5 Market Insights to Help Drive Your Portfolio Through 2024

Robust consumer spending helped power the stock market and the economy through 2023 headlines like driving a Humvee through a financial hurricane crisis with additional hype from Generative AI, lower inflation, and Fed rate cut expectations factored in.

While the not overly surprising tech selloff over the past week after a monstrous 2023 tech rally kept Santa away from Broad and Wall, we continue to focus on market history, data and trends when developing clients’ long term investment strategies and not headlines, market maxims, predictions, or short-term market turbulence.

We are still on the less popular bullish consensus side of the street for 2024 as consumer outlays account for nearly 70% of the U.S. economy and GDP, and the consumer has been strongly holding on with progressive wage inflation and sturdy jobs/employment numbers.

January Indicator or Barometer

After a shaky start to the first week of the year, though a small blip on the overall radar, now the media hounds are predicting whether January will be positive month or not for the S&P 500. The most popularized version of the January effect, or January barometer, encapsulates the idea: “As goes January, so goes the year.”

As for whether the January Effect is outdated or hokey it’s crucial to consider the broader economic and financial landscape, as well as company-specific fundamentals, when making investment choices. The January Effect, like many market indicators, should be taken with a grain of salt.

Looking past January, as noted recently by LPL Research, statistically 2024 may turn out to be better than expected. Taking all the years since 1950, when the S&P 500 rose 20% or more (there were 19 of them) the index gained an average of 9.6% during the next year. Also considering that statistically bear markets arrive every 5 or 6 years, the odds are better on the upside the next couple of years.

Look out for Black Swans

Economic recessions can be caused by many different elements, including loss of consumer confidence, high interest rates, supply side shocks, asset bubbles bursting, commodity shocks and credit crisis. So far none of these seem to be greatly ahead of us for 2024. Three items to keep an eye on may include: (1) direct conflict with Iran that could affect oil production or supply and then inflation (2) China invading Taiwan that could affect semiconductor chip supply and inflation (3) The U.S Debt that is snowballing forward at $34 Trillion dollars and projected to hit $46T by 2028 (US Debt Clock.)

While Black swan events are characterized by their extreme rarity, severe impact, and the widespread insistence they were obvious in hindsight, some of the after-effects of the items noted above may not come as a big surprise if they do occur. The word is “if.” Our goal as disciplined investors is to have a fluid, moving investment management strategy in place that is “all-weather” utilizing different tools with cash, bonds, stocks, and alternative strategies to help investors minimize volatility and unexpected events when they arrive.

Ambiguity from November’s U.S. Presidential Election race, again looking like a rematch between Trump and Biden – along with the potential for major shifts in fiscal and monetary policy, may provide possible risks for markets. Still, going back in our DeLorean, consider that the S&P 500 index has risen 73.9% of presidential election years since 1929, according to Dow Jones Market Data. That is higher than the overall average of 64.9%, regardless of the party that wins.

5 Market Insights and Charts

The most important lesson of 2023 for everyday investors that we often discuss, is that news headlines and economic events don’t always impact markets in obvious ways.

Last year’s positive returns occurred despite historic challenges including the worst banking crisis since 2008, rapid Fed rate hikes, debt ceilings and budget battles in Washington, the ongoing war in Ukraine, the conflict in the Middle East, cracks in China’s economy, and many more. If you had shared these headlines with an investor at the start of 2023, they would probably have assumed there would be a worsening bear market or a deep recession.

Why isn’t this what happened? At the risk of oversimplifying, the key factor driving markets the past few years has been mostly elevated inflation. High inflation affects all parts of the markets and economy including forcing the Fed to raise interest rates, slowing growth, hurting corporate profits, dampening consumer spending, and acting as a drag on bond returns. This is exactly what occurred in 2022 but many of these effects reversed in 2023 as inflation rates improved.

Thus, the recession that was anticipated by markets a year ago has not yet occurred. While many still expect economic growth to slow this year, it’s not unreasonable to suggest that the Fed could achieve a “soft landing” in which inflation stabilizes without causing a recession. This is why both markets and Fed forecasts show that they could begin to cut policy rates by the middle of the year.

