How Do Presidential Elections Affect the Stock Market?

The 2020 Presidential election race to the White House is in full gear with much of the headline controversy placing greater emphasis on the integrity, age and health of each candidate, more so than their proposed agendas.

Political science research has found that people don’t always vote in a way that reflects their policy preferences. A principal obstacle is lack of knowledge. In surveys, voters often can’t distinguish presidential candidates’ stances, even on critical issues or how policy changes may personally affect them our our nation.

On a short-term basis, election headlines have the power to move markets. How should investors react to what may be a bitter campaign? Should they fear either party winning the White House? Is it best to sit on the sidelines until the dust settles? Should you stay the course with your current portfolio strategy?

It’s important to separate personal and political feelings from investments and not make any rash short term moves that may derail your retirement. When it comes down to it, long-term investors should be wary of claims that one candidate or another will “kill the market” or “ruin the economy.” It’s likely that this has been said about every president in modern times across 14 presidencies since 1933 (7 from each party).

Who will win?

Jon here. Grappling to forecast who’s going to win the elections is as futile as trying to predict a future fashion trend, market crash, war, hurricane or Superbowl result.

The majority of stock market strategists polled by CNBC expect Democratic candidate Joe Biden to win the U.S. presidential race – but they’re significantly split on what the election would mean for the stock market. Then again, we learned back in the 2016 Presidential race, that polls and headlines may not be dependable barometers. With opinion polls, election forecasters had put Clinton’s chance of winning from 70% to as high as 99%.

As markets hate uncertainty, the worst outcome for the stock market for 2020 may be from a delayed and or disputed election result due to the rise in mail-in ballots from the pandemic.

The last time presidential election results were held up was in 2000 (George W. Bush vs Al Gore) when votes were so tight in South Florida that a recount was ordered due to “hanging chads.” The election was finally decided via a Supreme Court decision on December 12th, where our states 25 electoral votes ultimately decided the overall winner for the Oval Office. Meanwhile, the S&P 500 plunged nearly 10% and the Nasdaq plummeted 20% by the end of November.

Election year history

Investors often ask about the interplay between politics and the market: Do politics drive the market, or is it the other way around? There are many driving factors that correlate market performance more to what is going on in the world (market cycles, tech bubbles, wars, globalization, aging population, innovation) than to whom is President elect.

