Interest Rates are Shifting Gears and Heating Up

When driving a car, you may only have a vague idea of how the underlying engine mechanism works. Internal combustion engines can contain any number of combustion chambers (cylinders), typically between four and twelve. Yet you should know that the accelerator speeds you up and the breaks slow you down.

When driving a portfolio construction strategy, you may only have a vague understanding of the underlying factors (cylinders) that can drive bond values and rates up or down in a snap, including interest rate risk, credit/default risk, inflation, liquidity and market risks.

Short Term Rates

A bit opposite of the effects of the accelerator and brakes on your car, when the economy is decelerating the Fed downshifts short term rates (the Fed funds rate) into lower gears utilizing different tools (present situation) to help speed up the economy while encouraging lending and investing. At its January 2021 meeting, the Fed Committee (FOMC) said it would maintain the target fed funds rate at a range of 0% to 0.25%. When the economy is accelerating, the Fed works to “up-shift” short term rates into higher gears to help slow down inflation and the economy.

Long Term Rates

Long term rates are more market driven. Quantitative easing (QE) is an expansion of open market operations where the Fed buys massive amounts of securities to help keep longer term Treasury yields low while adding a huge influx of cash into the banking system. In 2008, QE increased total assets to $2.2 trillion. In 2020, it topped $7.2 trillion with “unlimited QE.”

We are a far cry from the 80’s music, movies, and fashion trends, when long term rates, benchmarked by the 10 Year Treasury were at a historical high near 16% in 1981 under President Regan. Fast forward 39 years to COVID19 where it fell to a historical low of .54% last August. The 10 Year Treasury has now spiked up 175% in just 7 months to 1.5% as of the first week of March while making the stock market and investors a bit jittery.

The recent massive bond sell-off by investors leading to recent rate spikes may be a sign that many believe inflation and economic growth will be arriving later this year (a good thing!) despite COVID19 effects and high unemployment numbers.

Are we concerned about this? No. Coming out of a global quarantine with long term rates having been near zero, this is expected, normal and healthy. The 10 year may even drift up closer to 2.5%- 3% by year-end as we saw with the 2013 “taper-tantrum” but not over heat much more with today’s aging population, innovation, unemployment and perhaps permanent changes to work and life in general due to the pandemic.

What Spikes in Interest Rates Mean for Your Portfolio

The sudden rise in interest rates has spooked investors and the markets. Fears of runaway inflation, the Fed losing control, and concerns over highly valued sectors have resulted in renewed stock market volatility. Of course, this adds to the ever-growing wall of worry around the pandemic, tech stocks and retail investor behavior How can patient investors keep all of these concerns in perspective as the outlook remains uncertain?

First, it’s important to understand the many factors that influence interest rates. In the short run, the buying and selling of bonds by investors (similar to the Fed QE discussion) can mechanically push rates lower or higher. Right now there is a selling frenzy.

Over time, through this buying and selling, interest rates settle in at levels that correspond to expectations on economic growth and inflation. Thus, interest rates can be both reflections and forecasts of economic trends. Rising rates signal the possibility of stronger growth ahead which is often positive for riskier assets like stocks.

So, although spikes in interest rates can be disruptive, especially if it impacts the borrowing costs of individuals and corporations, rising rates are usually a positive sign for markets once the dust settles.

Second, rising interest rates are thus normal and are not necessarily something to be feared by investors. They are consistent with the positive economic data over the past several weeks, including an improving job market, recovering industrial production, and the on-going rollout of vaccines. While some may be concerned about an overheating economy and accelerating inflation, these are unlikely to be the case today in our opinion.

However, this does mean that investors should keep a close eye on their asset allocations. Many fixed income sectors have declined this year as a result of higher interest rates and shrinking credit spreads, with the overall U.S. Aggregate Bond Index down 2%. (see below) Valuations for some bonds are elevated and finding income will continue to be a challenge for investors, just as it has been since 2008.

Finally, if the past two business cycles have taught us anything, it’s that Fed rate hikes are nothing to fear if they occur alongside an improving economy. In fact, the fear is often worse than the ordeal itself. For instance, the 2013 short-term spike in rates known as the “taper tantrum” was a consequence of investors over-reacting to then-Fed president Ben Bernanke’s comments. Although rates spiked for a few months, they eventually settled back down. The stock market continued to rally for years thereafter.

