason disciplined investors may have spent months last year adjusting to a Fed taper so that when it finally happened, it was fully expected. Last week’s FOMC minutes confirmed that the central bank is worried about inflation and may thus begin to tighten faster. This will require investors to adjust once again. Still, many economists expect inflation to stabilize and perhaps decline in the second half of the year as supply chains improve and year-over-year comparisons ease.

Faster Fed rate hikes may be a short-term shock to markets but they usually signal the beginning, not the end, of market cycles. It’s natural for the Fed to begin hiking rates once the economy is back on solid footing, which it has been for over a year. The fact that many are calling for rate hikes to combat inflation only further justifies these moves. The Fed funds rate, which is still at zero today, reached 2.25% prior to the pandemic and even the most hawkish expectations are for the Fed to raise it to 1% by the end of 2022. History suggests that markets can perform well once investors adjust.

Second, stock market valuations in general, and growth/tech valuations in particular, are still lofty. The S&P 500’s forward price-to-earnings ratio sits at 21.7x which, although lower than at the start of the recovery, is still the highest since the dot-com era. The price-to-book ratio of U.S. growth stocks is now 10.7x compared to 4.1x for the overall Russell 3000 and only 2.4x for value stocks.

While valuations do not predict short-term stock market performance, they do reflect expectations for what has to go right. Today’s high valuations are due to the steep rise in prices over the course of this rally. However, earnings are also expected to grow quickly with S&P 500 earnings-per-share possibly reaching $220 in twelve months. As is always the case, the rapid economic recovery and robust earnings growth have been the foundations of this market cycle.

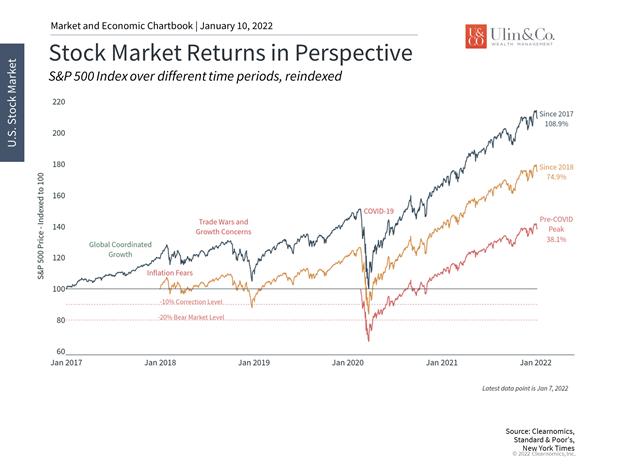

Finally, although the Fed policy changes and inflation tend to garner attention, short-term ups and downs in markets are completely normal. Even if this short-term pullback worsens, it is in the context of a significant bull rally that has lasted over 20 months. Staying patient and disciplined throughout these periods is ultimately why long-term investors are rewarded. After all, despite a never-ending list of concerns, the S&P 500 has gained 38% from the peak of the last cycle, 75% over the past 4 years, and 109% over the past 5 years. And while the past is no guarantee of the future, it is a reminder to not overreact to a few days of trading activity.

When policy is shifting, it is important for investors to have the right perspective on what has truly changed and what hasn’t. Thus, it’s important for investors to focus on the underlying trends. Below are three charts that help to put these points in perspective.

1 Areas of the market like tech have fallen this year

Markets are adjusting to a shift in Fed policy. This is weighing heavily on areas like tech and other growth stocks. However, history shows that the onset of Fed rate hikes is typically only just the beginning for bull market cycles.

2 Interest rates are rising due to Fed expectations

Interest rates have jumped on Fed expectations. This adds to last year’s increase due to the economic recovery and inflation. Rising rates are standard as the business cycle matures.

3 Focusing on long-term gains is the key to avoiding short-term mistakes

While shifts in policy naturally attract attention and result in short-term volatility, investors ought to keep these moves in perspective. Despite short periods of market pullbacks, including during the early stages of the pandemic, investors who have stayed patient have historically done well.

The bottom line? The market is adjusting to a more hawkish Fed putting the brakes on inflation. However, history suggests that this is both normal and positive at this stage in the business cycle.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.