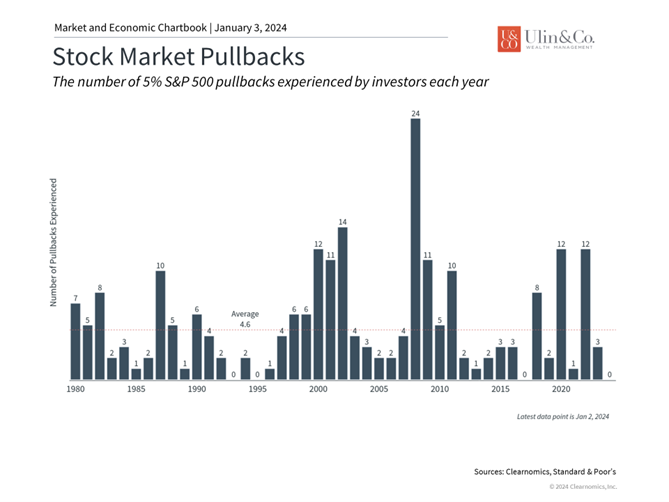

What does this mean for the year ahead? If 2022 was characterized by the worst inflation shock in 40 years, leading to a bear market in stocks and bonds, 2023 saw many of these factors turn around. These trends could continue if the Fed does begin to ease monetary policy. Of course, much is still uncertain, and investors should always expect the unexpected when it comes to market, economic, and geopolitical events. After all, markets never move up in a straight line and even the best years’ experience several short-term pullbacks as we saw last year.

The past year has shown us that it’s important to stay invested and diversified across all phases of the market cycle, rather than try to predict exactly what might happen on a daily, weekly, or monthly basis. Consider the following five key insights supported by our five charts that will likely be important for 2024:

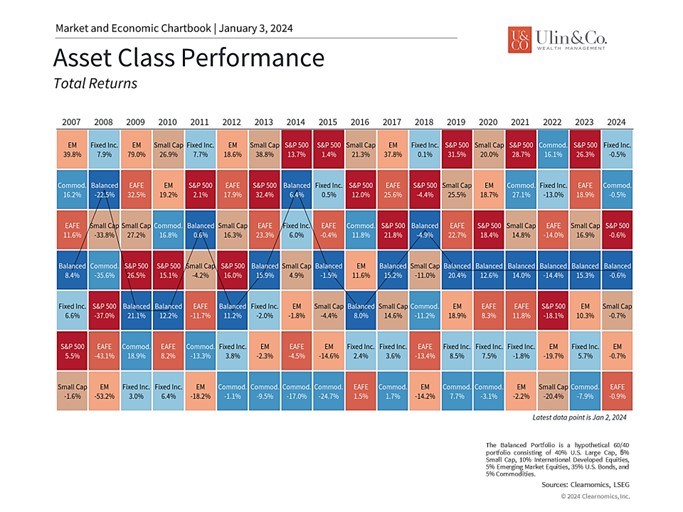

- Many asset classes performed exceptionally well in 2023

Strong economic growth and falling rates propelled many asset classes higher last year. Stocks reversed much of their losses from the previous year with a historically strong gains and bonds bounced back as interest rates fell in the final months of the year. Technology stocks, especially those related to artificial intelligence, helped to drive market returns as well, pushing the Nasdaq to a nearly 45% return. While the so-called “Magnificent 7” did double in value, other sectors also began to perform better as market conditions improved.

Most importantly, there are signs that earnings growth is recovering. Earnings-per-share for the S&P 500 are expected to have been flat in 2023, but Wall Street consensus estimates suggest that they could grow by double digits each of the next two years. While this will depend on the path of economic growth, any increase in earnings will help to improve valuations and support the stock market.

