Fed Rate Cut Roulette When the Economy is Strong

Believe nothing that you hear and only half of what you see, because many times the other half is an illusion. -Ben Franklin

Is it time to start popping champagne bottles now that the Fed finally initiated a new Fed rate cut cycle or an ominous sign of a future economic crash? The short answer is the former statement but to proceed a bit more prudently and thoughtfully. Put some trust in the “house” and Fed Chair Powell to potentially achieve an elusive soft landing.

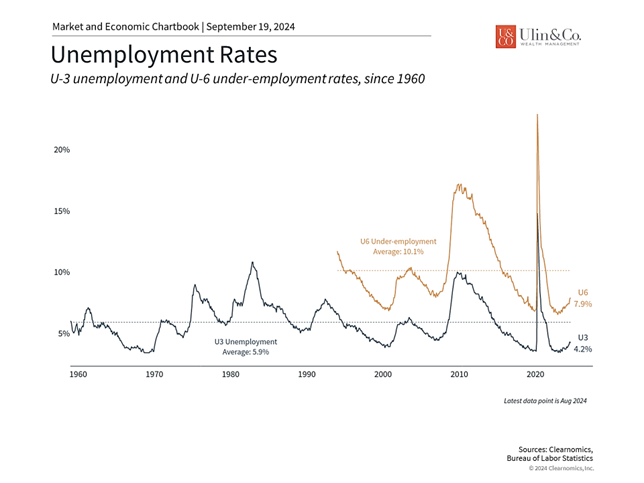

After an almost year of incorrect predictions on the direction of rate cuts, recessions and inflation by all the media experts last fall leading to an illusion of uncertainty, U.S. stocks had a remarkably strong first half of the year. The Fed finally cut rates by a half point last week, commencing what is expected to be a steady easing of monetary policy over the next year with a larger-than-usual reduction in borrowing costs that followed growing unease about the health of the job market.

Historically, the Federal Reserve has responded to economic crises with significant rate cuts. After the Dotcom crash in 2000-2001, the Fed slashed rates aggressively, from 6.5% to 1% by mid-2003. Similarly, during the Great Recession of 2008-2009, rates fell from 5.25% to near zero (0-0.25%) to mitigate the severe economic fallout. (see chart below) More recently, following the 2018 stock market downturn, the Fed reversed its tightening policy with three cuts just in 2019, reducing the rate by 75 basis points to cushion against a slowing economy right before the pandemic arrived to then cut again down to .05 by April 2020.

While the Fed recently emphasized taking a “cautious and data-driven approach” over the next year following the recent 50 basis point rate cut, bringing the Fed funds rate down to 4.75%-5%, the expectation of at least 8 cuts over the next year by prediction boards sounds a bit more aggressive like throwing water on a fire.

Soft Landing Not Free Fall

Did you know economists have predicted nine out of the last five recessions?

Many economists and students of the market may still have one last gasp of pessimistic air to cover, declaring that recessions typically begin after the Fed starts a new rate cut cycle. Still, correlation does not always indicate causation. The Fed controls the thermostat of the economy and decreases interest rates to help create more money flow into the economy from lending to investing. If you look back at history, many Fed rate cut cycles started after a recession had already started to help heal the economy. Today’s case of the Fed cutting rates before a recession is like administering a flu shot before flu season to help minimize getting sick.

While frequent rate cuts have often been linked with downturns, there is some optimism that the U.S. economy might see a soft landing this time around, akin to the Fed’s success in 1995 under Fed Chair Greenspan. The fact that earnings reports are projected to rise by 12% in 2025, though a wee bit over optimistic in our opinion, offers hope for resilience in the markets and could support the Fed’s goal of engineering a more gradual economic slowdown.

While it may take another year or so for core food, groceries and housing prices to come down, lower rates should spur spending faster than usual since they’re not aimed at rescuing a plummeting economy on the brink of widespread job losses. However, inflation may not again take off, and elevated asset valuations, like stocks, may limit the impact.

