Goldilocks Soft Landing Possible By Powell

Investors are coasting through a Goldilocks parable, where the main character of the story is Fed Chair Jay Powell analyzing a bit more than porridge, chairs and beds. Powell has been aggressively hiking rates in order to help reduce inflation down to a 2% CPI by the end of 2024. He is hopeful to create an economic outcome that is not too hot, not too cold, but “just right” for a soft landing, all without triggering a recession and getting eaten by the bears.

With inflation greatly down over the past year since the high of near 9.1%, corporate profits improving, and consumer spending (consumption) holding on despite an uncomfortable high rate environment, it comes as little surprise that there is a low probability of another Fed rate hike in the current cycle, and near a 50% probability of a 25-basis point rate cut by March of next year as noted by Fed-futures, magnified by a slowing economy.

It may be a bit more conventional to think that the Fed interest rate cuts would not happen until inflation returns to the Fed’s 2% target or the risk of recession is elevated, but the Fed’s medicine appears to be working despite strong consumer spending. The most recent CPI and PCE inflation and spending reports appear to have the Fed on the right path to achieve its goals.

While there may be a growing number of financial experts agreeing with our optimistic viewpoints of a Goldilocks outcome based on actual data, just remember a soft landing, however, is very much like a fable. It is rare to non-existent in real life. The Fed has pulled off a so-called soft landing just once since World War two. Still, investors to professional managers are getting off the sidelines in droves to eventually join the party and help to sop up over 5 trillion dollars in cash vehicles.

As recently noted by a Market Watch headline, “Fed rate-cut hopes are fueling an ‘everything rally’ on Wall Street.” Gold, Treasury bonds, long-shot call options to bitcoin are rising. Some have described it as the latest leg of an “everything rally” fueled by a broad macro bet on Federal Reserve interest-rate cuts beginning early next year. Investors may be onto something as consumers drive near 70% of corporate profits, profits drive stock prices and stock prices drive market returns.

Corporate Profits and Dividends at Work

The stock market has been supported by a healthier-than-expected economy this year, generating returns that have helped many portfolios to partially recover from last year’s bear market. Investors now hope these growth trends will translate into stronger corporate earnings since, in the long run, markets tend to follow the same trajectory as profits. The following are signs that companies might begin to see improved profitability.

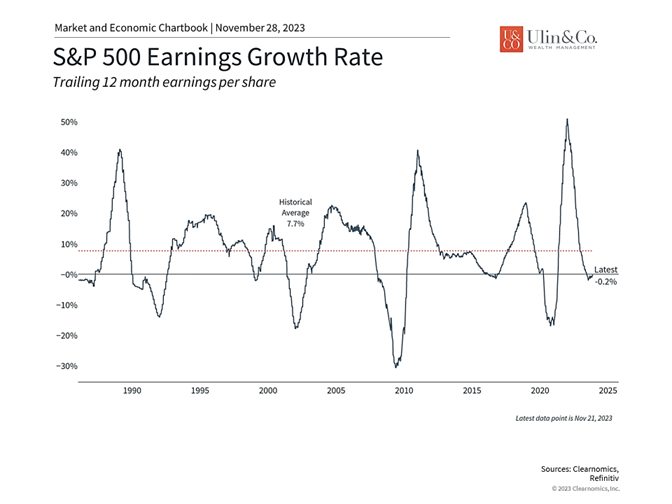

Earnings growth may have reached an inflection point

The third quarter earnings season is wrapping up with 94% of S&P 500 companies reporting their results. According to FactSet, 82% of these companies have had positive earnings surprises, yielding an expected year-over-year earnings-per-share growth rate of 4.3%. This is likely to be the first quarter of positive growth in a year, a notable inflection point that mirrors the surprising stability of the underlying economy. Consensus Wall Street estimates are for earnings to be flat this year at about $217 per share but to then rebound in 2024 by 11%. While this is somewhat at odds with economic forecasts for slowing growth in the coming quarters, it’s safe to say that any acceleration in earnings would be welcomed by investors.

As the accompanying chart shows, the growth of corporate profits has been slowing since its peak in 2021, but may have reached a turning point. Historically, large public companies have increased their earnings by an average of 7.7% per year, but this fluctuates alongside the business cycle. To oversimplify the earnings cycle, in good times companies increase their sales faster than their expenses, boosting profits and margins. In bad times, companies experience slowing revenues and cut costs to maintain margins. Better cost structures then allow companies to be more profitable once the economy turns around.

The stock market follows corporate earnings

It may seem obvious that profits matter and that, over long-time frames, they should reflect the value created by companies. Business owners, executives, and corporate boards have strong incentives to maintain and boost profitability and thus shareholder returns. When it comes to investing, there are three specific reasons why this matters to investors.