In general, the previous cycle showed that the Fed can maintain their monetary policy goals in the face of market skepticism. In fact, it kept the federal funds rate at the zero-lower-bound from the global financial crisis until December 2015, despite a recovering economy and rising stock market. Although it’s understandable that the market often scrutinizes the Fed, it’s often more important to focus on the underlying economic trends instead.

For long-term investors, all of this reinforces the need to stay focused on financial goals rather than daily market headlines. Below are three charts that provide perspective on recent rate spikes.

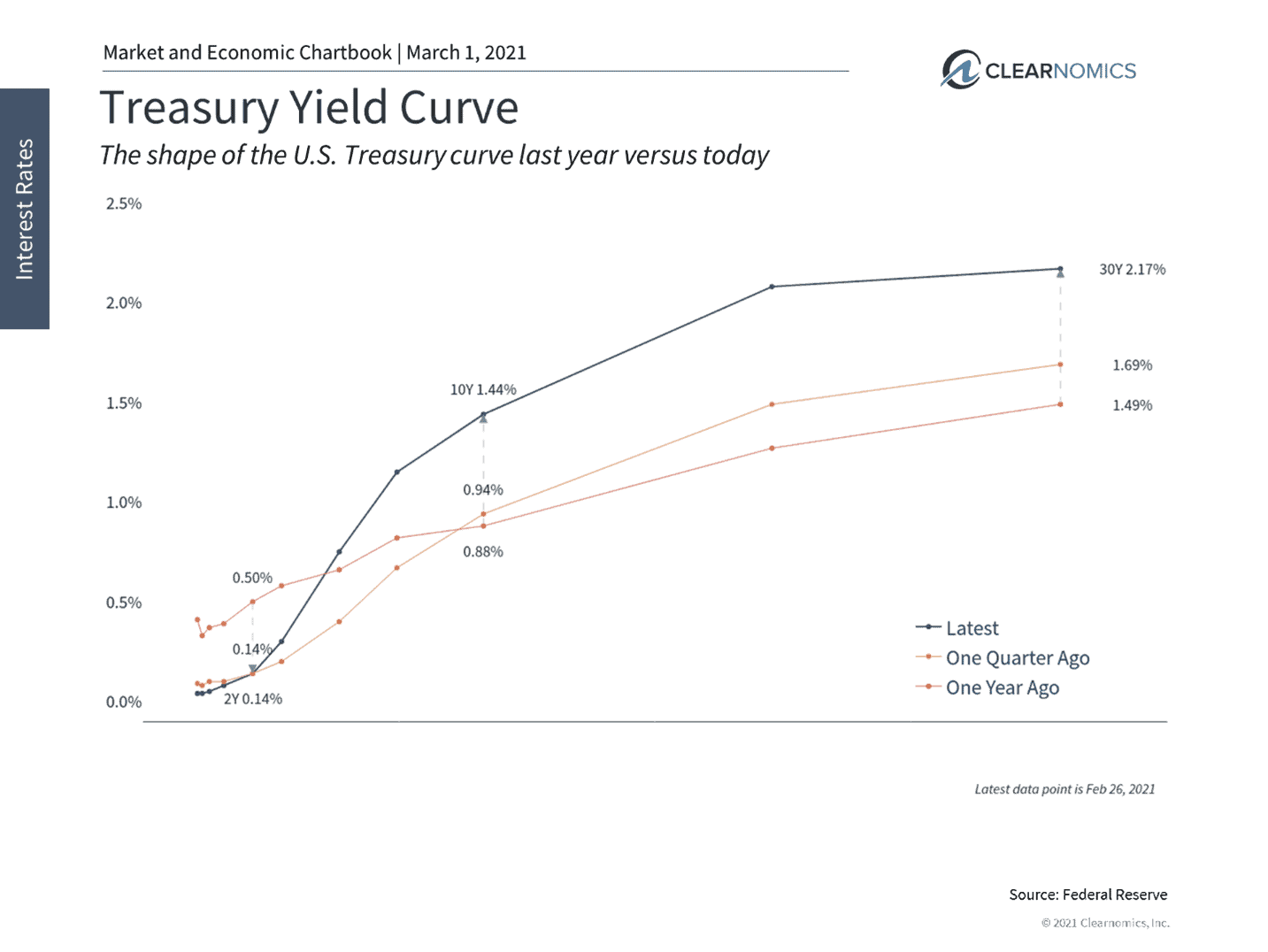

1 Interest rates have jumped in recent weeks

Medium and long-term interest rates have risen this year, stoking concerns over the Fed, inflation and more. It’s not unusual for longer-term rates to rise at the beginning of a recovery, as was seen in 2001 and 2009. Still, short-term shocks to rates can affect markets and the “real” economy by impacting borrowing rates for individuals and corporations.