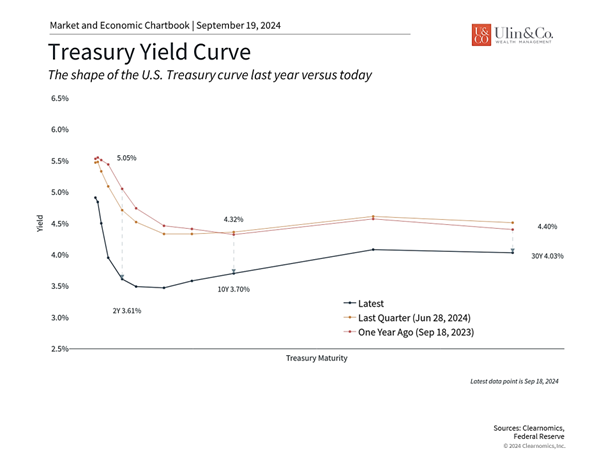

It’s important to note the Fed’s influence primarily affects short-term rates among banks, influencing the prime rate that guides credit card debt to home equity loans, SBA loans and other floating rate debt. The Fed’s control over broader interest rates is limited. Intermediate-term rates like the 10 Year Treasury impacts mortgage rates with typically a 1.5% to 2% spread between the 10 Year Treasury and 30-year mortgage rates.

FOMO to Fear of Heights

Fear is just an illusion. The more you try to understand and confront it, the more it fears you.= Wilbert Wynnberg

Jon here. We are getting some calls from clients wanting to deploy idle cash into the stock market from all the media excitement partially driven by the fear of missing out (FOMO). Other investors are calling in wondering if they “missed the boat with stocks at all new highs” and are worried that the bull market will diminish into dust regardless of the Fed pumping oxygen into the system along with a positive earnings outlook for stocks in 2025. While our clients moderate all-weather strategic diversified portfolios are on track with the Vanguard target benchmark returns of 11% year to date and 20% one year rolling, here we examine what may help stocks and bonds move past the hard landing discussion through 2025, or any landing for that matter as the ride on Wall Street continues.

We may likely revert over the next year to a more normalized low-rate cycle that we have experienced for over the past 15 years since the Great Recession while the euphoria of the recent sizzling high 5% yield on cash vehicles will fade. Locking in cash or investing in a CD today, with the expectation of renewal rates of around 3% by the end of next year, represents a decision influenced by opportunity cost, where the investor foregoes potential gains from participating in the current bullish stock and bond markets. Thus, the decision hinges on the investor’s risk tolerance, financial goals, and ongoing market conditions. In fact we are more bullish on bonds next year than anytime in the past decade as bonds gain value as rate decrease.

As some of the 6 trillion dollars in cash sitting on the sidelines along with even more currently sitting in short term CD’s gets redeployed back into the stock and bond markets, momentum will continue with new high highs. It’s important to understand that it is not unusual for the market to reach new highs during a bull market. By definition, since markets trend upward over long periods, bull markets spend much of their time at new record highs with the S&P 500 index averaging about 10%/year historically over decades with many times stocks hitting more than 30 new highs over the course of a year like in 2024.

The Magnificent 7 infamous ai/tech driven index underperforming the S&P 500 over the past 8 weeks may be a positive sign that the other 493 stocks in the S&P 500 are finally gaining traction as the bull market is broadening into other market caps and assets classes with lower inflation and rates that is also providing tailwinds to intermediate to longer duration bond sectors.

Fed Rate Cuts and Investing

In this uncertain environment, diversification is crucial. Investors should consider maintaining a balanced portfolio across equity asset classes, bonds, alternatives, commodities, real assets, and global markets to help manage risk while being cautious of over-reliance on U.S. stocks, given their elevated valuations. Additionally, the resurgence of bonds as a more attractive investment option due to higher yields and upside potential as rates fall, makes them a strong counterbalance to equities after being crushed over the past four years.