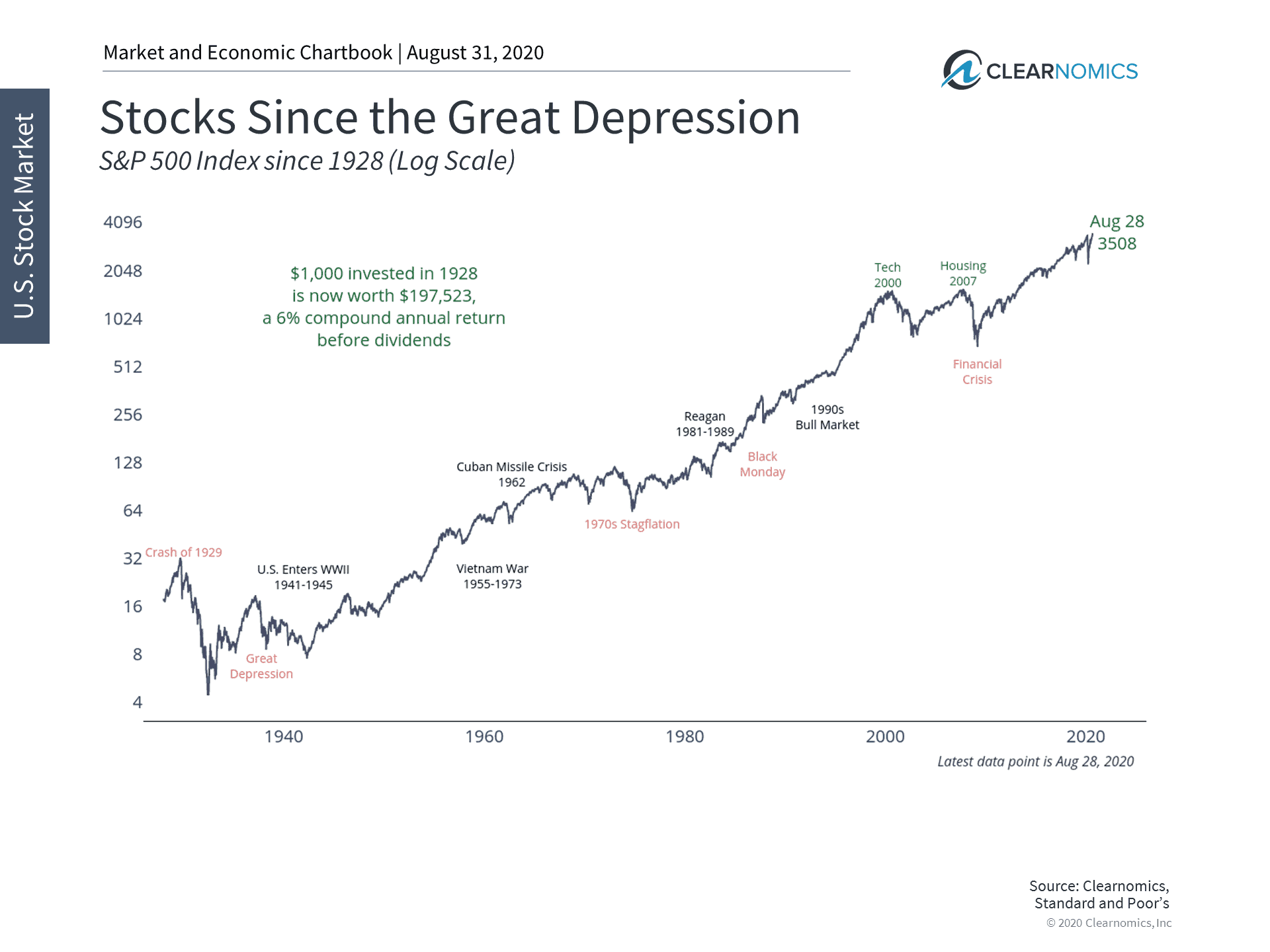

Looking back at the performance of the S&P 500® Index since 1928, the Schwab Center for Financial Research found that the market ended on a positive note in 17 of the past 23 presidential election years—or 74% of the time—with an average annual return of 7.1%.

Of the six presidential election years that coincided with down markets, most had obvious explanations. In 1932, the country was in the midst of the Great Depression; in 1940, the world was on the brink of war; in 2000, the tech bubble burst; and in 2008, markets suffered fallout from the financial crisis. In other words, market performance in those years likely had little to do with the presidential election or political party affiliations. And this year may follow suit, because of the COVID-19 pandemic and the resulting recession.

Where to invest

We strongly caution against mixing portfolios and politics. While trying to pick political winners is futile, working to “crystal-ball” election investments in your portfolio may be equally ineffective. Some investors are asking us on “what the best Trump or Biden sectors or stocks may be,” or telling us they are working to “cash out and instead sit on the sidelines” from their own research.

More than a few investors we spoke to recently are greatly concerned about the direct potential impact of policy changes (such as on income taxes and healthcare) which if either party won a house and senate majority could be issues to keep an eye on.

From a high level, it may be possible that under a Biden Presidency, renewable energy and infrastructure (industrial) sectors may benefit, while under Trump, infrastructure, traditional energy (oil, coal), financials, technology, defense and aerospace may excel, in our opinion.

As we do not promote market timing or stock picking, focusing your energy on executing and maintaining a diversified “all weather” portfolio – no matter who wins the White House in November -may be a more disciplined and less stressful way to proceed. Having an experienced fiduciary advisor in your corner to help develop and manage your investment and retirement plan, even better.

Presidents, policies and the stock market

You never know what you may get. In 2016, markets plummeted overnight when Candidate Trump became President-elect Trump, only to then reach all-time highs by the end of the year and rally until the COVID-19 crisis. During the 2012 midterm elections, political pundits focused on the Affordable Care Act (“Obamacare”) and how it would burden the economy. An investor who bought on election day in 2012 and held until election day 2016 would have experienced a 63% total return, or roughly a 16% average annual return. Throughout these examples and more, investors who over-reacted to politics rather than the underlying economic facts would have missed out on significant portfolio growth.

To be clear, this doesn’t guarantee that either candidate has sound economic plans or suggest that their policy proposals and values don’t matter. Government policy can certainly have an impact on economic growth, e.g. through corporate taxes and trade, and can also affect specific stocks, bonds, and sectors. However, for most long-term investors, it makes more sense to focus on economic and market fundamentals rather than day-to-day election coverage.

This is because the relationship between politics and the stock market is not a simple and obvious one.

While there may be conventional wisdom about how each political party may affect the economy, these views actually have a poor record when it comes to predicting stock market returns. Not only is economic policy difficult to evaluate, implementing and enforcing such policies take time (and approval across party lines via house and senate votes.) And even when investor predictions are correct, the market tends to price in these facts well ahead of time.

For instance, one reason for a significant surge in the stock market after 2016 was a recovery from the corporate “earnings recession” of 2015-2016. Similarly, one reason the market performed so well after 2008 and 2012 was that it bounced back from the global financial crisis, Eurozone crisis, and other problems along the way. It’s not a stretch to argue that these macro trends would have driven markets irrespective of which party controlled the White House.

This is perhaps best illustrated by the 1990s and early 2000s: the Clinton era happened to coincide with the tech boom while the dot-com bust coincided with the start of the George W. Bush presidency. It would be a stretch to argue that their presidencies caused the boom and bust, respectively.

