Calibrate Your Financial Vitals While Charting in the New Year

There is no better time than the top of the new year to meet with your primary care physician and your financial advisor to check up on your physical and financial vitals, make any required adjustments and put a long-term plan in place for your health and wealth resolutions

Vital signs (vitals) are the four most important indicators of the body’s vital (life-sustaining) functions which include your body temperature, blood pressure, heart rate, and breathing rate. These measurements are taken to help assess the general physical health of a person, give clues to possible diseases, and show progress toward recovery.

Metrics in many areas of life help us to better visualize, benchmark and understand distance, pace and results, like when running long distances. Two essential financial vitals that can be fiscally life sustaining to help meet your goals over time include your investment and retirement policy statements.

Investment Policy Statement

Investment Policy Statements (IPS) provide specific guidelines for informed decision-making between advisors and clients, while serving as an investor blueprint. The IPS covers the investor’s age, time frame, risk tolerance, investment goals, asset allocation and financial objectives. The IPS should also cover the standards for selecting investments and the specifics of how – and how often the process will be monitored and managed.

Your IPS may change year to year based upon your age, beliefs, life events or a change in risk appetite. Managing your portfolio without an IPS can feel like driving across the country without a GPS or map. The IPS, along with a disciplined investment strategy, can help you to mentally and emotionally “stay on course” when volatility arises. Not verifying your IPS periodically can be as detrimental to your fiscal health as not checking your blood pressure.

Retirement Policy Statement

Retirement Policy Statements (RPS) are critical to develop and maintain whether you are aspiring to retire or living in retirement. With advances in healthcare and longevity, many people are experiencing a retirement longer than their working years.

The RPS should address the specifics of your household cash flow: your targeted income needs adjusted for inflation and taxes and how much of them will be covered by Social Security, pensions, annuities or other recurring revenue streams; your portfolio spending (distribution) rate; and whether you are utilizing an income-centric, total-return, or blended approach. Checking the pulse of your retirement income strategy is vital to help reduce the risk of outliving your savings.

Top 5 Economic Insights and Charts

With the ups and downs of the market and the on-going pandemic, the fact that we are approaching the third year of the business cycle through the junior year of the pandemic may surprise some people. After many disturbing headlines last year, one might expect that the market would have struggled.

Events during this period include the attack on the U.S. Capitol, the delta and omicron variants, the foreign policy disaster in Afghanistan, Fed tapering, challenges passing new fiscal bills and potential tax hikes, reddit trades, the rise of cryptocurrencies, China’s bursting real estate bubble, inflation at multi-decade highs, supply chain disruptions, and many more matters. As in most years, there was no shortage of reasons to be pessimistic.

Yet, the S&P 500 index had an excellent year in 2021. Even though markets felt choppy, last year was objectively one of the least volatile years on record. This all occurred even though the 10-year Treasury yield jumped to 1.5% leaving many major bond indices in the red last year with the Fed set to tighten policy in the coming months.

Jon here. 2020 and 2021 both underscore the importance of staying invested and diversified while consuming less headline news.

2020 and 2021 both underscore the importance of staying invested and diversified. The path of markets and the economy are difficult if not impossible to predict, even in the face of a once-in-a-century pandemic or skyrocketing inflation. These lessons will also likely be true of 2022 regardless of what transpires. Already, investors are worried about a first Fed rate hike by mid-year, the midterm election in November, and whether inflation will ease or worsen in the second half of the year.

In times like these, it can help to focus on the big picture. Although every market cycle is different, we are still quite early in this expansion. The underlying economic trends are strong with businesses growing, earnings rising and employees finding better jobs and higher wages. Controversy over these topics is what fuels the day-to-day market debate. Below are five key lessons of the past year that will no doubt carry forward into 2022 and beyond.

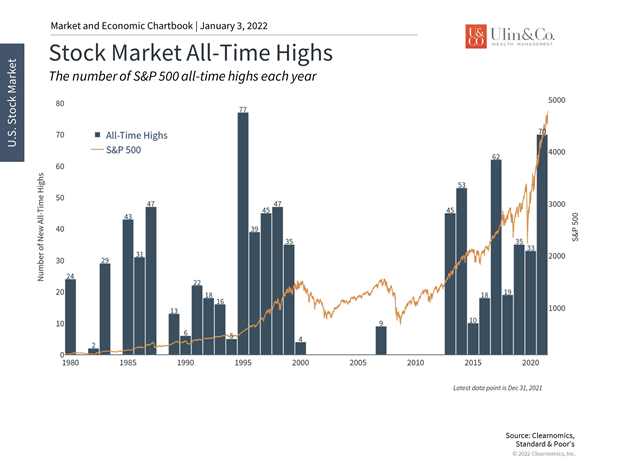

1 Markets can do well when investors least expect it

Despite ongoing concerns around a variety of issues, the S&P 500 achieved 70 new record closes in 2021. This is the most since 1995 during the early stages of the dot-com boom. This is not unusual – the U.S. stock market has historically risen over long periods of time and, by definition, spends much of each cycle at new all-time highs.