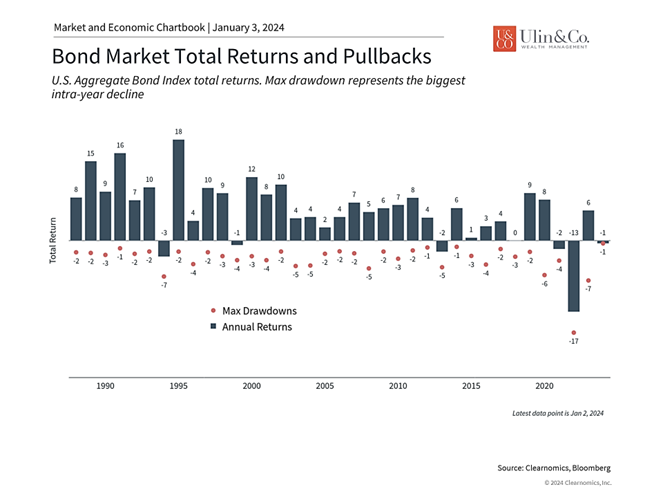

- Bonds have rebounded as interest rates have stabilized

Bonds had a much better year with interest rates rising through October then falling on positive inflation data. While bonds have not recovered their 2022 losses after a historic spike in inflation, recent performance shows that bonds are still an important asset classes that can help to balance stocks in diversified portfolios. This is true across many sectors including high yield, investment grade, government bonds, and more.

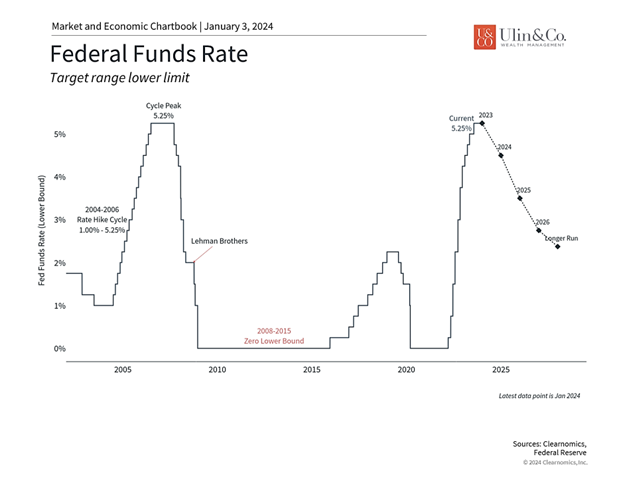

- The Fed is expected to cut rates in 2024

Improving inflation coupled with a historically strong job market have helped the Fed to achieve its policy objectives. While it’s too early to declare victory, many expect the Fed to begin cutting rates in 2024. The Fed’s own projections suggest they could lower rates by 75 basis points by the end of the year. Market-based expectations are much more aggressive and are expecting twice as many cuts. While it’s hard to predict exactly what the Fed may do this year, the fact that rates could begin to fall could help to support financial markets and the economy.

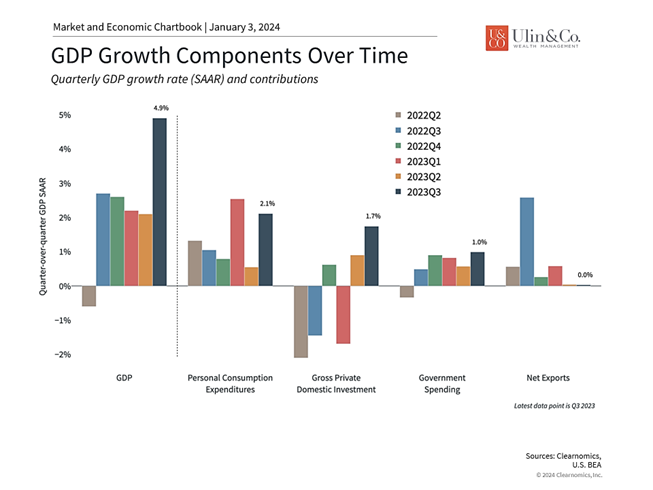

- The economy has been remarkably strong

The economy has been stronger than many expected over the past twelve months. GDP grew by 4.9% in the third quarter, one of the fastest rates in recent years. Consumer spending helped as did a rebound in business investment as the interest rate outlook stabilized. Unemployment is still only 3.7% and while monthly job gains have slowed somewhat, the labor market is still far stronger than economic theory would have predicted given the sharp increase in interest rates.

- The most important lesson for investors is to stay invested

While the past twelve months have been positive for investment portfolios, investors should not become complacent. Volatility in the stock market is both normal and expected with even the best years experiencing short-term swings, as shown in the accompanying chart. Rather than trying to predict exactly when these pullbacks will occur, it’s more important for investors to hold diversified portfolios that can withstand unforeseen events. The past few years are a reminder that holding an appropriate portfolio is the best way for investors to achieve their long-term financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.