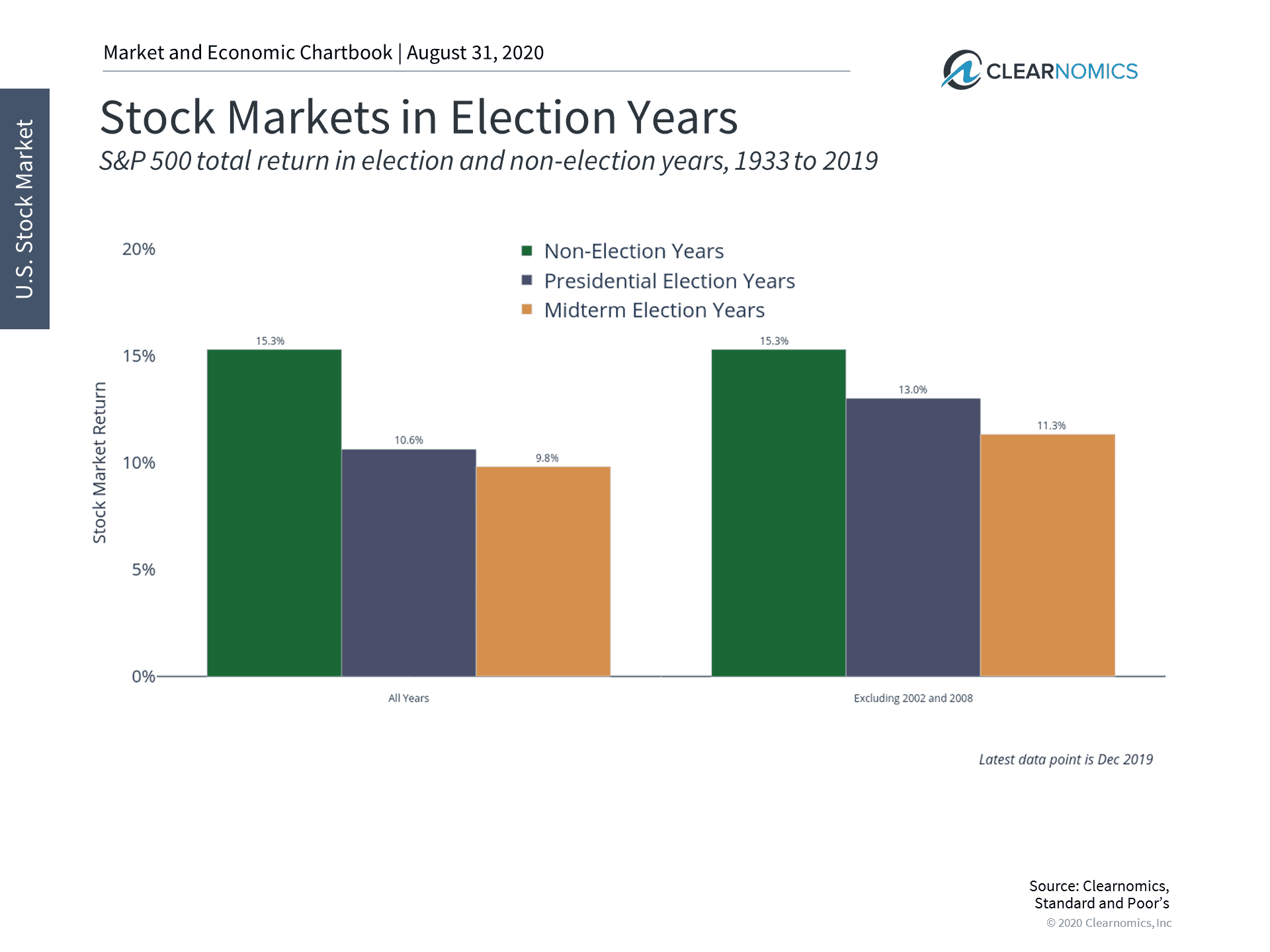

More importantly, even if there is a large difference in stock market performance, it’s clear that returns are positive under both parties. History also tells us that market returns are positive on average during election and non-election years alike. Jumping out of the market due to the outcome of an election, or simply because an election is occurring, is not a decision supported by history. (see below)