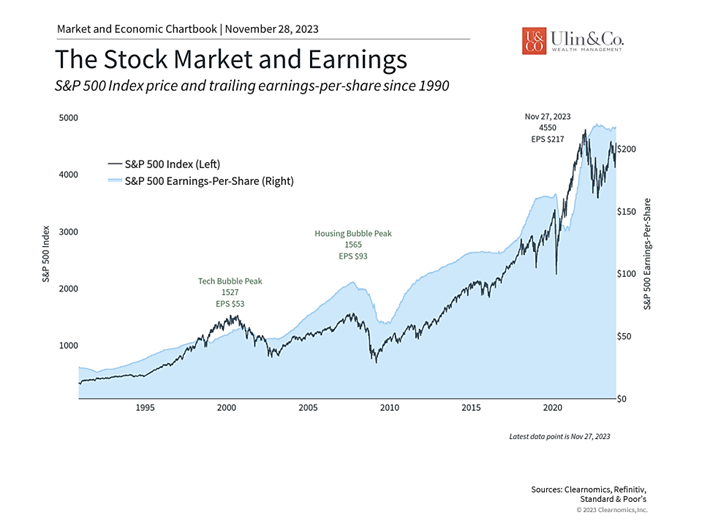

First, the stock market tends to follow corporate earnings in the long run. The accompanying chart shows that while the price and earnings of the S&P 500 do not line up perfectly, they follow the same broad trends. This is because economic growth boosts earnings which in turn pushes stock prices higher. So, while the economy and the stock market are not one and the same, the two are closely related through the performance of companies.

Second, whether the stock market is “cheap” or “expensive” depends not just on stock prices but also on corporate performance, the most important of which is arguably earnings. The price-to-earnings ratio, for instance, is simply the price of a stock or index divided by some earnings measure, such as expected earnings over the next twelve months.

What this means is that even if prices don’t change, increasing earnings will make the market more attractive, and vice versa. The current S&P 500 price-to-earnings ratio is 18.7 times next-twelve-month earnings, above the historical average of 15.6 but still well below the 2020 peak of around 23. If earnings growth does begin to accelerate, this measure could improve further.

Watch Dividends

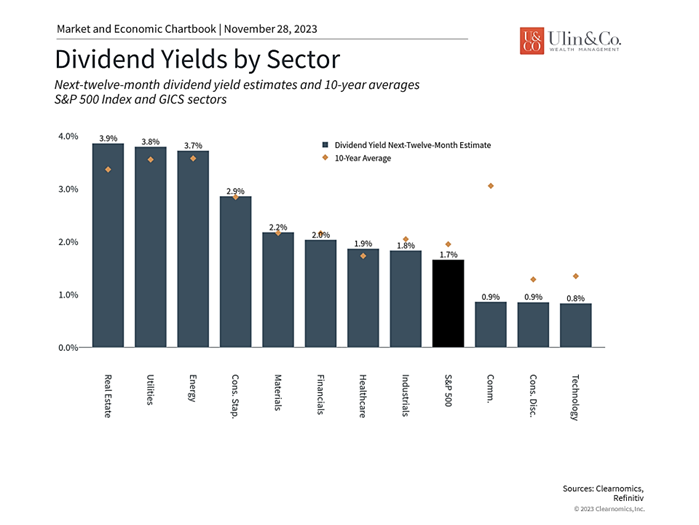

Third, profits support dividend payments. From a corporation’s perspective, dividends are a way to return cash to shareholders. In theory, if a corporation has no attractive investment opportunities, it makes sense to return cash to shareholders who can invest it themselves. In general, however, corporations pay steady dividends in order to attract investors, especially if they can grow these payments over time. Additionally, some companies have been holding on to more and more cash and some sectors pay relatively low dividends, especially across technology-related companies.

For investors, dividends are an integral part of total returns. Historically, dividends – and not price appreciation – were one of the primary reasons for investing. Today, everyday investors seem to focus mostly on stock prices except in cases where portfolio income is needed, such as for those nearing or in retirement.

While bond yields have risen this year and the market has been volatile, the accompanying chart shows that many sectors still have very attractive dividend yields but still a bit below bond and cash vehicle yields today. Not surprisingly, sectors that have underperformed this year, including Real Estate, Utilities, and Energy, can generate yields just under 4%. Sectors that have seen the most price appreciation, namely Communication Services, Consumer Discretionary, and Information Technology, also have the lowest yields. Thus, investors should not focus exclusively on recent performance or dividend yields. Instead, it’s important to diversify across sectors in order to benefit from all phases of the market cycle, especially if earnings do continue to turn around.

The bottom line? Economic growth drives corporate earnings which in turn support the stock market. Investors should follow these longer-term trends as inflation cools off and may lead to a soft landing, rather than day-to-day market movements and headlines, as they work toward their financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.

Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Adviser. IFP and Ulin & Co. Wealth Management are not affiliated.