With many major investment companies predicting lower, if not middling returns for stocks over the next decade, diversification may be key to success moving forward, not being overweight tech, gold, oil, crypto or even cash instruments. The Feds interest rate decisions remain a focal point for markets. While the timing and size of rate cuts are the subject of debate, why the central bank is cutting rates and how the full rate cut cycle might play out are far more important. This is because the implications are not as straightforward as they might seem, and market expectations have shifted dramatically over the past year.

The rationale behind Fed rate cuts is important

Today, the Fed is not reactively battling a sudden economic collapse or financial crisis as illustrated through many of the past historical rate cut cycles but is instead proactively navigating a period of steady but slowing growth with improving inflation and a weakening but still strong labor market. In other words, the current situation is quite different from periods of emergency rate cuts. This is why the rationale for lowering rates matters when considering how they might impact markets in the months and years ahead.

As we discussed above, an applicable example is the 1994-1996 rate cycle, when the Fed raised rates to combat inflation fears before lowering them again shortly thereafter. Periods like these are often referred to as “soft landings” since the Fed arguably managed to cool the economy without triggering a recession. While there was a significant shock to the bond market – just as there was in 2022 – markets eventually responded positively to rate cuts once the economy stabilized.

The Fed’s task is to balance inflation and growth

The Fed’s dual mandate, as described in the 1977 Federal Reserve Act, is “to promote maximum employment and stable prices.” Today, this is interpreted as returning inflation to 2% while ensuring the economy continues to grow steadily.

These objectives can be in conflict, since faster growth should, in theory, result in higher inflation. From 2009 to early 2020, inflation was nearly non-existent, allowing the Fed to keep interest rates exceptionally low resulting in one of the strongest job markets in history. In contrast, the inflation of the past few years has required the Fed to make tough choices between price stability and jobs.

Fortunately, inflation has been improving since its peak in 2022. The latest Consumer Price Index report showed that prices continued their gradual descent in August, with the headline index rising only 2.5% year-over-year. However, the Fed is hesitant to declare victory since core CPI, which excludes volatile food and energy prices to measure the underlying trend, experienced a slight uptick to 3.2%. This was primarily due to stickiness in housing prices which has been a point of concern for economists.

It’s been said that monetary policy works with “long and variable lags.” In other words, if the Fed waits for inflation to be all the way back down to 2%, it may have waited too long. The cost of doing so would be an over-tightening of the job market, which would have real world consequences on households and businesses. Thus, the recent softening in the employment data provides further support for reducing rates.

Bond yields are adjusting to rate cuts

Given these economic trends, most economists and investors believe the Fed will cut rates a few times this year and throughout 2025. Bond yields have responded with the yield curve “disinverting” for the first time since the rate hike cycle began in 2022. This is because short-term interest rates, which are tied to Fed policy, have begun to fall while long-term interest rates, which are tied to economic growth, have not declined as much. This results in an “upward-sloping” yield curve which is often seen as positive for the economy.

While the past is no guarantee of the future, lower rates have been positive for both stocks and bonds across history. Bond prices, in particular, move in the opposite direction of bond yields, which is why many bond indices have rebounded in recent weeks.

For stocks, lower interest rates mean that businesses have access to cheaper financing for investment and expansion. When it comes to the math of valuing companies, lower rates mean that future cash flows are discounted less, which can result in more attractive prices today. Of course, the market never moves up in a straight line, and investors should always be prepared for periods of volatility as the financial system adjusts to Fed moves.

As we enter a new phase of monetary policy, economists will be closely monitoring these indicators, particularly those related to employment and growth. The Fed’s challenge will be to calibrate its policy response to support the economy without reigniting inflationary pressures or creating imbalances in financial markets.

The bottom line? Understanding why the Fed is cutting rates is as important as the policy moves themselves. Rather than focus on individual rate cuts, investors should maintain a long-term perspective to stay on track toward their financial goals.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.