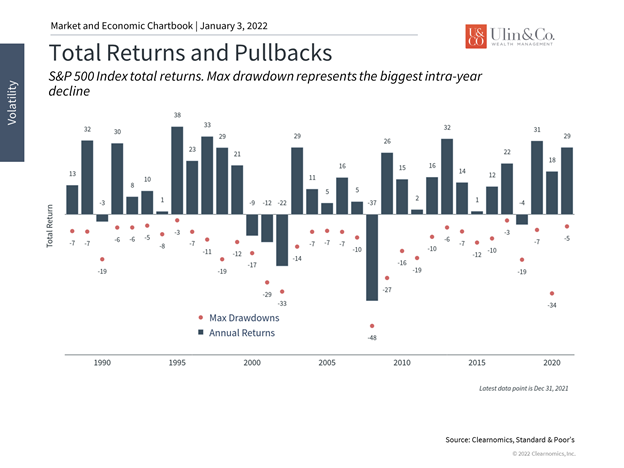

2 Investors should expect more uncertainty

Despite the stellar performance of stocks over the past two years, investors were constantly worried on a day-to-day basis. In reality, 2021 was one of the least volatile years on record with only a single 5% pullback that occurred at the end of the third quarter. Thus, there was a wide disconnect between how investors felt and how markets actually performed.

At the same time, investors should always expect greater uncertainty and volatility in the stock market. After all, the willingness to take appropriate risks is why investors are rewarded in the long run. Last year’s volatility fell far short of the average decline experienced by the S&P 500 each year.

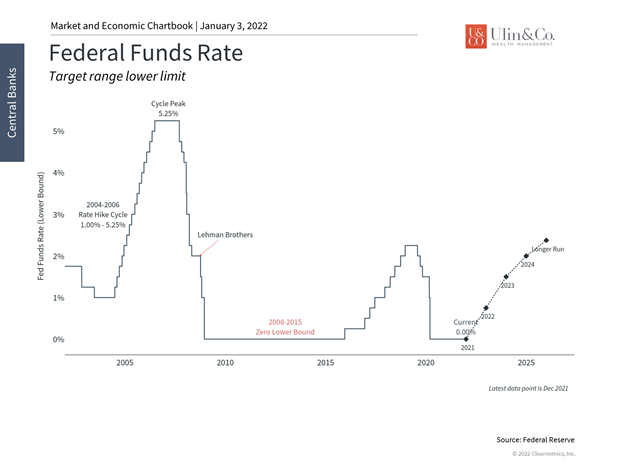

3 Fed rate hikes are only the beginning, not the end, of the cycle

The Fed has accelerated its taper process, which reduces the amount of bonds it purchases each month, and is expected to raise rates by the middle of the year. Although this will no doubt continue to drive market volatility, Fed rate hikes are normal and justified if the economy is doing well. Fed officials currently expect three rate hikes in 2022.

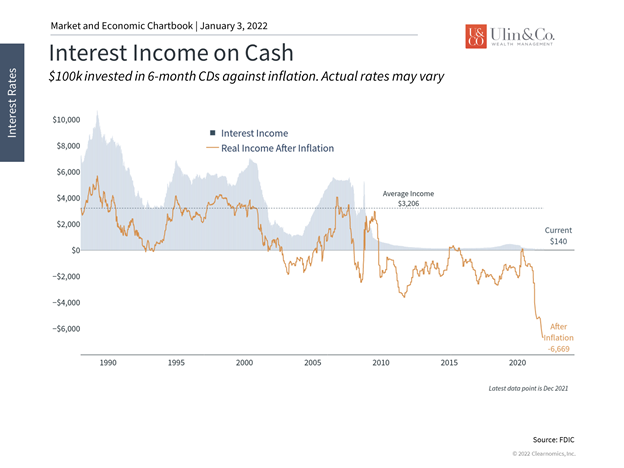

4 The value of cash is eroded by inflation

Rising inflation has a number of implications for the economy and investment portfolios. For many, however, the primary challenge is that inflation erodes the value of hard-earned cash savings. This underscores the need to properly invest this cash to generate a return in order to preserve purchasing power over time.

5 Many parts of the economy are booming

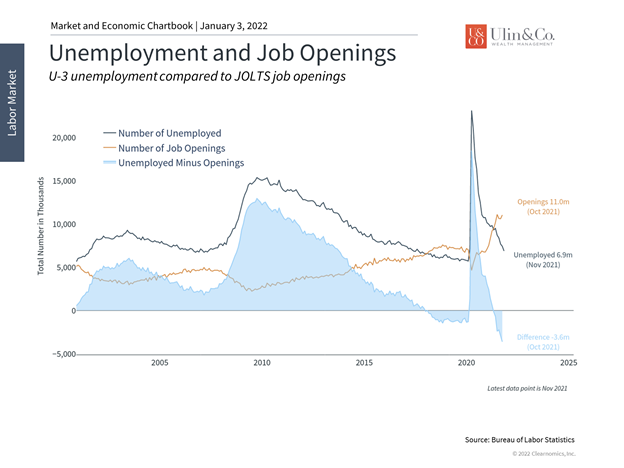

The economy is doing well. Businesses are hiring at a rapid pace and job openings exceed the number of unemployed individuals. Over time, workers who had previously given up may re-join the labor force while others may receive new job training. Ultimately, this is a positive sign for the economy in the years to come.

The bottom line? Rather than trying to accurately predict every outcome and incur trading mistakes, the better approach that has heled work for decades is to hold an appropriately diversified portfolio that can withstand these uncertainties, while benefiting from the long-term growth of markets and the economy. Doing so in a way that is aligned with broader financial goals, especially with the guidance of a trusted advisor, has stood the test of time.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.