Long Term Odds are in Your Favor When Globally Diversified

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.”

This passage from A Tale of Two Cities is an appropriate metaphor for 2022 through the polarizing issues surrounding the lingering pandemic, U.S. politics, oil and energy debacles, the environment, war, taxes, interest rates, record high inflation and the churning bear market.

Jon here. As this is primarily a financial newsletter, the buck stops here on the economy and wall street to help long term investors look at world through a unique lens (past/present/future) while making smarter investing decisions while staying the course through the eye of economic hurricanes in a disciplined manner.

Lessons Learned

Investing isn’t an IQ test; it’s a test of patience and character. It has been a wee-bit difficult year for new and old investors alike working through the first major market crash since the credit crisis led crash and great recession 14 years ago, while not overly weighing the 2020 pandemic-led crash and swift rebound. Stocks, bonds, crypto to real estate sectors are all in the red this year. Not even cold-hard cash provides much insulation or confidence through sizzling inflation.

While we continue to dismiss market timing while endorsing asset allocation and diversification methods to build wealth over time, people of all ages looking to make a quick buck or invest in a unique asset or product as a market hedge continually get separated from their money by speculating or market timing. If you can’t explain what you are investing in down to the paperclips, you may have been better off going to Vegas.

What are the Odds?

Investing for your retirement should not look or feel like Vegas nor should your results when being globally diversified with your portfolio. Casino games do not have good odds for players. There’s a reason for the phrase, “the house always wins.” Every casino game is designed to give the house a better edge. The odds of winning any of the most popular casino games in Vegas from roulette, slots, craps to blackjack average only about 50%. You can enjoy a casino and accept that it will cost you some money to be there. Likewise, you’ll spend money if you go to an amusement park.

Lottery odds are quite worse, though Americans spend about $72B on Lottery Tickets every year. More than a third of people believe winning the lottery is the only way they will ever retire comfortably. But the odds of winning either the Powerball or Mega Millions are roughly 1 in 292.2 million and 1 in 302.5 million, respectively.

Things That Are More Likely Than Winning the Lottery include; Car accident: 106 to one, Falling out of bed: 2 million to one, Lightning strike: 1.2 million to one, Dog attack: 118,776 to one, Shark attack: 3.75 million to one. Turns out swimming with the sharks is safer than petting a dog, driving your car, or sleeping in your bed.

Focus on Years To Build Wealth

Stock market odds look even better- over time. The key for long-term investors is that the stock market tends to rise over long periods of time even if it can swing wildly in the short run. Knowing that historically there has been a bear market every seven years since 1966 when looking at the S&P 500 index followed by a bull market for six years, or 86% of the time, may not make you feel any better or smarter, we get that. Still, everything in life happens in cycles and revolutions like the tides and planets.

Like many things, the power of compounding works slowly over time and positive returns over any individual day, month or year are never guaranteed. Market pullbacks and corrections may grab attention and headlines like an approaching CAT-5 hurricane, but it is the slow building of wealth in the face of never-ending market fear that works in investors’ favor over the course of years and decades.

Global Economy and Investing

The global economy has faced many setbacks this year due to inflation, the war in Ukraine, China’s zero-Covid policy, and many other factors. Unlike the U.S. which largely rebounded from the pandemic, many countries have faced a tougher road to recovery. The effects of high energy prices and supply chain problems have only added to these difficulties. Still, there are reasons to maintain a broad perspective on the global landscape, especially as these factors stabilize and inflation appears to be rolling down and off over time while the Fed is getting closer to their rate hike goal.

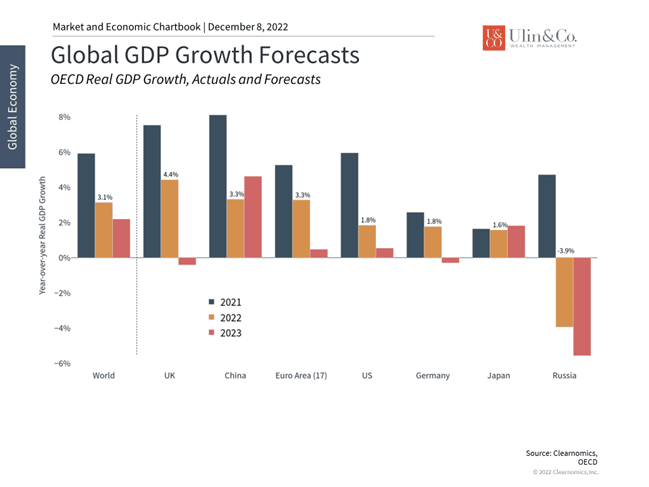

Global growth is expected to slow further in 2023 before recovering

While one of the core principles of investing is to be diversified, this is often easier said than done. Within the U.S., investors already have many factors to consider such as sectors (e.g. energy vs tech), styles (e.g. value vs growth), and sizes (e.g. small vs large caps). However, investors shouldn’t neglect to look beyond U.S. borders at international opportunities. Staying on top of developments across global economies, including trends in trade and geopolitics, can make investing exponentially more complex. Fortunately, diversification can benefit investors even without following events and data in every country. What helps is simply to focus on the right global trends.

For instance, simply understanding global growth expectations can be valuable. Twice a year, the OECD, an international organization consisting of mostly developed countries, releases new economic projections across regions and countries. Its most recent report highlights the challenges that still face the global economy. Overall, worldwide economic output is forecasted to decelerate from 3.1% in 2022 to 2.2% in 2023 (see above.) These numbers represent significant declines from 2021 when many economies were roaring back from the pandemic and before inflation began surging. There are a few important points to note from these forecasts.