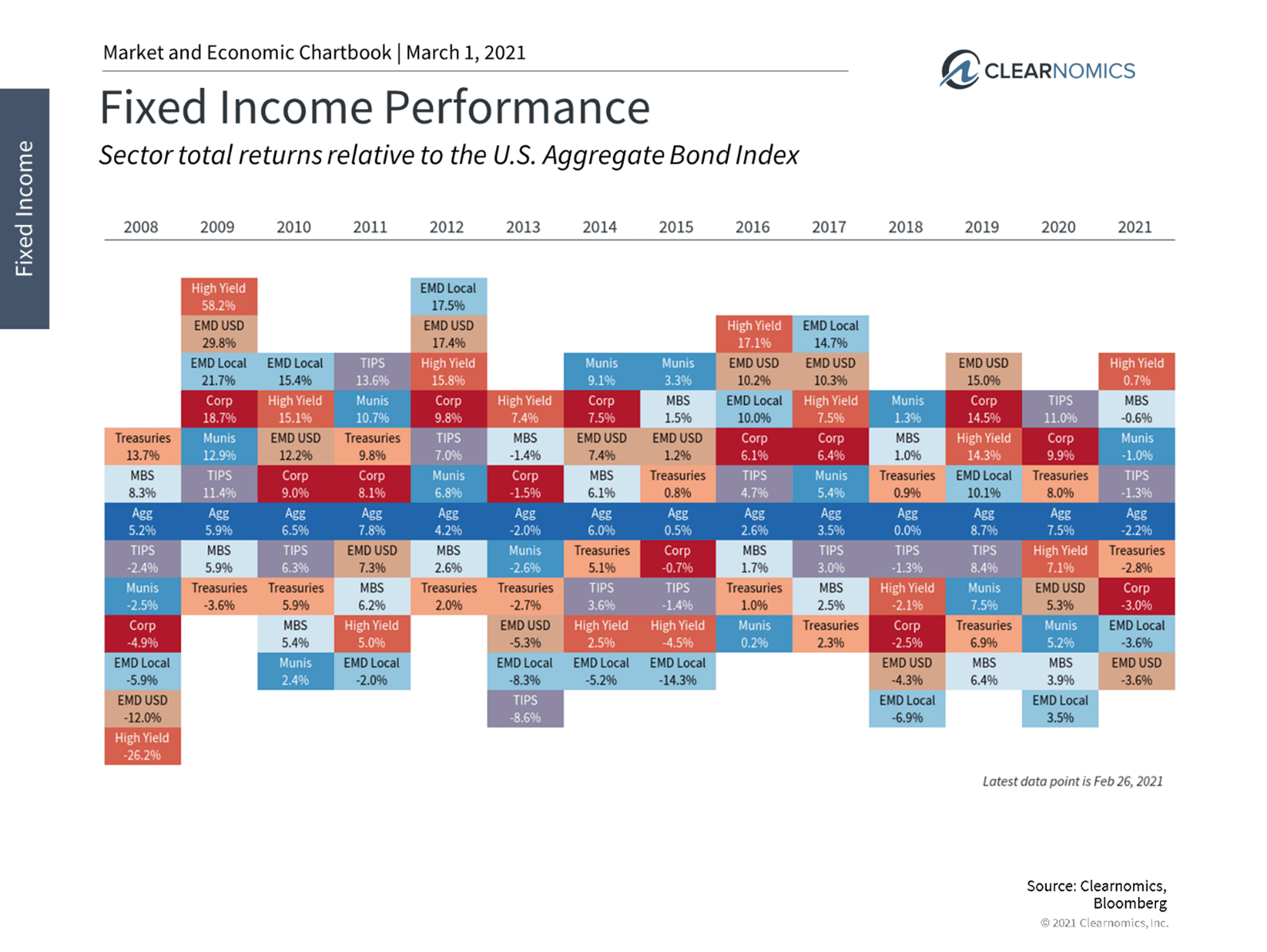

2 Many fixed income sectors are underperforming as a result

Rate spikes and shrinking credit spreads have resulted on a drag across fixed income sectors. The U.S. Aggregate bond index is down over 2% while Treasuries and Corporates have suffered losses year-to-date as well. It is certainly the case that lower yields and higher valuations make investing in fixed income more challenging.

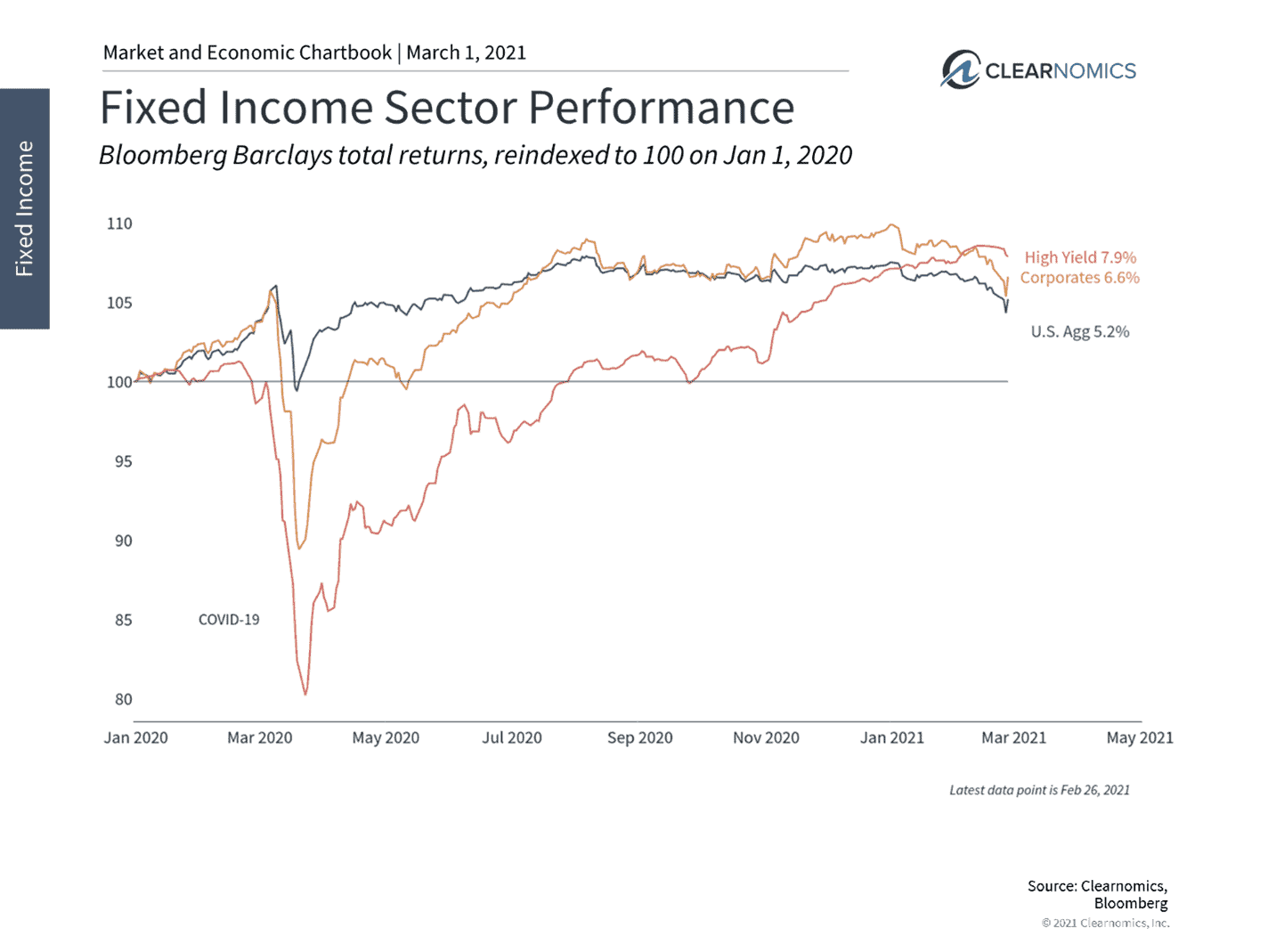

3 Still, fixed income helps to maintain portfolio balance in uncertain times

However, fixed income will likely still provide stability to portfolios in difficult market environments. Sticking with the most appropriate asset class allocation in order to achieve long-term goals is still the primary challenge for investors today.

The bottom line? Although spikes in interest rates can be disruptive, especially if it impacts the borrowing costs of individuals and corporations, rising rates are usually a positive sign for markets once the dust settles. Investors should remain patient, disciplined and diversified as the market adjusts to the economic recovery while maintaining a proper portfolio mix to help achieve long-term financial goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.