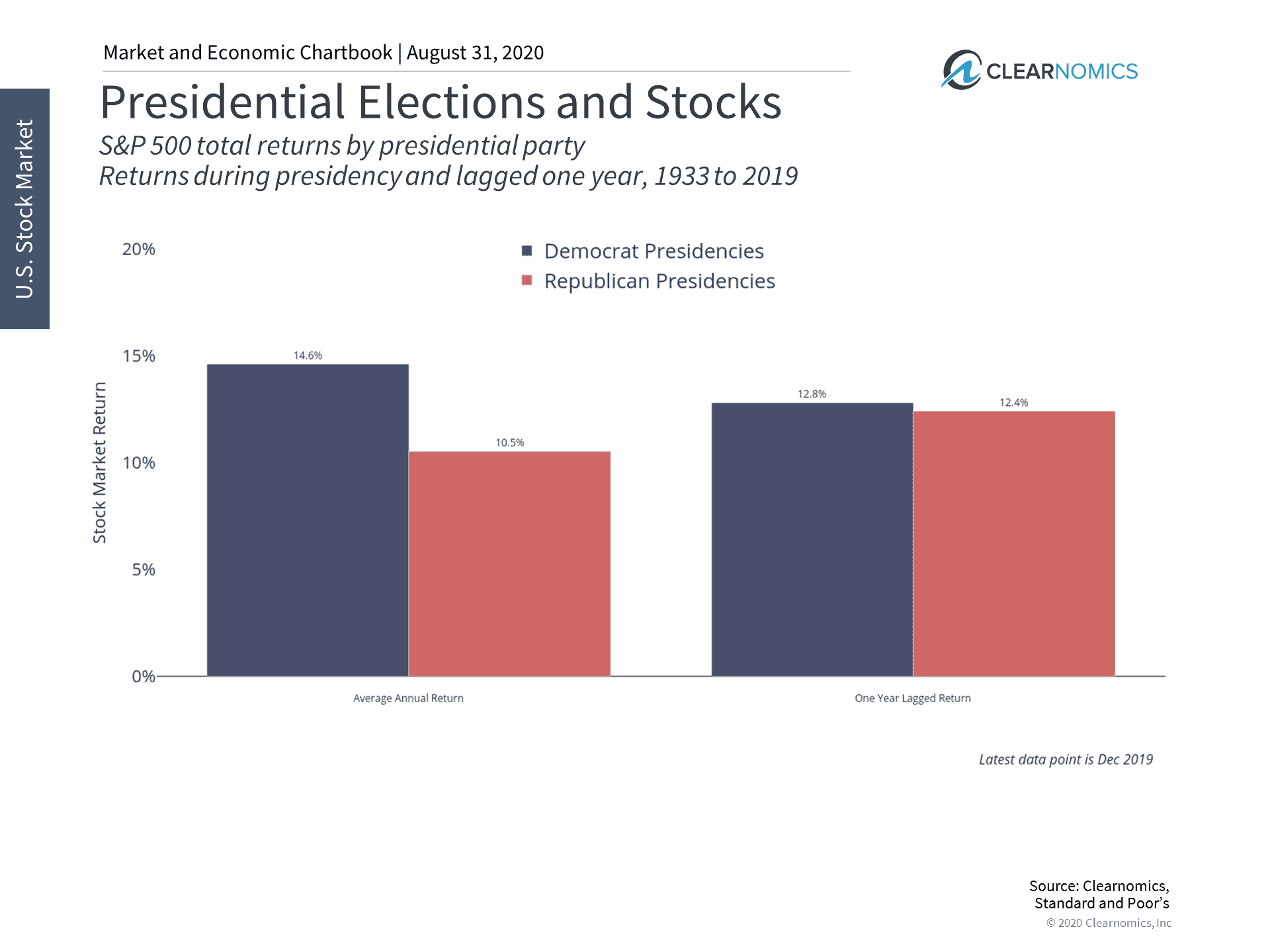

- The stock market has performed well under both parties

A simple average of stock market returns under Democrats and Republicans shows a clear advantage for Democrats. However, not only are there outliers including the dot-com bust and the 2008 financial crisis that happened to fall under Republican years (and arguably had nothing to do with which party was in office), but it can take years to fully see the effect of economic policies.

Incorporating a lag into the data shows that there’s hardly any difference in stock returns between the two parties. More importantly – stock returns are positive on average regardless of presidential party. Thus, making portfolio decisions on the basis of political preference can often backfire.

2. Market returns are historically positive in all years

While it does appear that non-election years tend to have higher returns on average than election years, this difference is small after excluding 2002 and 2008. Additionally, the fact that all years are positive means that avoiding election years is generally not supported by history.

3. In the long run, economic trends matter more than politics

Over the past 90 years, the stock market has trended upward due to innovation and economic growth. This has been the case despite global conflicts, financial crises, recessions and a pandemic while different parties have controlled the White House and Congress.

The bottom line? In the long run, it’s economic growth that matters more so than who is sitting in the White House. There is no simple way to predict stock market returns based on presidential elections. Long-term investors should stay focused while developing and maintain a liquid, low cost, balanced “all weather” investment strategy that matches their goals and needs while not emotionally over-reacting to day-to-day election coverage.

As citizens, taxpayers and voters, elections are extremely important. This is true regardless of which side of the aisle you’re on and which candidate you support. Your vote helps to determine the principles that will be upheld by the country in the years to come.

For more information on our firm or to request portfolio and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.