First, while growth is expected to slow, few major regions and countries are anticipating recessions (i.e. negative growth). Even where recessions are expected in major countries, the declines are small and not on the scale of 2008 or 2020. This is true even in Europe which is on the front lines of the war in Ukraine and has been heavily exposed to rising energy prices. So, although growth in the region will be meager, dragged down by countries like Germany, it could also be supported by growth in countries such as France, Spain and Italy.

In contrast, China might experience re-accelerating growth if it begins to ease its Covid policies, allowing its economy and manufacturing activities to fully reopen. This is also true in Japan which has experienced only modest inflation, unlike most other parts of the world. Other major countries in the region, including Korea and India, are expected to see relatively steady growth. Unsurprisingly, Russia is the outlier and is expected to shrink by 3.9% in 2022 and 5.6% in 2023 due to the heavy toll from its military campaign.

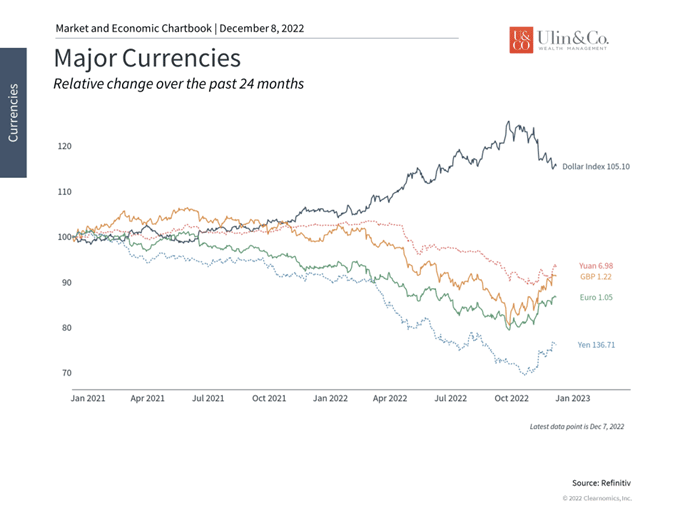

Major currencies have reflected economic weakness in many countries

Second, these forecasts also suggest that growth could rebound again in 2024 once the economic shocks of the past year begin to fade. Based on this, nearly all economies are expected to experience positive growth in 2024. While multi-year forecasts should be taken with a grain of salt, they suggest that many economies can eventually bounce back from today’s challenges.

Third, what matters to investors is that, despite ongoing economic challenges, it’s likely that markets have already priced-in much of the current headwind information. After all, the inflationary and geopolitical pressures that have driven these trends have been on investors’ radars since the start of the year. In fact, any easing of these pressures could help to improve investment and valuation prospects.

For example, the U.S. dollar had been appreciating in value for much of the year until recently when the Fed confirmed that may begin to slow the pace of rate hikes. Many countries that experienced weaker currencies during this period may have had difficulty buying foreign goods including food and energy, exacerbating their inflationary problems. The fact that the dollar has weakened recently may provide some relief. For U.S.-based companies, a weaker dollar can be a welcome sign if it helps to boost foreign sales.

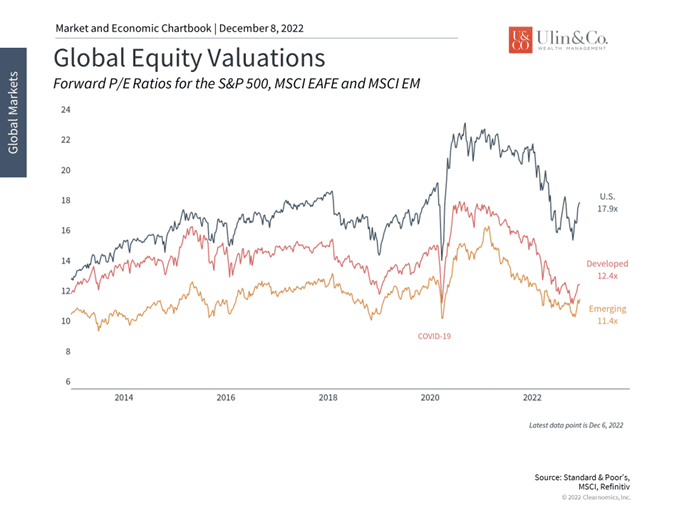

International valuations are attractive

Unfortunately, some investors may have grown discouraged with international investing over the last decade due to a series of challenges faced by developed and emerging markets alike. Even during the many years when international stocks performed well, the U.S. typically experienced outsized gains. For this reason, the U.S. has had significantly more expensive valuation levels over this period, as shown in the chart above.

However, the events of the last few years only underscore the need to stay diversified and to take advantage of more attractively valued investments. Predicting which region or country might outperform in any given year is not only difficult, but might be impossible. While the U.S. has done well over the past decade, the decade prior to this experienced significant growth and returns across international markets. Ultimately, this is not an either-or choice. Instead, what matters is maintaining a proper asset allocation that benefits from global trends across all regions, ideally with the guidance of a trusted advisor.

In this environment, it may take time for trends such as high energy prices and geopolitical tensions to be fully resolved. Investors should also not be surprised by unforeseen events such as those of the past few years. However, other factors such as Fed tightening, interest rates and financial conditions have begun to ease. As this occurs, poor economic performance and investor sentiment could shift in many countries. This won’t be an overnight process, just as the OECD’s forecasts suggest, but this is also why it takes patience to be positioned for long-term gains.

The bottom line? Investors ought to stay globally diversified to benefit from international investment opportunities while helping to increase their odds of success over the long haul.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetically used for illustrative purposes only and do not represent any actual investment.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment.